Calculating inflation in Excel is a straightforward process that can help you understand the purchasing power of money over time. Inflation is a sustained increase in the general price level of goods and services in an economy over a period of time. It's measured as an annual percentage increase in the Consumer Price Index (CPI), which is the most widely used indicator of inflation. Here are 5 easy ways to calculate inflation in Excel.

Inflation is a critical economic indicator that affects everyone's daily life. It influences the prices of goods and services, the value of money, and the overall economic growth. Calculating inflation accurately is essential for businesses, investors, and policymakers to make informed decisions. Excel provides various methods to calculate inflation, making it a valuable tool for anyone interested in economics and finance.

To calculate inflation in Excel, you need to have the historical data on the Consumer Price Index (CPI) or any other relevant price index. You can obtain this data from reliable sources such as the Bureau of Labor Statistics (BLS) or the World Bank.

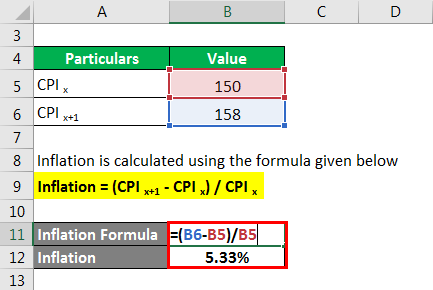

Method 1: Using the Formula for Inflation Rate

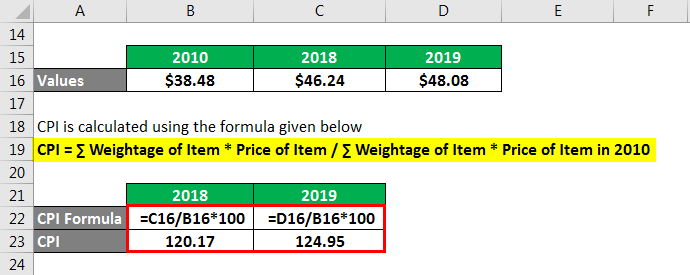

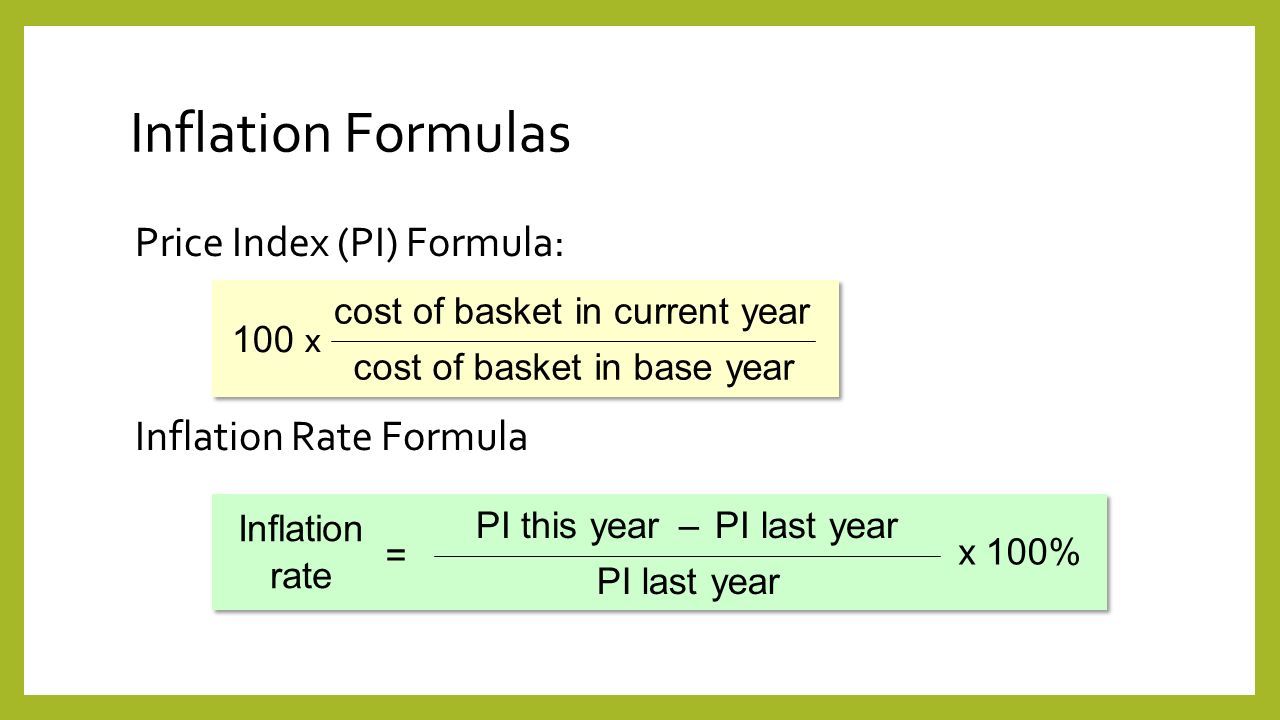

The inflation rate is calculated using the formula:

Inflation Rate = (Current Year CPI - Previous Year CPI) / Previous Year CPI

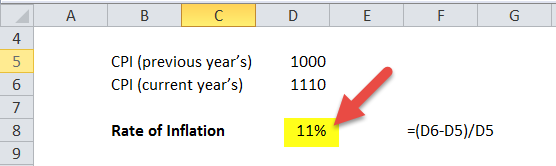

You can use this formula in Excel to calculate the inflation rate. Suppose you have the following data:

| Year | CPI |

|---|---|

| 2020 | 100 |

| 2021 | 105 |

| 2022 | 110 |

To calculate the inflation rate, follow these steps:

- Select the cell where you want to display the inflation rate.

- Type the formula

=(B2-B1)/B1, where B1 is the previous year's CPI and B2 is the current year's CPI. - Press Enter to calculate the inflation rate.

How to Calculate Inflation Rate in Excel

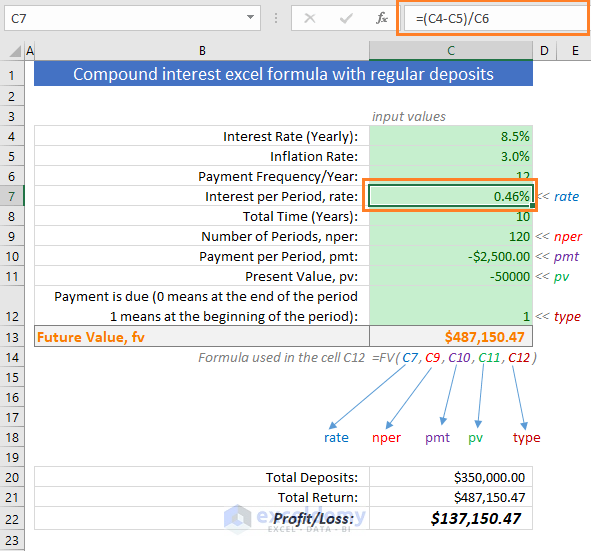

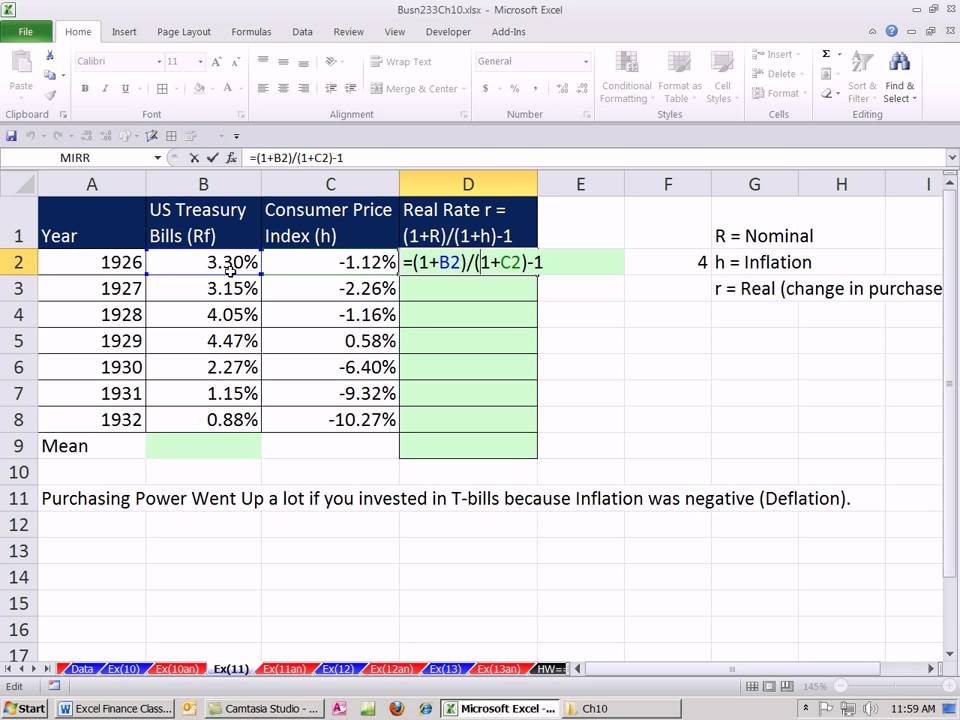

Method 2: Using the Excel RATE Function

The Excel RATE function calculates the interest rate of an investment or a loan. However, you can also use it to calculate the inflation rate.

- Select the cell where you want to display the inflation rate.

- Type the formula

=RATE(A2, A3, B2, B1), where A2 is the number of periods (years), A3 is the present value (previous year's CPI), B2 is the future value (current year's CPI), and B1 is the type (0 for the beginning of the period). - Press Enter to calculate the inflation rate.

Inflation Rate Calculation Using Excel RATE Function

Method 3: Using the Excel IPMT Function

The Excel IPMT function calculates the interest payment for a given period. However, you can also use it to calculate the inflation rate.

- Select the cell where you want to display the inflation rate.

- Type the formula

=IPMT(A2, A3, B2, B1), where A2 is the interest rate (inflation rate), A3 is the number of periods (years), B2 is the present value (previous year's CPI), and B1 is the future value (current year's CPI). - Press Enter to calculate the inflation rate.

Inflation Rate Calculation Using Excel IPMT Function

Method 4: Using the Excel XNPV Function

The Excel XNPV function calculates the present value of a series of cash flows. However, you can also use it to calculate the inflation rate.

- Select the cell where you want to display the inflation rate.

- Type the formula

=XNPV(A2, A3, B2, B1), where A2 is the discount rate (inflation rate), A3 is the cash flow dates, B2 is the cash flows, and B1 is the type (0 for the beginning of the period). - Press Enter to calculate the inflation rate.

Inflation Rate Calculation Using Excel XNPV Function

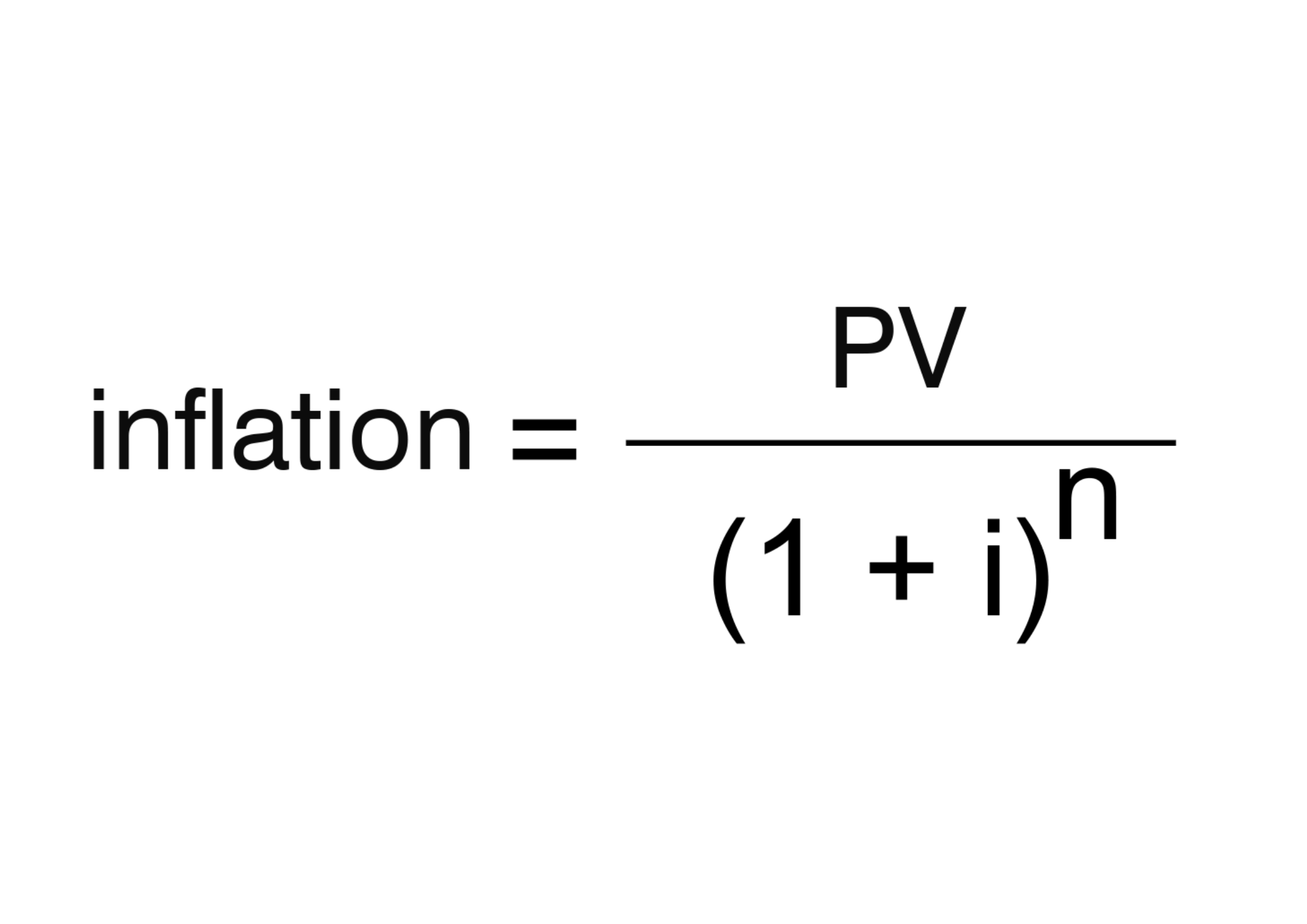

Method 5: Using a Formula with the Excel POWER Function

You can also calculate the inflation rate using a formula with the Excel POWER function.

- Select the cell where you want to display the inflation rate.

- Type the formula

=((B2/B1)^(1/A2))-1, where B2 is the current year's CPI, B1 is the previous year's CPI, and A2 is the number of periods (years). - Press Enter to calculate the inflation rate.

Inflation Rate Calculation Using Excel POWER Function

Conclusion

Calculating inflation in Excel is a straightforward process that can help you understand the purchasing power of money over time. The five methods outlined above provide different ways to calculate the inflation rate, and you can choose the one that best suits your needs. Remember to always use the correct formula and data to get accurate results.

Take Your Next Step

If you're interested in learning more about inflation and its impact on the economy, we recommend exploring the following resources:

- Bureau of Labor Statistics (BLS)

- World Bank

- International Monetary Fund (IMF)

Stay informed and stay ahead of the curve by regularly checking these resources for updates on inflation and economic trends.

Share Your Thoughts

We'd love to hear from you! Share your thoughts on inflation and its impact on your daily life in the comments below.

Gallery of Inflation-Related Keywords

FAQs

What is inflation?

+Inflation is a sustained increase in the general price level of goods and services in an economy over a period of time.

How is inflation measured?

+Inflation is typically measured using the Consumer Price Index (CPI), which is a basket of goods and services that represents the average household's expenditure.

Why is inflation important?

+Inflation is important because it affects the purchasing power of money, the value of investments, and the overall economic growth.