Mastering the actual vs budget Excel template is a crucial skill for any business or individual looking to effectively manage their finances. By comparing actual spending to budgeted amounts, you can identify areas where you need to make adjustments to stay on track financially. In this article, we'll explore five ways to master the actual vs budget Excel template, including setting up the template, tracking expenses, analyzing variances, creating dashboards, and automating reports.

Setting Up the Actual vs Budget Excel Template

The first step in mastering the actual vs budget Excel template is to set it up correctly. To do this, you'll need to create a new Excel spreadsheet and set up the following columns:

- Budget: This column will contain your budgeted amounts for each expense category.

- Actual: This column will contain your actual spending for each expense category.

- Variance: This column will contain the difference between your actual spending and your budgeted amounts.

- Percentage Variance: This column will contain the percentage difference between your actual spending and your budgeted amounts.

Tracking Expenses

Tracking Expenses

Once you've set up your actual vs budget Excel template, you'll need to start tracking your expenses. This involves regularly updating your actual spending column with your current expenses. You can do this by:

- Using a budgeting app to track your expenses and automatically update your Excel spreadsheet.

- Manually entering your expenses into your Excel spreadsheet.

- Using a receipt scanner to scan your receipts and automatically update your Excel spreadsheet.

Analyzing Variances

Analyzing Variances

Analyzing variances is a critical step in mastering the actual vs budget Excel template. By analyzing the differences between your actual spending and your budgeted amounts, you can identify areas where you need to make adjustments to stay on track financially. To analyze variances, you can:

- Use conditional formatting to highlight cells that contain variances.

- Create a variance report that summarizes the differences between your actual spending and your budgeted amounts.

- Use charts and graphs to visualize your variances and identify trends.

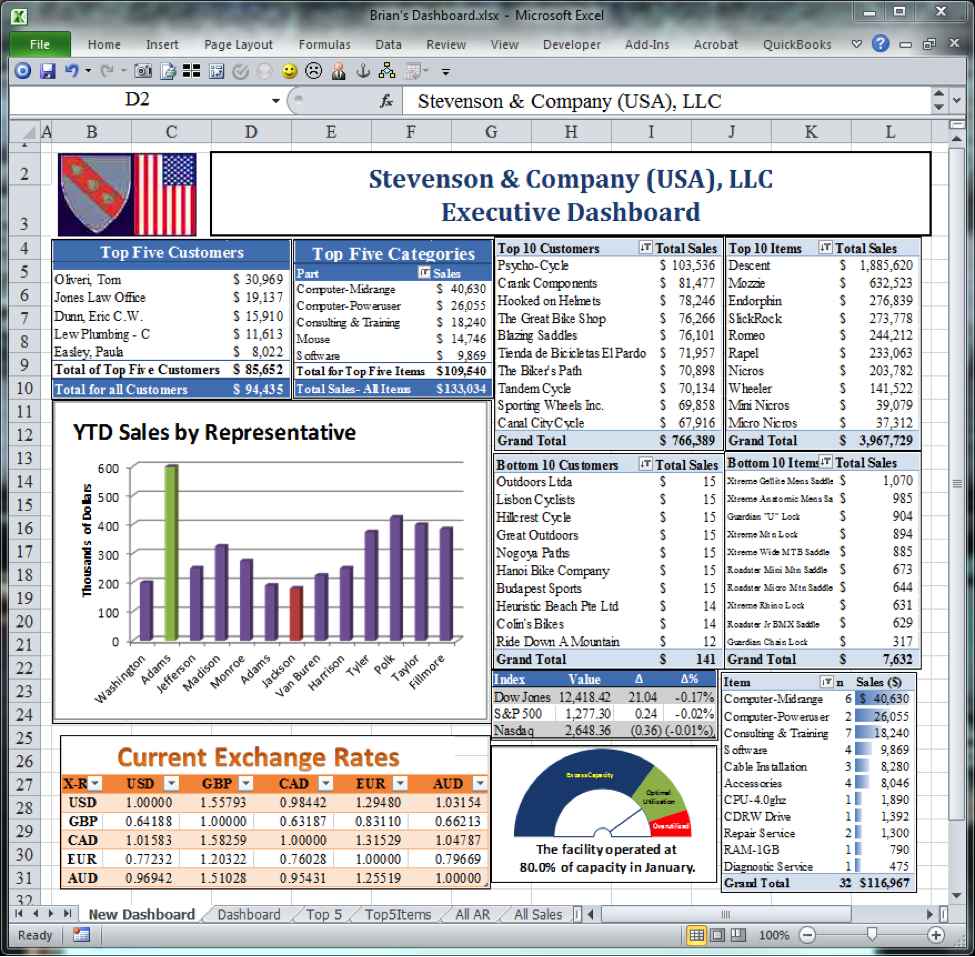

Creating Dashboards

Creating Dashboards

Creating dashboards is a great way to visualize your actual vs budget data and make it easier to analyze. A dashboard is a visual representation of your data that allows you to quickly see the key metrics and trends. To create a dashboard, you can:

- Use Excel's built-in dashboard tools to create a dashboard.

- Use a third-party add-in to create a dashboard.

- Create a custom dashboard using Excel's chart and graph tools.

Automating Reports

Automating Reports

Automating reports is a great way to save time and make it easier to analyze your actual vs budget data. By automating your reports, you can:

- Use Excel's built-in reporting tools to create automated reports.

- Use a third-party add-in to create automated reports.

- Create a custom report using Excel's chart and graph tools.

Gallery of Actual vs Budget Excel Templates

FAQs

What is an actual vs budget Excel template?

+An actual vs budget Excel template is a spreadsheet that allows you to compare your actual spending to your budgeted amounts.

Why is it important to track expenses?

+Tracking expenses is important because it allows you to identify areas where you need to make adjustments to stay on track financially.

How can I automate reports in Excel?

+You can automate reports in Excel by using Excel's built-in reporting tools or by using a third-party add-in.

By following these five ways to master the actual vs budget Excel template, you can effectively manage your finances and make informed decisions about your business or personal spending. Remember to track expenses, analyze variances, create dashboards, and automate reports to get the most out of your actual vs budget Excel template.