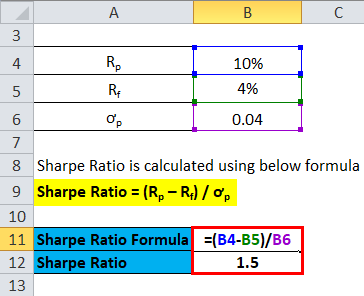

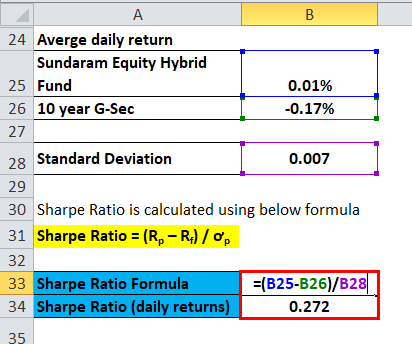

The Sharpe ratio is a financial metric that helps investors understand the relationship between risk and return of an investment. It is defined as the average return of an investment minus the risk-free rate, divided by the standard deviation of the investment's returns. In this article, we will explore five ways to calculate the Sharpe ratio in Excel.

Investors and financial analysts use the Sharpe ratio to evaluate the performance of an investment and compare it to others. A higher Sharpe ratio indicates that an investment has generated excess returns relative to its risk. The Sharpe ratio is widely used in finance and is considered an essential metric for investment analysis.

There are several ways to calculate the Sharpe ratio in Excel, and we will cover five methods in this article. Before we dive into the calculations, let's briefly discuss the components of the Sharpe ratio.

Components of the Sharpe Ratio

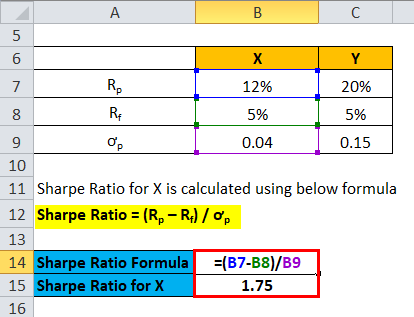

The Sharpe ratio consists of three main components:

- Average Return: This is the average return of the investment over a specified period.

- Risk-Free Rate: This is the return of a risk-free asset, such as a U.S. Treasury bond.

- Standard Deviation: This measures the volatility or risk of the investment.

Now, let's move on to the five ways to calculate the Sharpe ratio in Excel.

Method 1: Using the AVERAGE, STDEV, and Formula Functions

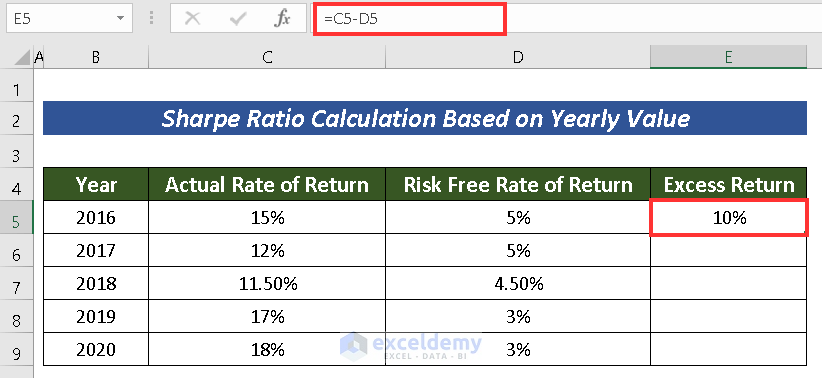

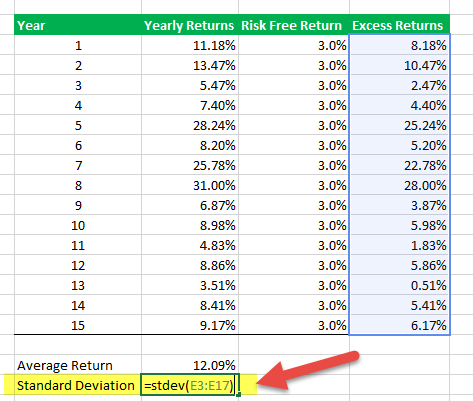

This is the most basic method to calculate the Sharpe ratio in Excel. We will use the AVERAGE function to calculate the average return, the STDEV function to calculate the standard deviation, and then use a formula to calculate the Sharpe ratio.

Assuming we have the returns of an investment in cells A1:A10, the risk-free rate in cell B1, and we want to calculate the Sharpe ratio in cell C1, we can use the following formula:

Sharpe Ratio = (AVERAGE(A1:A10) - B1) / STDEV(A1:A10)

Method 2: Using the RISK Function and Formula

This method uses the RISK function to calculate the standard deviation of the investment returns and then uses a formula to calculate the Sharpe ratio.

Assuming we have the returns of an investment in cells A1:A10, the risk-free rate in cell B1, and we want to calculate the Sharpe ratio in cell C1, we can use the following formula:

Sharpe Ratio = (AVERAGE(A1:A10) - B1) / RISK(A1:A10, 0)

Method 3: Using the AVERAGEIF and STDEVIF Functions

This method uses the AVERAGEIF and STDEVIF functions to calculate the average return and standard deviation of the investment returns, respectively, and then uses a formula to calculate the Sharpe ratio.

Assuming we have the returns of an investment in cells A1:A10, the risk-free rate in cell B1, and we want to calculate the Sharpe ratio in cell C1, we can use the following formula:

Sharpe Ratio = (AVERAGEIF(A1:A10, ">0") - B1) / STDEVIF(A1:A10, ">0")

Method 4: Using VBA Code

This method uses VBA code to calculate the Sharpe ratio. We will create a user-defined function that calculates the Sharpe ratio based on the input parameters.

Here's an example of how to create a VBA function to calculate the Sharpe ratio:

Function SharpeRatio(Returns As Range, RiskFreeRate As Double) As Double

SharpeRatio = (WorksheetFunction.Average(Returns) - RiskFreeRate) / WorksheetFunction.StDev(Returns)

End Function

Method 5: Using Excel Formulas with Multiple Ranges

This method uses Excel formulas to calculate the Sharpe ratio when the investment returns are divided into multiple ranges.

Assuming we have the returns of an investment in cells A1:A10, A11:A20, and A21:A30, the risk-free rate in cell B1, and we want to calculate the Sharpe ratio in cell C1, we can use the following formula:

Sharpe Ratio = ((AVERAGE(A1:A10) + AVERAGE(A11:A20) + AVERAGE(A21:A30))/3 - B1) / SQRT(((STDEV(A1:A10)^2 + STDEV(A11:A20)^2 + STDEV(A21:A30)^2)/3))

Gallery of Sharpe Ratio Calculations in Excel

What is the Sharpe ratio?

+The Sharpe ratio is a financial metric that measures the excess return of an investment over the risk-free rate, relative to its volatility. It is used to evaluate the performance of an investment and compare it to others.

How is the Sharpe ratio calculated?

+The Sharpe ratio is calculated by subtracting the risk-free rate from the average return of an investment, and then dividing the result by the standard deviation of the investment's returns.

What is the risk-free rate?

+The risk-free rate is the return of a risk-free asset, such as a U.S. Treasury bond. It is used as a benchmark to evaluate the performance of an investment.