Calculating the Internal Rate of Return (IRR) is a crucial task in finance, and Google Sheets provides an excellent platform to do so. The IRR formula is a powerful tool used to determine the return on investment (ROI) for a series of cash flows. In this article, we will explore the ways to use the IRR formula in Google Sheets, along with practical examples and tips to enhance your financial calculations.

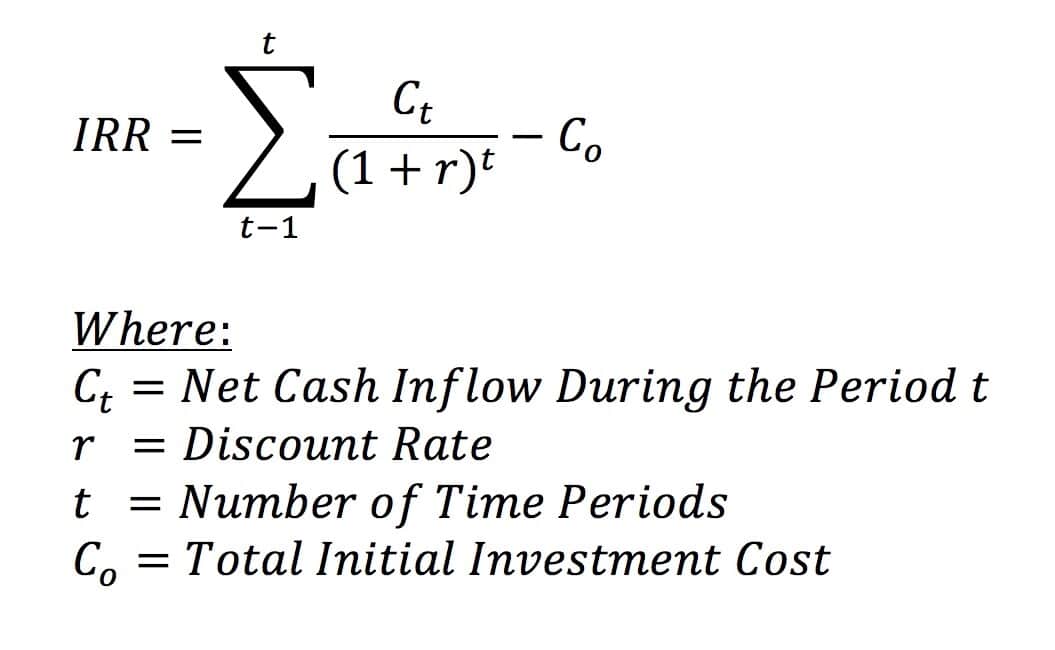

Understanding the IRR Formula

The IRR formula calculates the rate at which the present value of a series of cash flows equals zero. It's a measure of the profitability of an investment, and it's widely used in financial analysis. The IRR formula in Google Sheets is IRR(values, guess) where values is the range of cells containing the cash flows, and guess is the initial estimate of the IRR (optional).

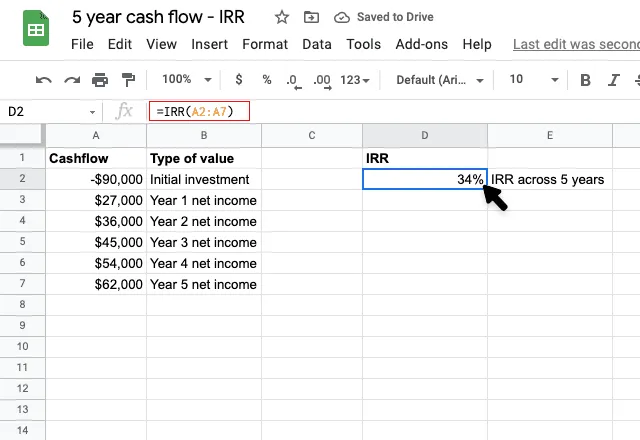

1. Basic IRR Calculation

To calculate the IRR of a series of cash flows, follow these steps:

- Enter the cash flows in a column, starting from the first row.

- Select the cell where you want to display the IRR result.

- Type

=IRR(A1:A10)(assuming the cash flows are in cells A1:A10). - Press Enter to calculate the IRR.

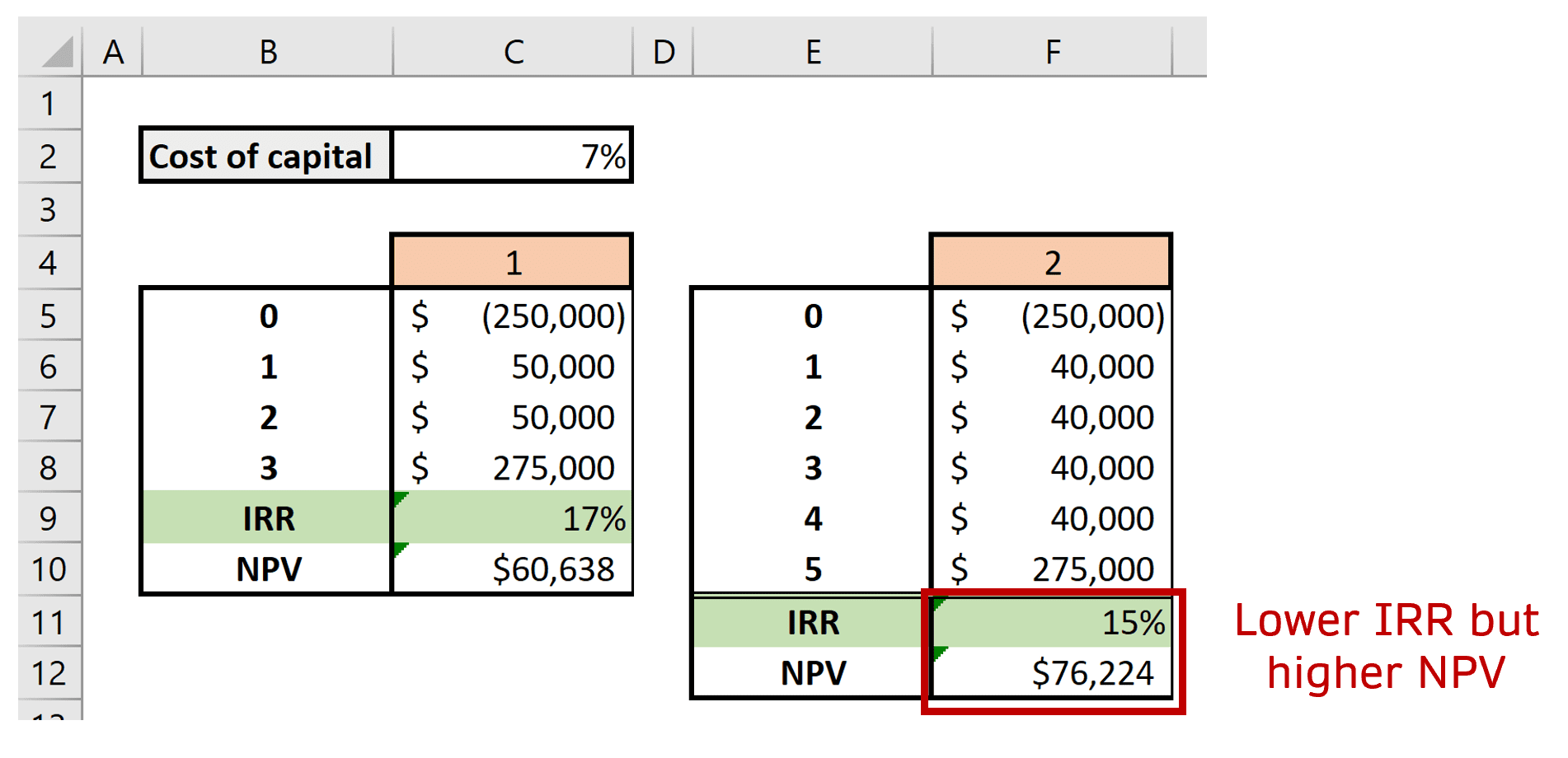

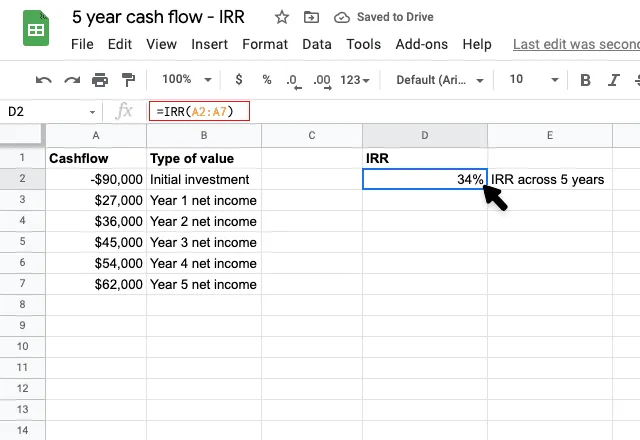

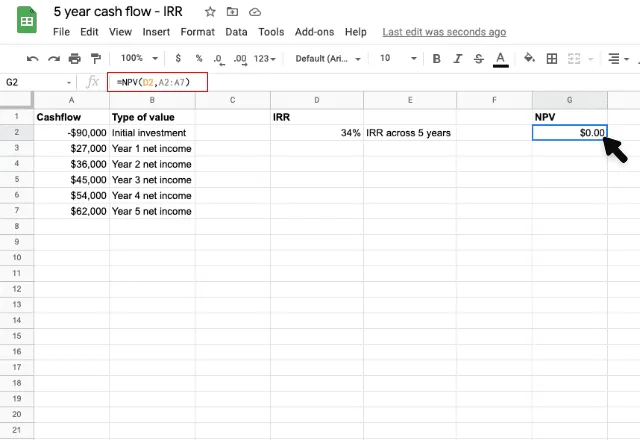

Example: Calculating IRR for a Project

Suppose you have a project with the following cash flows: -$100,000 (initial investment), $50,000 (year 1), $70,000 (year 2), and $90,000 (year 3). To calculate the IRR, enter the cash flows in cells A1:A4 and type =IRR(A1:A4) in cell B1.

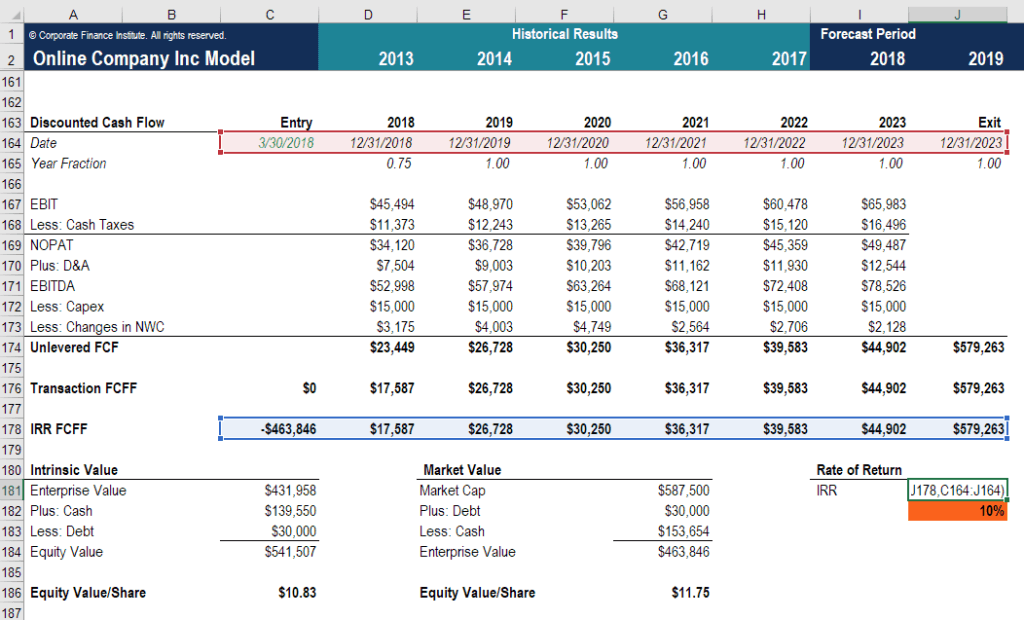

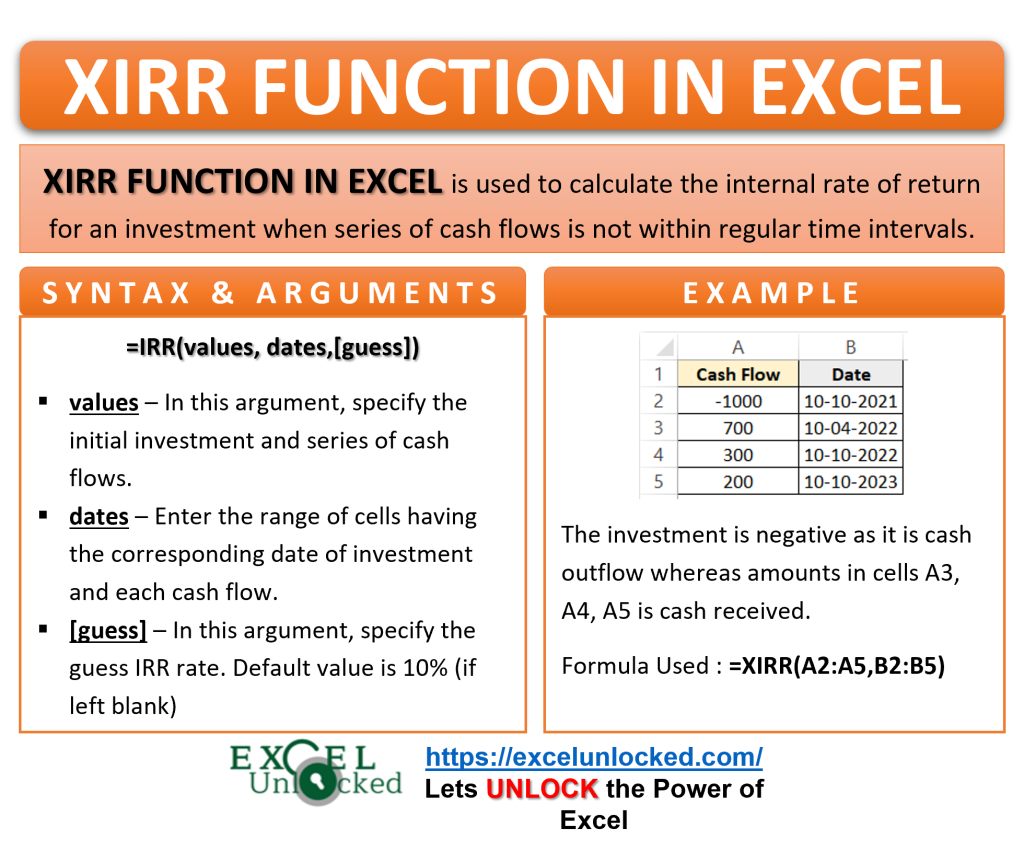

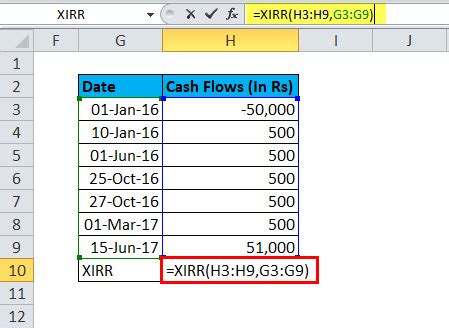

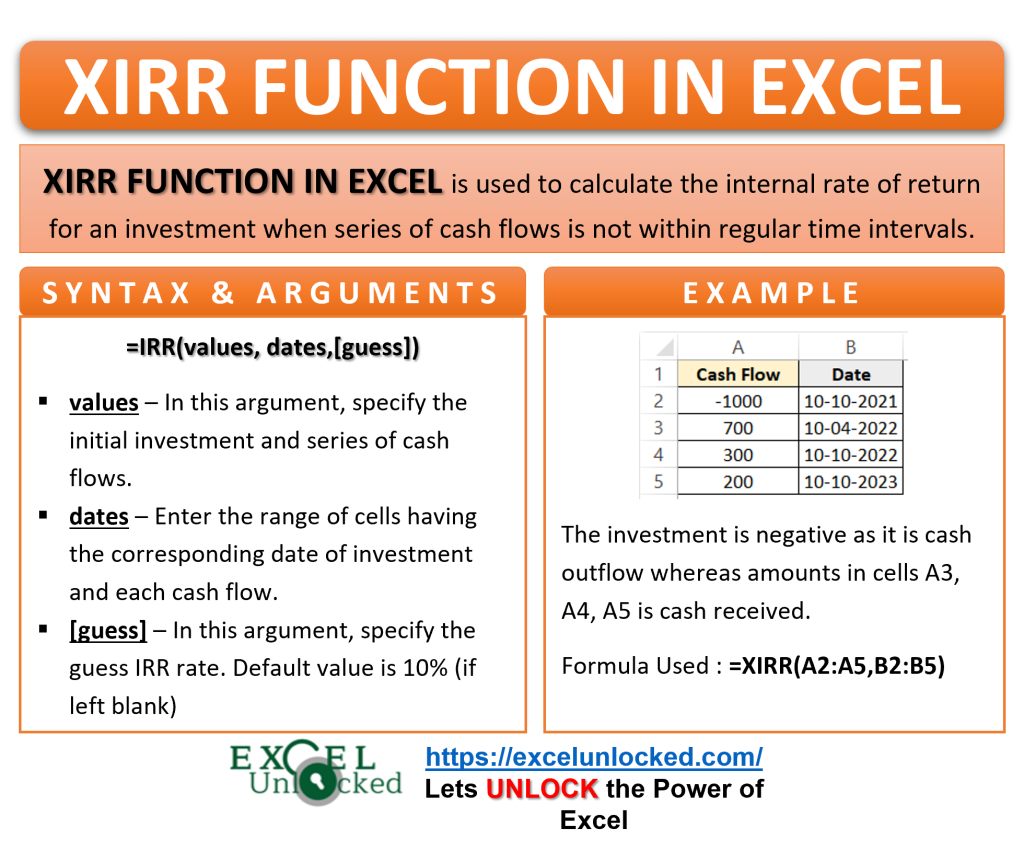

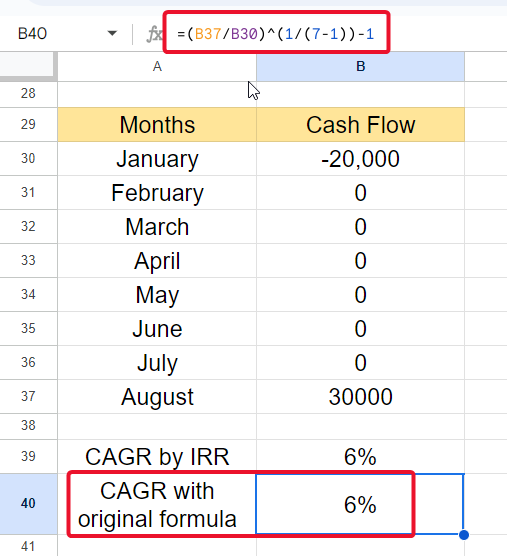

2. Using the XIRR Function

The XIRR function is an alternative to the IRR function, which allows you to specify the dates for the cash flows. This is useful when the cash flows are not periodic.

- Enter the cash flows in a column, starting from the first row.

- Enter the corresponding dates in another column, starting from the first row.

- Select the cell where you want to display the IRR result.

- Type

=XIRR(B:B, A:A)(assuming the cash flows are in column B and the dates are in column A). - Press Enter to calculate the IRR.

Example: Calculating XIRR for a Project

Suppose you have a project with the following cash flows and dates: -$100,000 (January 1, 2020), $50,000 (June 30, 2020), $70,000 (December 31, 2020), and $90,000 (June 30, 2021). To calculate the XIRR, enter the cash flows in column B and the dates in column A, and type =XIRR(B:B, A:A) in cell C1.

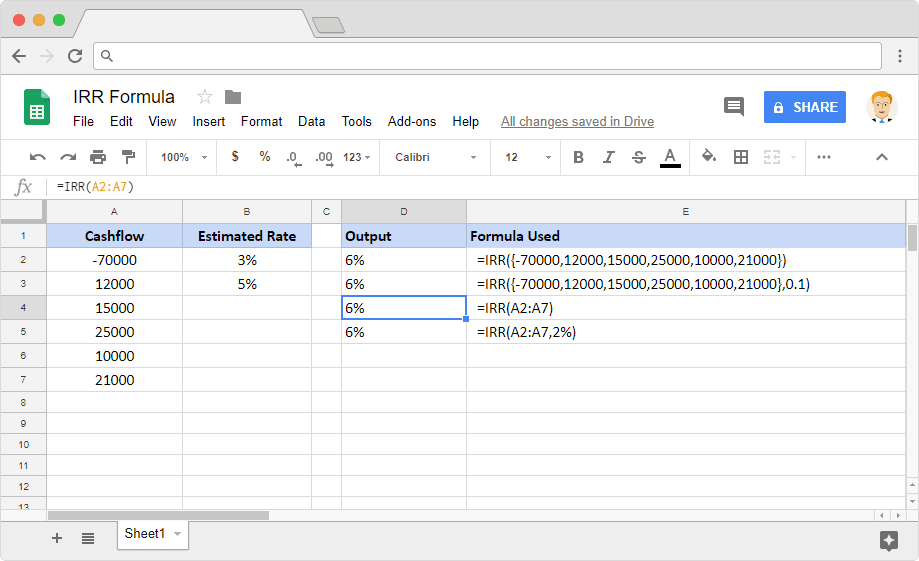

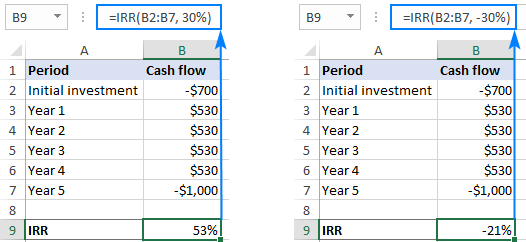

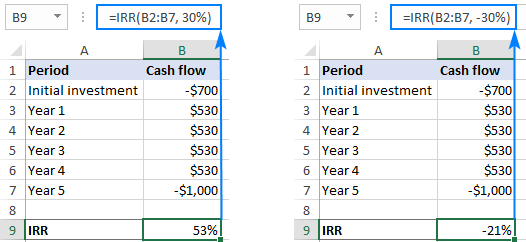

3. Calculating IRR with Multiple Guesses

In some cases, the IRR function may not converge to a solution, and you may need to provide multiple guesses. To do this, use the IRR(values, guess) function with multiple guesses.

- Enter the cash flows in a column, starting from the first row.

- Select the cell where you want to display the IRR result.

- Type

=IRR(A1:A10, 0.1, 0.2)(assuming the cash flows are in cells A1:A10 and the guesses are 0.1 and 0.2). - Press Enter to calculate the IRR.

Example: Calculating IRR with Multiple Guesses

Suppose you have a project with the following cash flows: -$100,000 (initial investment), $50,000 (year 1), $70,000 (year 2), and $90,000 (year 3). To calculate the IRR with multiple guesses, enter the cash flows in cells A1:A4 and type =IRR(A1:A4, 0.1, 0.2) in cell B1.

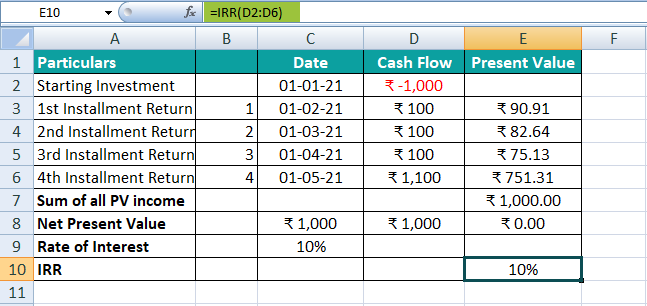

4. Creating an IRR Template

To simplify the IRR calculation process, you can create an IRR template in Google Sheets.

- Create a new spreadsheet with the following columns: Cash Flow, Date, and IRR.

- Enter the cash flows in the Cash Flow column.

- Enter the corresponding dates in the Date column.

- Select the cell where you want to display the IRR result.

- Type

=IRR(B:B, A:A)(assuming the cash flows are in column B and the dates are in column A). - Press Enter to calculate the IRR.

Example: Creating an IRR Template

Suppose you have a project with the following cash flows and dates: -$100,000 (January 1, 2020), $50,000 (June 30, 2020), $70,000 (December 31, 2020), and $90,000 (June 30, 2021). To create an IRR template, enter the cash flows in column B and the dates in column A, and type =IRR(B:B, A:A) in cell C1.

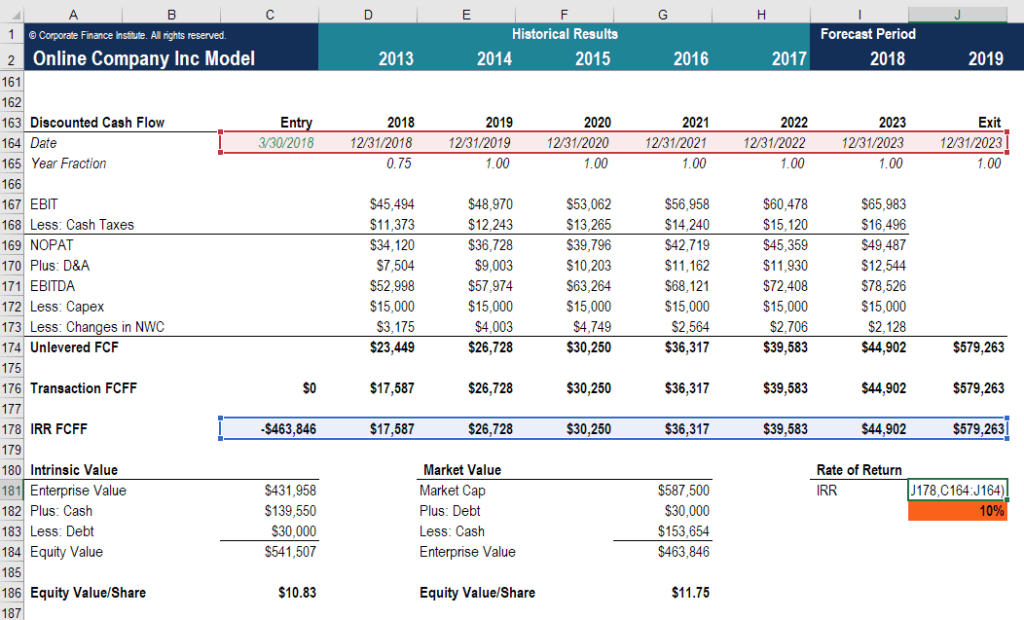

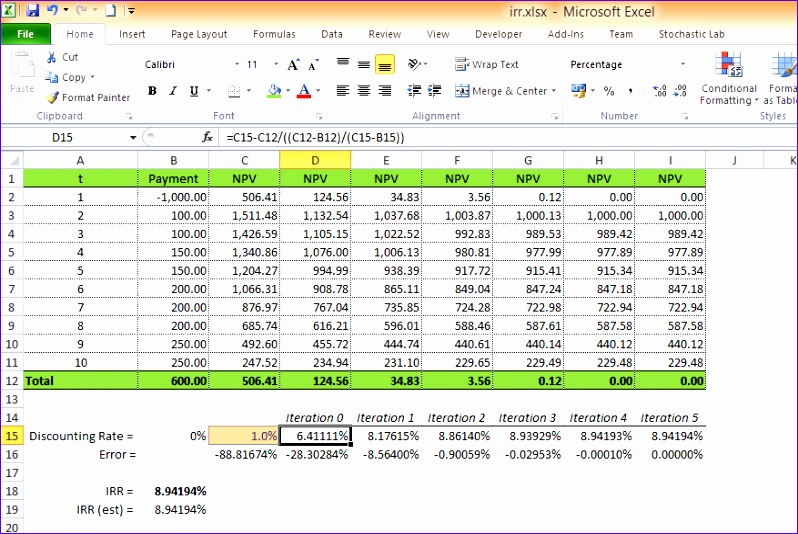

5. Advanced IRR Calculations

In some cases, you may need to perform advanced IRR calculations, such as calculating the IRR for a series of cash flows with different frequencies.

- Use the

XIRRfunction to calculate the IRR for a series of cash flows with different frequencies. - Use the

IRRfunction with multiple guesses to calculate the IRR for a series of cash flows with multiple frequencies.

Example: Advanced IRR Calculations

Suppose you have a project with the following cash flows and frequencies: -$100,000 (initial investment, monthly), $50,000 (year 1, quarterly), $70,000 (year 2, annually), and $90,000 (year 3, semiannually). To calculate the IRR, use the XIRR function with the corresponding frequencies.

Conclusion

In this article, we explored the ways to use the IRR formula in Google Sheets. We discussed the basic IRR calculation, using the XIRR function, calculating IRR with multiple guesses, creating an IRR template, and advanced IRR calculations. We also provided practical examples to illustrate each concept. By mastering the IRR formula in Google Sheets, you can simplify your financial calculations and make more informed investment decisions.

What is the IRR formula in Google Sheets?

+The IRR formula in Google Sheets is =IRR(values, guess) where values is the range of cells containing the cash flows, and guess is the initial estimate of the IRR (optional).

How do I calculate the IRR in Google Sheets?

+To calculate the IRR in Google Sheets, enter the cash flows in a column, select the cell where you want to display the IRR result, type =IRR(A1:A10) (assuming the cash flows are in cells A1:A10), and press Enter.

What is the difference between the IRR and XIRR functions?

+The IRR function calculates the IRR for a series of cash flows with the same frequency, while the XIRR function calculates the IRR for a series of cash flows with different frequencies.

![How to Use IRR Function in Google Sheets [2020]](https://www.sheetaki.com/wp-content/uploads/2020/10/Screen-Shot-2020-10-27-at-19.33.18.png)

![How to Use IRR Function in Google Sheets [2020]](https://www.sheetaki.com/wp-content/uploads/2020/10/Screen-Shot-2020-10-27-at-19.25.59.png)