Creating a bi-weekly budget can be a daunting task, especially for those who are new to managing their finances. However, with the right tools and a clear understanding of the process, it can be made easy. In this article, we will discuss the importance of having a bi-weekly budget, its benefits, and provide a step-by-step guide on how to create a bi-weekly budget using an Excel template.

Having a bi-weekly budget is essential for individuals who get paid every other week. It helps to manage finances effectively, ensure timely bill payments, and make smart financial decisions. A bi-weekly budget also helps to reduce financial stress and anxiety, allowing individuals to feel more in control of their financial situation.

Benefits of a Bi-Weekly Budget

A bi-weekly budget offers several benefits, including:

- Improved financial management: A bi-weekly budget helps to manage finances effectively, ensuring that all expenses are accounted for and paid on time.

- Reduced financial stress: By having a clear picture of income and expenses, individuals can reduce financial stress and anxiety.

- Increased savings: A bi-weekly budget helps to identify areas where costs can be reduced, allowing individuals to save more.

- Better financial decisions: A bi-weekly budget provides a clear understanding of financial situation, enabling individuals to make smart financial decisions.

Creating a Bi-Weekly Budget Excel Template

Creating a bi-weekly budget Excel template is easy and straightforward. Here's a step-by-step guide to help you get started:

Step 1: Determine Your Income

Start by calculating your bi-weekly income. If you're paid every other week, you'll need to calculate your income for each pay period. Make sure to include all sources of income, including your salary, investments, and any side hustles.

Step 2: Identify Your Expenses

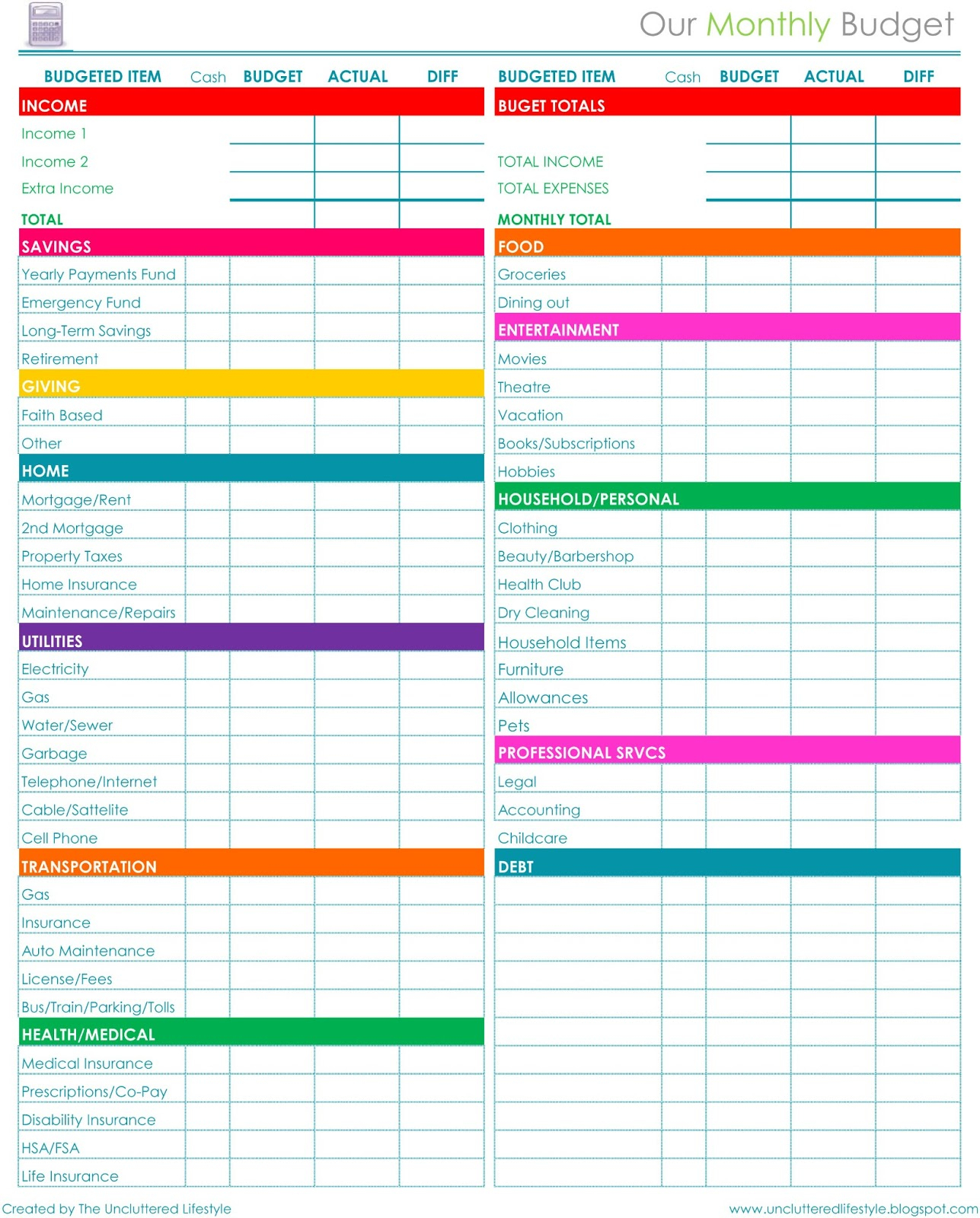

Next, identify all your expenses, including fixed expenses such as rent, utilities, and loan payments, as well as variable expenses such as groceries, entertainment, and transportation costs. Make sure to include all expenses, no matter how small they may seem.

Step 3: Categorize Your Expenses

Categorize your expenses into different groups, such as housing, transportation, food, and entertainment. This will help you to see where your money is going and make adjustments as needed.

Step 4: Set Financial Goals

Set financial goals, such as saving for a down payment on a house, paying off debt, or building an emergency fund. Having specific goals in mind will help you to stay motivated and focused on your financial plan.

Step 5: Create a Budget Plan

Create a budget plan that outlines projected income and expenses for each pay period. Make sure to include a buffer for unexpected expenses and emergencies.

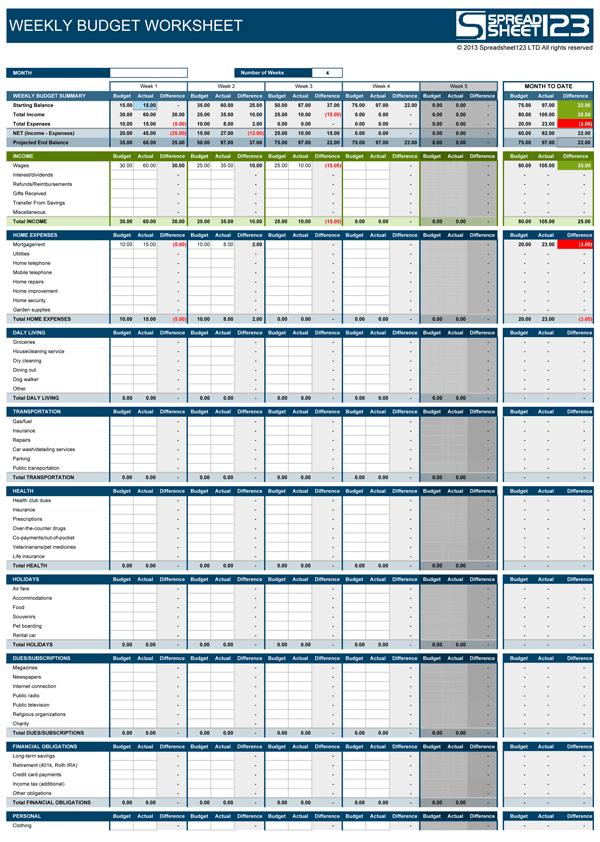

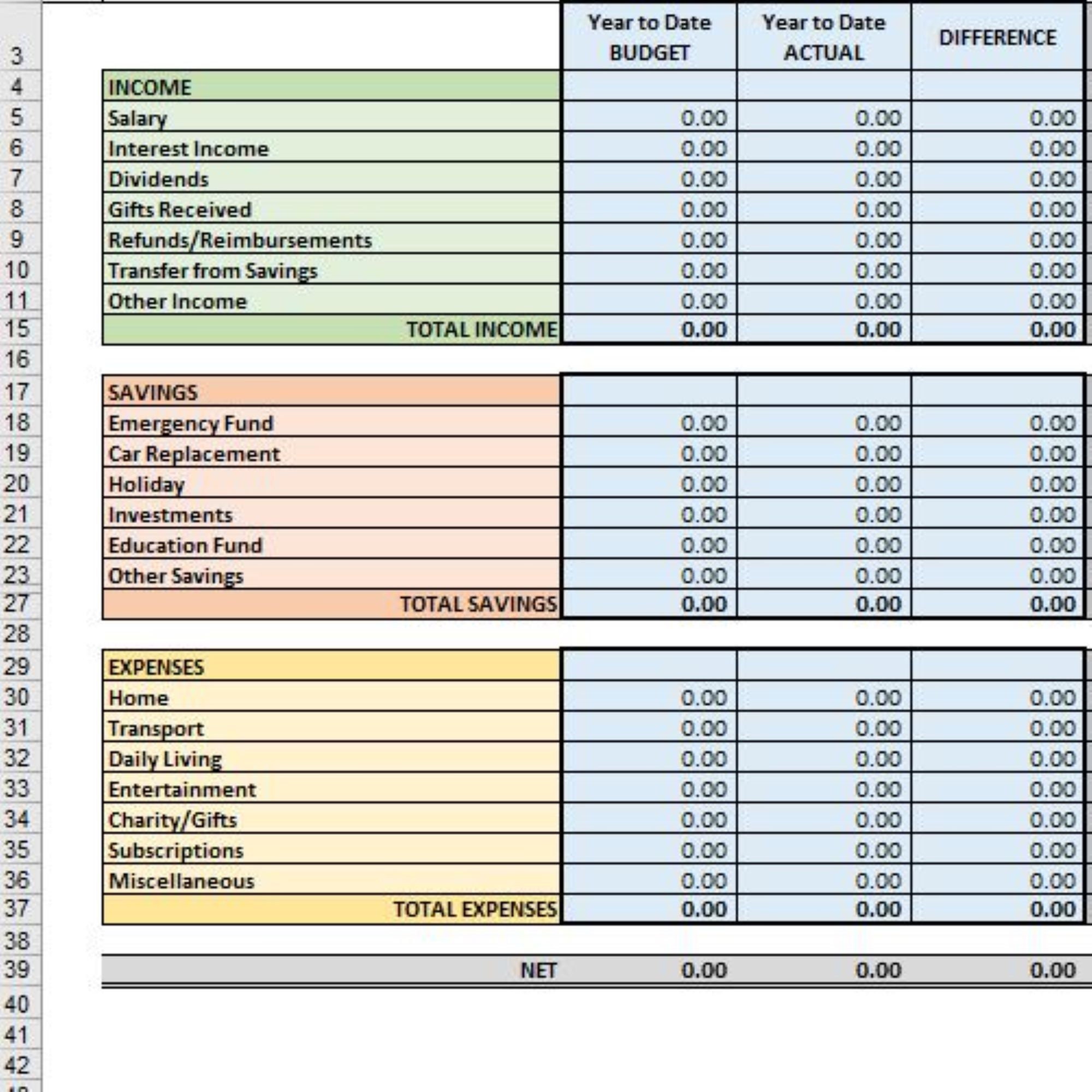

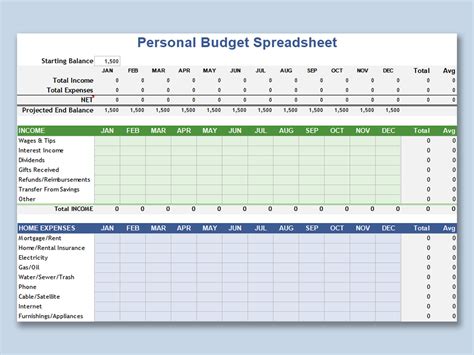

Bi-Weekly Budget Excel Template

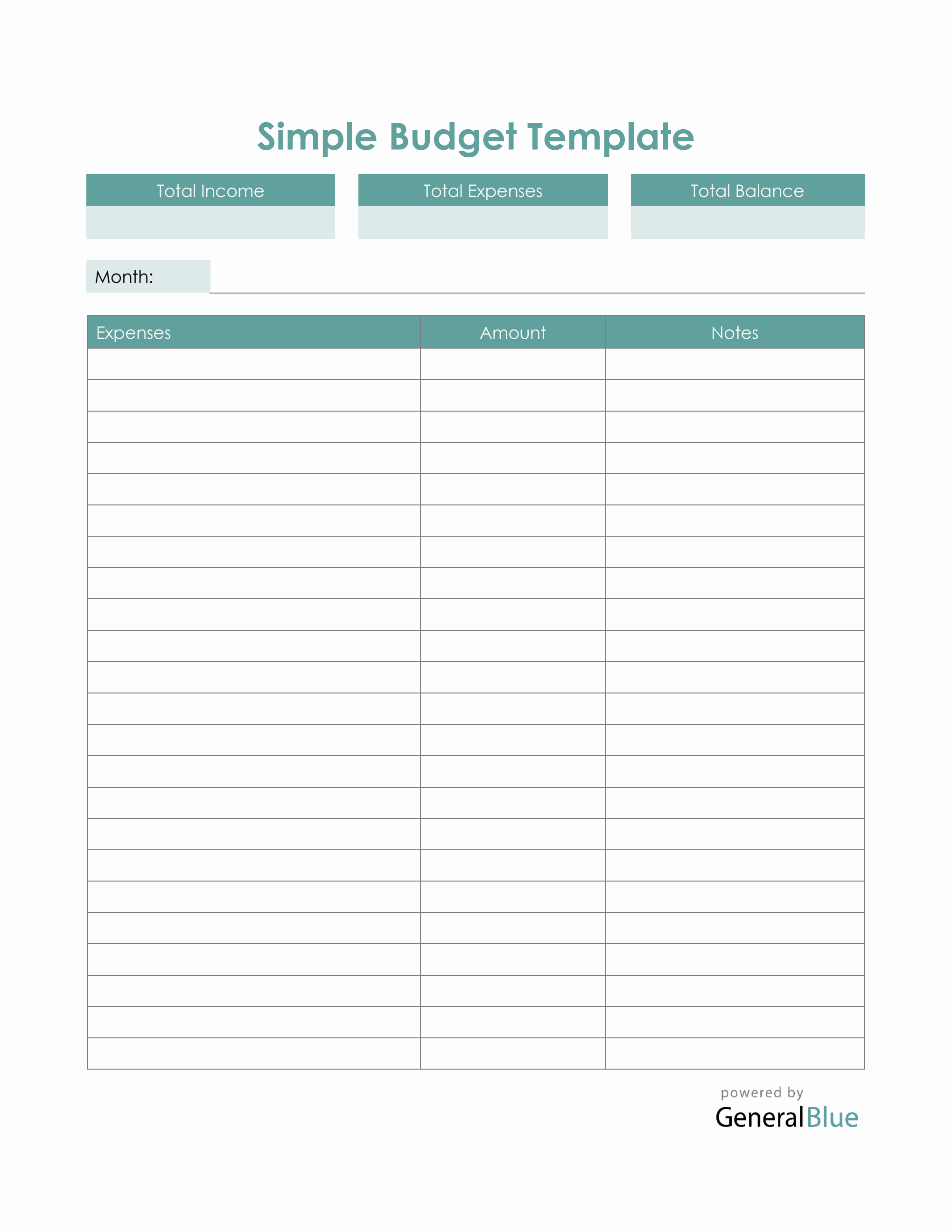

Here's a sample bi-weekly budget Excel template to help you get started:

| Category | Projected Income | Projected Expenses |

|---|---|---|

| Housing | $1,000 | $800 |

| Transportation | $500 | $300 |

| Food | $300 | $200 |

| Entertainment | $200 | $100 |

| Savings | $500 | $0 |

| Debt Repayment | $500 | $500 |

| Emergency Fund | $1,000 | $0 |

Tips for Using a Bi-Weekly Budget Excel Template

Here are some tips for using a bi-weekly budget Excel template:

- Make sure to review and update your budget regularly to ensure it's accurate and relevant.

- Use formulas to automatically calculate totals and percentages.

- Use charts and graphs to visualize your data and identify trends.

- Consider using a budgeting app or software to help track expenses and stay on top of your finances.

Gallery of Budgeting Templates

Frequently Asked Questions

What is a bi-weekly budget?

+A bi-weekly budget is a budget plan that outlines projected income and expenses for each pay period, typically every other week.

Why is a bi-weekly budget important?

+A bi-weekly budget is important because it helps to manage finances effectively, ensures timely bill payments, and reduces financial stress and anxiety.

How do I create a bi-weekly budget Excel template?

+To create a bi-weekly budget Excel template, start by calculating your bi-weekly income, identifying your expenses, categorizing your expenses, setting financial goals, and creating a budget plan.

We hope this article has provided you with a clear understanding of the importance of having a bi-weekly budget and how to create a bi-weekly budget Excel template. Remember to review and update your budget regularly to ensure it's accurate and relevant. With a bi-weekly budget, you'll be able to manage your finances effectively, reduce financial stress and anxiety, and achieve your financial goals.