In today's mortgage market, adjustable-rate mortgages (ARMs) are becoming increasingly popular due to their lower initial interest rates compared to fixed-rate mortgages. However, understanding how ARMs work and calculating their costs can be complex. Fortunately, with the help of Microsoft Excel, you can create an adjustable-rate mortgage calculator to simplify the process.

Why Use an Adjustable Rate Mortgage Calculator?

Before we dive into creating an ARM calculator in Excel, let's understand why you might need one. Adjustable-rate mortgages can offer significant savings in the short term, but they also come with risks. With an ARM calculator, you can:

- Calculate your monthly payments and total interest paid over the life of the loan

- Compare different ARM scenarios to determine which one is best for your financial situation

- Understand how changes in interest rates will affect your mortgage payments

Creating an Adjustable Rate Mortgage Calculator in Excel

To create an ARM calculator in Excel, you'll need to set up a few key inputs and formulas. Here's a step-by-step guide to help you get started:

- Set up your inputs: Create a table with the following inputs:

- Loan amount (the initial amount borrowed)

- Interest rate (the initial interest rate)

- Loan term (the number of years the loan will be outstanding)

- Adjustment period (the frequency at which the interest rate will be adjusted)

- Caps (the maximum amount the interest rate can increase or decrease)

- Calculate the monthly payment: Use the PMT function in Excel to calculate the monthly payment based on the initial interest rate and loan term. The formula is:

=PMT(Interest Rate/12, Loan Term*12, Loan Amount)

For example, if the loan amount is $200,000, the interest rate is 3.5%, and the loan term is 30 years, the formula would be:

=PMT(0.035/12, 30*12, 200000)

This will give you the monthly payment of $898.09.

Adding Adjustable Rate Functionality

To make the calculator truly adjustable, you'll need to add some formulas that account for changes in interest rates. Here's how:

- Calculate the adjusted interest rate: Create a new column to calculate the adjusted interest rate based on the adjustment period and caps. For example, if the adjustment period is 1 year, and the cap is 2%, you can use the following formula:

=IF(Month Counter >= Adjustment Period, MIN(MAX(Interest Rate + 2%, Cap), Floor), Interest Rate)

This formula checks if the month counter is greater than or equal to the adjustment period. If it is, it calculates the new interest rate by adding 2% to the current interest rate, but capping it at the maximum allowed rate.

- Update the monthly payment: Once you have the adjusted interest rate, you can update the monthly payment formula to use the new rate:

=PMT(Adjusted Interest Rate/12, Loan Term*12, Loan Amount)

Adding Visualizations and What-If Scenarios

To make your ARM calculator more interactive and user-friendly, you can add some visualizations and what-if scenarios. Here are a few ideas:

- Create a chart to show the impact of interest rate changes: Use a line chart or bar chart to show how changes in interest rates affect the monthly payment.

- Add a scenario planner: Create a table that allows users to input different scenarios, such as changes in interest rates or loan terms, and see how they affect the monthly payment.

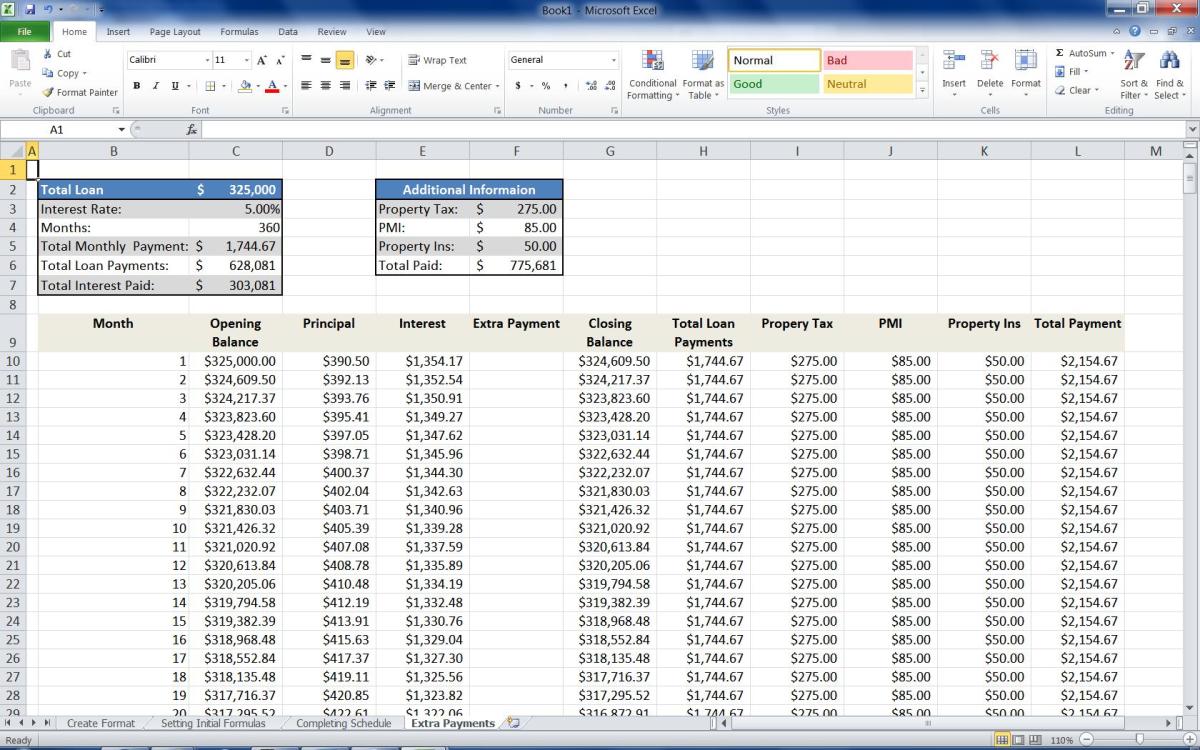

Example of an Adjustable Rate Mortgage Calculator in Excel

Here's an example of what your ARM calculator might look like in Excel:

| Input | Value |

|---|---|

| Loan Amount | $200,000 |

| Interest Rate | 3.5% |

| Loan Term | 30 years |

| Adjustment Period | 1 year |

| Caps | 2% |

| Month | Interest Rate | Monthly Payment |

|---|---|---|

| 1 | 3.5% | $898.09 |

| 2 | 3.5% | $898.09 |

| 3 | 3.7% | $934.19 |

| ... | ... | ... |

In this example, the calculator shows the initial interest rate and monthly payment, as well as the adjusted interest rate and monthly payment after the first year.

Tips and Variations

Here are a few tips and variations to keep in mind when creating your ARM calculator:

- Use multiple scenarios: Create multiple scenarios to compare different ARM options and see how they affect the monthly payment.

- Add a sensitivity analysis: Use a sensitivity analysis to see how changes in interest rates or loan terms affect the monthly payment.

- Use different interest rate scenarios: Use different interest rate scenarios, such as a flat rate or a tiered rate, to see how they affect the monthly payment.

Conclusion

Creating an adjustable-rate mortgage calculator in Excel can help you understand the complexities of ARMs and make informed decisions about your mortgage options. By following the steps outlined in this article, you can create a calculator that takes into account the unique features of ARMs, such as adjustable interest rates and caps. With this calculator, you'll be able to compare different ARM scenarios, understand how changes in interest rates will affect your mortgage payments, and make more informed decisions about your financial future.

Image

Gallery

Gallery of Adjustable Rate Mortgage Calculators

FAQs

What is an adjustable-rate mortgage?

+An adjustable-rate mortgage (ARM) is a type of mortgage where the interest rate can change over time.

How does an ARM calculator work?

+An ARM calculator uses a formula to calculate the monthly payment based on the initial interest rate, loan term, and loan amount.

What are the benefits of using an ARM calculator?

+Using an ARM calculator can help you understand the complexities of ARMs, compare different scenarios, and make informed decisions about your mortgage options.