Simple interest is a type of interest that is calculated as a percentage of the principal amount, and it is not compounded over time. Calculating simple interest can be a tedious task, but with the help of Excel, you can easily create a simple interest calculator.

What is Simple Interest?

Simple interest is a type of interest that is calculated as a percentage of the principal amount, and it is not compounded over time. It is calculated using the formula:

Simple Interest = (Principal x Rate x Time)

Where:

- Principal is the initial amount of money

- Rate is the interest rate as a percentage

- Time is the time period for which the interest is being calculated

Why Use a Simple Interest Calculator in Excel?

Using a simple interest calculator in Excel can help you to easily calculate the interest on a loan or investment. It can also help you to compare different interest rates and loan terms, and to make informed decisions about your financial planning.

How to Create a Simple Interest Calculator in Excel

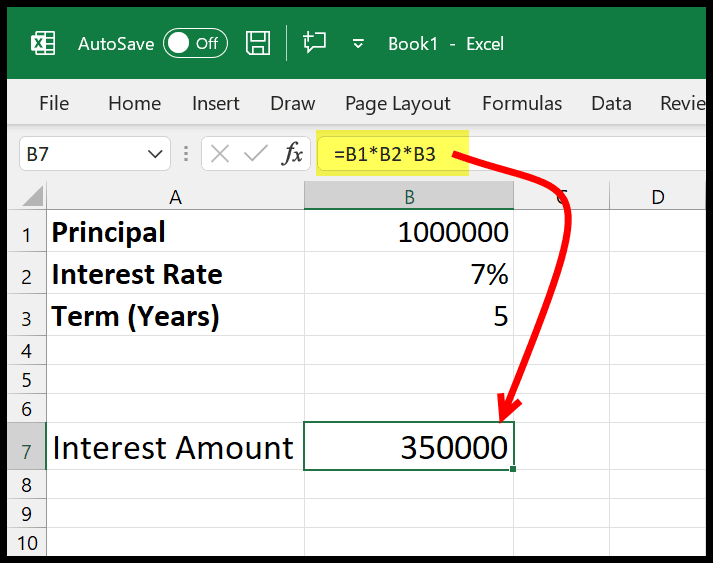

Creating a simple interest calculator in Excel is easy and straightforward. Here's a step-by-step guide to create a simple interest calculator:

- Open a new Excel spreadsheet and create a table with the following columns:

- Principal

- Rate

- Time

- Simple Interest

- In the cell next to the "Simple Interest" column, enter the formula:

= (A2 * B2 * C2)

Where:

- A2 is the cell containing the principal amount

- B2 is the cell containing the interest rate

- C2 is the cell containing the time period

- Format the cells to display the interest rate as a percentage.

- Test the formula by entering some sample data into the table.

Example Simple Interest Calculator in Excel

Here is an example of a simple interest calculator in Excel:

| Principal | Rate | Time | Simple Interest |

|---|---|---|---|

| 1000 | 5% | 1 | 50 |

| 5000 | 10% | 2 | 1000 |

| 2000 | 3% | 5 | 300 |

Using Formulas to Calculate Simple Interest

In addition to creating a simple interest calculator, you can also use formulas to calculate simple interest directly in Excel. Here are some examples:

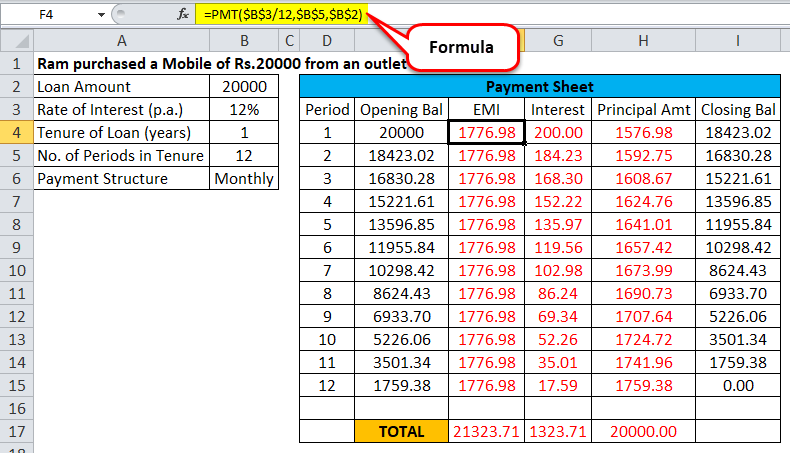

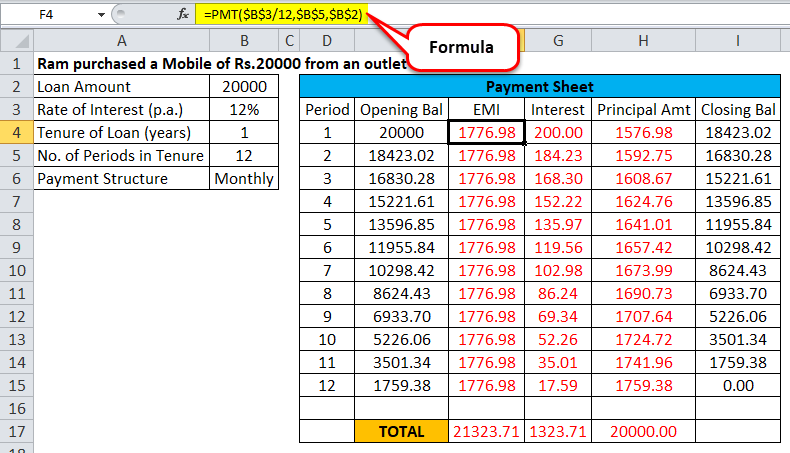

- To calculate the simple interest on a loan, you can use the formula:

= IPMT(rate, time, principal)

Where:

-

rate is the interest rate as a decimal

-

time is the time period for which the interest is being calculated

-

principal is the initial amount of money

-

To calculate the total amount due on a loan, including simple interest, you can use the formula:

= principal + IPMT(rate, time, principal)

Where:

- principal is the initial amount of money

- rate is the interest rate as a decimal

- time is the time period for which the interest is being calculated

Tips and Tricks

- Use absolute references to make the formula easier to read and understand.

- Use named ranges to make the formula more readable and easier to maintain.

- Use formatting to make the output more readable and easy to understand.

- Test the formula with different input values to ensure that it is working correctly.

Gallery of Simple Interest Calculators

Here is a gallery of simple interest calculators in Excel:

FAQs

What is simple interest?

+Simple interest is a type of interest that is calculated as a percentage of the principal amount, and it is not compounded over time.

How do I create a simple interest calculator in Excel?

+To create a simple interest calculator in Excel, you can use the formula = (A2 * B2 * C2) where A2 is the cell containing the principal amount, B2 is the cell containing the interest rate, and C2 is the cell containing the time period.

What is the difference between simple interest and compound interest?

+Simple interest is calculated as a percentage of the principal amount, while compound interest is calculated on both the principal amount and any accrued interest.

By following these steps and tips, you can easily create a simple interest calculator in Excel to help you make informed decisions about your financial planning.