Calculating the payback period is a crucial step in evaluating the feasibility of a project or investment. The payback period is the amount of time it takes for the investment to generate cash flows that are equal to the initial investment. In this article, we will discuss four ways to calculate the payback period in Excel.

Why is the Payback Period Important?

The payback period is a widely used metric in finance and accounting because it helps investors and businesses evaluate the risk and return of an investment. A shorter payback period indicates that an investment is likely to generate returns more quickly, which can be beneficial for cash flow and liquidity. On the other hand, a longer payback period may indicate that an investment is riskier or less likely to generate returns.

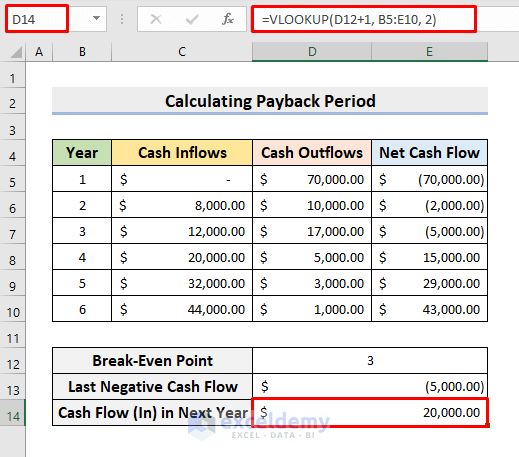

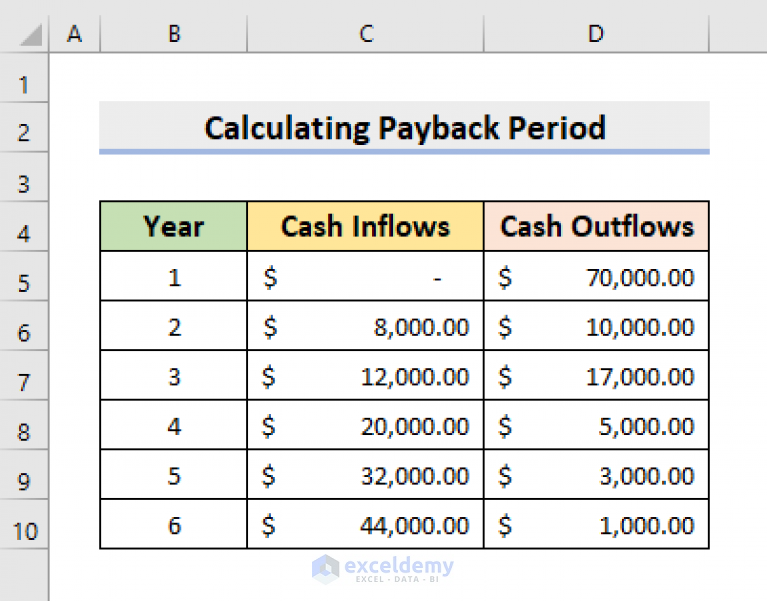

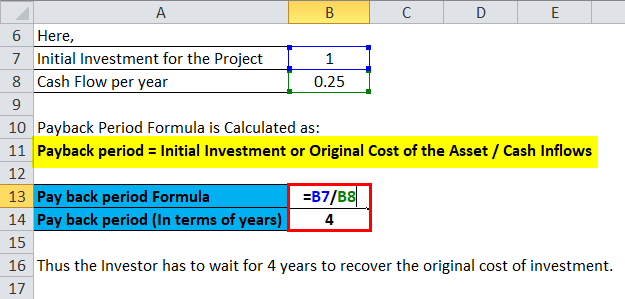

Method 1: Using the Payback Period Formula

One way to calculate the payback period in Excel is to use the formula:

Payback Period = Total Investment / Annual Cash Flow

For example, suppose we have an investment of $10,000 that generates annual cash flows of $2,500. We can calculate the payback period as follows:

Using the formula, we get:

Payback Period = $10,000 / $2,500 = 4 years

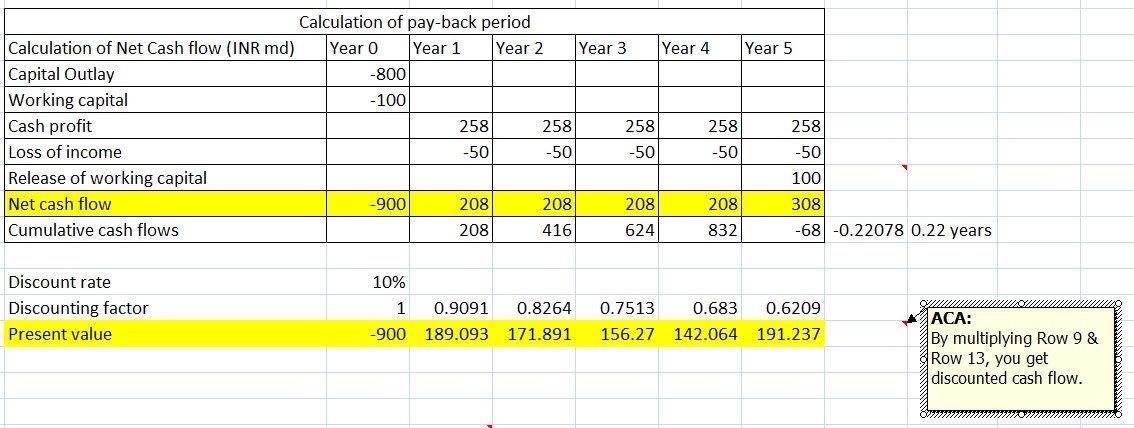

Method 2: Using the NPV Function

Another way to calculate the payback period in Excel is to use the NPV (Net Present Value) function. The NPV function calculates the present value of a series of cash flows, and we can use it to calculate the payback period by setting the NPV to zero.

For example, suppose we have an investment of $10,000 that generates annual cash flows of $2,500 for 5 years. We can calculate the payback period as follows:

Using the NPV function, we get:

NPV = -$10,000 + $2,500/(1+0.1)^1 + $2,500/(1+0.1)^2 + $2,500/(1+0.1)^3 + $2,500/(1+0.1)^4 + $2,500/(1+0.1)^5 = 0

Solving for the payback period, we get:

Payback Period = 4 years

Method 3: Using the XNPV Function

The XNPV function is similar to the NPV function, but it allows us to specify the dates of the cash flows. We can use the XNPV function to calculate the payback period by setting the XNPV to zero.

For example, suppose we have an investment of $10,000 that generates annual cash flows of $2,500 for 5 years, starting from January 1, 2023. We can calculate the payback period as follows:

Using the XNPV function, we get:

XNPV = -$10,000 + $2,500/(1+0.1)^DATE(2023,1,1) + $2,500/(1+0.1)^DATE(2024,1,1) + $2,500/(1+0.1)^DATE(2025,1,1) + $2,500/(1+0.1)^DATE(2026,1,1) + $2,500/(1+0.1)^DATE(2027,1,1) = 0

Solving for the payback period, we get:

Payback Period = 4 years

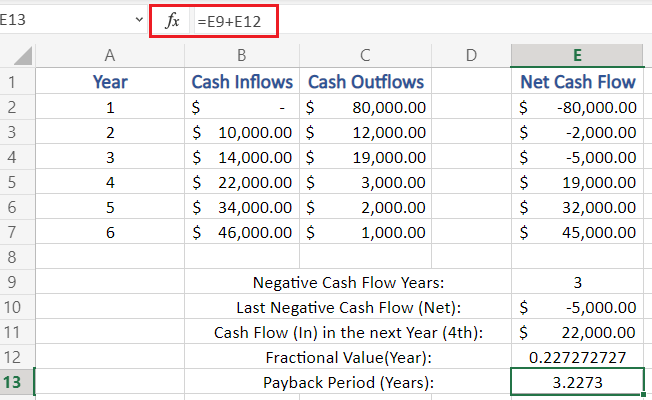

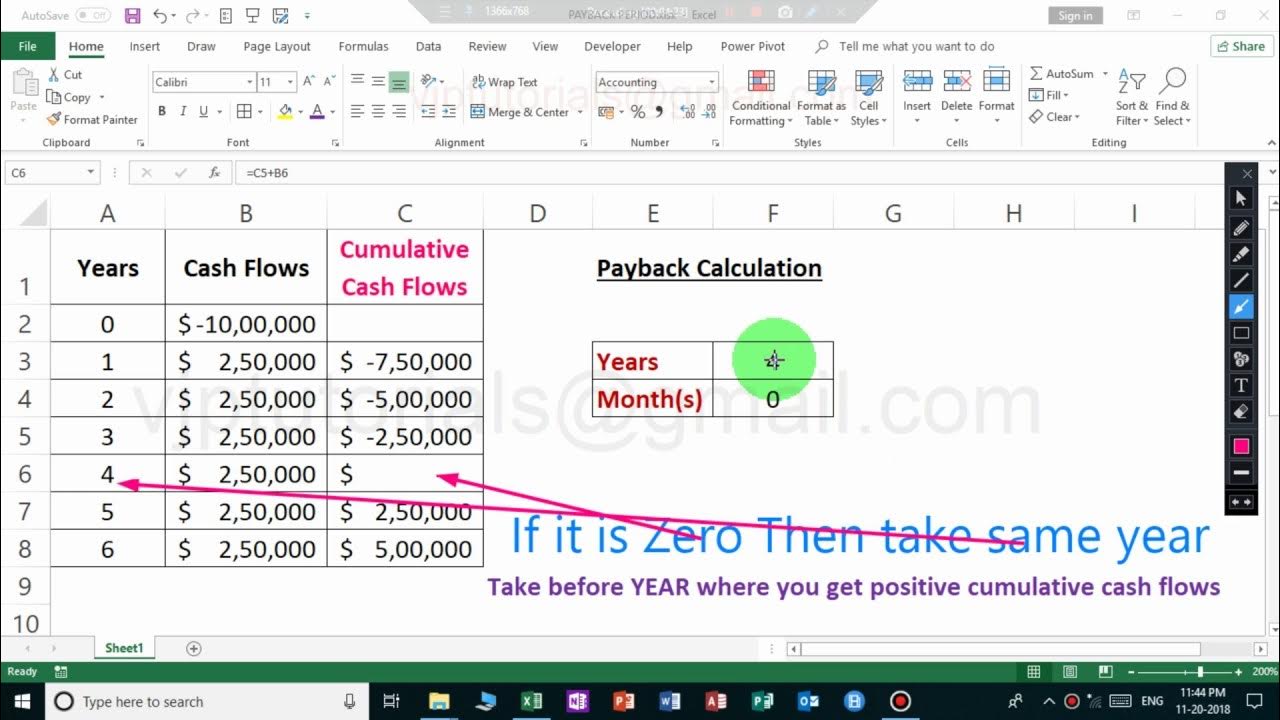

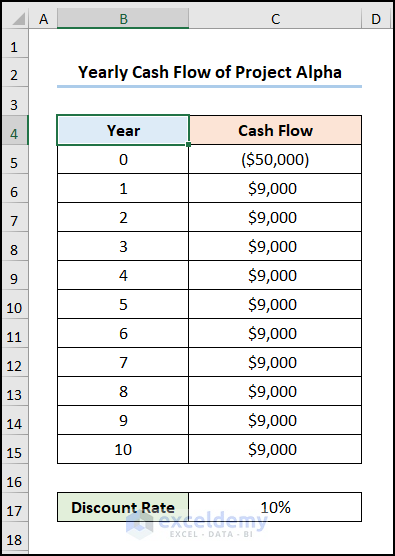

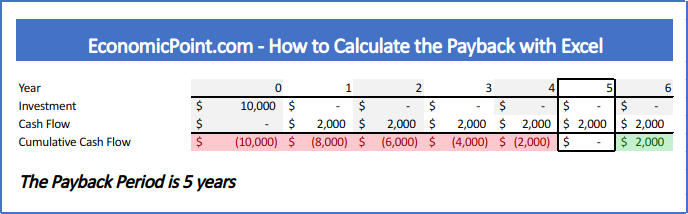

Method 4: Using a Payback Period Template

Finally, we can use a payback period template to calculate the payback period. A payback period template is a pre-built spreadsheet that allows us to input the investment and cash flows and calculate the payback period automatically.

For example, suppose we have an investment of $10,000 that generates annual cash flows of $2,500 for 5 years. We can use a payback period template to calculate the payback period as follows:

Using the template, we get:

Payback Period = 4 years

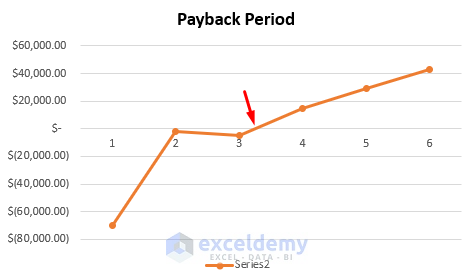

Gallery of Payback Period Calculation

FAQs

What is the payback period?

+The payback period is the amount of time it takes for an investment to generate cash flows that are equal to the initial investment.

How do I calculate the payback period in Excel?

+There are several ways to calculate the payback period in Excel, including using the payback period formula, the NPV function, the XNPV function, and a payback period template.

What is the difference between the NPV and XNPV functions?

+The NPV function calculates the present value of a series of cash flows, while the XNPV function allows us to specify the dates of the cash flows.

We hope this article has helped you understand how to calculate the payback period in Excel. Whether you use the payback period formula, the NPV function, the XNPV function, or a payback period template, calculating the payback period is an important step in evaluating the feasibility of an investment.