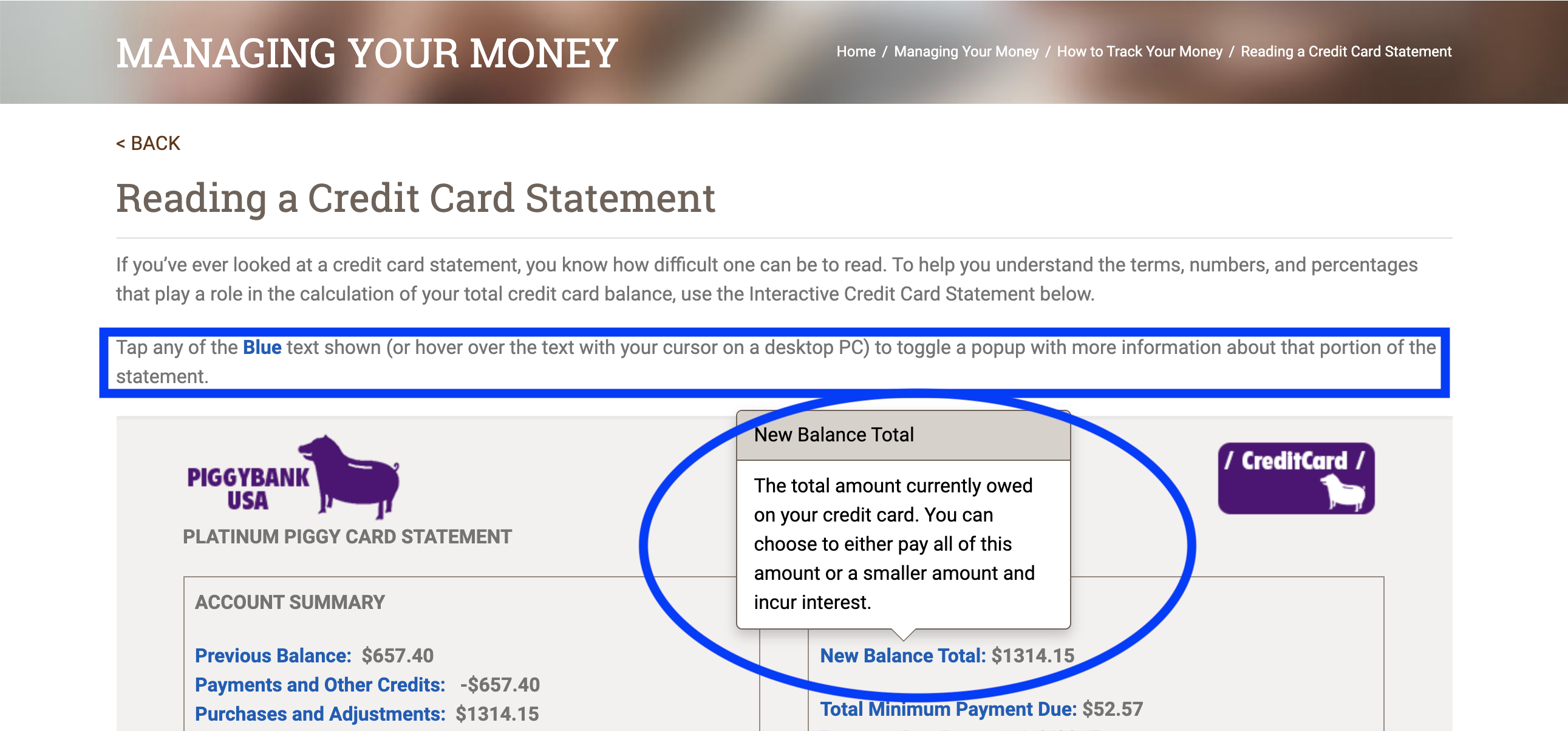

Converting credit card statements to Excel can be a daunting task, especially when dealing with multiple transactions, dates, and amounts. However, with the right techniques and tools, you can easily convert your credit card statements to Excel and make sense of your financial data. In this article, we will explore five ways to convert credit card statements to Excel.

Managing your credit card expenses can be overwhelming, especially when you have multiple cards and transactions to keep track of. Converting your credit card statements to Excel can help you streamline your finances, identify areas where you can cut back, and make informed decisions about your money. Whether you're a business owner or an individual, having a clear picture of your credit card expenses can be a game-changer.

With the rise of digital banking and online transactions, it's easier than ever to access your credit card statements. Most banks and credit card companies provide online statements that you can download and export to Excel. However, the process can be time-consuming and requires some technical know-how. In this article, we will explore five ways to convert credit card statements to Excel, including manual entry, using online tools, and leveraging Excel's built-in features.

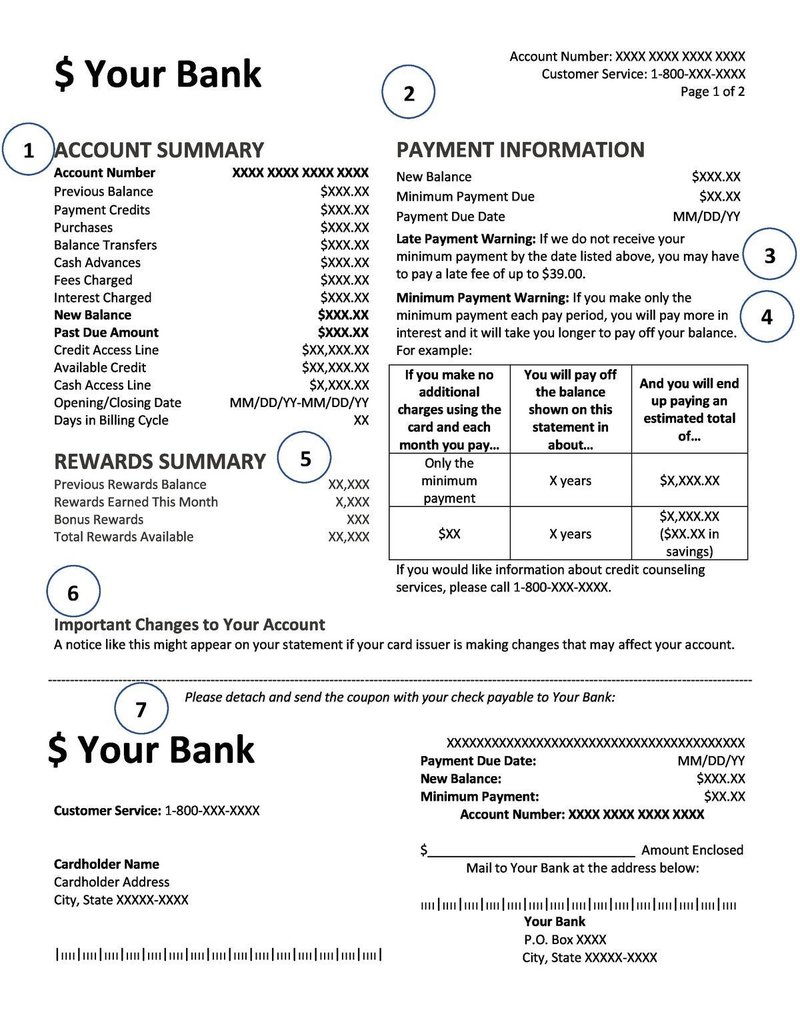

Method 1: Manual Entry

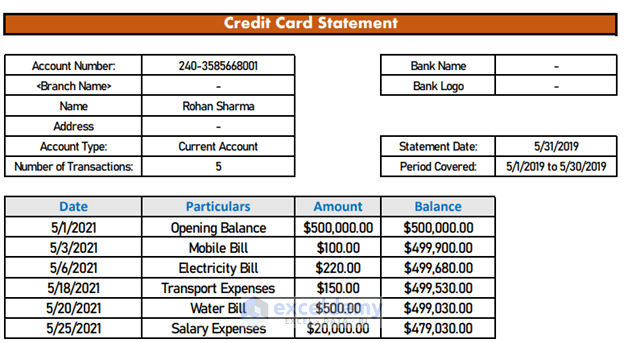

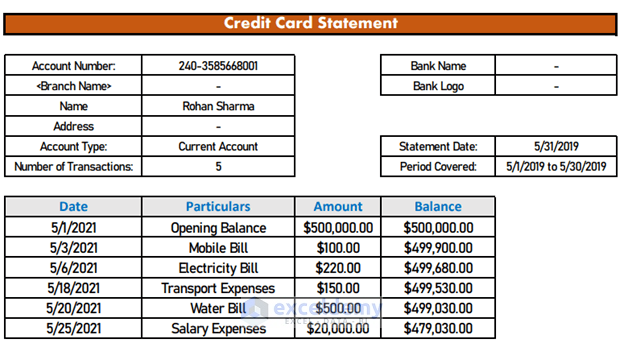

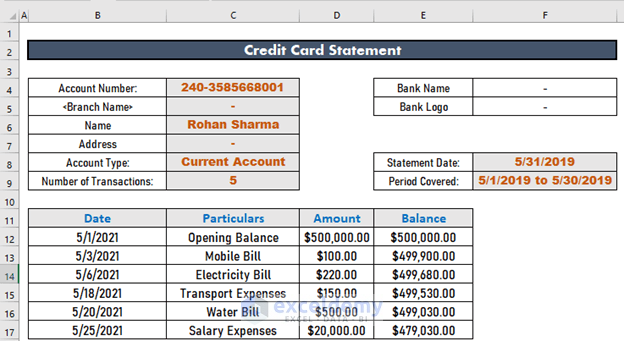

One of the simplest ways to convert credit card statements to Excel is to manually enter the data. This method involves creating a table in Excel and entering each transaction manually. While this method can be time-consuming, it's a great way to ensure accuracy and attention to detail.

To manually enter your credit card statement data, follow these steps:

- Create a new Excel spreadsheet and set up a table with the following columns: date, description, amount, and category.

- Open your credit card statement and start entering each transaction into the corresponding columns.

- Use Excel's auto-fill feature to quickly fill in dates and descriptions.

- Use Excel's formatting features to highlight important information, such as large transactions or suspicious activity.

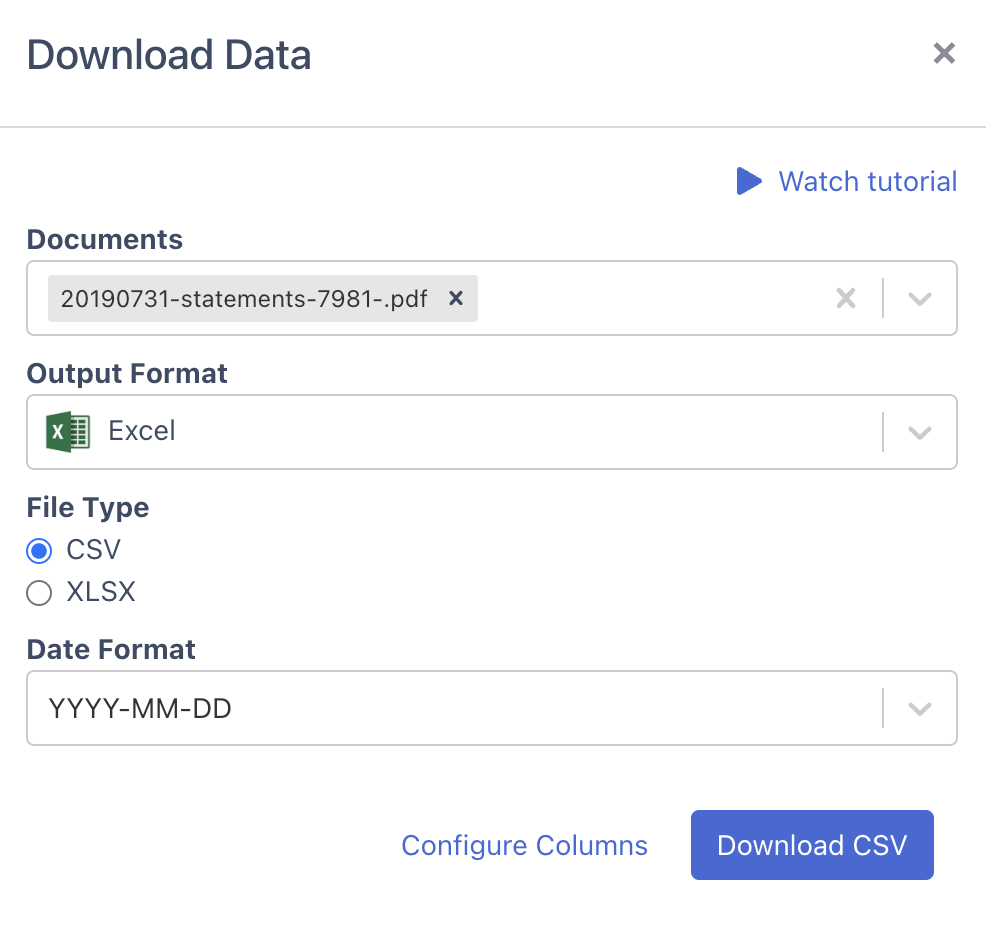

Method 2: Using Online Tools

There are several online tools that can help you convert credit card statements to Excel. These tools can save you time and effort, and often offer additional features, such as data analysis and budgeting.

Some popular online tools for converting credit card statements to Excel include:

- Mint: A personal finance app that allows you to connect your credit cards and export transactions to Excel.

- Personal Capital: A financial management app that provides detailed transaction data and allows you to export to Excel.

- Credit Karma: A credit monitoring app that provides transaction data and allows you to export to Excel.

To use online tools to convert credit card statements to Excel, follow these steps:

- Sign up for an account with the online tool of your choice.

- Connect your credit card account to the tool.

- Export your transaction data to Excel using the tool's built-in export feature.

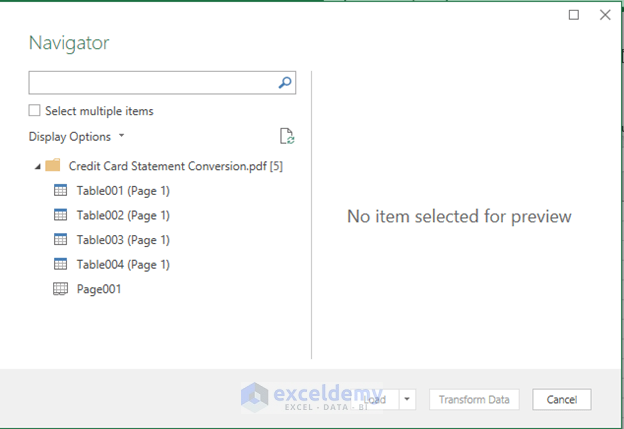

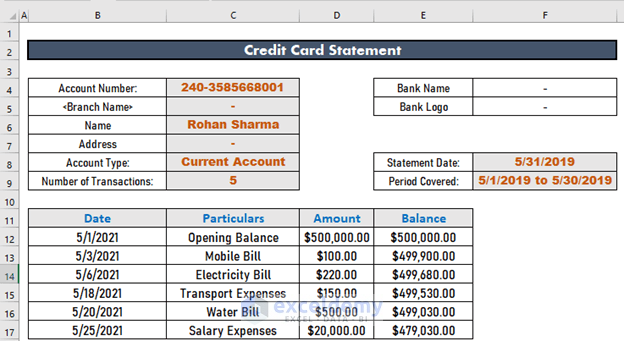

Method 3: Using Excel's Built-In Features

Excel has several built-in features that can help you convert credit card statements to Excel. These features include the ability to import data from text files, web pages, and other sources.

To use Excel's built-in features to convert credit card statements to Excel, follow these steps:

- Open Excel and create a new spreadsheet.

- Go to the "Data" tab and select "From Text" or "From Web".

- Select the credit card statement file or web page you want to import.

- Follow the prompts to import the data into Excel.

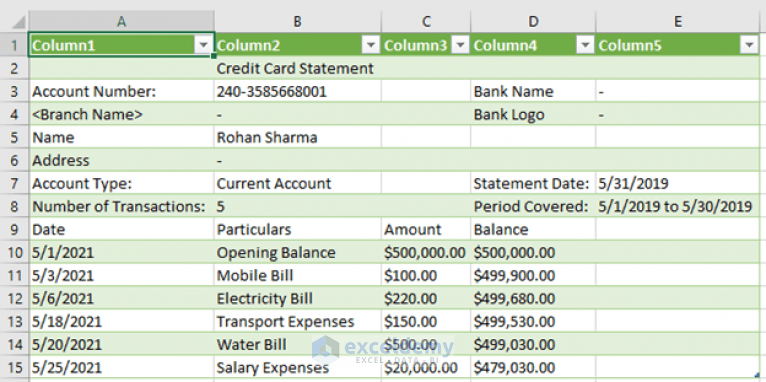

Method 4: Using CSV Files

Many credit card companies provide CSV files that contain transaction data. These files can be easily imported into Excel.

To use CSV files to convert credit card statements to Excel, follow these steps:

- Download the CSV file from your credit card company's website.

- Open Excel and create a new spreadsheet.

- Go to the "Data" tab and select "From Text".

- Select the CSV file and follow the prompts to import the data into Excel.

Method 5: Using Third-Party Software

There are several third-party software programs that can help you convert credit card statements to Excel. These programs often offer advanced features, such as data analysis and budgeting.

Some popular third-party software programs for converting credit card statements to Excel include:

- YNAB (You Need a Budget): A budgeting app that allows you to import transaction data from credit cards and other sources.

- Quicken: A personal finance app that provides detailed transaction data and allows you to export to Excel.

- GnuCash: A free, open-source accounting app that allows you to import transaction data from credit cards and other sources.

To use third-party software to convert credit card statements to Excel, follow these steps:

- Download and install the software program of your choice.

- Connect your credit card account to the software program.

- Export your transaction data to Excel using the software program's built-in export feature.

Conclusion

Converting credit card statements to Excel can be a simple and effective way to manage your finances. Whether you choose to use manual entry, online tools, Excel's built-in features, CSV files, or third-party software, there are many options available to suit your needs. By following the steps outlined in this article, you can easily convert your credit card statements to Excel and start making sense of your financial data.

FAQs

Q: How do I convert my credit card statement to Excel? A: There are several ways to convert your credit card statement to Excel, including manual entry, using online tools, Excel's built-in features, CSV files, and third-party software.

Q: What are the benefits of converting my credit card statement to Excel? A: Converting your credit card statement to Excel can help you manage your finances, identify areas where you can cut back, and make informed decisions about your money.

Q: Can I use online tools to convert my credit card statement to Excel? A: Yes, there are several online tools that can help you convert your credit card statement to Excel, including Mint, Personal Capital, and Credit Karma.

Q: How do I use Excel's built-in features to convert my credit card statement to Excel? A: You can use Excel's built-in features, such as the "From Text" or "From Web" feature, to import your credit card statement data into Excel.

Q: Can I use third-party software to convert my credit card statement to Excel? A: Yes, there are several third-party software programs that can help you convert your credit card statement to Excel, including YNAB, Quicken, and GnuCash.

What is the easiest way to convert my credit card statement to Excel?

+The easiest way to convert your credit card statement to Excel is to use online tools, such as Mint or Personal Capital.

Can I use Excel's built-in features to convert my credit card statement to Excel?

+What are the benefits of converting my credit card statement to Excel?

+Converting your credit card statement to Excel can help you manage your finances, identify areas where you can cut back, and make informed decisions about your money.