Simple interest is a type of interest that is calculated on the initial principal amount, without taking into account any accrued interest. It is widely used in various financial calculations, such as loans, deposits, and investments. Calculating simple interest can be done manually using the simple interest formula, but it can also be easily calculated using Microsoft Excel.

In this article, we will discuss the simple interest formula, how to calculate it manually, and how to use Excel to make the calculation easier. We will also provide examples and step-by-step instructions on how to use the formula in Excel.

What is Simple Interest?

Simple interest is a type of interest that is calculated on the initial principal amount, without taking into account any accrued interest. It is calculated as a percentage of the principal amount, and is usually expressed as a decimal or a percentage.

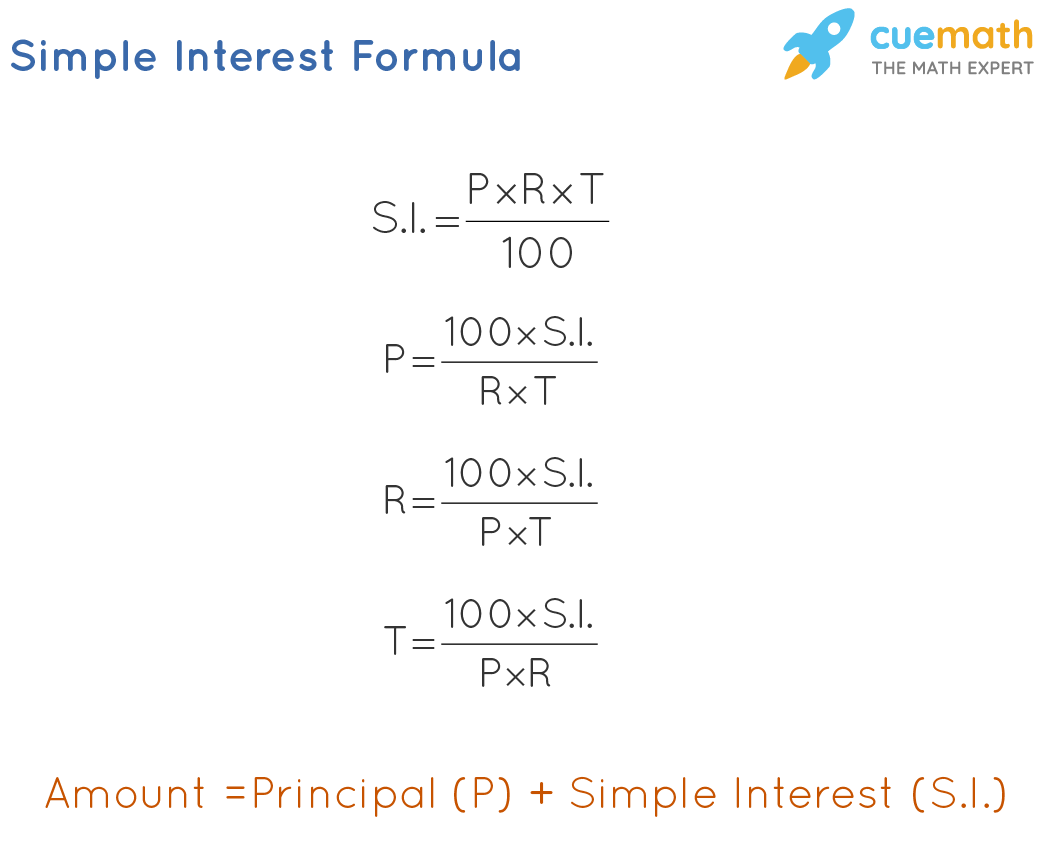

Simple Interest Formula

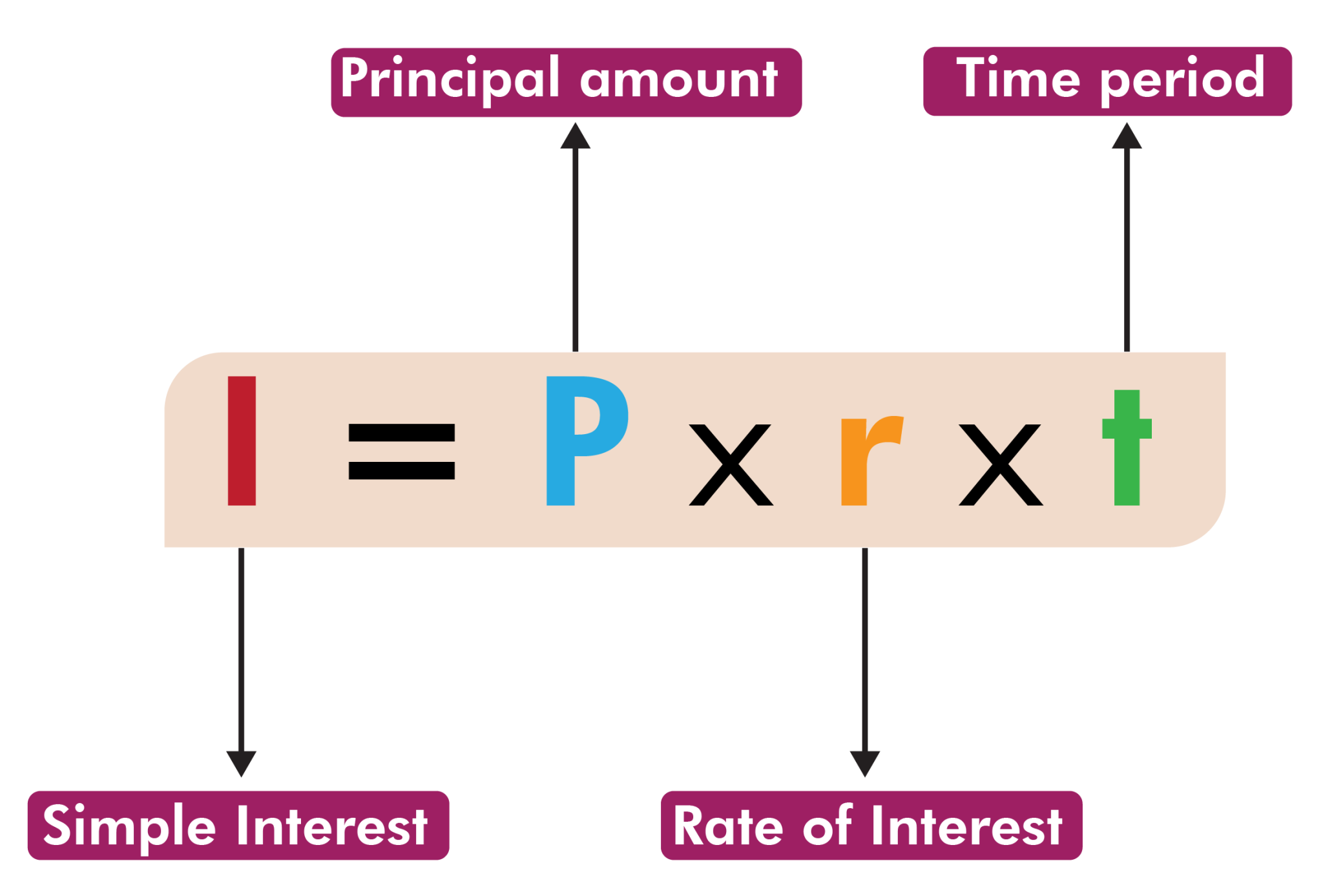

The simple interest formula is:

I = P x R x T

Where:

- I = Simple Interest

- P = Principal Amount

- R = Rate of Interest (expressed as a decimal)

- T = Time (expressed in years)

For example, if you deposit $1,000 into a savings account with a 5% interest rate for 2 years, the simple interest would be:

I = $1,000 x 0.05 x 2 = $100

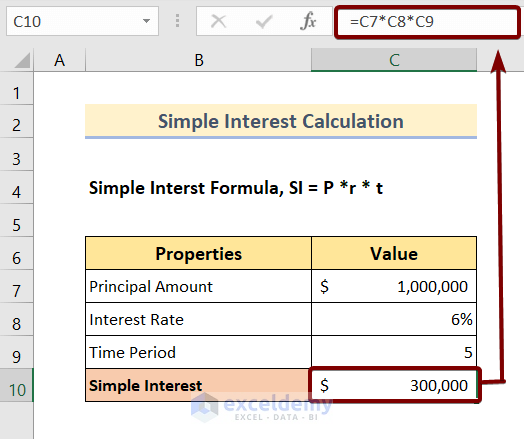

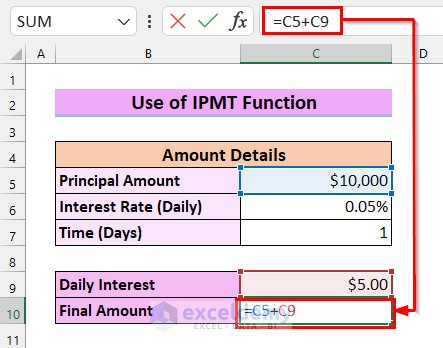

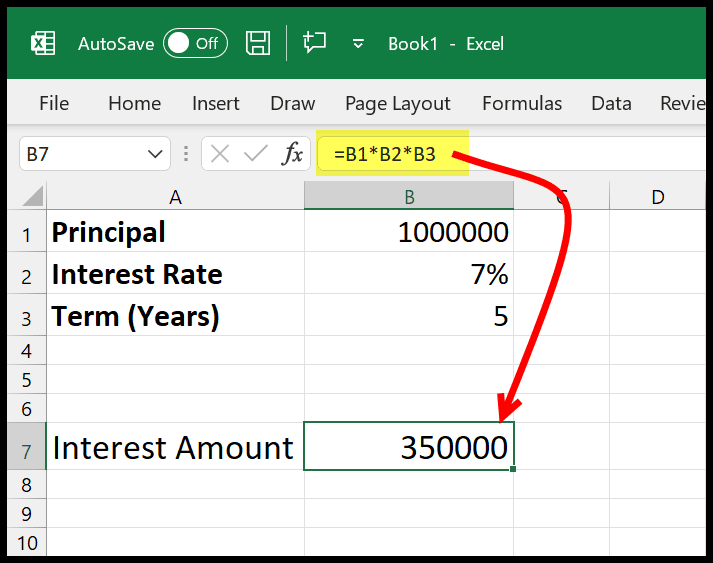

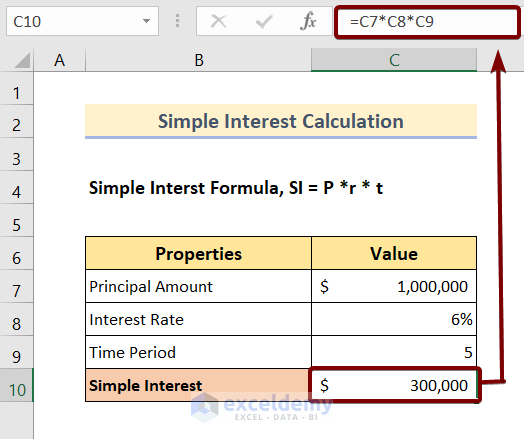

How to Calculate Simple Interest in Excel

Calculating simple interest in Excel is a straightforward process. Here's a step-by-step guide:

- Open a new Excel worksheet or use an existing one.

- Enter the principal amount, rate of interest, and time period in separate cells.

- Use the formula =PRT to calculate the simple interest.

- Press Enter to calculate the result.

For example, if you enter the following values:

| Cell | Value |

|---|---|

| A1 | 1000 (Principal Amount) |

| A2 | 0.05 (Rate of Interest) |

| A3 | 2 (Time Period) |

You can use the formula =A1A2A3 to calculate the simple interest.

Excel Formula

Here is the Excel formula to calculate simple interest:

=principalratetime

Where:

- principal is the cell reference for the principal amount

- rate is the cell reference for the rate of interest

- time is the cell reference for the time period

Example

Suppose you want to calculate the simple interest on a loan of $10,000 with a 6% interest rate for 3 years. You can use the following formula:

=100000.063

This formula calculates the simple interest as $1,800.

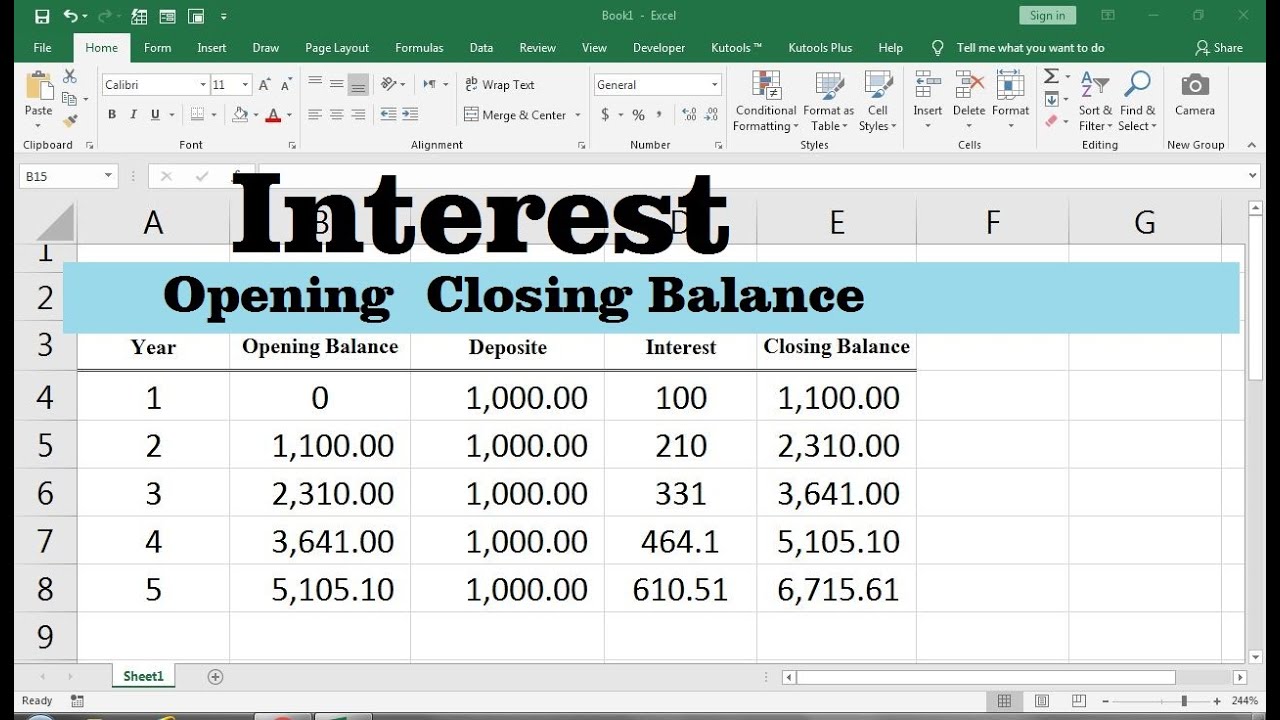

Simple Interest Formula with Multiple Payments

If you have multiple payments, you can use the following formula:

=SUM(principalratetime)

Where:

- principal is the cell reference for the principal amount

- rate is the cell reference for the rate of interest

- time is the cell reference for the time period

Example

Suppose you have a loan of $10,000 with a 6% interest rate for 3 years, and you make annual payments of $3,000. You can use the following formula:

=SUM(100000.063)

This formula calculates the total simple interest as $1,800.

Conclusion

Calculating simple interest is a straightforward process that can be done manually or using Excel. By using the simple interest formula in Excel, you can easily calculate the interest on loans, deposits, and investments. Whether you're a financial professional or just starting to learn about personal finance, understanding how to calculate simple interest is an essential skill that can help you make informed decisions about your money.

Gallery of Simple Interest Formula Examples

Frequently Asked Questions

What is the simple interest formula?

+The simple interest formula is I = P x R x T, where I is the simple interest, P is the principal amount, R is the rate of interest, and T is the time period.

How do I calculate simple interest in Excel?

+To calculate simple interest in Excel, use the formula =principal*rate*time, where principal is the cell reference for the principal amount, rate is the cell reference for the rate of interest, and time is the cell reference for the time period.