Repaying student loans can be a daunting task, especially with the numerous options and strategies available. However, having a clear plan and utilizing the right tools can make the process more manageable. One such tool is an Excel calculator, which can help you determine the best repayment strategy for your student loans. In this article, we will explore five ways to repay student loans with an Excel calculator.

Understanding Student Loan Repayment Options

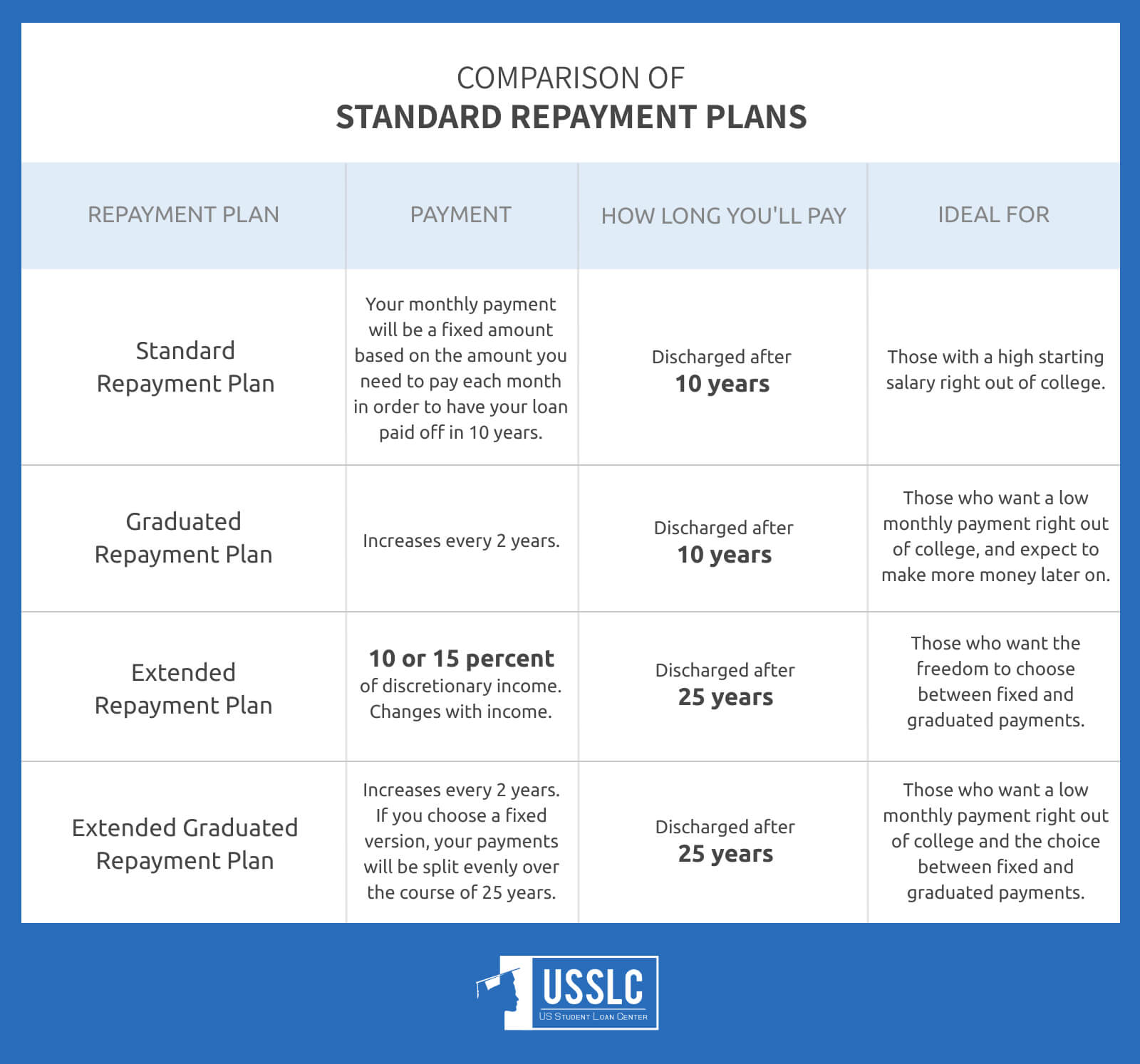

Before we dive into the Excel calculator methods, it's essential to understand the various student loan repayment options available. These include:

- Standard Repayment Plan: This plan requires fixed monthly payments over a set period, usually 10 years.

- Graduated Repayment Plan: This plan starts with lower monthly payments that gradually increase over time.

- Extended Repayment Plan: This plan allows borrowers to extend their repayment period, resulting in lower monthly payments.

- Income-Driven Repayment (IDR) Plans: These plans adjust monthly payments based on the borrower's income and family size.

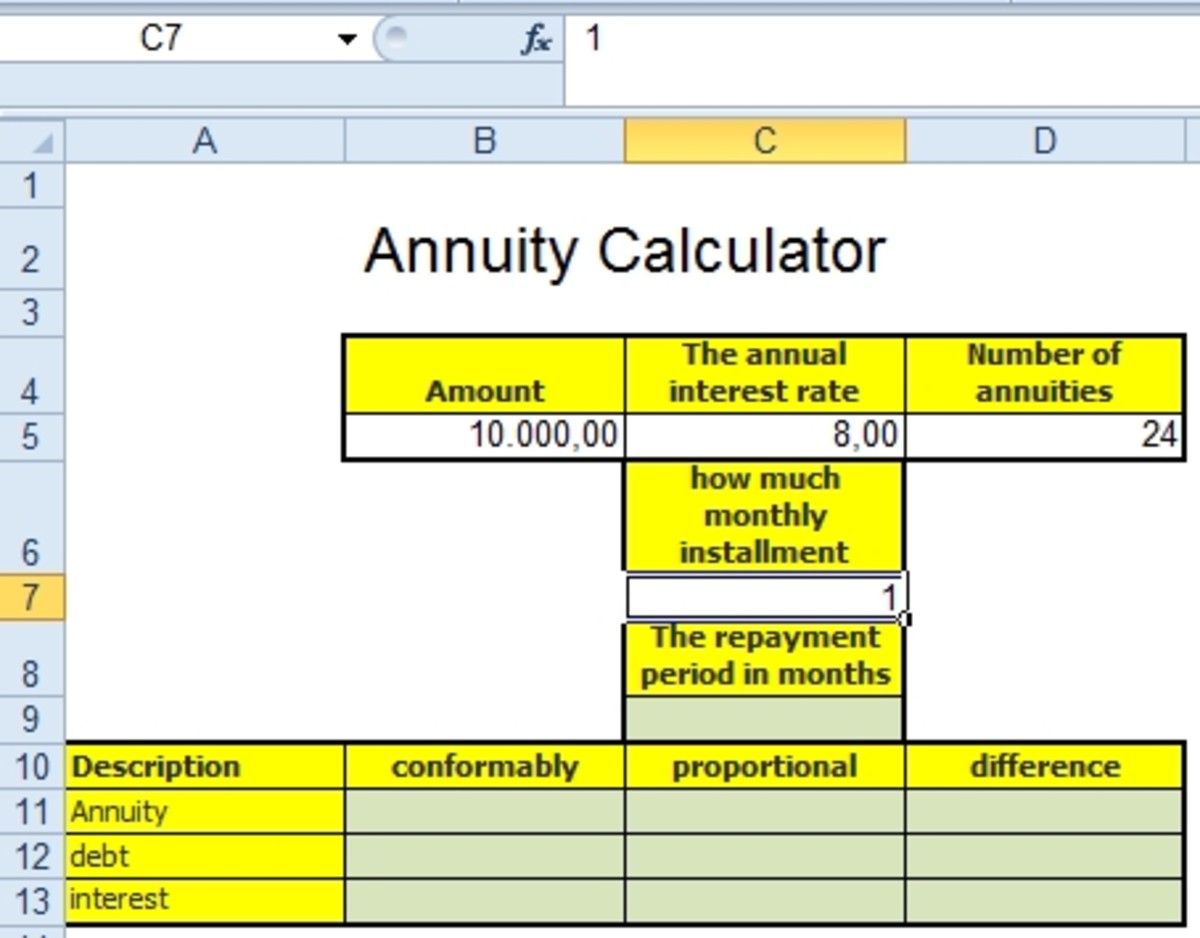

Method 1: Calculating Monthly Payments with a Standard Repayment Plan

To calculate monthly payments using a standard repayment plan, you can use the following formula in your Excel calculator:

M = P [ i(1 + i)^n ] / [ (1 + i)^n - 1]

Where: M = monthly payment P = principal loan amount i = monthly interest rate n = number of payments

For example, if you have a $30,000 loan with a 6% interest rate and a 10-year repayment period, your monthly payment would be:

M = $30,000 [ 0.005(1 + 0.005)^120 ] / [ (1 + 0.005)^120 - 1] ≈ $333.39

Method 2: Comparing Repayment Plans with an Excel Calculator

Using an Excel calculator, you can compare different repayment plans to determine which one is best for your situation. For instance, you can calculate the total interest paid over the life of the loan for each plan.

Assuming the same loan details as before, here's a comparison of the standard and graduated repayment plans:

| Repayment Plan | Monthly Payment | Total Interest Paid |

|---|---|---|

| Standard Repayment Plan | $333.39 | $6,311.14 |

| Graduated Repayment Plan | $222.22 (year 1-2), $333.39 (year 3-10) | $7,144.19 |

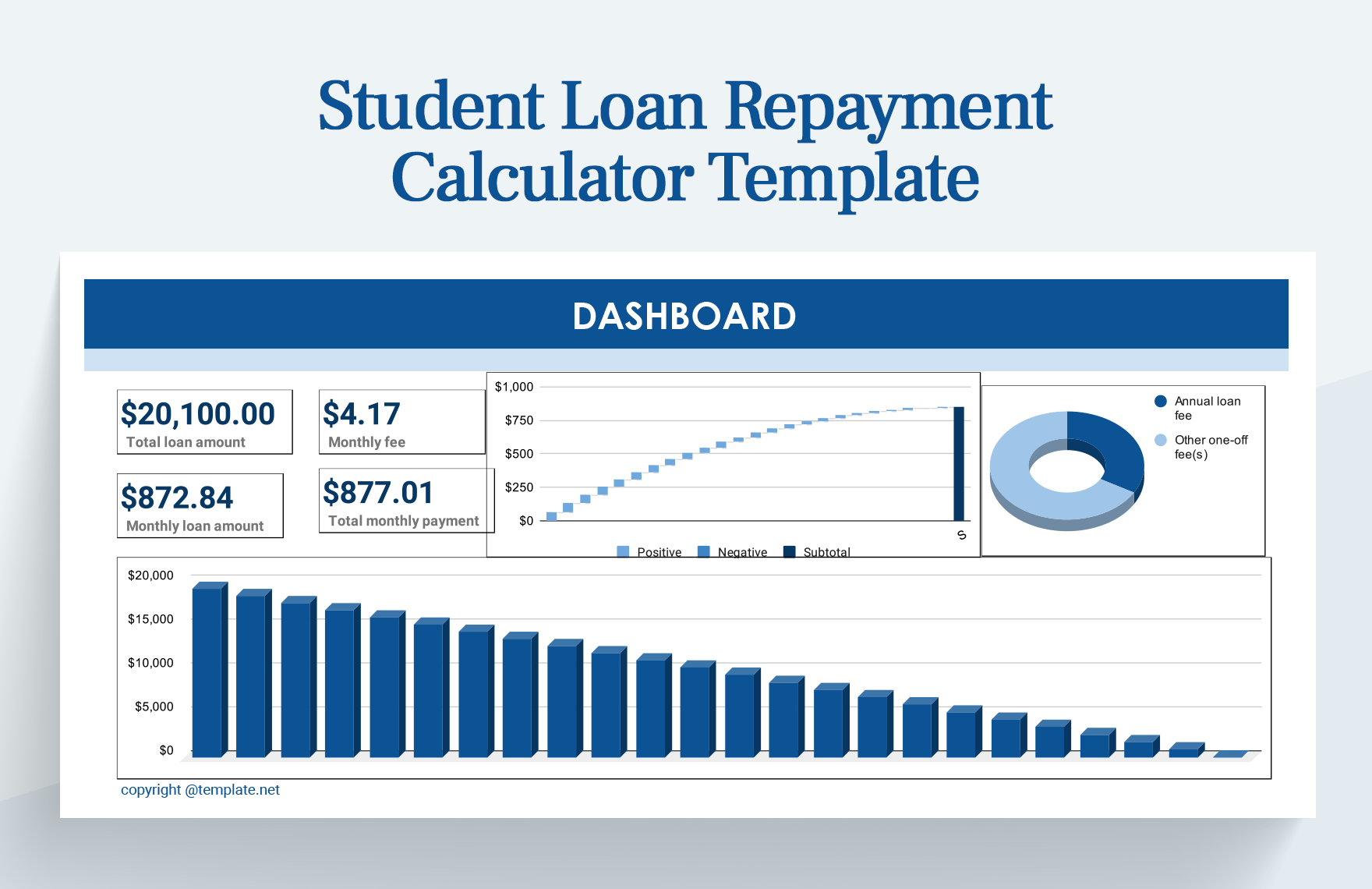

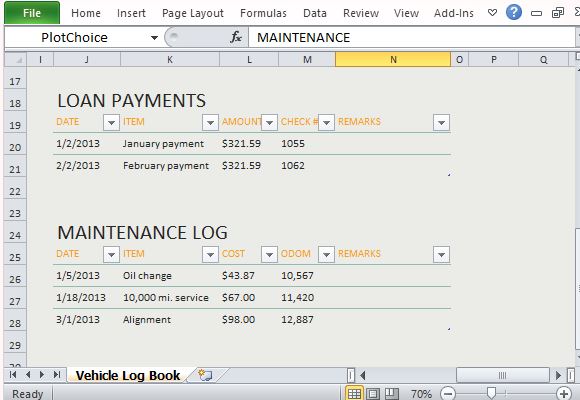

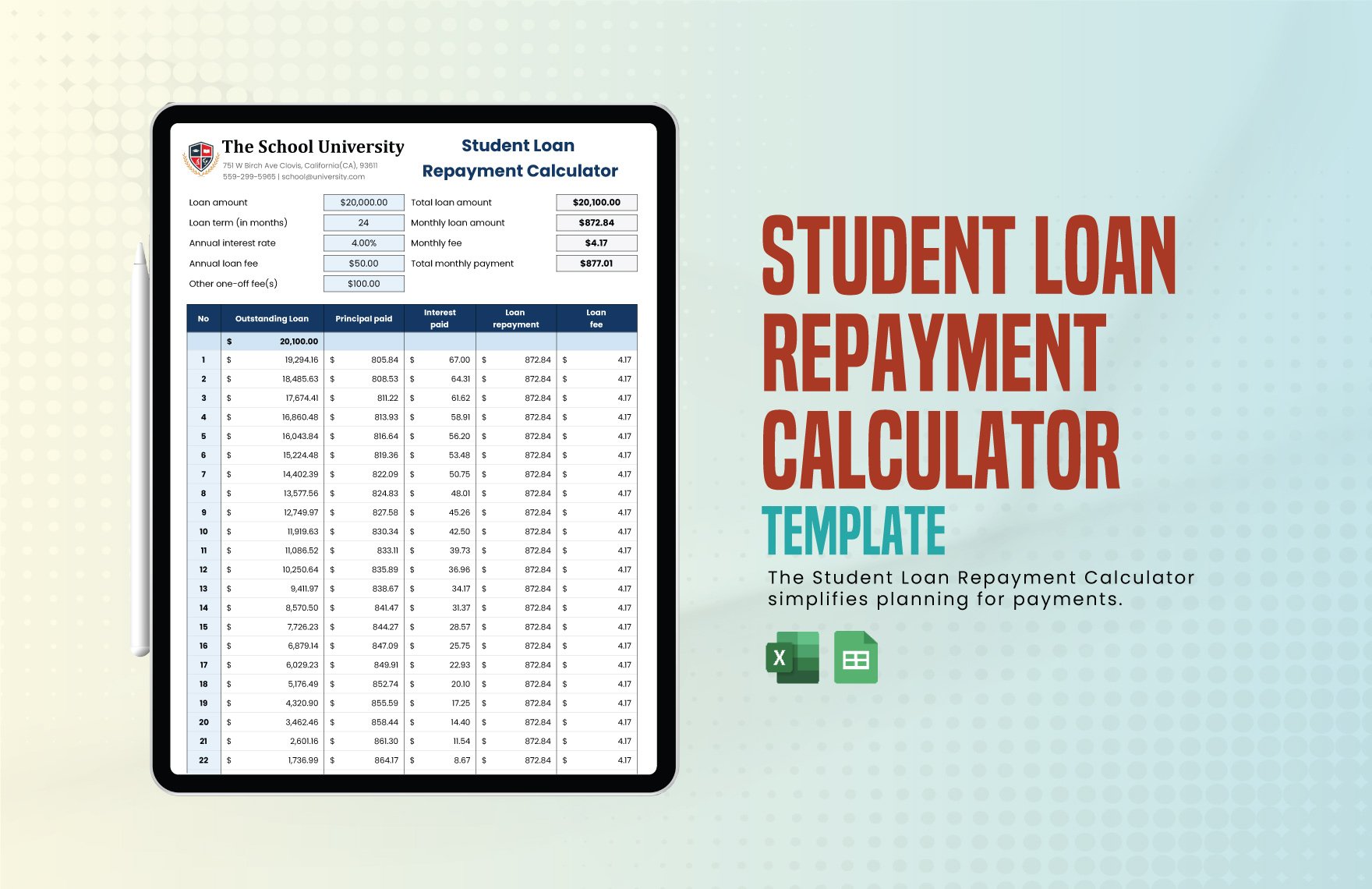

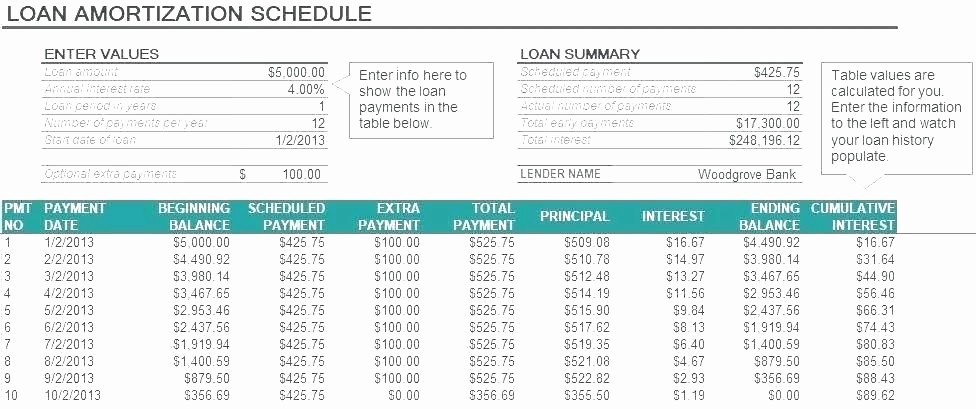

Method 3: Creating a Repayment Schedule with an Excel Calculator

An Excel calculator can help you create a repayment schedule that outlines your monthly payments, interest paid, and outstanding balance over time. You can use the following formulas to create a repayment schedule:

- Monthly payment: =PMT(rate, nper, pv)

- Interest paid: =IPMT(rate, nper, pv)

- Outstanding balance: =PV(rate, nper, pmt)

Where: rate = monthly interest rate nper = number of payments pv = principal loan amount pmt = monthly payment

For example, here's a partial repayment schedule for the same loan:

| Month | Monthly Payment | Interest Paid | Outstanding Balance |

|---|---|---|---|

| 1 | $333.39 | $125.00 | $29,875.00 |

| 2 | $333.39 | $124.38 | $29,741.61 |

| ... | ... | ... | ... |

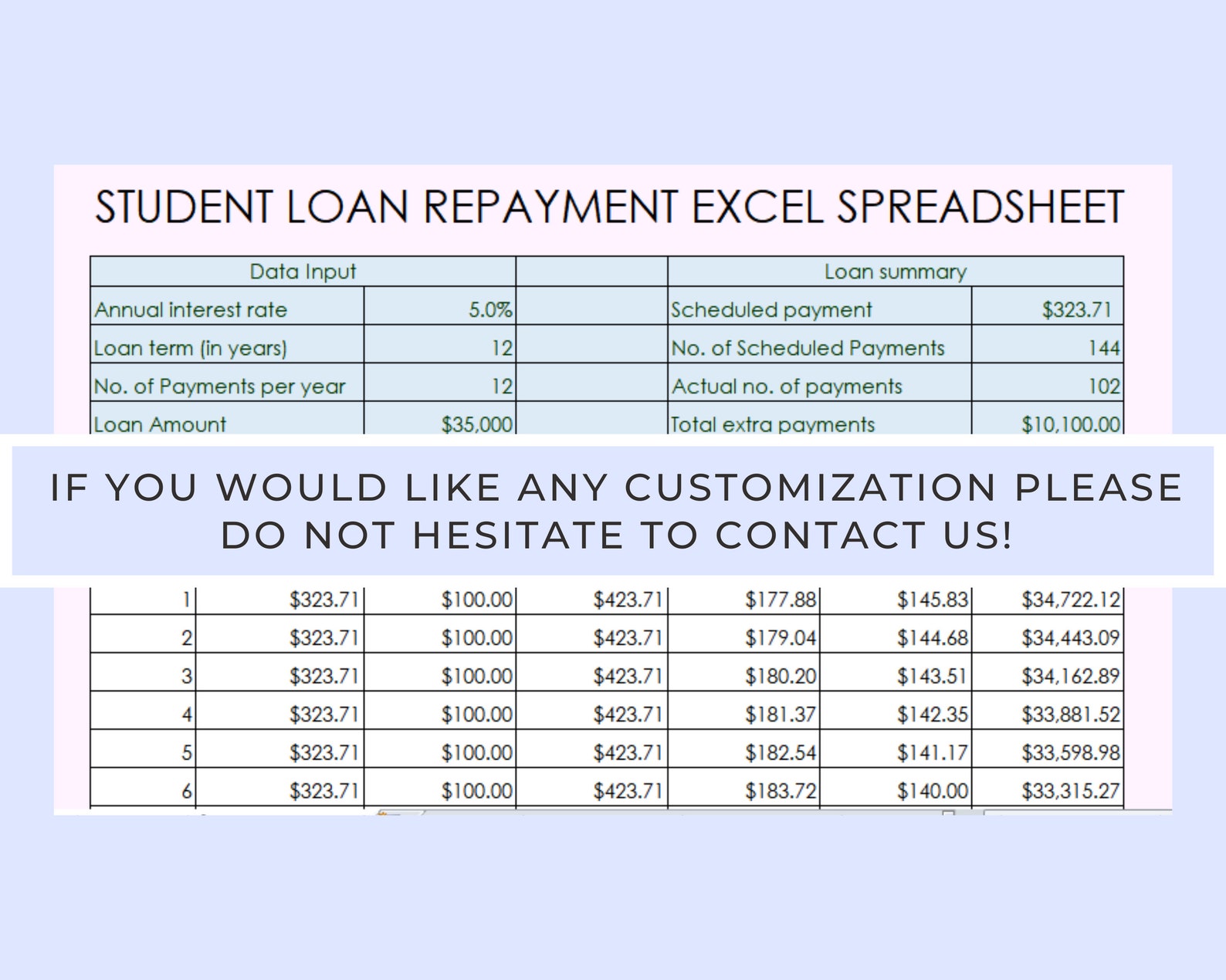

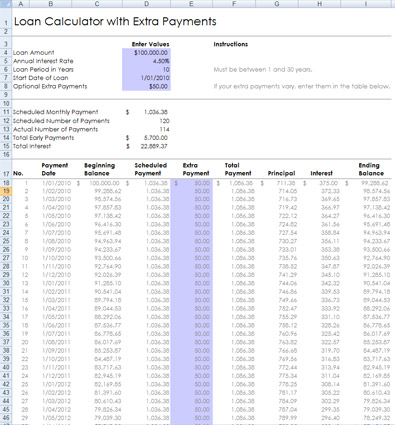

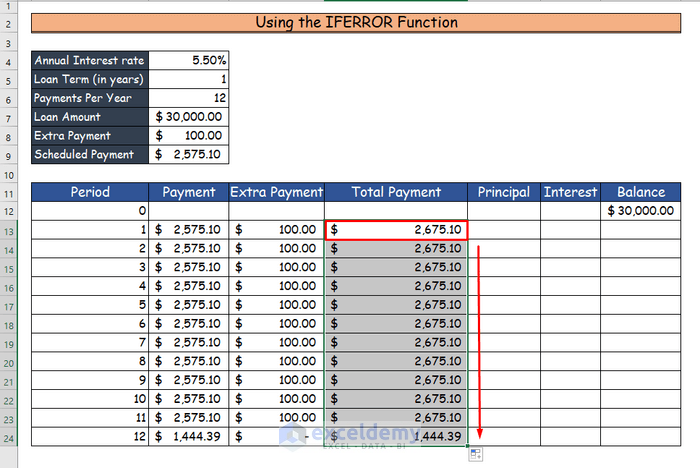

Method 4: Determining the Impact of Extra Payments with an Excel Calculator

Making extra payments can significantly reduce the total interest paid over the life of the loan. An Excel calculator can help you determine the impact of extra payments on your student loan repayment.

Assuming the same loan details as before, here's the impact of making an extra payment of $100 per month:

- Original repayment period: 10 years

- Original total interest paid: $6,311.14

- New repayment period: 8 years

- New total interest paid: $4,319.19

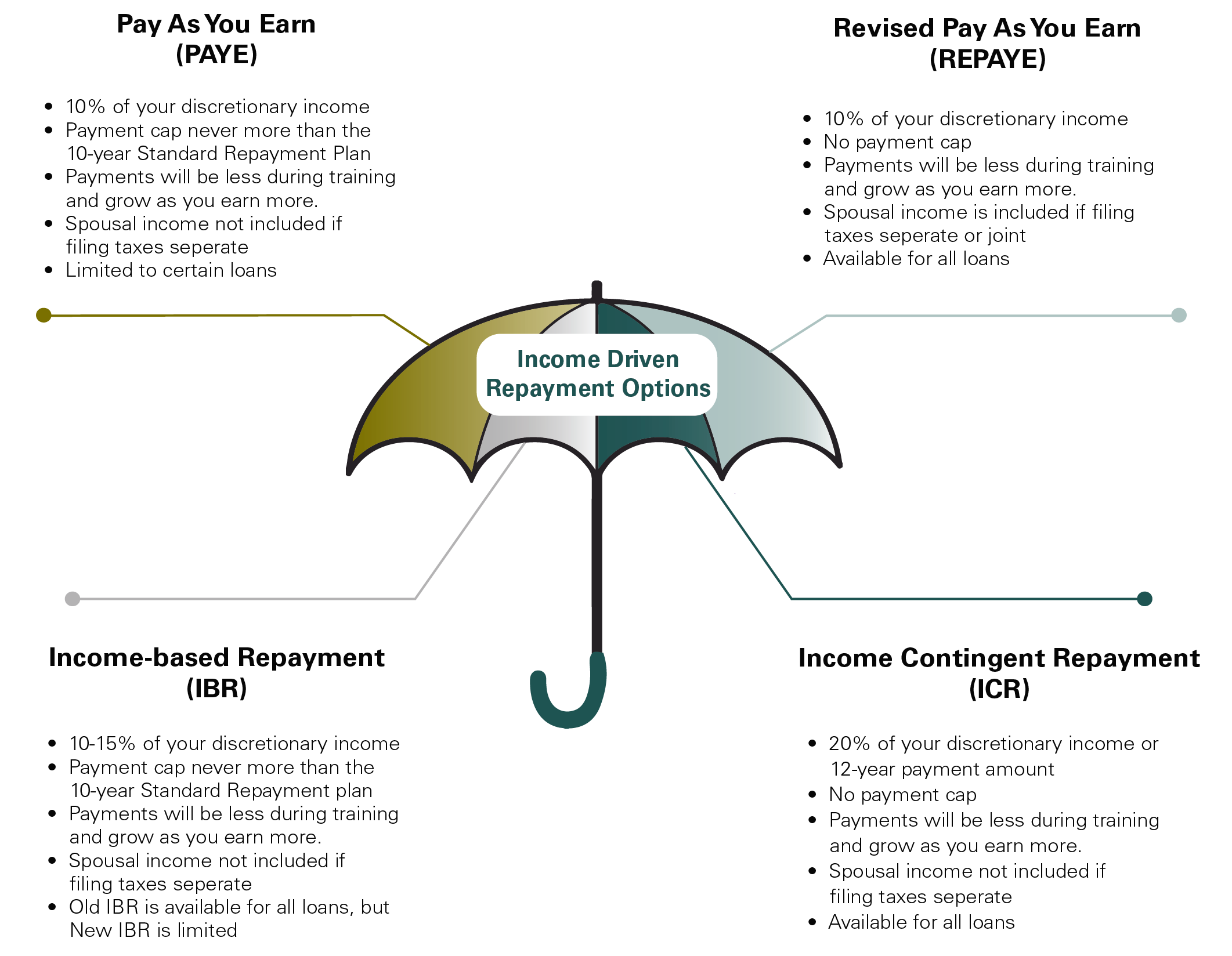

Method 5: Evaluating Income-Driven Repayment (IDR) Plans with an Excel Calculator

IDR plans adjust monthly payments based on the borrower's income and family size. An Excel calculator can help you evaluate IDR plans and determine which one is best for your situation.

For example, let's say you're considering the Income-Based Repayment (IBR) plan, which caps monthly payments at 10% of your discretionary income. Assuming a gross income of $50,000 and a family size of 2, your monthly payment would be:

M = $250.00 (10% of $2,500 discretionary income)

Using an Excel calculator, you can compare the IBR plan to the standard repayment plan and determine which one is more beneficial for your situation.

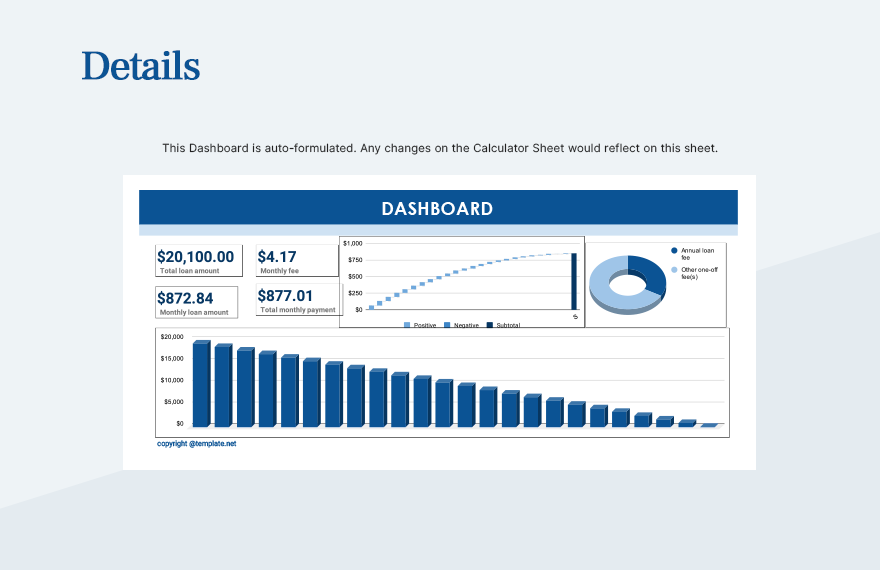

In conclusion, an Excel calculator can be a powerful tool in helping you repay your student loans efficiently. By using the methods outlined above, you can create a repayment plan that suits your needs and saves you money in the long run.

Gallery of Student Loan Repayment Strategies

What is the best way to repay student loans?

+The best way to repay student loans depends on your individual financial situation and goals. Consider using an Excel calculator to compare different repayment plans and strategies.

How can I determine which repayment plan is best for me?

+Use an Excel calculator to compare different repayment plans, including the standard repayment plan, graduated repayment plan, and income-driven repayment plans.

Can I make extra payments on my student loans?

+Yes, making extra payments can significantly reduce the total interest paid over the life of the loan. Use an Excel calculator to determine the impact of extra payments on your student loan repayment.

Share your thoughts on student loan repayment strategies in the comments below!