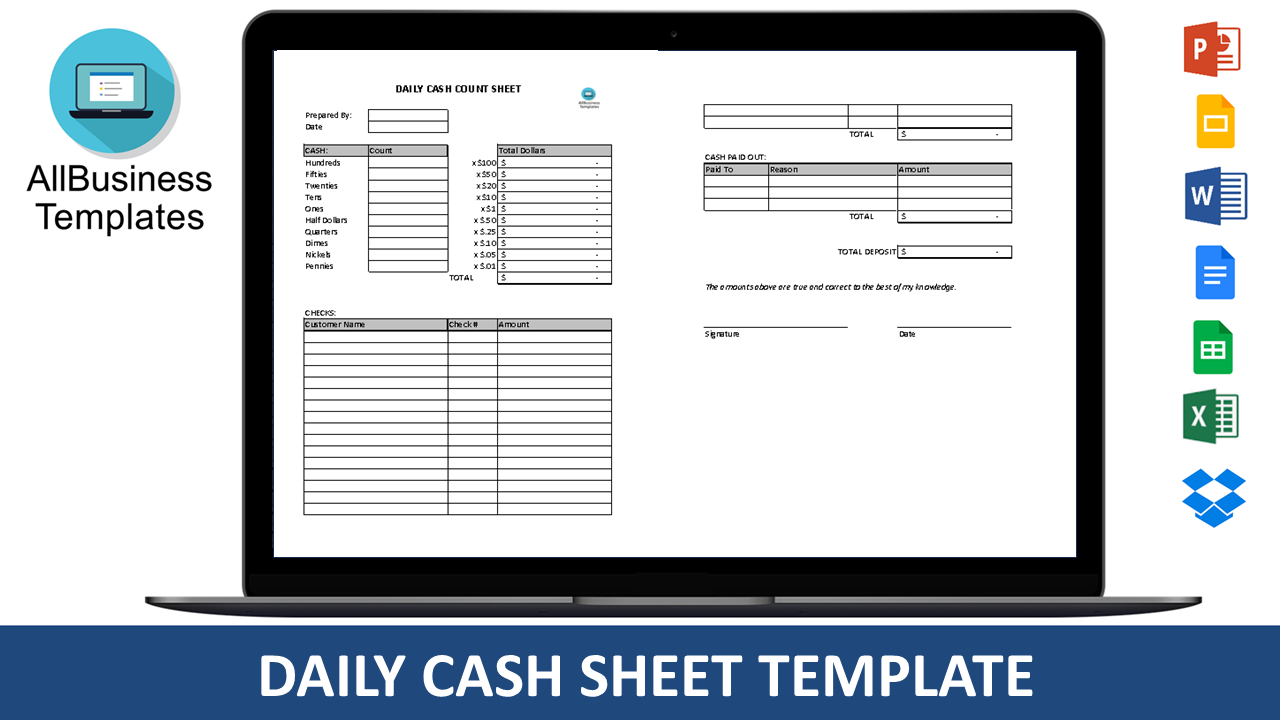

Managing cash flow is essential for any business, as it directly impacts the ability to meet financial obligations, invest in growth, and ultimately, stay afloat. A daily cash sheet is a powerful tool in this endeavor, providing a snapshot of the inflows and outflows of cash on a daily basis. This can help identify trends, manage liquidity, and make informed decisions. While it's possible to manually track cash flow, utilizing a template can significantly streamline the process. Here, we'll delve into the benefits of using a daily cash sheet template in Excel and provide guidance on how to create or customize one to fit your business needs.

Benefits of Using a Daily Cash Sheet Template in Excel

- Efficiency: Manually tracking daily cash inflows and outflows can be time-consuming and prone to errors. An Excel template automates much of this process, saving time and reducing mistakes.

- Accuracy: By using formulas, Excel templates can accurately calculate total cash flow, making it easier to see the overall financial health of your business.

- Flexibility: Excel templates can be easily modified to fit the specific needs of your business. Whether you need to track cash flow by department, project, or another category, an Excel template can be adjusted accordingly.

- Scalability: As your business grows, your daily cash sheet template can grow with it. Excel's functionality allows for easy expansion, ensuring that your template remains a useful tool regardless of your business's size.

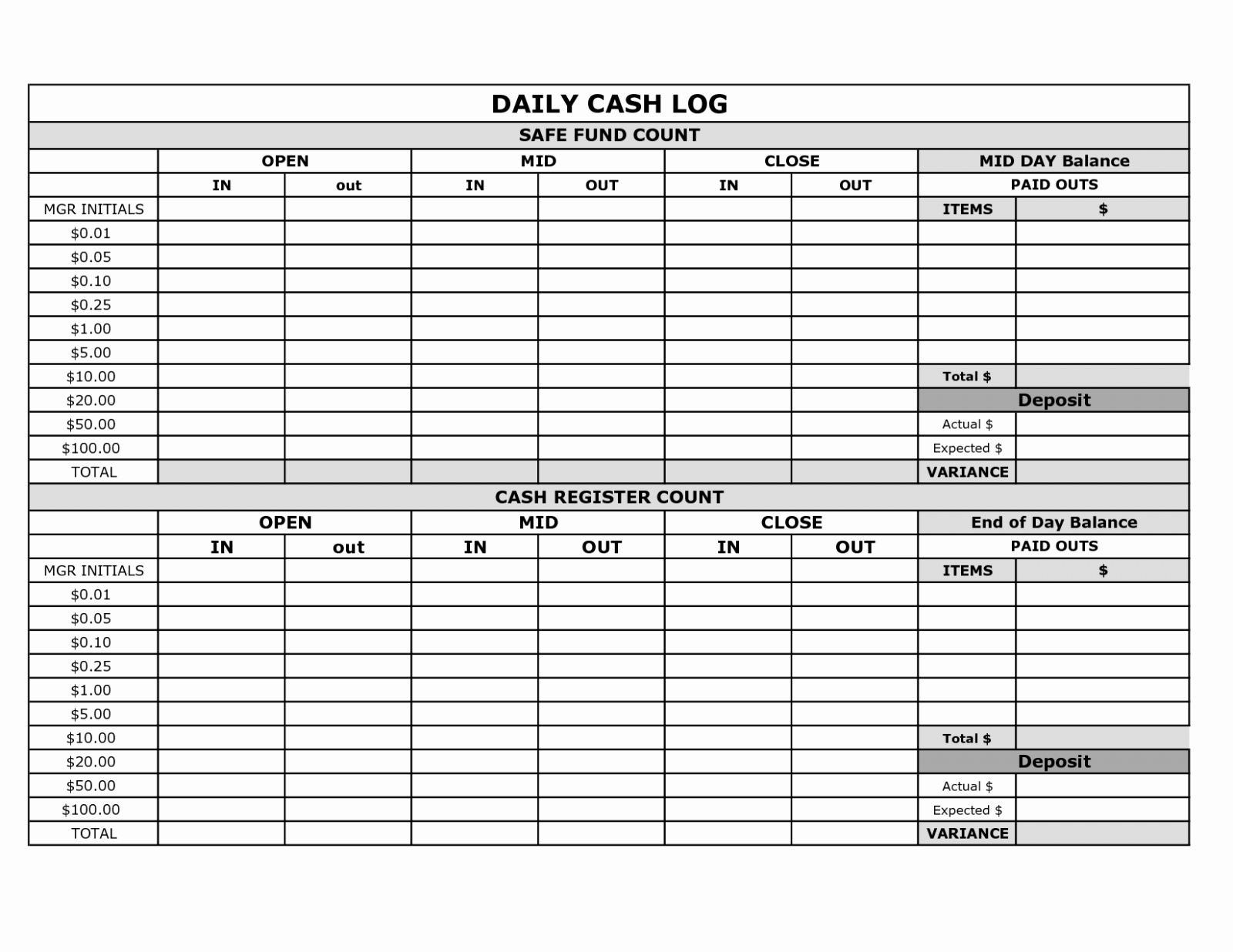

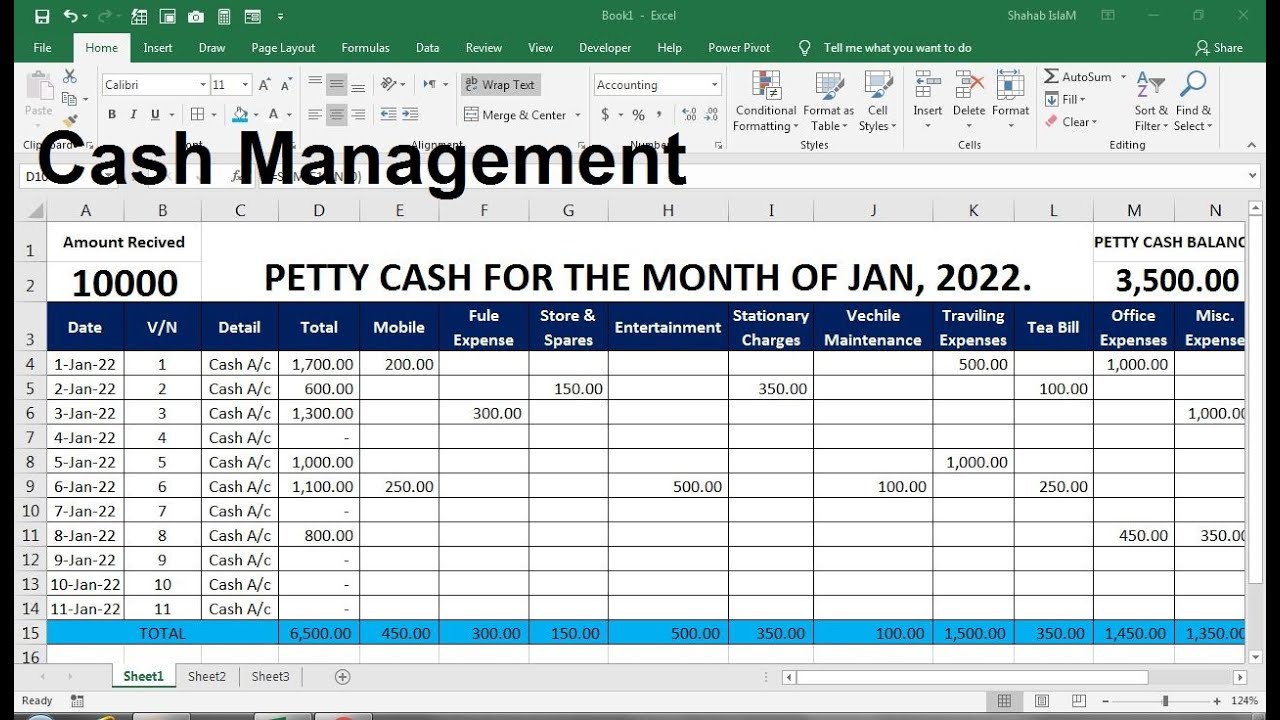

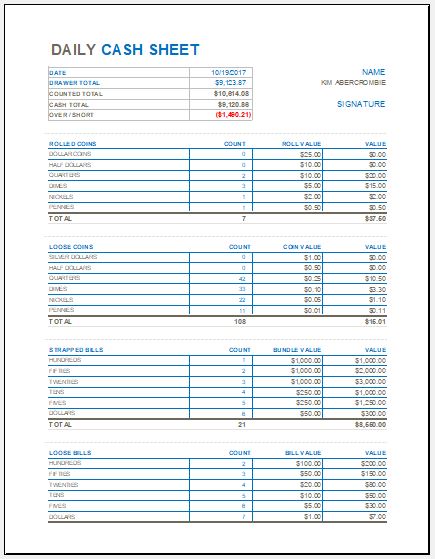

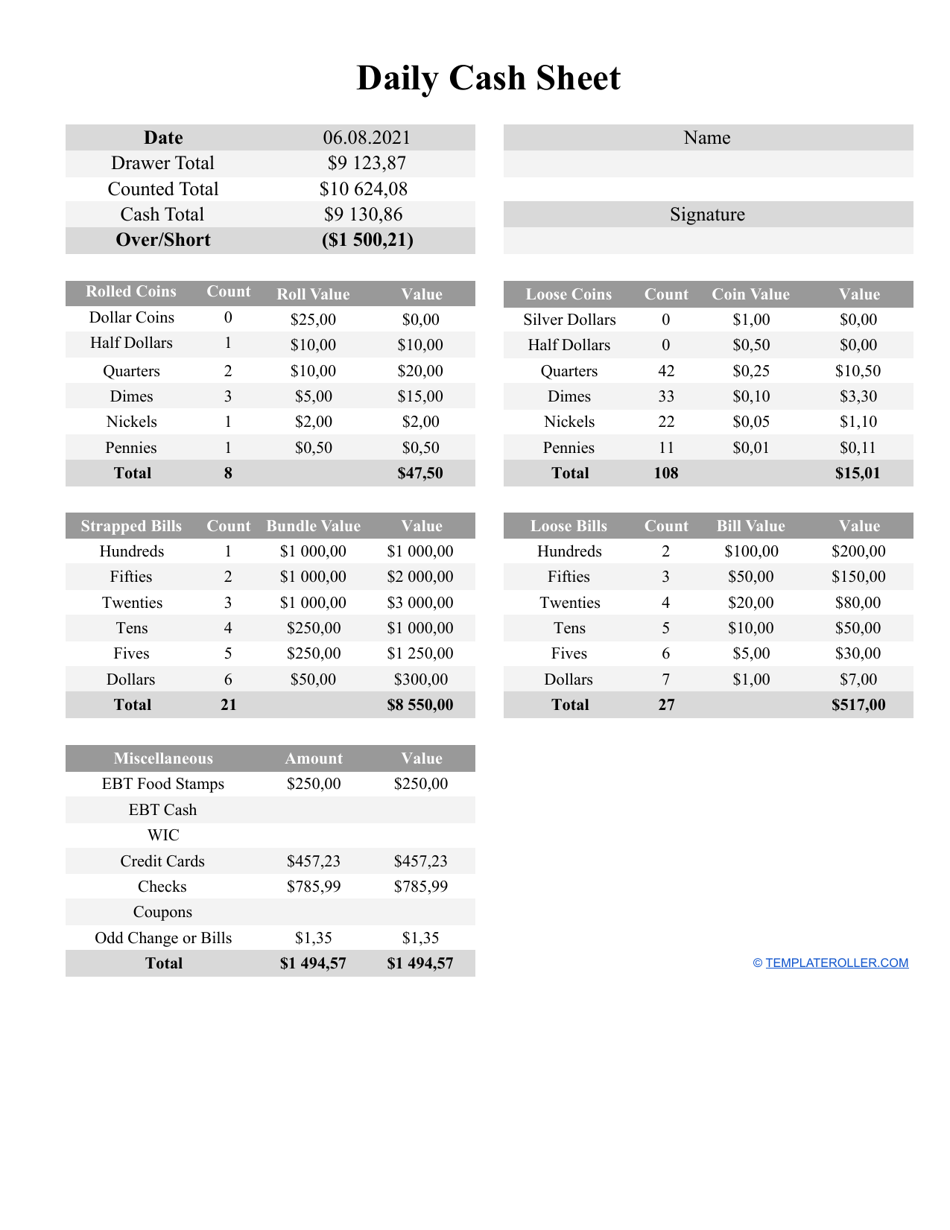

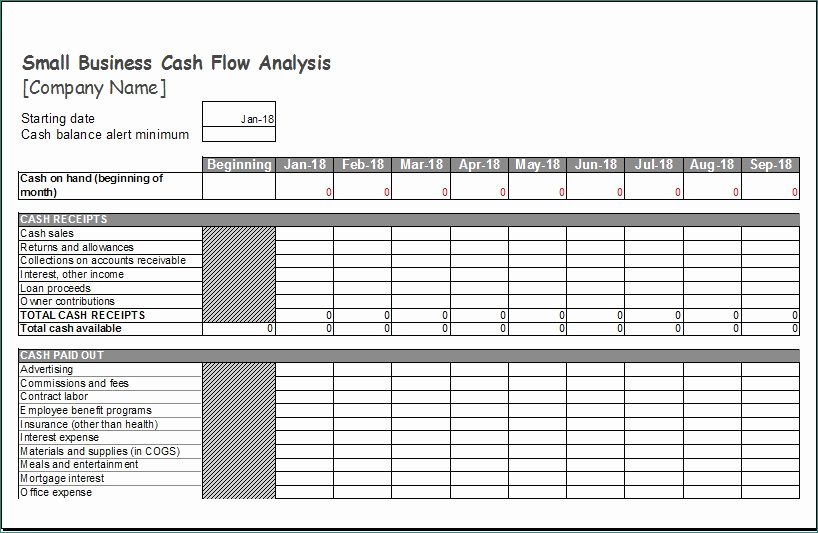

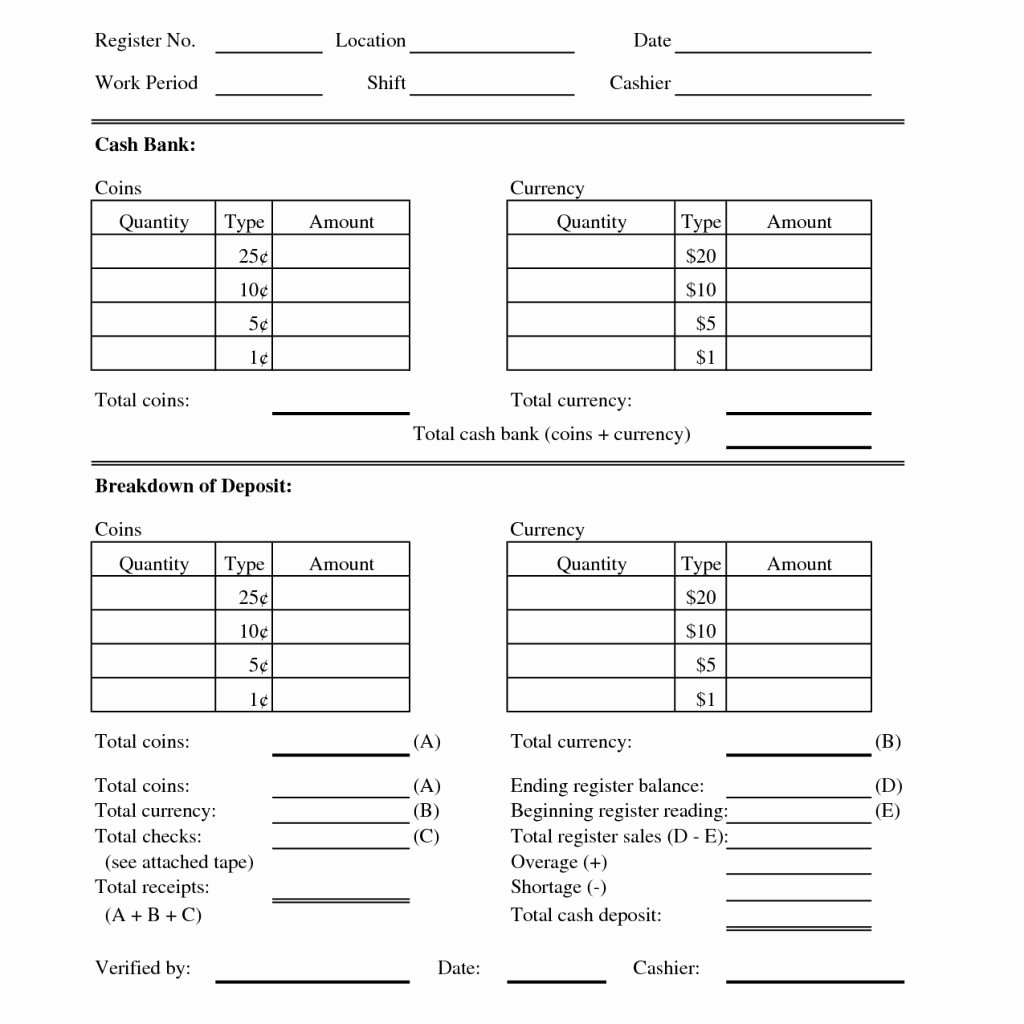

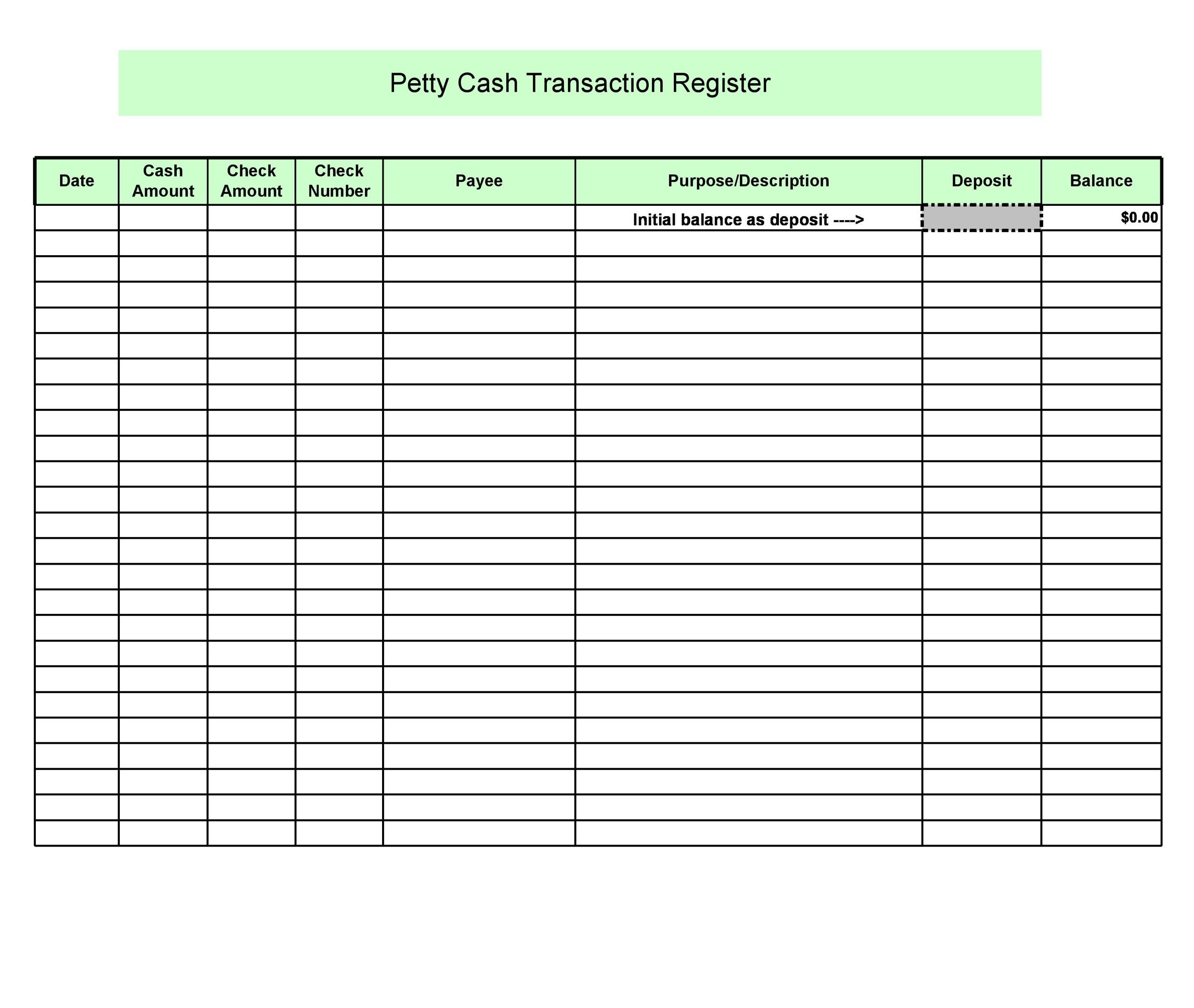

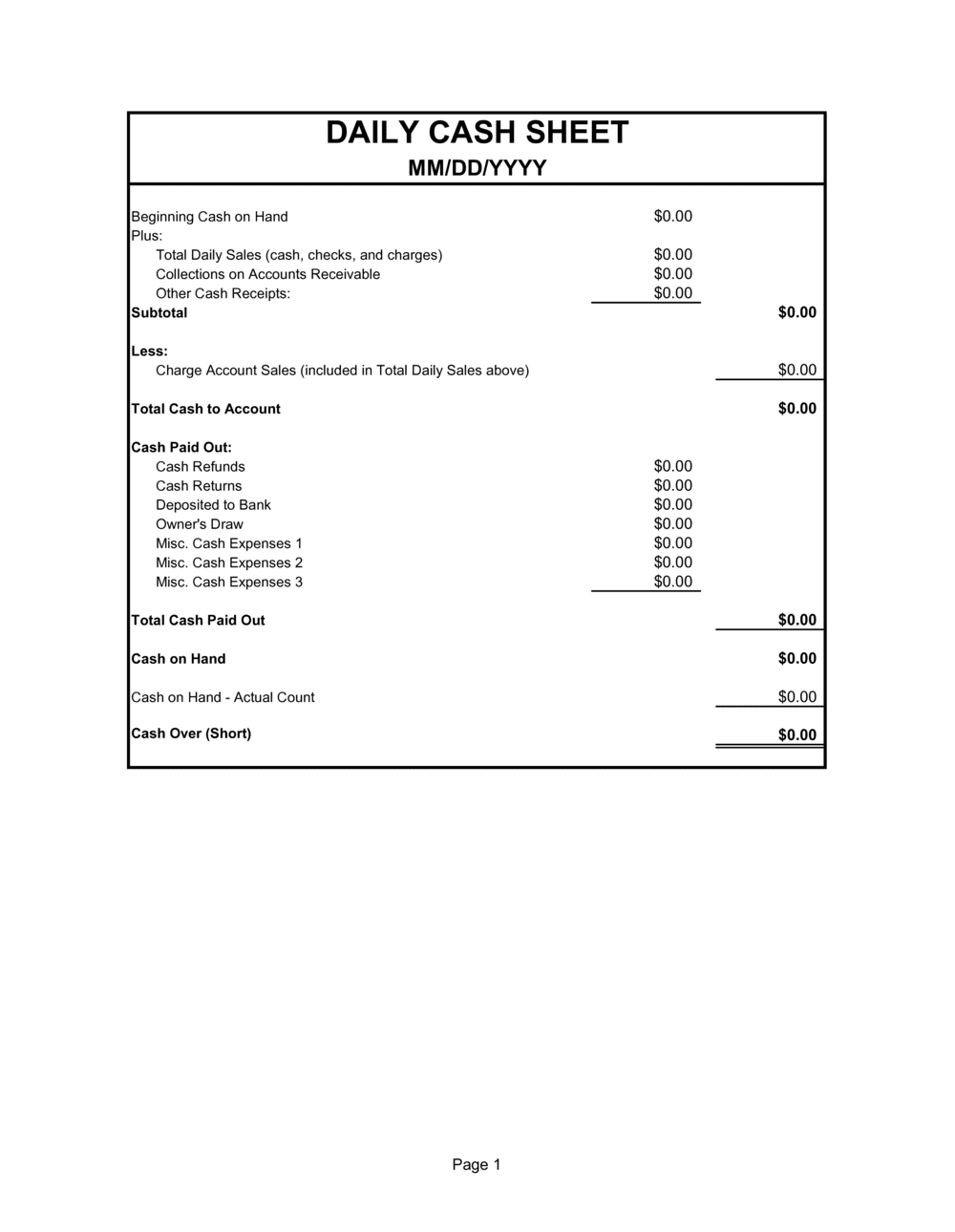

Key Components of a Daily Cash Sheet Template in Excel

- Date: A column to record the date, allowing for easy tracking over time.

- Cash Inflows: Columns or rows to list all cash received by the business, including sales, loans, investments, etc.

- Cash Outflows: Similar to cash inflows, columns or rows to detail all cash spent by the business, such as expenses, salaries, and purchases.

- Total Cash Flow: A calculation that sums the cash inflows and subtracts the cash outflows to provide a net cash flow figure.

- Opening Balance: The starting cash balance at the beginning of the day.

- Closing Balance: The ending cash balance after accounting for all inflows and outflows, calculated by adding the total cash flow to the opening balance.

How to Create a Daily Cash Sheet Template in Excel

Creating a basic daily cash sheet template in Excel is straightforward and can be done by following these steps:

- Open Excel: Start by opening a new Excel document.

- Set Up the Grid: Create columns for Date, Description, Cash In, Cash Out, and Running Balance. Adjust column widths as needed for easy viewing.

- Input Formulas:

- In the Cash In and Cash Out columns, use simple addition formulas to calculate totals.

- For the Running Balance, start with the opening balance in the first row, then use a formula that adds the cash inflows and subtracts the cash outflows for each subsequent row.

- Add Conditional Formatting: Use Excel's conditional formatting feature to highlight cells based on conditions, such as negative balances or significant transactions.

- Test and Refine: Enter sample data to test the template's functionality. Refine the template as needed to fit your business's specific requirements.

Customizing Your Daily Cash Sheet Template

While the basic template can be useful, it might not fully meet the unique needs of your business. Customization can include:

- Additional Columns: For tracking specific types of income or expenses.

- Drop-down Lists: For categorizing transactions or selecting from a list of common descriptions.

- Budget Tracking: By adding columns or sheets to compare actual spending against budgeted amounts.

- Charts and Graphs: To visually represent cash flow trends and make it easier to identify areas for improvement.

Conclusion

A daily cash sheet template in Excel is a versatile and powerful tool for managing cash flow. By understanding its benefits, key components, and how to create or customize a template, businesses can improve their financial management and make better-informed decisions. Whether you're a small startup or an established enterprise, adapting this tool to your specific needs can lead to improved liquidity management and, ultimately, better financial health.

Gallery of Daily Cash Sheet Templates

FAQs

What is the main purpose of a daily cash sheet template?

+The main purpose is to track and manage the daily inflows and outflows of cash to maintain liquidity and make informed financial decisions.

How can I customize a daily cash sheet template in Excel for my business?

+You can add or remove columns, use drop-down lists, and integrate budget tracking and visual representations like charts and graphs to fit your business needs.

What are the key components that should be included in a daily cash sheet template?

+Date, Description, Cash In, Cash Out, and Running Balance, along with the ability to calculate totals and closing balances.