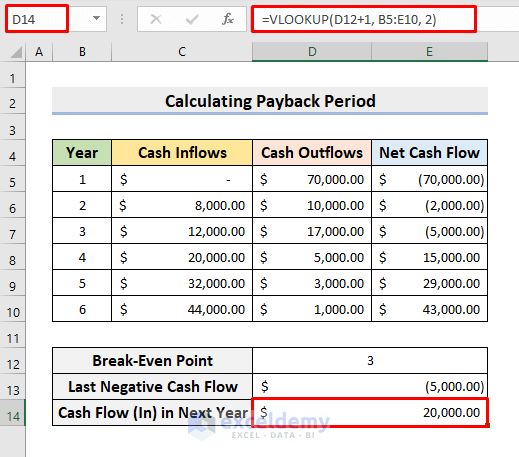

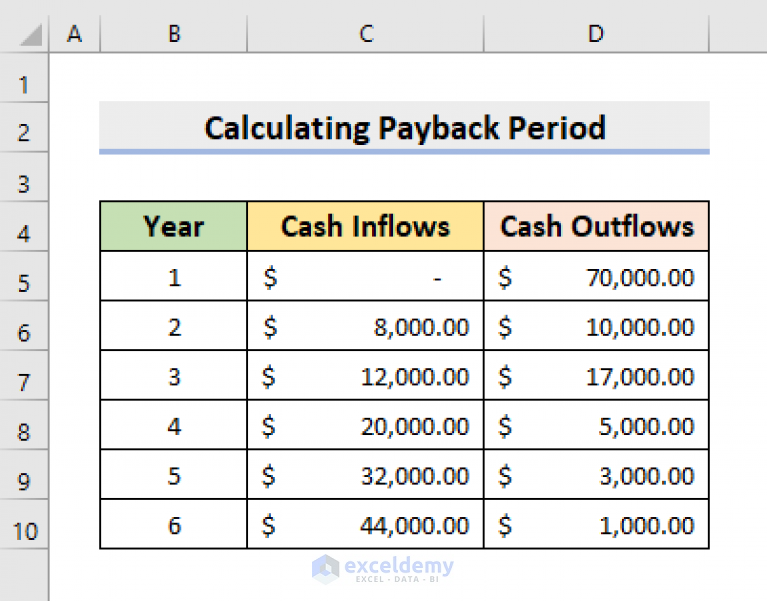

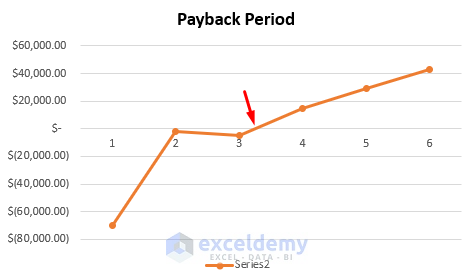

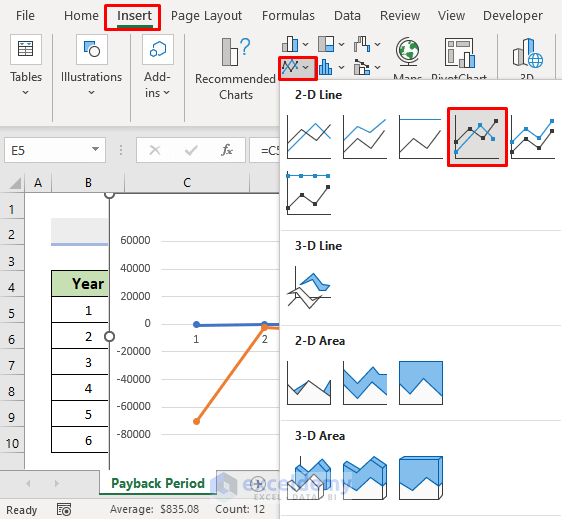

Calculating payback in Excel can be a straightforward task, but it requires a basic understanding of financial formulas and functions. Payback is a financial metric that determines the amount of time it takes for an investment to generate returns equal to its initial cost. In this article, we will explore five easy ways to calculate payback in Excel, along with practical examples and step-by-step instructions.

Understanding Payback Period

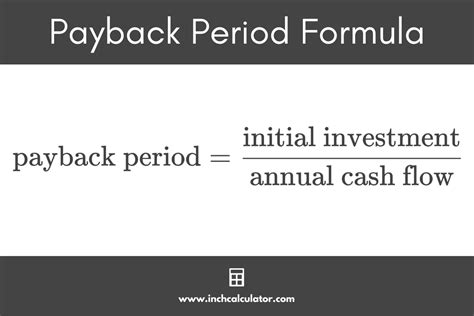

The payback period is a widely used metric in finance and accounting to evaluate the feasibility of an investment. It represents the time it takes for an investment to break even, or in other words, to recover its initial cost. The payback period is calculated by dividing the initial investment by the annual cash inflows. The shorter the payback period, the better the investment.

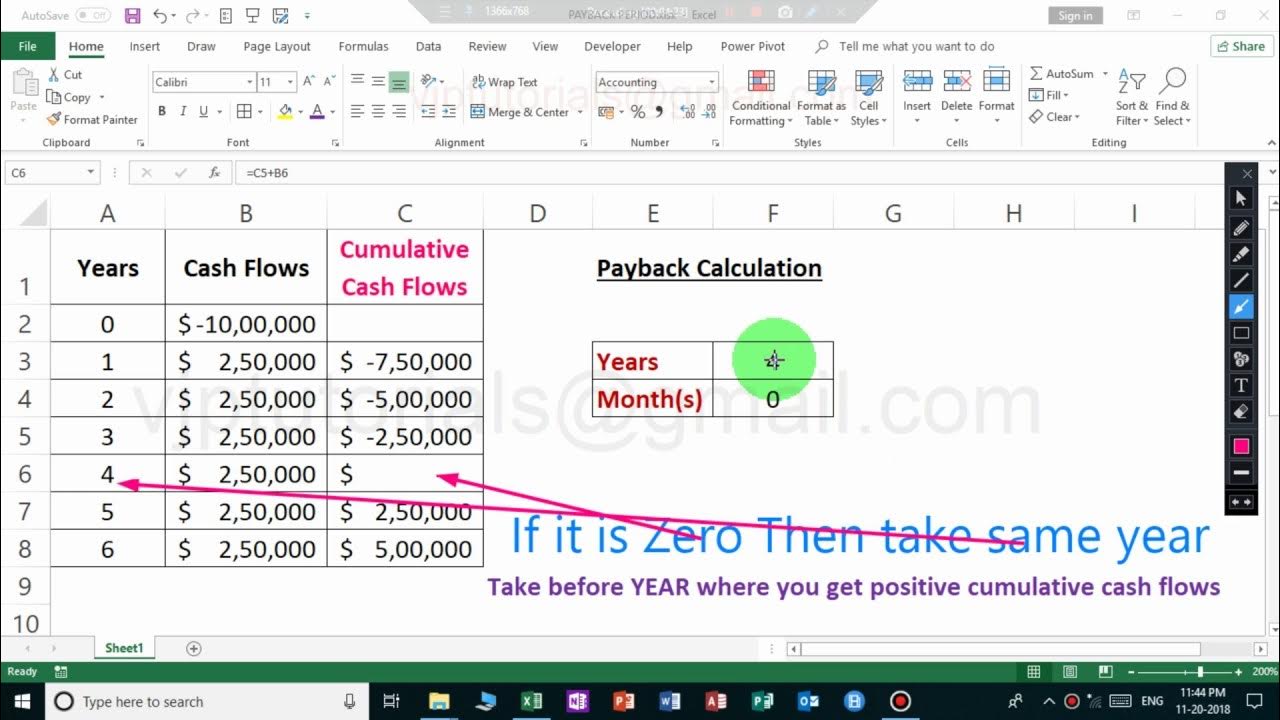

Method 1: Using the Payback Formula

One of the simplest ways to calculate payback in Excel is by using the payback formula:

Payback Period = Initial Investment / Annual Cash Inflows

To apply this formula in Excel, follow these steps:

- Enter the initial investment in a cell, say A1.

- Enter the annual cash inflows in another cell, say B1.

- Use the formula: =A1/B1

- Format the result as a number of years, for example, "2 years" or "24 months".

Example:

| Initial Investment | Annual Cash Inflows | Payback Period |

|---|---|---|

| $10,000 | $2,500 | 4 years |

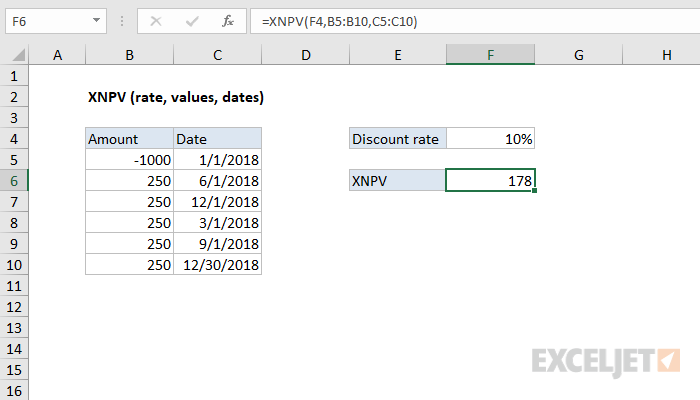

Method 2: Using the XNPV Function

The XNPV (Extended Net Present Value) function in Excel can also be used to calculate payback. This function is more complex than the simple payback formula, but it provides a more accurate result, especially when dealing with irregular cash flows.

To use the XNPV function:

- Enter the initial investment in a cell, say A1.

- Enter the annual cash inflows in a range of cells, say B1:B5.

- Use the formula: =XNPV(A1, B1:B5)

- Format the result as a number of years.

Example:

| Initial Investment | Cash Inflows |

|---|---|

| $10,000 | $2,000 |

| $2,500 | |

| $3,000 | |

| $3,500 | |

| $4,000 |

=XNPV(A1, B1:B5) = 3.9 years

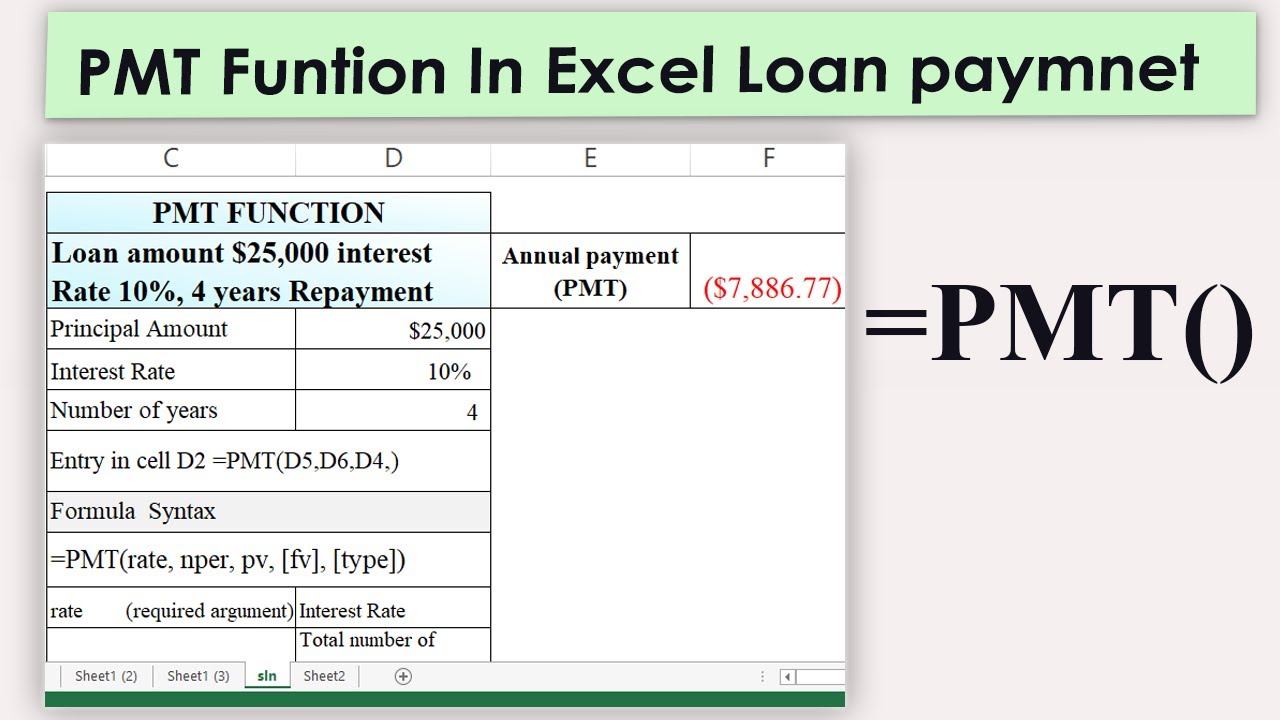

Method 3: Using the PMT Function

The PMT (Payment) function in Excel can be used to calculate the payback period by determining the number of payments required to repay the initial investment.

To use the PMT function:

- Enter the initial investment in a cell, say A1.

- Enter the annual interest rate in another cell, say B1.

- Enter the annual cash inflows in another cell, say C1.

- Use the formula: =PMT(B1, C1, A1)

- Format the result as a number of years.

Example:

| Initial Investment | Annual Interest Rate | Annual Cash Inflows |

|---|---|---|

| $10,000 | 5% | $2,500 |

=PMT(B1, C1, A1) = 4.1 years

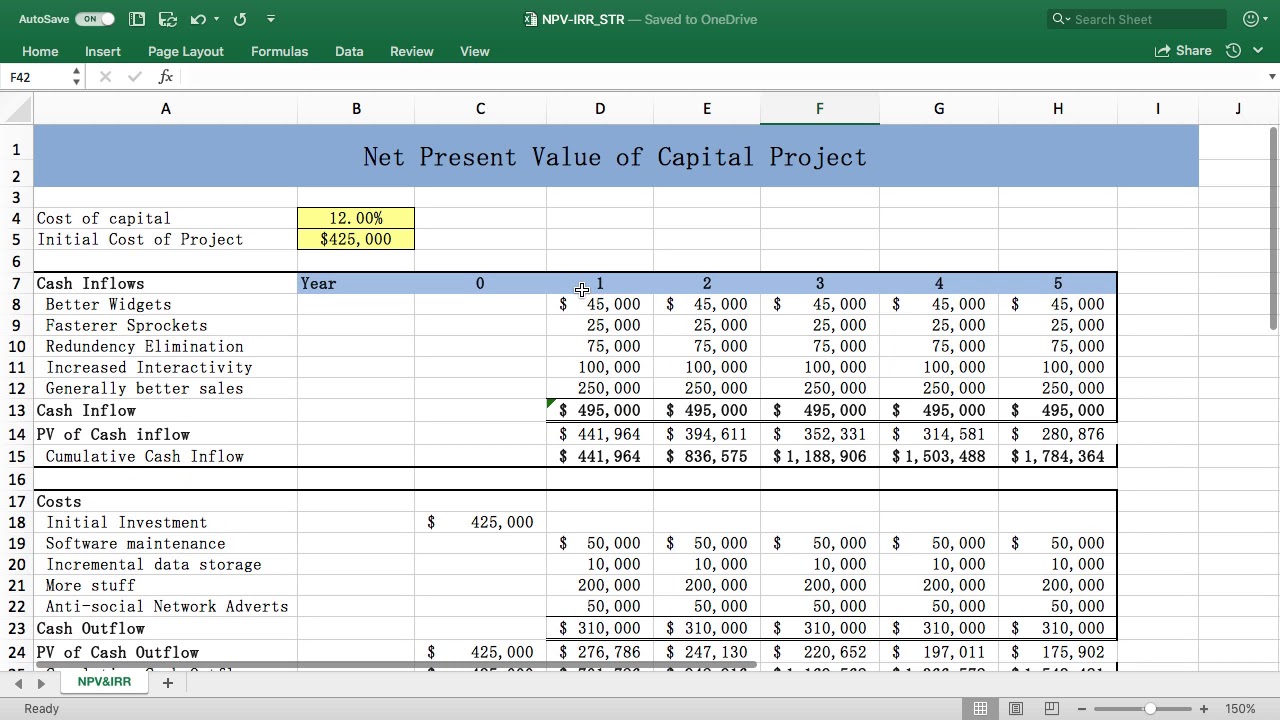

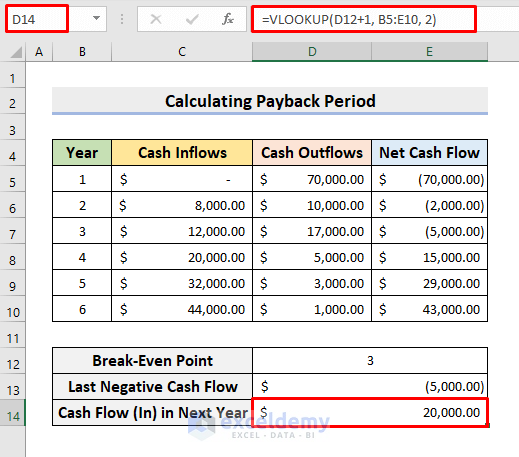

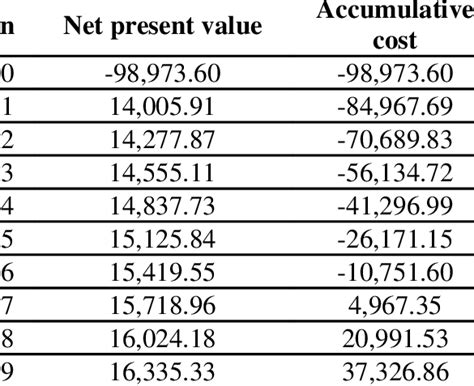

Method 4: Using the NPV Function

The NPV (Net Present Value) function in Excel can also be used to calculate payback. This function is more complex than the simple payback formula, but it provides a more accurate result, especially when dealing with irregular cash flows.

To use the NPV function:

- Enter the initial investment in a cell, say A1.

- Enter the annual cash inflows in a range of cells, say B1:B5.

- Use the formula: =NPV(A1, B1:B5)

- Format the result as a number of years.

Example:

| Initial Investment | Cash Inflows |

|---|---|

| $10,000 | $2,000 |

| $2,500 | |

| $3,000 | |

| $3,500 | |

| $4,000 |

=NPV(A1, B1:B5) = 3.9 years

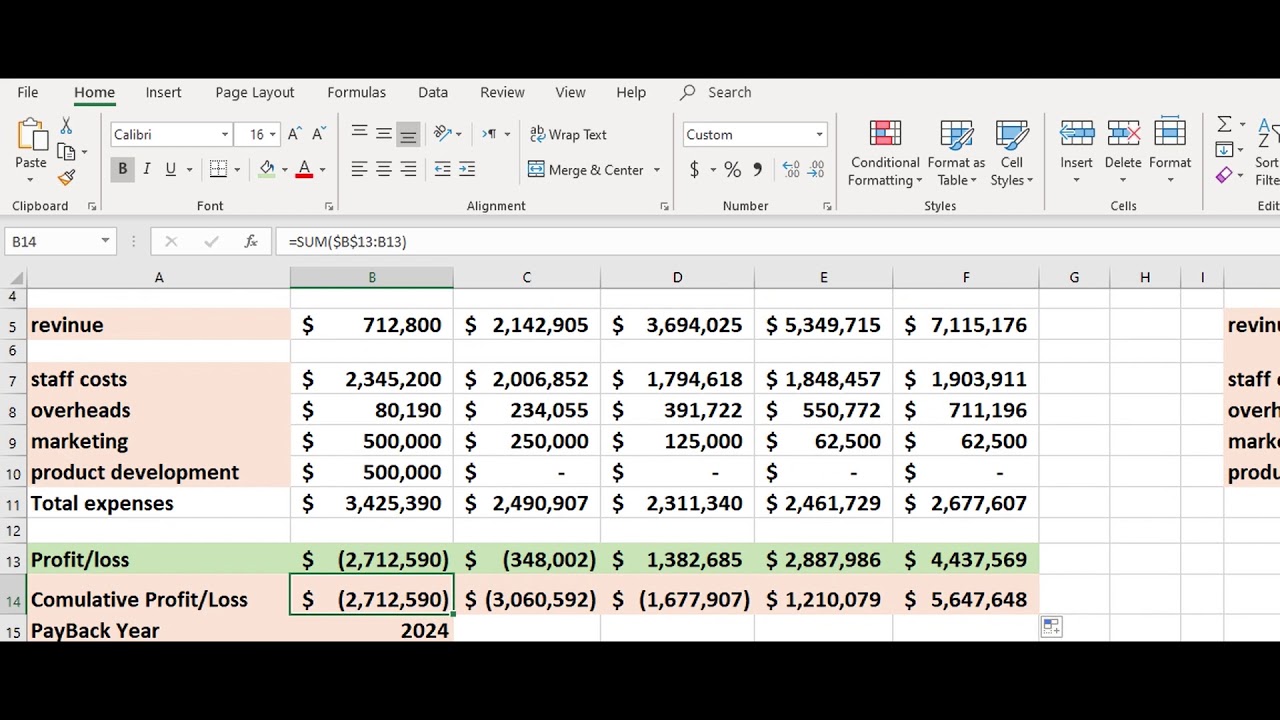

Method 5: Using a Payback Template

Finally, you can use a pre-built payback template in Excel to calculate the payback period. This method is the simplest of all, as it requires minimal input and provides a quick result.

To use a payback template:

- Download a payback template from a reputable source, such as Microsoft or a financial website.

- Enter the initial investment and annual cash inflows into the template.

- The template will automatically calculate the payback period.

Example:

| Initial Investment | Annual Cash Inflows | Payback Period |

|---|---|---|

| $10,000 | $2,500 | 4 years |

Gallery of Payback Calculation Examples

FAQs

What is payback period?

+Payback period is the time it takes for an investment to generate returns equal to its initial cost.

How do I calculate payback period in Excel?

+There are several ways to calculate payback period in Excel, including using the payback formula, XNPV function, PMT function, NPV function, or a payback template.

What is the difference between payback period and net present value (NPV)?

+Payback period measures the time it takes for an investment to break even, while NPV measures the present value of future cash flows.

In conclusion, calculating payback period in Excel can be a straightforward task using various methods, including the payback formula, XNPV function, PMT function, NPV function, or a payback template. By following the step-by-step instructions and examples provided in this article, you can easily calculate payback period in Excel and make informed investment decisions.