Managing finances, investments, and loans often involves calculating cumulative interest, which is the total interest accrued over a specific period. Microsoft Excel, with its powerful formulas and functions, is an ideal tool for performing such calculations. In this article, we will explore three methods to calculate cumulative interest in Excel, covering simple interest, compound interest, and the use of the IPMT and CUMIPMT functions for more complex scenarios.

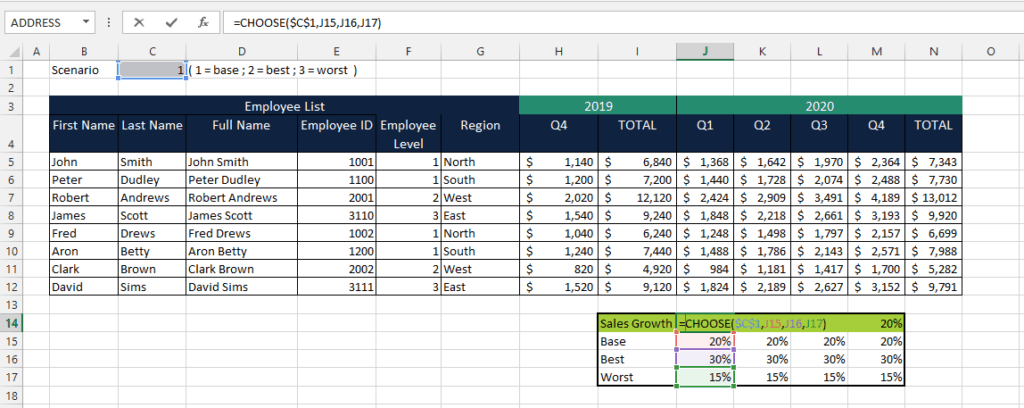

Excel offers a variety of functions to calculate interest, including IPMT, CUMIPMT, and the XNPV and XIRR functions for more advanced calculations involving irregular cash flows. However, for straightforward interest calculations, understanding how to apply simple and compound interest formulas is fundamental.

Understanding Interest Types

Before diving into the calculations, it's essential to understand the two primary types of interest: simple interest and compound interest.

-

Simple Interest is calculated only on the initial principal amount. It does not take into account any accrued interest from previous periods.

-

Compound Interest is calculated on the initial principal, which also includes all of the accrued interest from previous periods on a deposit or loan. This results in a much higher total amount over time, especially with high-interest rates or over long periods.

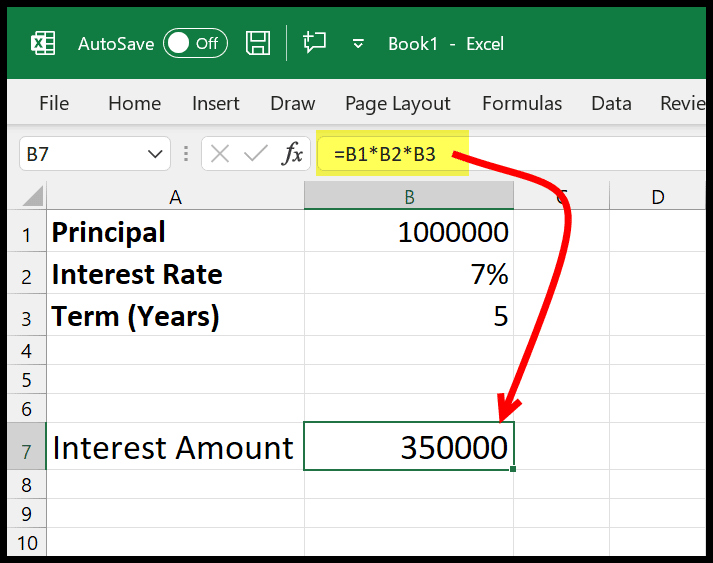

Method 1: Calculating Simple Interest

Simple interest is calculated using the formula:

[ \text{Simple Interest} = P \times R \times T ]

Where:

- (P) is the principal amount,

- (R) is the annual interest rate (in decimal form),

- (T) is the time the money is invested or borrowed for, in years.

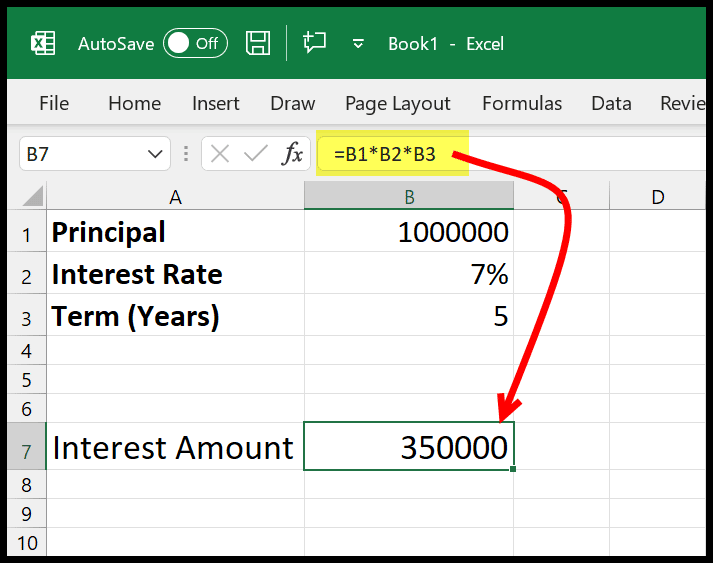

In Excel, if you have the principal amount in cell A1, the interest rate in cell A2, and the time in cell A3, you can calculate the simple interest with the formula:

=A1*A2*A3

Assuming A1 = $1,000, A2 = 5% or 0.05, and A3 = 2 years, the formula would return $100 as the simple interest, making the total amount $1,100.

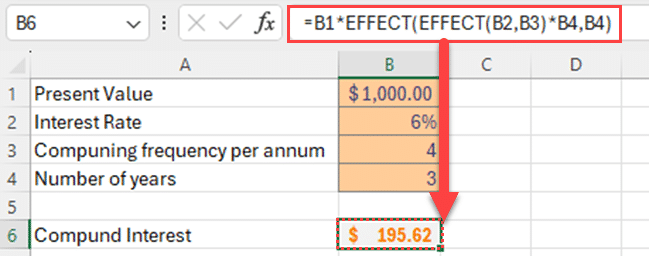

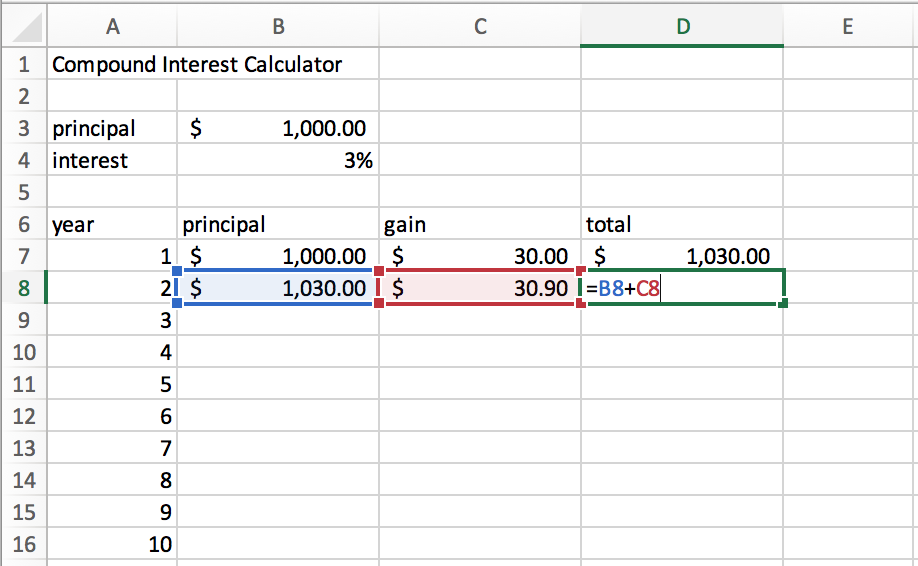

Method 2: Calculating Compound Interest

Compound interest can be calculated using the formula for the future value of an investment or loan:

[ A = P(1 + r)^n ]

Where:

- (A) is the amount of money accumulated after n years, including interest,

- (P) is the principal amount,

- (r) is the annual interest rate (in decimal form),

- (n) is the number of years the money is invested or borrowed for.

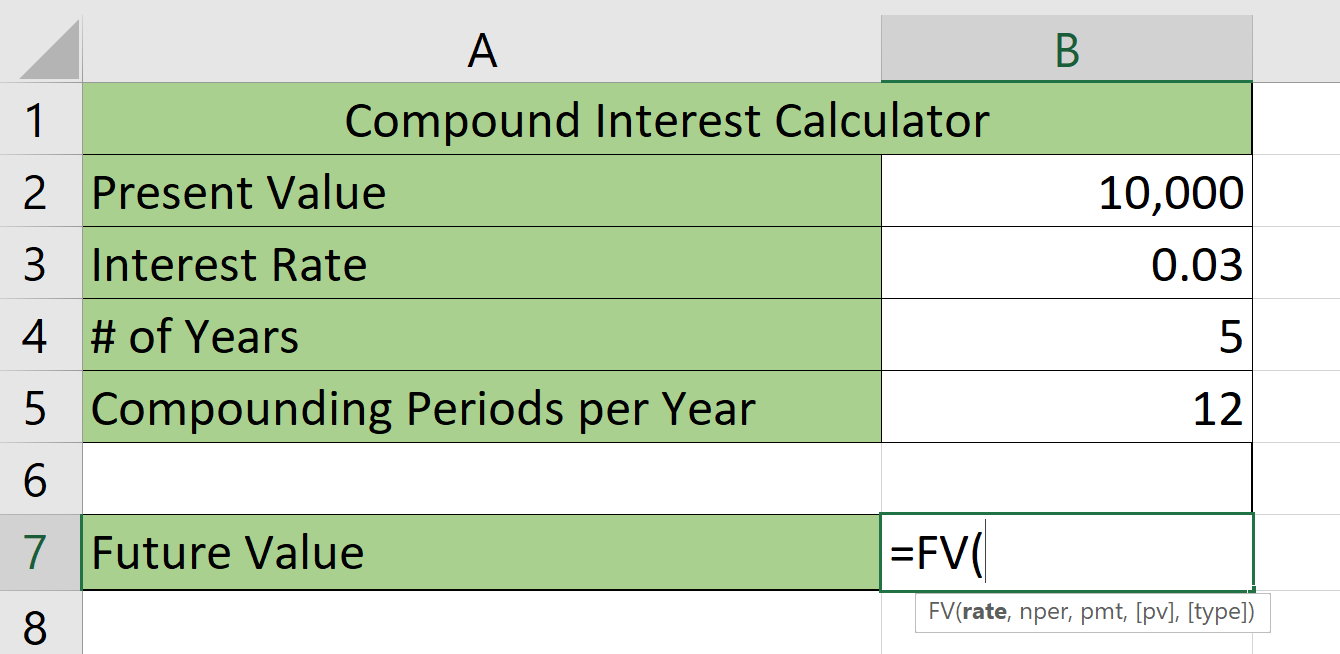

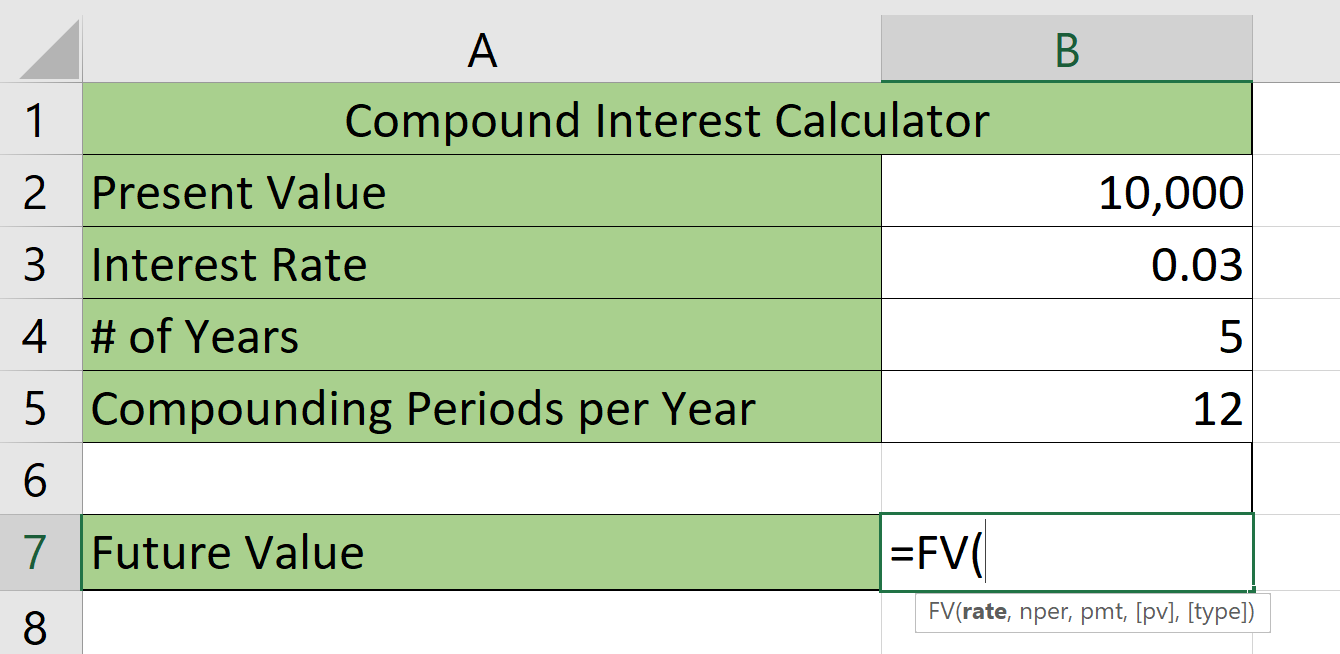

In Excel, you can calculate the future value using the FV function:

=FV(A2, A3, 0, -A1)

Assuming A1 = $1,000, A2 = 5% or 0.05, and A3 = 2, this formula calculates the future value of your investment, assuming compound interest is applied annually.

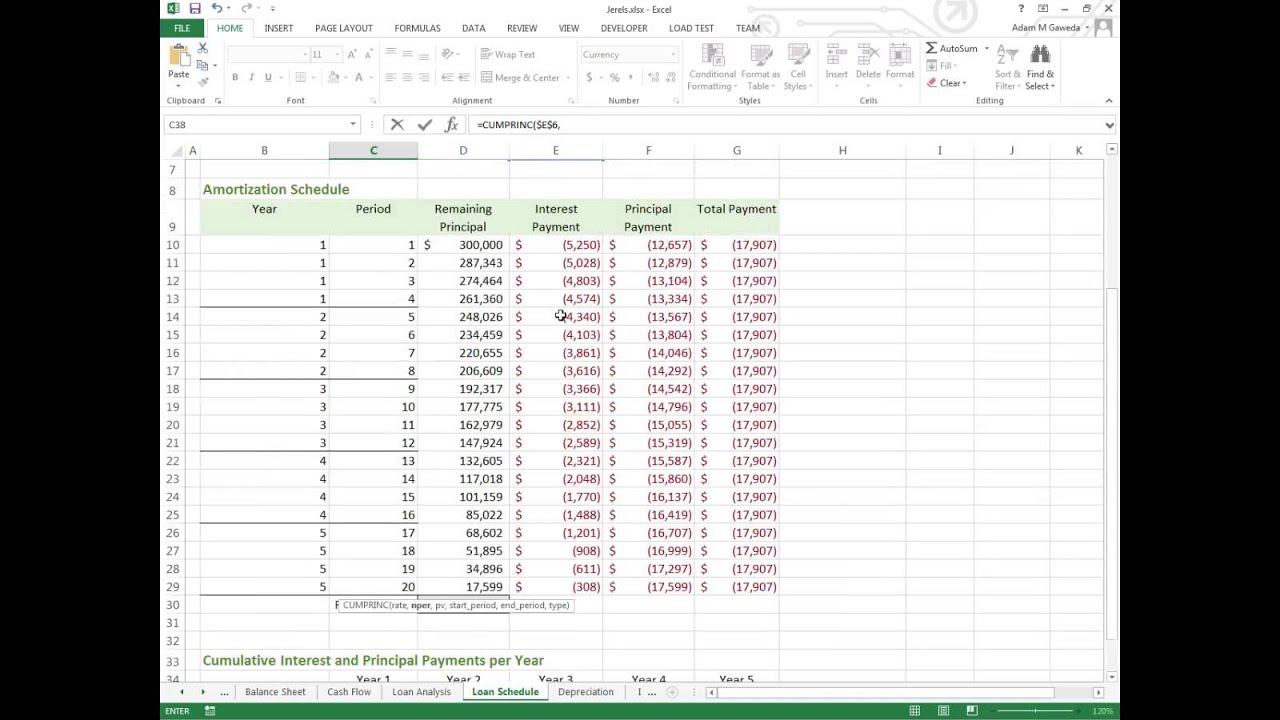

Method 3: Using IPMT and CUMIPMT Functions for Cumulative Interest

For more complex financial calculations, such as calculating the cumulative interest paid on a loan over a specified period, you can use the IPMT and CUMIPMT functions.

-

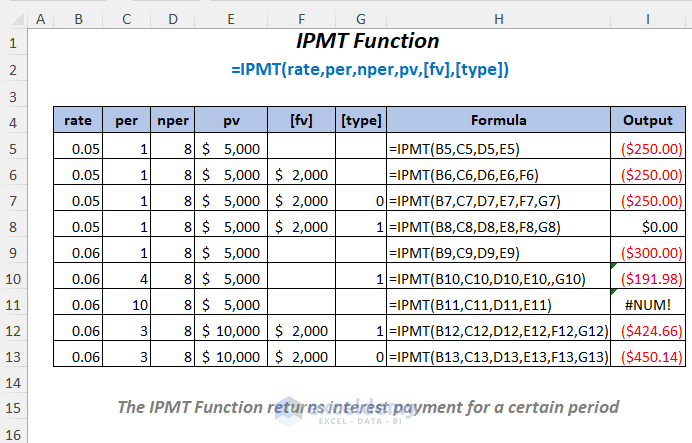

The IPMT function calculates the interest portion of a loan payment for a given period. The syntax is

IPMT(rate, per, nper, pv, [fv], [type]), where:rateis the interest rate,peris the period for which you want to find the interest,nperis the total number of payment periods,pvis the present value (the initial amount of the loan),[fv]is the future value (optional),[type]is whether payments are due at the beginning or end of the period (optional).

-

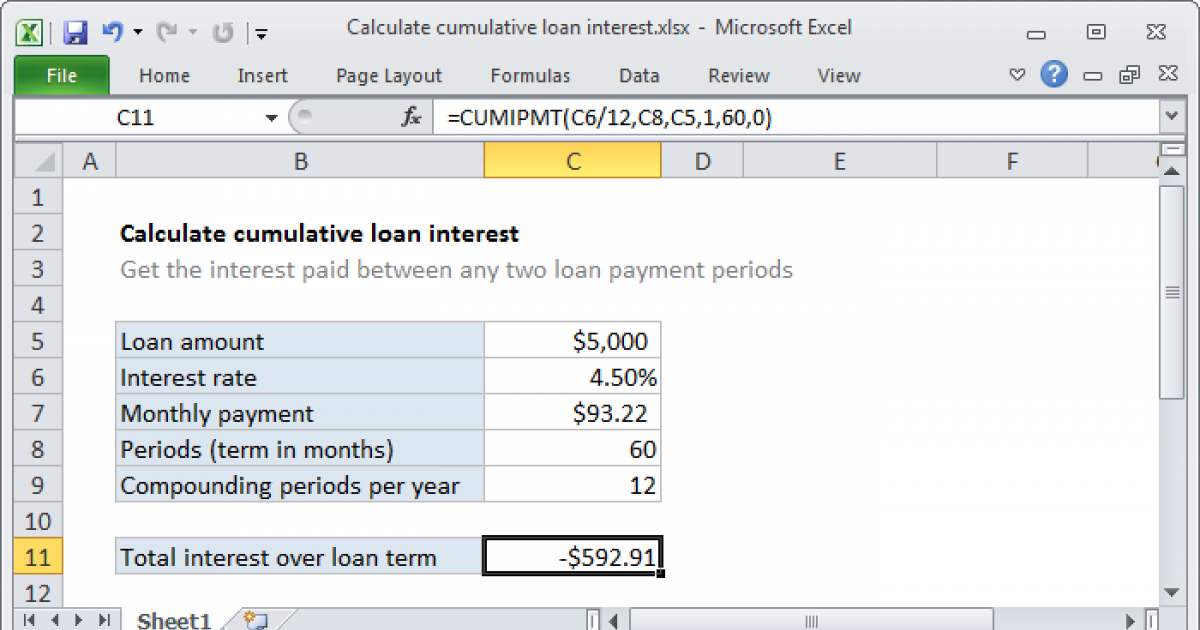

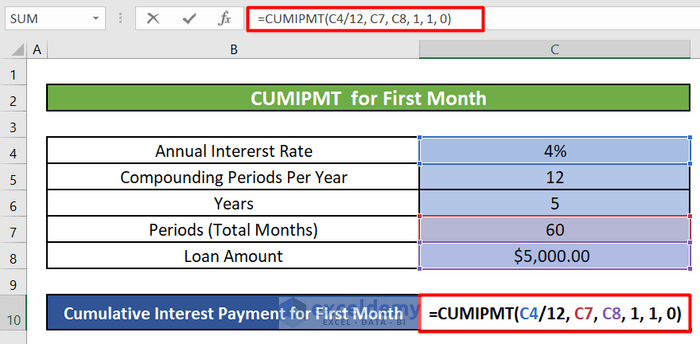

The CUMIPMT function calculates the cumulative interest paid between two periods. The syntax is

CUMIPMT(rate, nper, pv, start_period, end_period, type), where:rateis the interest rate,nperis the total number of payment periods,pvis the present value,start_periodandend_perioddefine the period for which to calculate the cumulative interest,typeis whether payments are due at the beginning or end of the period.

Using these functions allows you to delve into more complex financial planning and analysis directly within Excel.

=IPMT(A2, A3, A4, A1)

=CUMIPMT(A2, A4, A1, A3, A5, 0)

Assuming the interest rate is in A2, the period for the IPMT calculation is in A3, the total number of payments is in A4, the present value (loan amount) is in A1, the start period for the CUMIPMT calculation is in A3, and the end period is in A5, these formulas calculate the interest for a specific period and the cumulative interest over a range of periods, respectively.

Conclusion

Calculating cumulative interest in Excel can be straightforward or complex, depending on the financial scenario you're modeling. By understanding the basics of simple and compound interest and how to apply Excel's built-in financial functions like IPMT and CUMIPMT, you can tackle a wide range of financial planning and analysis tasks. Whether you're an individual managing personal finances or a professional working with complex financial models, mastering these concepts and functions in Excel can significantly enhance your financial analysis capabilities.

Gallery of Excel Financial Calculations

FAQs

What is the difference between simple and compound interest?

+Simple interest is calculated only on the initial principal amount, while compound interest is calculated on the initial principal and includes all accrued interest from previous periods.

How do I calculate cumulative interest in Excel?

+Cumulative interest can be calculated using the IPMT and CUMIPMT functions in Excel, depending on whether you're calculating for a specific period or cumulative over multiple periods.

What is the IPMT function used for in Excel?

+The IPMT function is used to calculate the interest portion of a loan payment for a given period, based on the loan amount, interest rate, and payment period.

![How to Calculate Compound Interest in Excel [Quick Ways]](https://10pcg.com/wp-content/uploads/fv-function-compound-interest.jpg)