Effective accounts receivable management is crucial for the financial health of any business. It involves tracking the amount of money customers owe to the company, following up on payments, and ensuring timely collection. Excel templates can significantly simplify this process by providing a structured approach to managing accounts receivable. Here, we'll explore five essential accounts receivable Excel templates that can help streamline your financial management.

The importance of efficient accounts receivable management cannot be overstated. It directly impacts a company's cash flow, which is vital for day-to-day operations, paying suppliers, and investing in growth opportunities. Delays or inefficiencies in collecting receivables can lead to liquidity crises, damage relationships with suppliers and partners, and ultimately affect profitability.

What are Accounts Receivable Excel Templates?

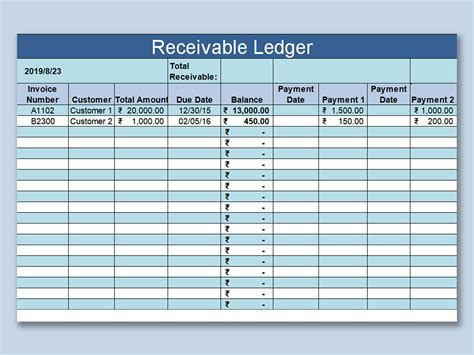

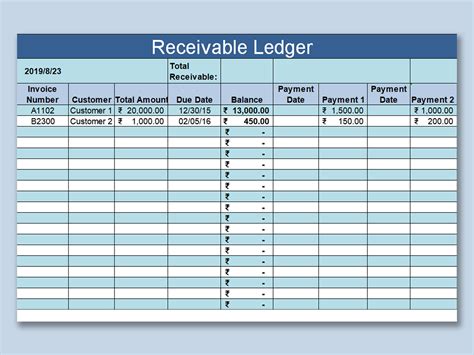

Accounts receivable Excel templates are pre-designed spreadsheets that provide a framework for tracking, managing, and analyzing accounts receivable data. These templates typically include columns and formulas for organizing customer information, invoice details, payment statuses, and aging schedules. They can be customized to fit the specific needs of a business, making it easier to manage receivables, identify trends, and make informed financial decisions.

Benefits of Using Accounts Receivable Excel Templates

- Improved Organization: Excel templates help in keeping all accounts receivable data in one place, making it easier to access and manage.

- Enhanced Tracking: Templates can be designed to automatically update payment statuses and track aging receivables, ensuring that no payment is overlooked.

- Customization: Businesses can tailor these templates to fit their unique needs, including specific columns, formulas, and formatting.

- Data Analysis: Excel's analytical capabilities allow for quick insights into receivables trends, helping in making informed decisions.

- Cost-Effective: Utilizing Excel templates for accounts receivable management can be more cost-effective than purchasing specialized software, especially for small to medium-sized businesses.

5 Essential Accounts Receivable Excel Templates

1. Simple Accounts Receivable Template

This template is ideal for small businesses or those just starting out with accounts receivable management. It includes basic columns for customer information, invoice numbers, dates, amounts, and payment status.

2. Aging Schedule Template

An aging schedule template is crucial for tracking the length of time invoices have been outstanding. It helps in identifying which receivables are nearing or past due, enabling proactive follow-up actions.

3. Customer Statement Template

This template is used to generate periodic statements for customers, detailing their outstanding balances and payment history. It's an effective tool for encouraging timely payments and maintaining transparent customer relationships.

4. Invoice Tracker Template

The invoice tracker template provides a detailed view of all outstanding invoices, including the date issued, due date, amount, and payment status. It's invaluable for managing the invoicing process and ensuring that no invoice slips through the cracks.

5. Receivables Forecasting Template

This template is designed for projecting future receivables based on historical data and current trends. It's a powerful tool for financial planning and cash flow management, helping businesses anticipate and prepare for upcoming financial obligations.

Implementing Accounts Receivable Excel Templates Effectively

- Customize the Template: Tailor the template to fit your business's specific needs and workflows.

- Regular Updates: Ensure that the template is updated regularly to reflect the latest data and trends.

- Integration with Other Systems: Consider integrating your Excel templates with other financial management tools for a more holistic approach.

- Training and Support: Provide adequate training and support to staff to ensure they can effectively use and manage the templates.

Conclusion

Effective management of accounts receivable is crucial for maintaining a healthy cash flow and ensuring the financial stability of a business. Accounts receivable Excel templates offer a versatile, cost-effective, and efficient way to streamline this process. By understanding the benefits and types of these templates, businesses can better navigate their financial landscape and make informed decisions for growth and success.

What is the primary benefit of using accounts receivable Excel templates?

+The primary benefit is improved organization and tracking of accounts receivable data, leading to enhanced financial management and decision-making.

Can accounts receivable Excel templates be customized?

+Yes, Excel templates can be tailored to fit the specific needs and workflows of a business, making them highly adaptable and effective tools.

What types of Excel templates are commonly used for accounts receivable management?

+Commonly used templates include simple accounts receivable templates, aging schedule templates, customer statement templates, invoice tracker templates, and receivables forecasting templates.