The Exponential Moving Average (EMA) is a popular technical indicator used in finance to smooth out price fluctuations and highlight trends. Calculating EMA in Excel can be a daunting task, but fear not, as we'll break it down into simple steps.

What is Exponential Moving Average (EMA)?

The Exponential Moving Average (EMA) is a type of moving average that gives more weight to recent price data, making it more sensitive to recent price movements. This is in contrast to the Simple Moving Average (SMA), which gives equal weight to all price data.

Why Use EMA in Excel?

Using EMA in Excel can help you:

- Identify trends: EMA can help you spot trends in price data, making it easier to make informed investment decisions.

- Reduce noise: EMA can smooth out price fluctuations, reducing the impact of random price movements.

- Improve forecasting: By giving more weight to recent price data, EMA can help improve forecasting accuracy.

Calculating EMA in Excel

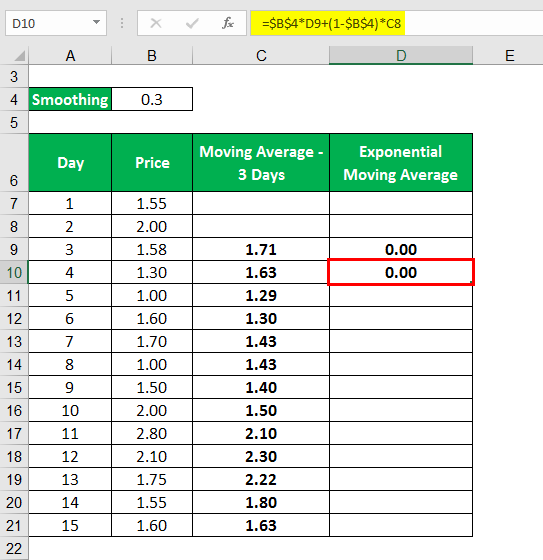

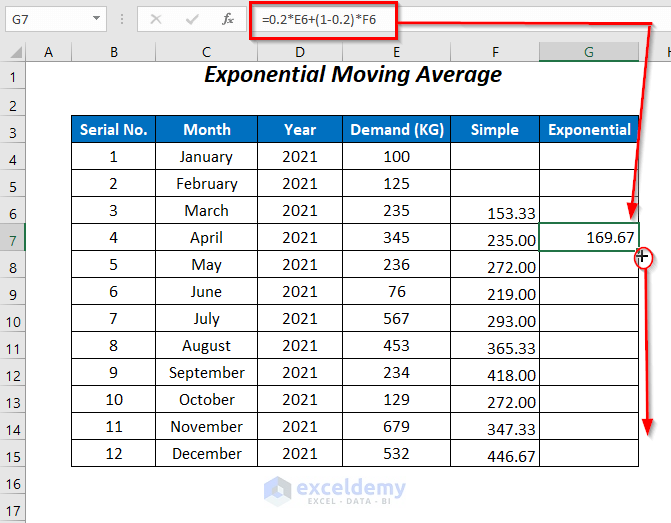

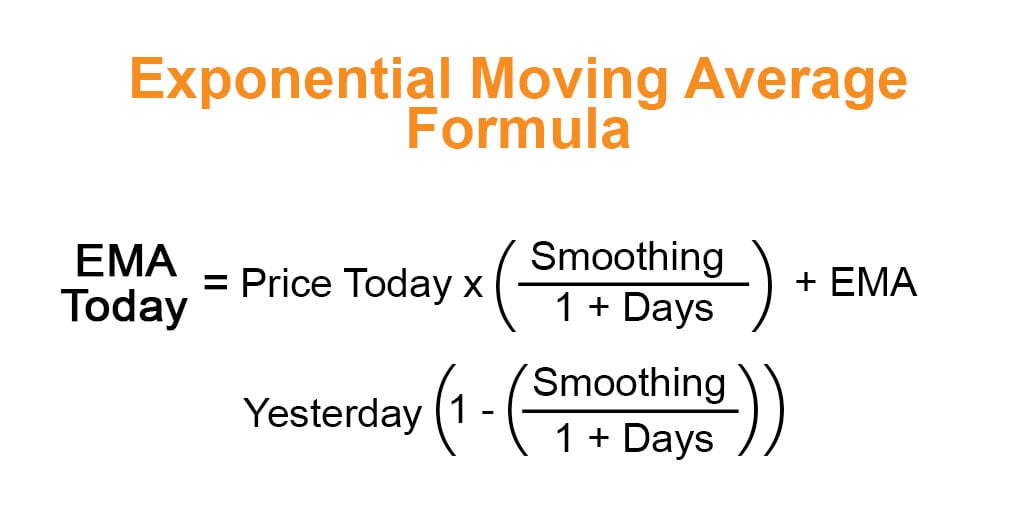

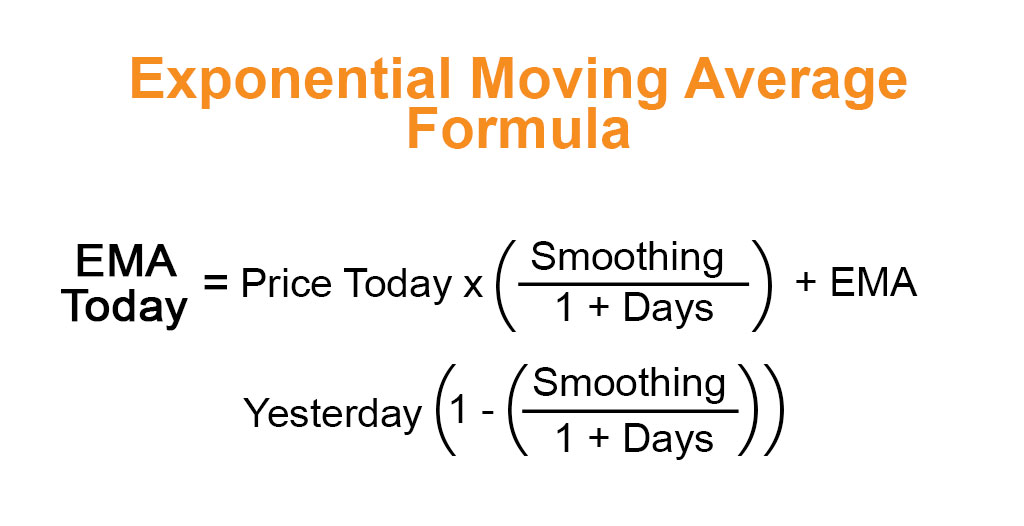

To calculate EMA in Excel, you'll need to use the following formula:

EMA = (Current Price x Smoothing Factor) + (Previous EMA x (1 - Smoothing Factor))

Where:

- Current Price is the current price of the security

- Smoothing Factor is a value between 0 and 1 that determines the rate at which the EMA reacts to price changes

- Previous EMA is the previous EMA value

Step-by-Step Instructions

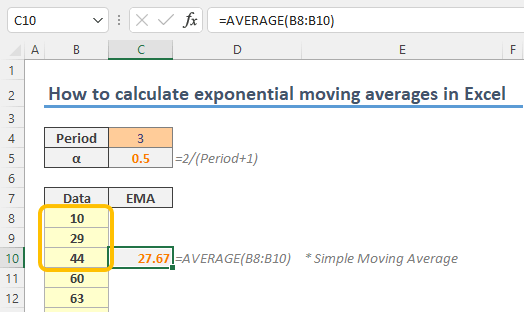

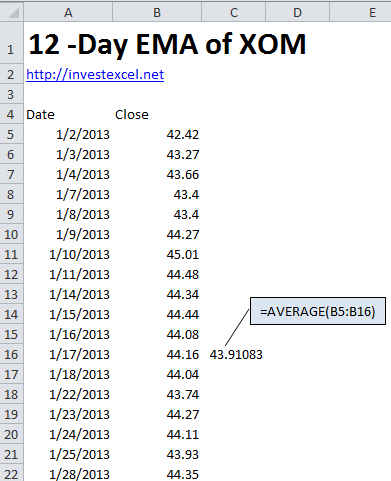

To calculate EMA in Excel, follow these steps:

- Prepare your data: Enter your price data into a column in Excel. Make sure the data is in chronological order.

- Determine the smoothing factor: Choose a smoothing factor value between 0 and 1. A higher value will make the EMA more sensitive to price changes, while a lower value will make it less sensitive.

- Calculate the first EMA value: Use the following formula to calculate the first EMA value:

EMA = Current Price x Smoothing Factor

Assuming your data is in column A, and the smoothing factor is 0.2, the formula would be:

=B2*0.2

Where B2 is the current price. 4. Calculate subsequent EMA values: Use the following formula to calculate subsequent EMA values:

EMA = (Current Price x Smoothing Factor) + (Previous EMA x (1 - Smoothing Factor))

Assuming your data is in column A, and the smoothing factor is 0.2, the formula would be:

=B30.2 + B2(1-0.2)

Where B3 is the current price, and B2 is the previous EMA value.

Using Excel Formulas

To make it easier to calculate EMA in Excel, you can use the following formulas:

=A2*0.2+(A1*(1-0.2))for the first EMA value=A3*0.2+(A2*(1-0.2))for subsequent EMA values

Assuming your data is in column A, and the smoothing factor is 0.2.

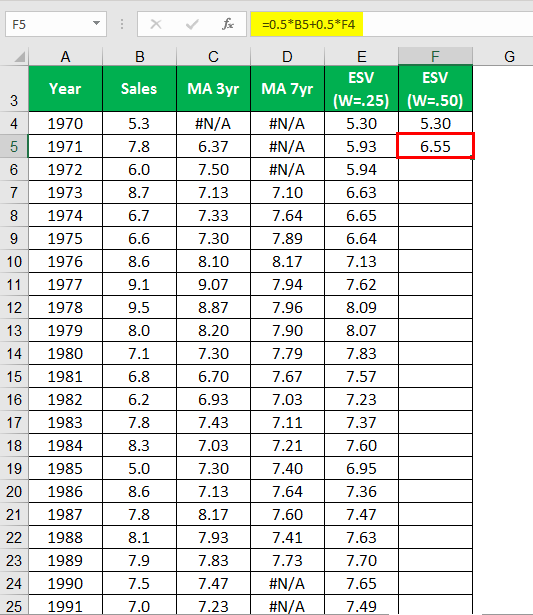

Example

Here's an example of how to calculate EMA in Excel:

| Date | Price | EMA |

|---|---|---|

| 2022-01-01 | 100 | |

| 2022-01-02 | 105 | 102 |

| 2022-01-03 | 110 | 106.8 |

| 2022-01-04 | 115 | 112.32 |

In this example, the smoothing factor is 0.2, and the EMA values are calculated using the formulas above.

Tips and Variations

Here are some tips and variations to keep in mind when calculating EMA in Excel:

- Use a shorter smoothing factor for shorter-term trends and a longer smoothing factor for longer-term trends.

- Experiment with different smoothing factor values to find the one that works best for your data.

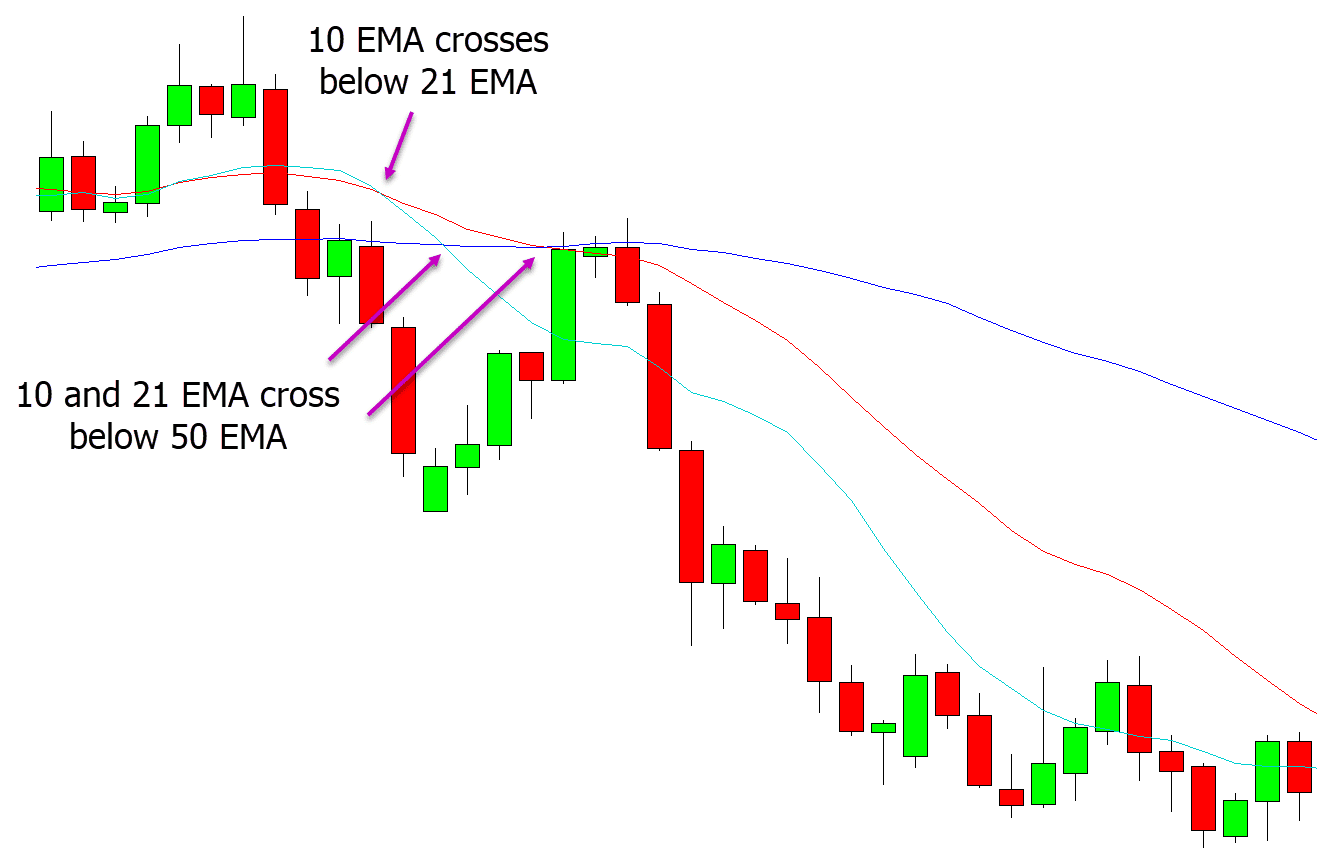

- Consider using a multiple of the EMA, such as the 20-period EMA and the 50-period EMA, to create a more robust trend-following system.

Gallery of Exponential Moving Average Examples

Frequently Asked Questions

What is the difference between EMA and SMA?

+EMA gives more weight to recent price data, making it more sensitive to recent price movements. SMA gives equal weight to all price data.

How do I choose the right smoothing factor for my EMA?

+Experiment with different smoothing factor values to find the one that works best for your data. A shorter smoothing factor is suitable for shorter-term trends, while a longer smoothing factor is suitable for longer-term trends.

Can I use EMA for forecasting?

+Yes, EMA can be used for forecasting. By giving more weight to recent price data, EMA can help improve forecasting accuracy.

In conclusion, calculating Exponential Moving Average in Excel is a straightforward process that can help you identify trends, reduce noise, and improve forecasting accuracy. By following the steps outlined above, you can easily calculate EMA in Excel and start using it to inform your investment decisions.