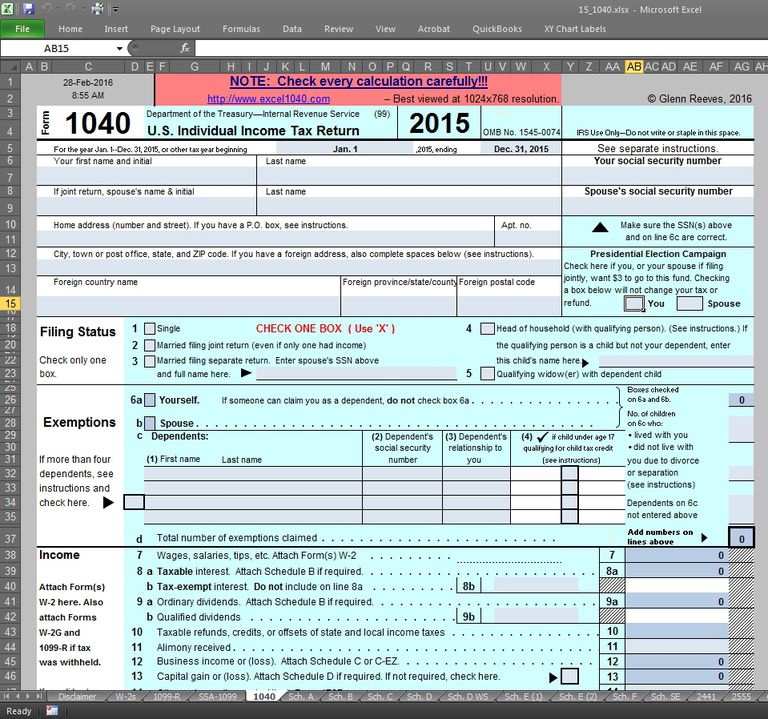

Streamlining Your Finances with Glenn Reeves Tax Spreadsheet

As a homeowner, property manager, or real estate investor, managing your finances can be a daunting task. With the help of Glenn Reeves' tax spreadsheet, you can streamline your financial records, reduce stress, and make tax season a breeze. In this article, we will delve into the world of tax spreadsheets, explore the benefits of using one, and provide a comprehensive guide on how to create and utilize Glenn Reeves' tax spreadsheet.

What is a Tax Spreadsheet?

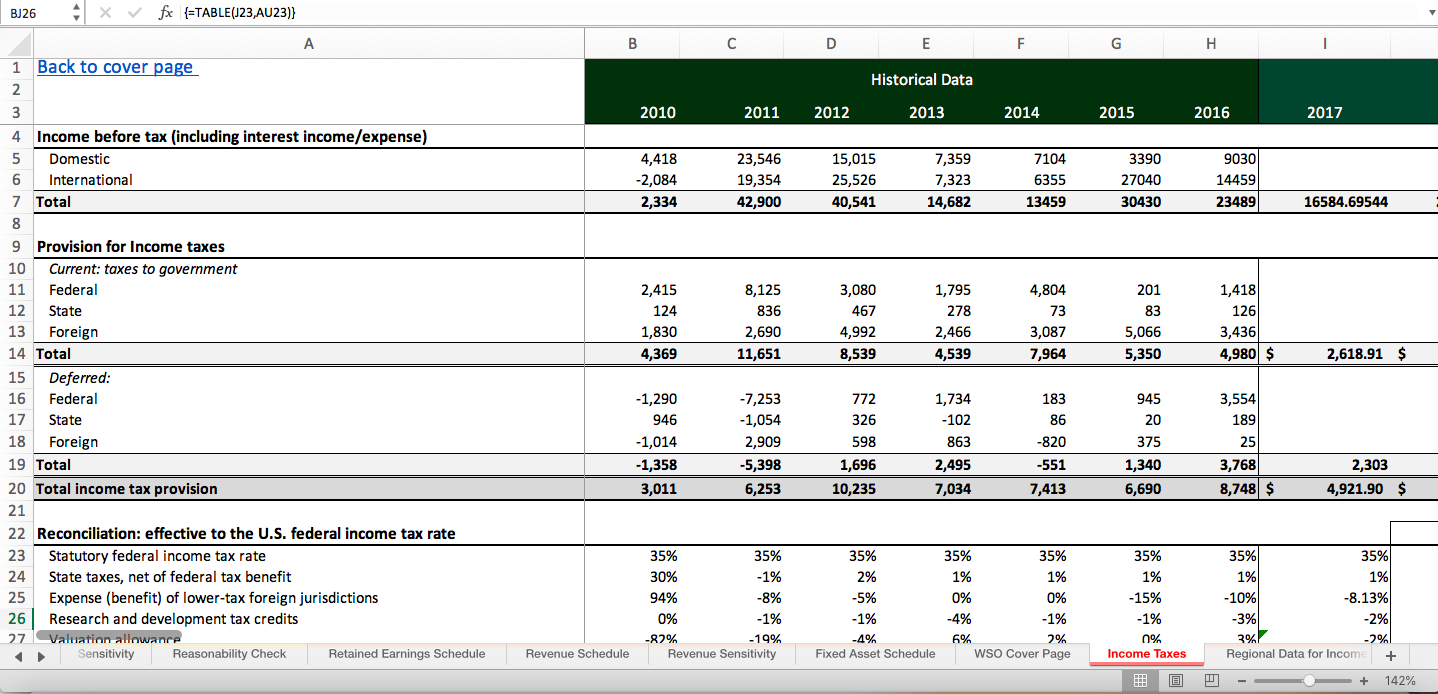

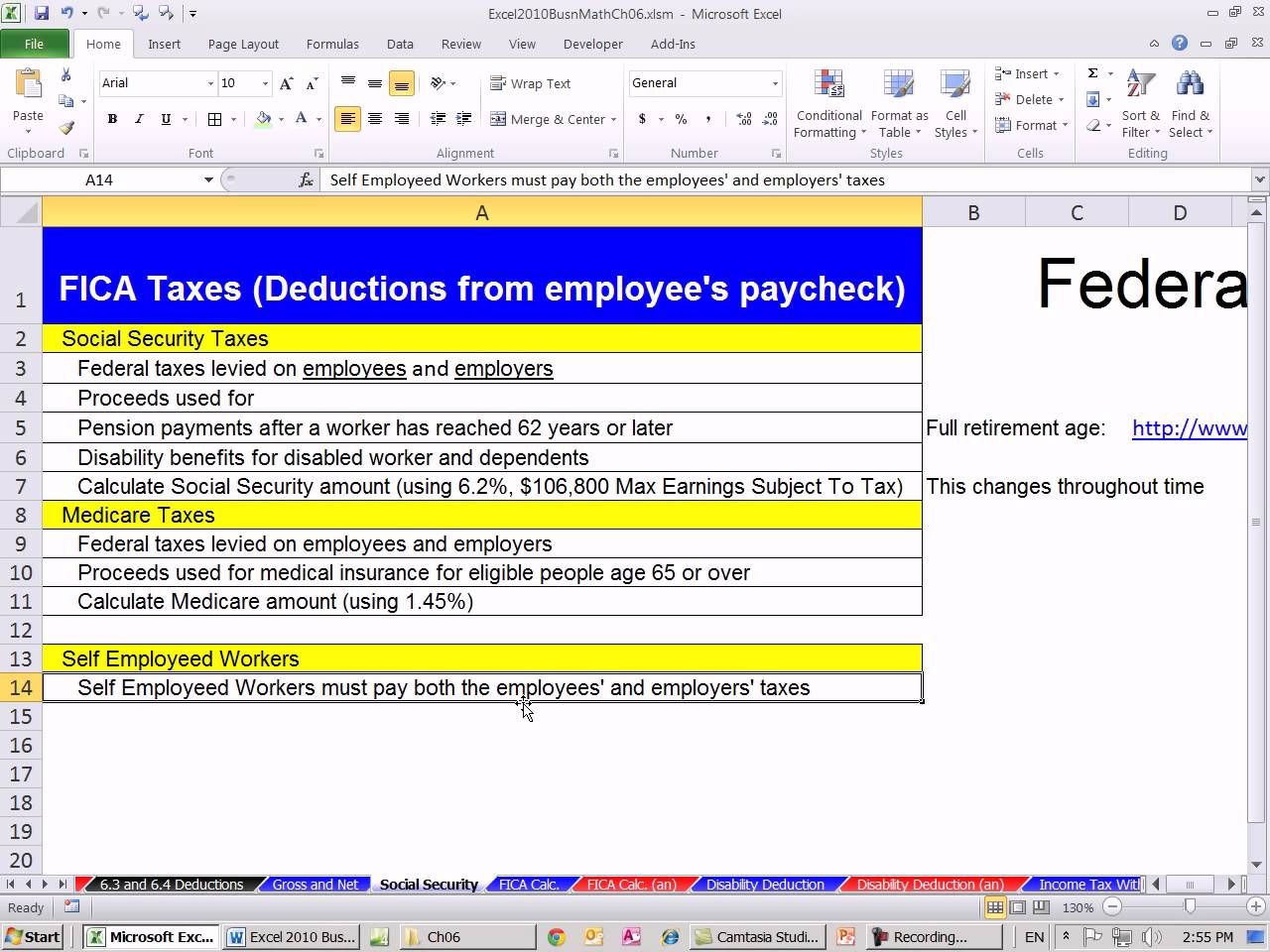

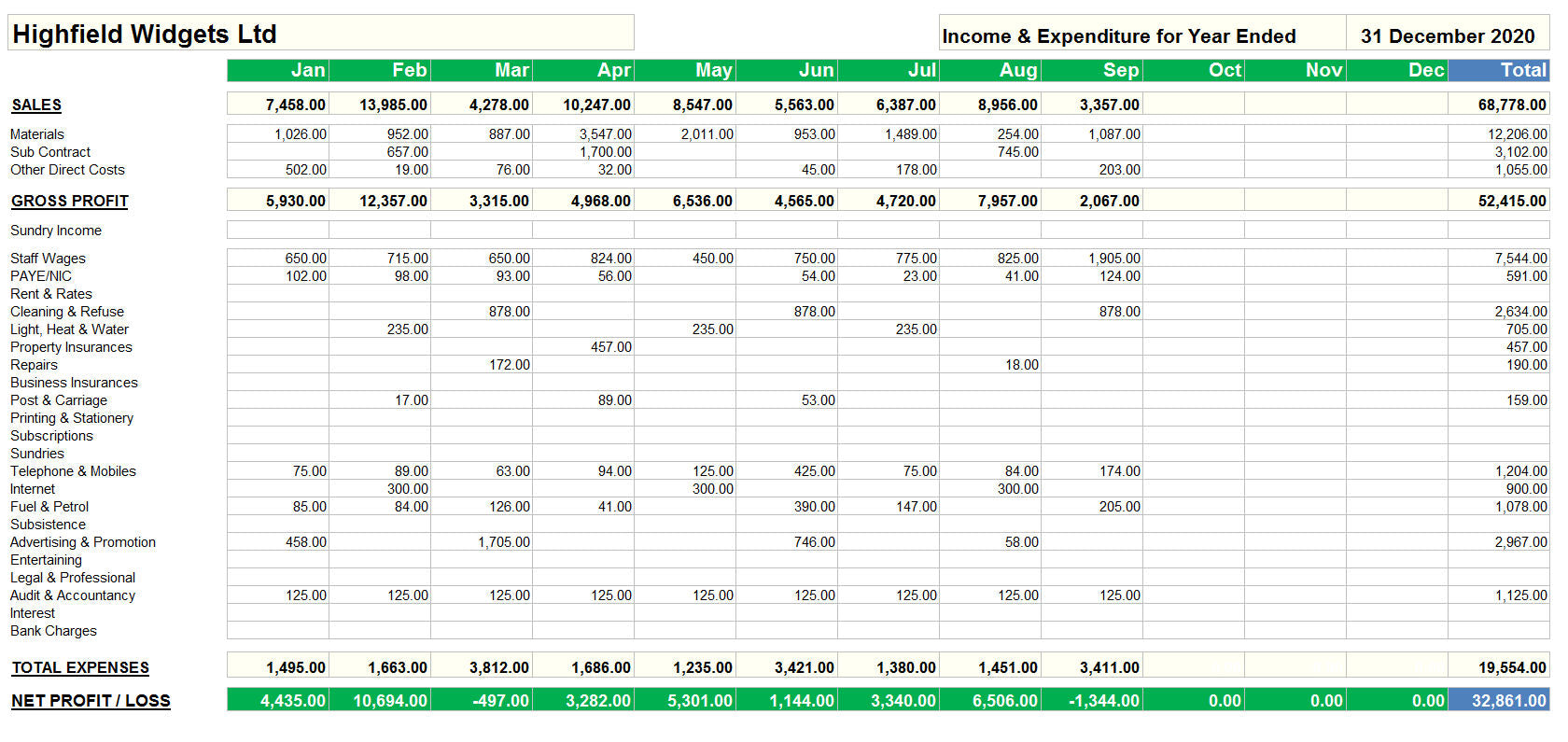

A tax spreadsheet is a digital tool used to organize and track financial data, making it easier to prepare for tax season. It's a centralized platform where you can record income, expenses, deductions, and credits, ensuring that you're taking advantage of all the tax benefits available to you. A well-designed tax spreadsheet can save you time, reduce errors, and help you make informed financial decisions.

Benefits of Using a Tax Spreadsheet

- Accurate Record-Keeping: A tax spreadsheet helps you maintain accurate and up-to-date financial records, reducing the risk of errors and missed deductions.

- Time-Saving: By automating calculations and organizing data, a tax spreadsheet saves you time and effort during tax preparation.

- Improved Financial Visibility: A tax spreadsheet provides a clear picture of your financial situation, enabling you to make informed decisions and identify areas for improvement.

- Reduced Stress: With a tax spreadsheet, you'll feel more confident and prepared for tax season, reducing stress and anxiety.

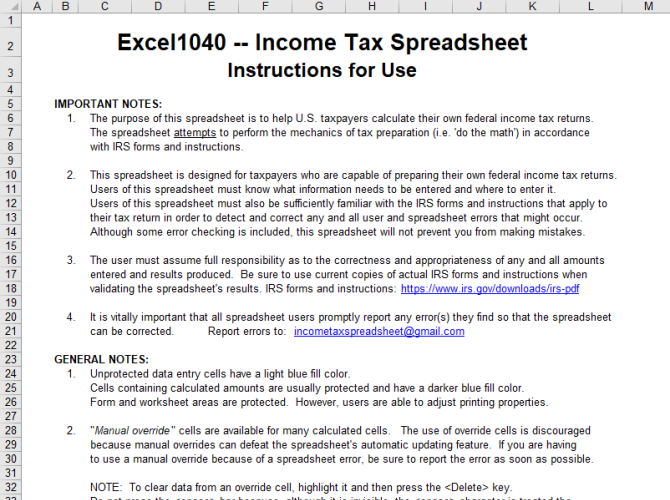

Glenn Reeves' Tax Spreadsheet: A Comprehensive Guide

Glenn Reeves' tax spreadsheet is a popular choice among homeowners and real estate investors. This spreadsheet is designed to help you track income, expenses, and deductions, making it easier to prepare for tax season. Here's a step-by-step guide to creating and using Glenn Reeves' tax spreadsheet:

Setting Up the Spreadsheet

- Download the Template: Start by downloading the Glenn Reeves tax spreadsheet template from a reputable source.

- Customize the Template: Customize the template to fit your specific needs, adding or removing sections as necessary.

- Enter Your Data: Enter your financial data, including income, expenses, and deductions.

Tracking Income

- Rental Income: Record rental income from each property, including the date, amount, and property address.

- Interest Income: Track interest income from bank accounts, investments, and other sources.

- Dividend Income: Record dividend income from stocks, mutual funds, and other investments.

Tracking Expenses

- Mortgage Interest: Record mortgage interest payments, including the date, amount, and property address.

- Property Taxes: Track property taxes, including the date, amount, and property address.

- Insurance: Record insurance premiums, including the date, amount, and type of insurance.

Claiming Deductions

- Mortgage Interest Deduction: Claim the mortgage interest deduction, using the formula provided in the spreadsheet.

- Property Tax Deduction: Claim the property tax deduction, using the formula provided in the spreadsheet.

- Depreciation: Calculate depreciation on your properties, using the formulas provided in the spreadsheet.

Tips and Best Practices

- Regularly Update the Spreadsheet: Regularly update the spreadsheet to ensure accurate and up-to-date financial records.

- Use Formulas and Functions: Use formulas and functions to automate calculations and reduce errors.

- Backup Your Data: Backup your data regularly to prevent loss or corruption.

Gallery of Tax Spreadsheet Examples

FAQs

What is the purpose of a tax spreadsheet?

+A tax spreadsheet is used to organize and track financial data, making it easier to prepare for tax season.

How do I set up a tax spreadsheet?

+Download a template, customize it to fit your needs, and enter your financial data.

What are the benefits of using a tax spreadsheet?

+A tax spreadsheet helps you maintain accurate records, saves time, and reduces stress during tax season.

By following the guidelines outlined in this article, you can create and utilize Glenn Reeves' tax spreadsheet to streamline your finances and make tax season a breeze. Remember to regularly update the spreadsheet, use formulas and functions, and backup your data to ensure accurate and up-to-date financial records.

/Excel1040_2015-56f1f7675f9b5867a1c78a4f.jpg)