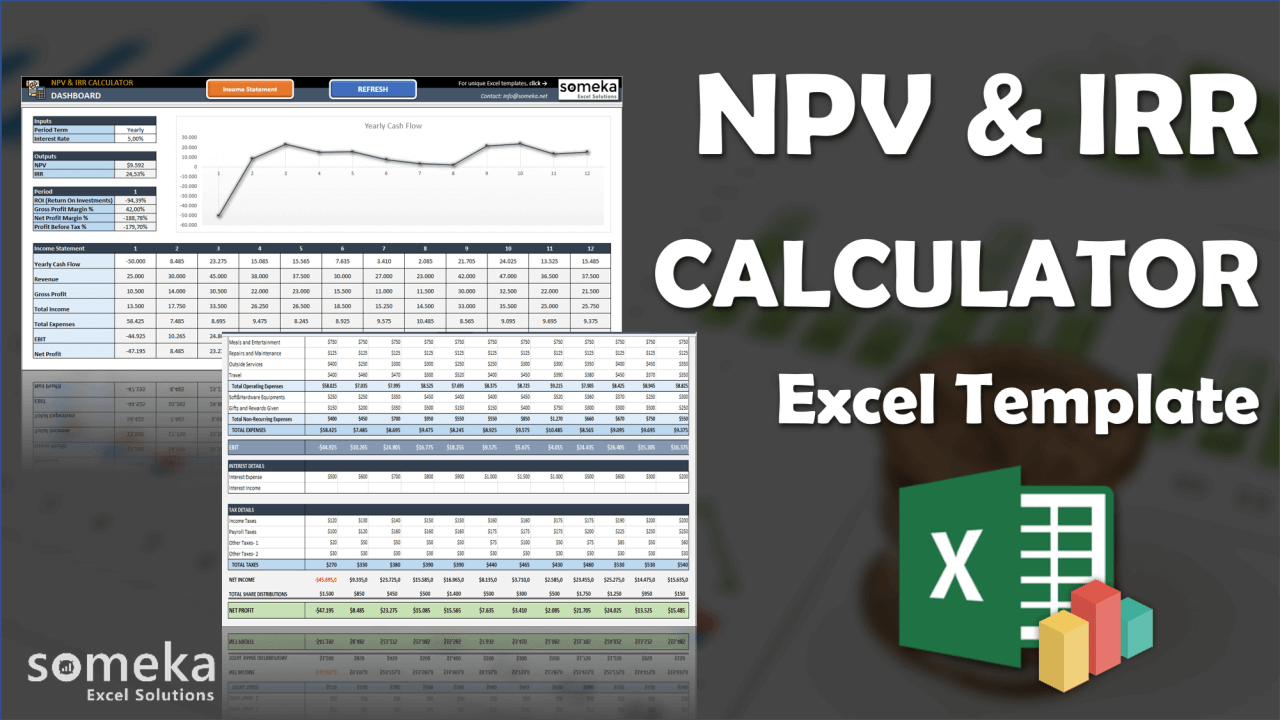

In the world of finance and business, making informed decisions about investments and projects is crucial for success. One of the key tools used to evaluate the feasibility of a project or investment is the Net Present Value (NPV) calculator. When it comes to calculating NPV, using an Excel template can streamline the process and reduce errors. In this article, we'll explore five ways to use an NPV calculator Excel template to make better financial decisions.

NPV is a fundamental concept in finance that represents the difference between the present value of cash inflows and the present value of cash outflows. It's a critical metric used to evaluate the profitability of a project or investment. By using an NPV calculator Excel template, you can quickly and accurately calculate the NPV of a project and make informed decisions.

What is an NPV Calculator Excel Template?

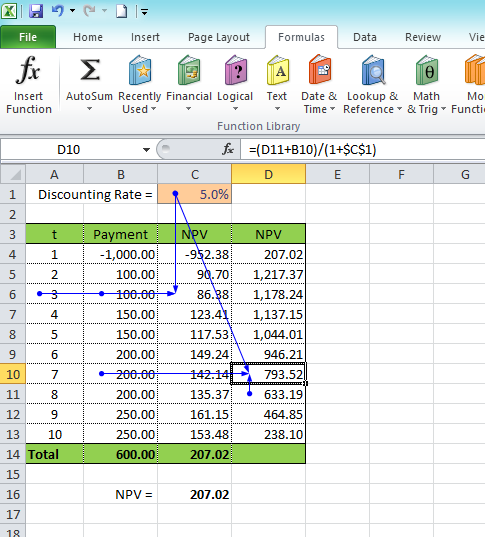

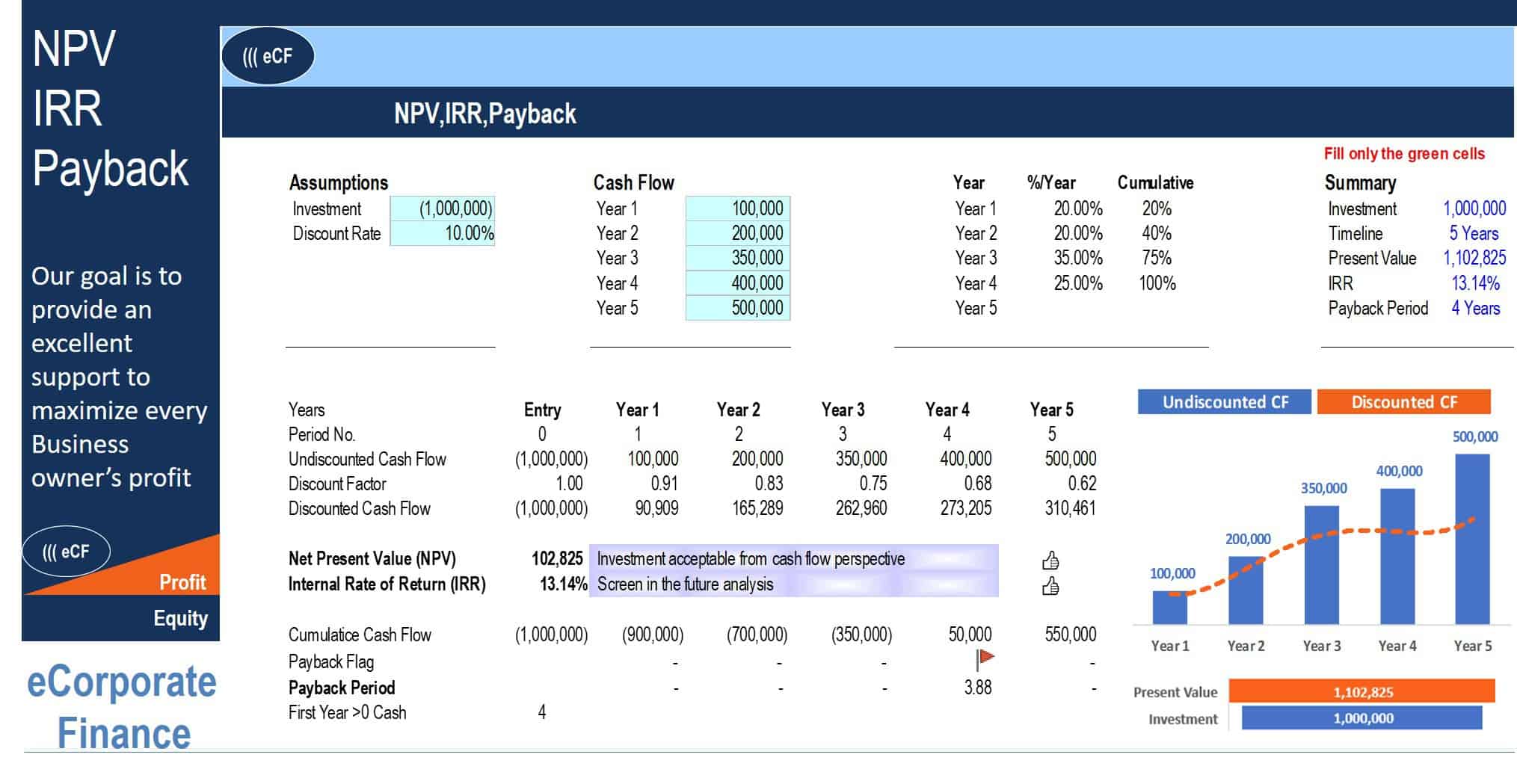

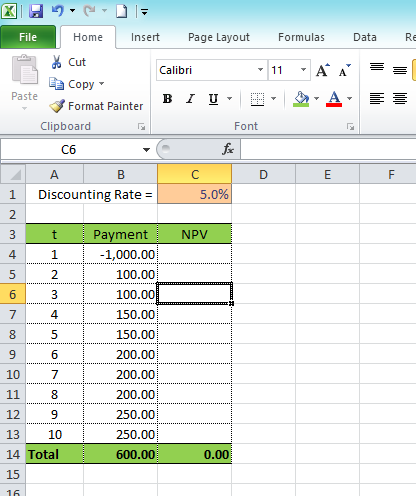

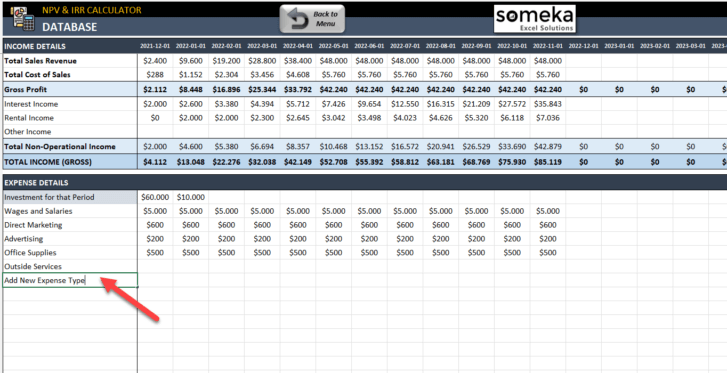

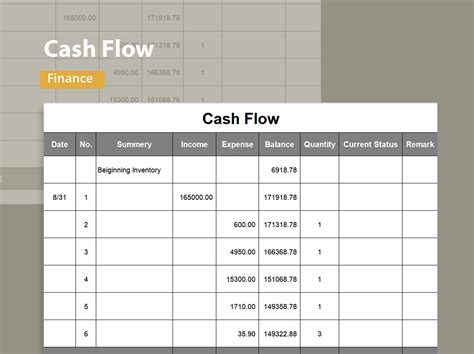

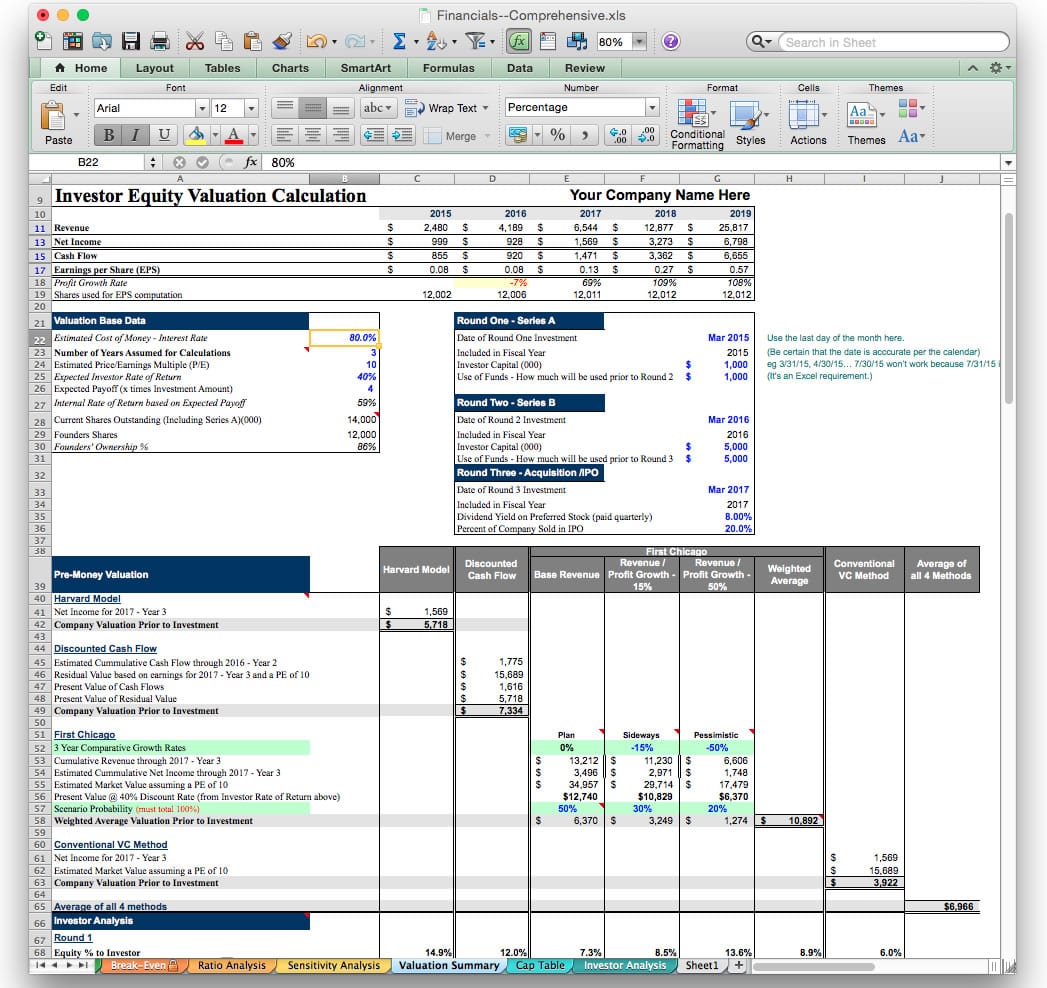

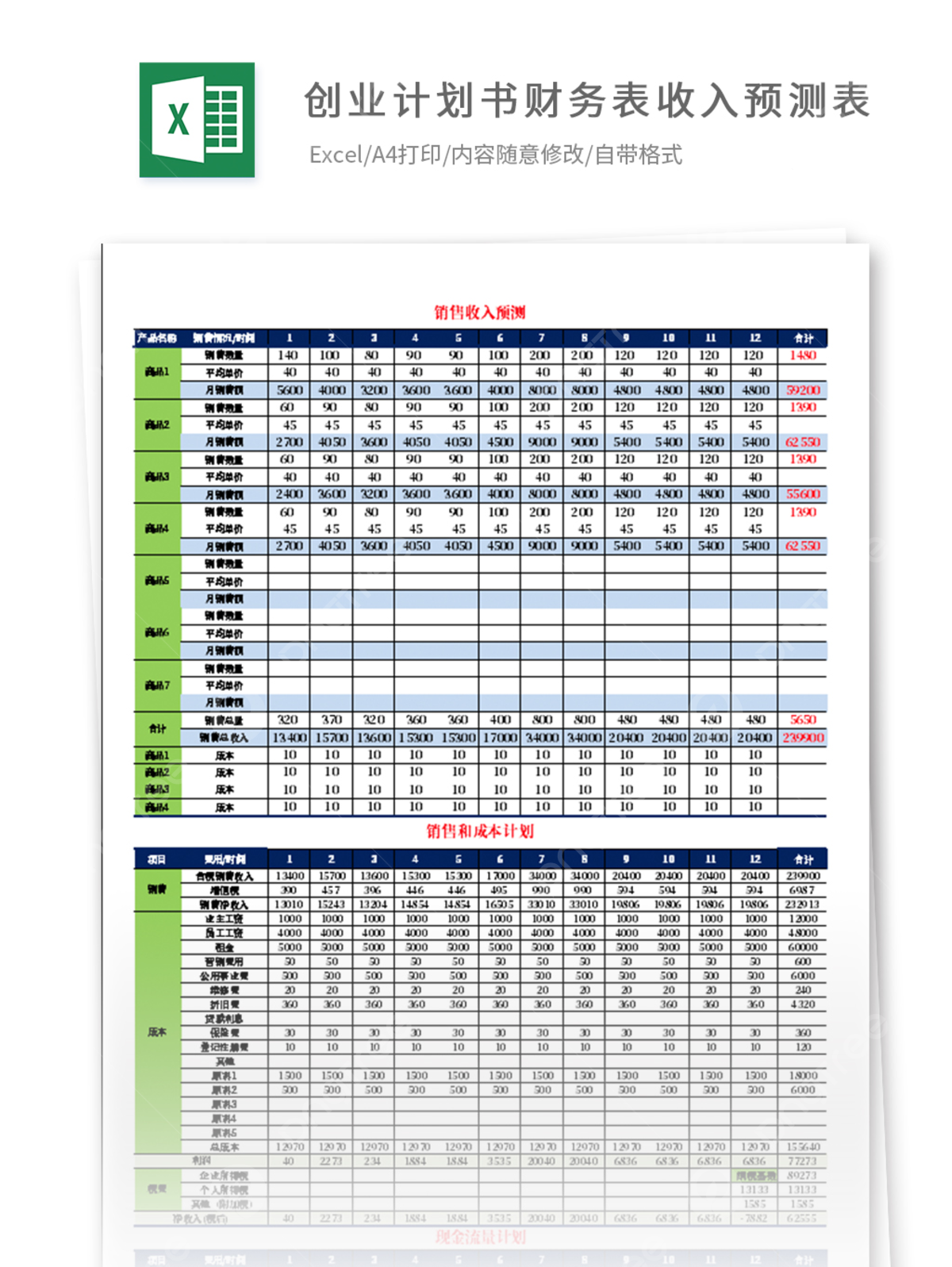

An NPV calculator Excel template is a pre-built spreadsheet that allows you to calculate the NPV of a project or investment. The template typically includes a set of formulas and tables that enable you to input cash flow data and calculate the NPV. Using an NPV calculator Excel template can save time and reduce errors compared to creating a spreadsheet from scratch.

5 Ways to Use an NPV Calculator Excel Template

1. Evaluating Project Feasibility

One of the primary uses of an NPV calculator Excel template is to evaluate the feasibility of a project. By calculating the NPV of a project, you can determine whether it's worth investing in. If the NPV is positive, it indicates that the project is expected to generate more value than it costs, making it a viable investment opportunity.

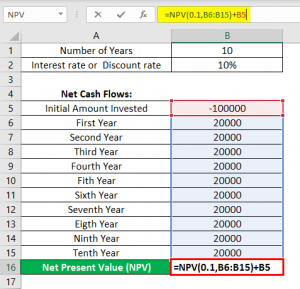

For example, let's say you're considering investing in a new business venture that requires an initial investment of $100,000. The project is expected to generate annual cash flows of $20,000 for the next five years. Using an NPV calculator Excel template, you can calculate the NPV of the project based on a discount rate of 10%.

| Year | Cash Flow | Discount Factor | Present Value |

|---|---|---|---|

| 0 | -$100,000 | 1.0000 | -$100,000 |

| 1 | $20,000 | 0.9091 | $18,182 |

| 2 | $20,000 | 0.8264 | $16,528 |

| 3 | $20,000 | 0.7513 | $15,026 |

| 4 | $20,000 | 0.6830 | $13,660 |

| 5 | $20,000 | 0.6209 | $12,418 |

The NPV of the project is $15,814, indicating that it's expected to generate more value than it costs.

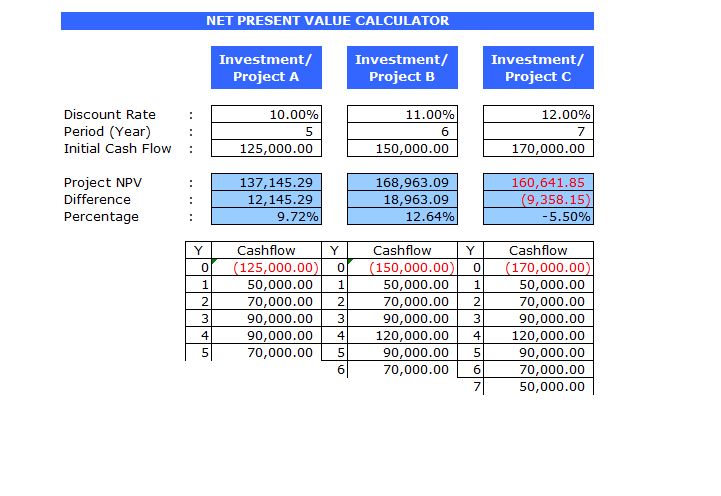

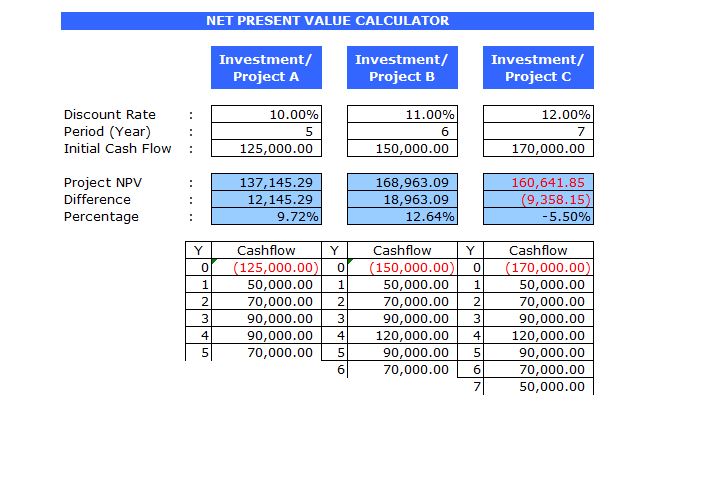

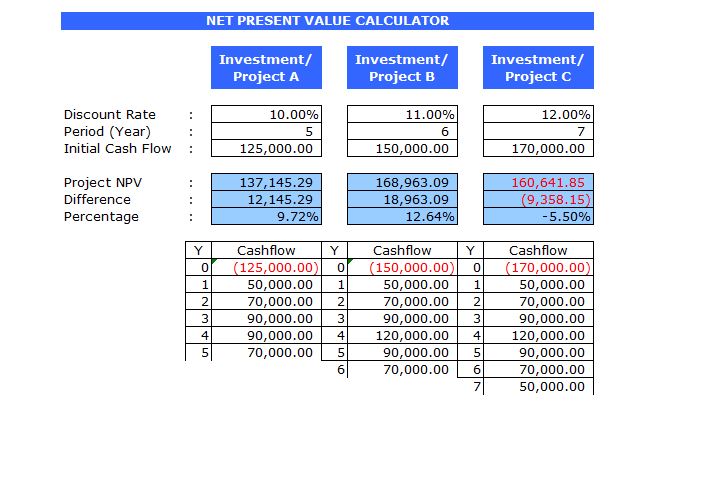

2. Comparing Investment Options

Another way to use an NPV calculator Excel template is to compare different investment options. By calculating the NPV of each option, you can determine which one is the most profitable.

For example, let's say you're considering investing in two different projects, A and B. Both projects require an initial investment of $50,000, but they have different cash flow profiles.

| Project | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

|---|---|---|---|---|---|

| A | $15,000 | $18,000 | $20,000 | $22,000 | $25,000 |

| B | $10,000 | $12,000 | $15,000 | $18,000 | $20,000 |

Using an NPV calculator Excel template, you can calculate the NPV of each project based on a discount rate of 12%.

| Project | NPV |

|---|---|

| A | $23,919 |

| B | $18,421 |

The results indicate that Project A has a higher NPV than Project B, making it the more profitable investment option.

3. Evaluating Sensitivity to Discount Rates

An NPV calculator Excel template can also be used to evaluate the sensitivity of a project's NPV to different discount rates. By calculating the NPV of a project using different discount rates, you can determine how sensitive the project's profitability is to changes in the discount rate.

For example, let's say you're evaluating a project with the following cash flow profile:

| Year | Cash Flow |

|---|---|

| 0 | -$100,000 |

| 1 | $20,000 |

| 2 | $20,000 |

| 3 | $20,000 |

| 4 | $20,000 |

| 5 | $20,000 |

Using an NPV calculator Excel template, you can calculate the NPV of the project using different discount rates.

| Discount Rate | NPV |

|---|---|

| 10% | $15,814 |

| 12% | $13,919 |

| 15% | $11,943 |

The results indicate that the project's NPV is sensitive to changes in the discount rate. As the discount rate increases, the NPV of the project decreases.

4. Evaluating Sensitivity to Cash Flow Assumptions

An NPV calculator Excel template can also be used to evaluate the sensitivity of a project's NPV to different cash flow assumptions. By calculating the NPV of a project using different cash flow assumptions, you can determine how sensitive the project's profitability is to changes in the cash flow profile.

For example, let's say you're evaluating a project with the following cash flow profile:

| Year | Cash Flow |

|---|---|

| 0 | -$100,000 |

| 1 | $20,000 |

| 2 | $20,000 |

| 3 | $20,000 |

| 4 | $20,000 |

| 5 | $20,000 |

Using an NPV calculator Excel template, you can calculate the NPV of the project using different cash flow assumptions.

| Cash Flow Assumption | NPV |

|---|---|

| 10% increase in cash flows | $20,101 |

| 10% decrease in cash flows | $11,627 |

| 5% increase in cash flows | $17,419 |

| 5% decrease in cash flows | $14,209 |

The results indicate that the project's NPV is sensitive to changes in the cash flow assumptions. As the cash flows increase, the NPV of the project also increases.

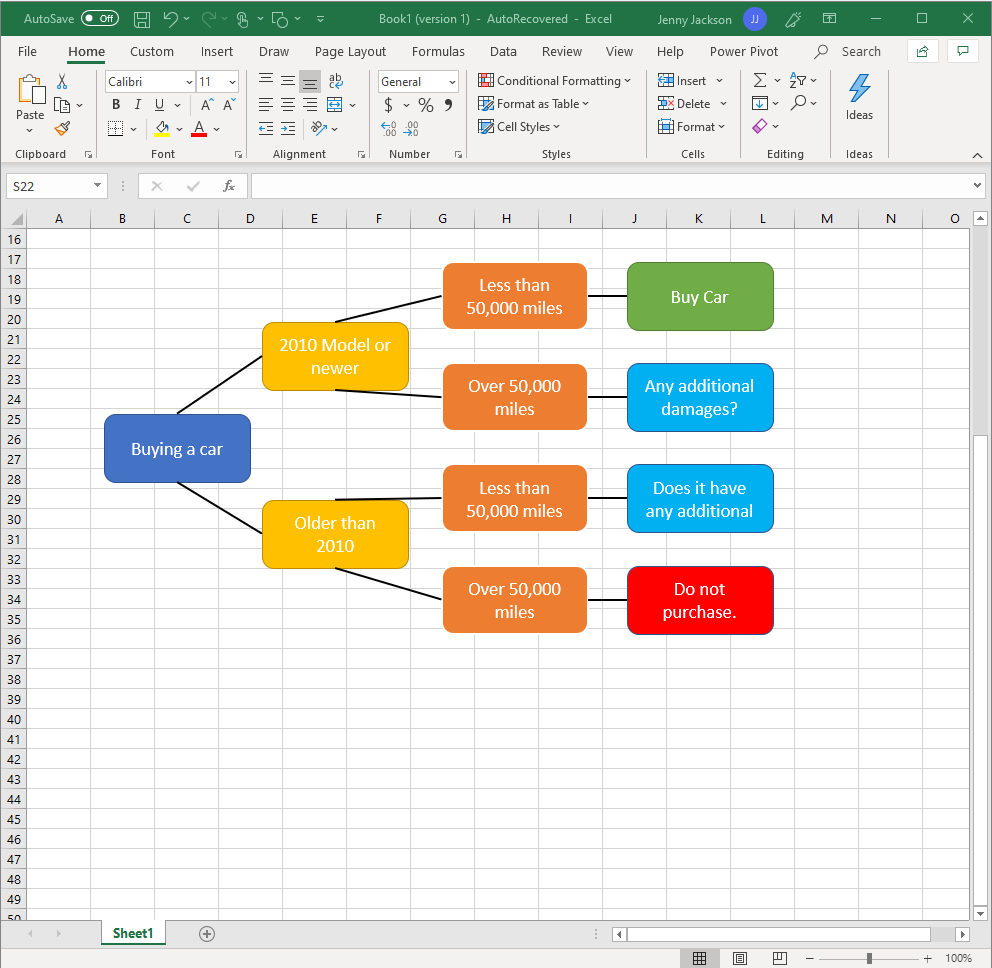

5. Creating a Decision Tree

An NPV calculator Excel template can also be used to create a decision tree that evaluates different investment scenarios. By calculating the NPV of each scenario, you can determine which one is the most profitable.

For example, let's say you're considering investing in a new business venture that has three different investment scenarios:

Scenario 1: Invest $100,000 and generate annual cash flows of $20,000 for the next five years. Scenario 2: Invest $150,000 and generate annual cash flows of $30,000 for the next five years. Scenario 3: Invest $200,000 and generate annual cash flows of $40,000 for the next five years.

Using an NPV calculator Excel template, you can calculate the NPV of each scenario based on a discount rate of 10%.

| Scenario | NPV |

|---|---|

| 1 | $15,814 |

| 2 | $25,009 |

| 3 | $34,309 |

The results indicate that Scenario 3 has the highest NPV, making it the most profitable investment option.

Conclusion

In conclusion, an NPV calculator Excel template is a powerful tool that can be used to evaluate the feasibility of a project or investment. By calculating the NPV of a project, you can determine whether it's worth investing in. An NPV calculator Excel template can also be used to compare different investment options, evaluate sensitivity to discount rates and cash flow assumptions, and create a decision tree. By using an NPV calculator Excel template, you can make informed financial decisions and achieve your business goals.

What is NPV?

+NPV stands for Net Present Value, which is a financial metric used to evaluate the profitability of a project or investment. It represents the difference between the present value of cash inflows and the present value of cash outflows.

How do I calculate NPV?

+NPV can be calculated using the formula: NPV = Σ (CFt / (1 + r)^t), where CFt is the cash flow at time t, r is the discount rate, and t is the time period.

What is a discount rate?

+A discount rate is the rate used to discount future cash flows to their present value. It reflects the time value of money and the risk associated with the investment.