The concept of pro rata insurance is a fundamental principle in the insurance industry. It refers to the proportionate allocation of insurance premiums or claims based on the number of days or months an insurance policy is in effect. In many cases, insurance companies use pro rata calculations to determine the amount of premium that needs to be refunded to a policyholder if they cancel their policy mid-term.

In this article, we will delve into the world of insurance pro rata calculators in Excel. We will explore how to create a pro rata calculator in Excel, its benefits, and provide examples of how it can be used in real-world scenarios.

What is an Insurance Pro Rata Calculator?

An insurance pro rata calculator is a tool used to calculate the proportionate amount of insurance premium that needs to be refunded to a policyholder if they cancel their policy mid-term. The calculator takes into account the number of days or months the policy was in effect and the total premium paid.

Benefits of Using an Insurance Pro Rata Calculator in Excel

Using an insurance pro rata calculator in Excel offers several benefits, including:

- Accuracy: Excel pro rata calculators ensure accurate calculations, reducing the risk of human error.

- Time-saving: Calculators automate the calculation process, saving time and increasing efficiency.

- Flexibility: Excel calculators can be easily modified to accommodate different insurance products and scenarios.

- Transparency: Calculators provide a clear and transparent breakdown of the calculation process, making it easier to understand and communicate with policyholders.

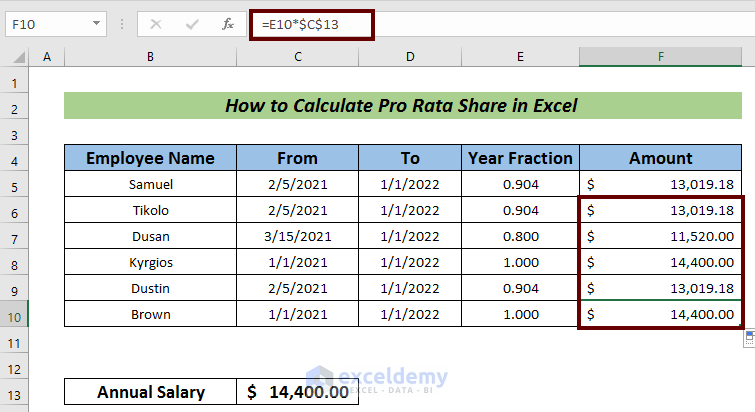

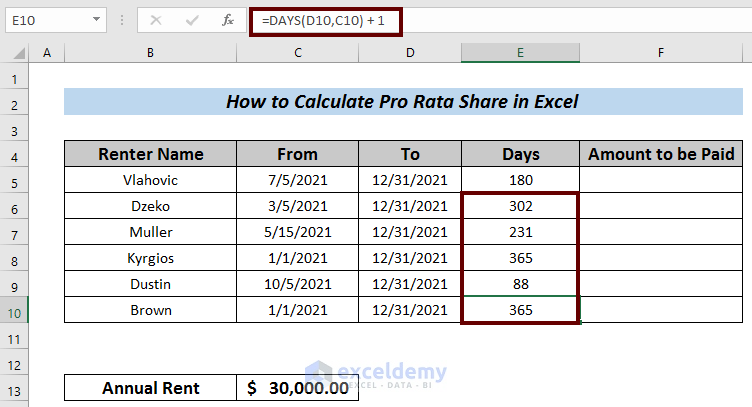

How to Create an Insurance Pro Rata Calculator in Excel

Creating an insurance pro rata calculator in Excel is a straightforward process. Here's a step-by-step guide:

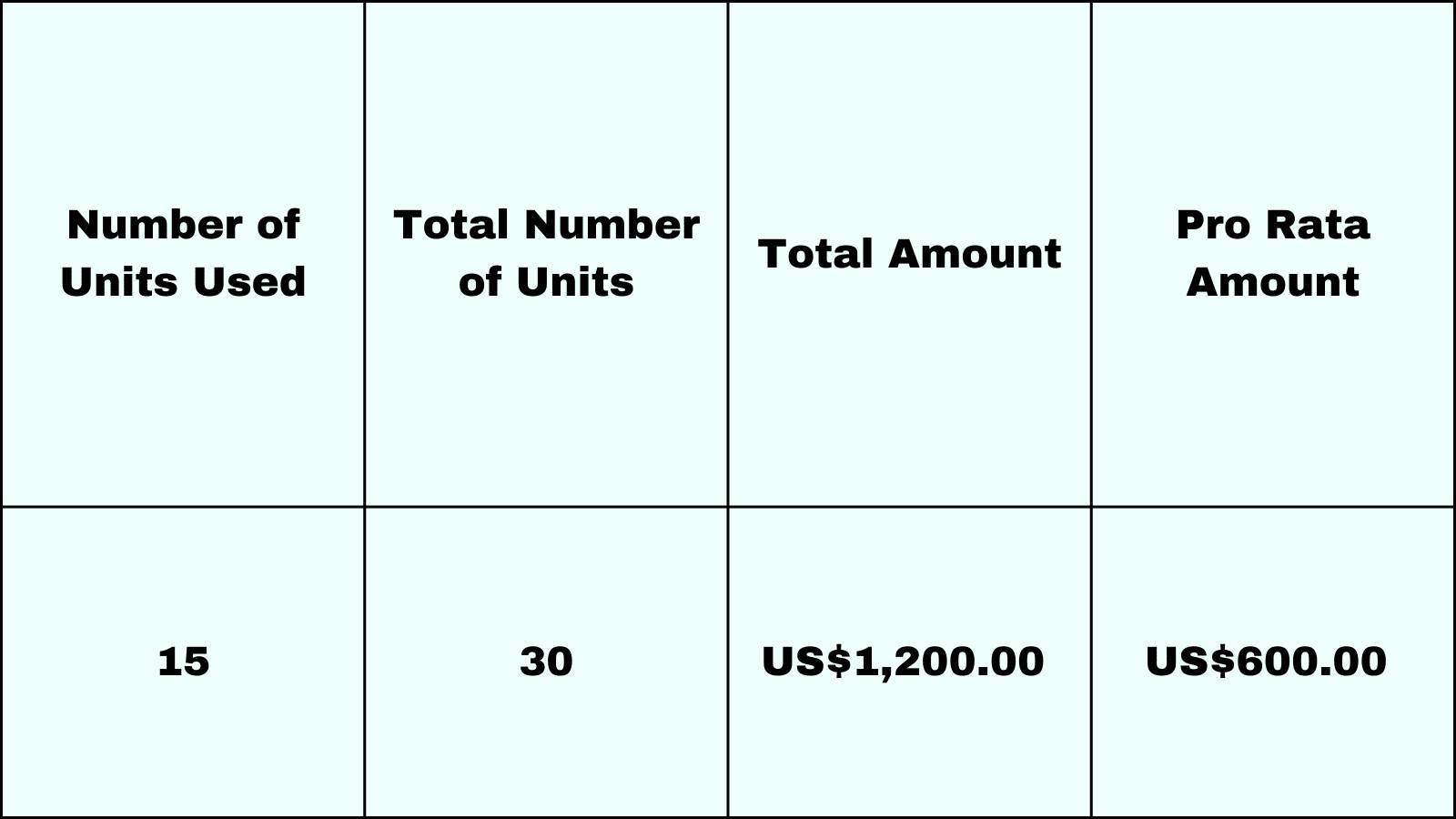

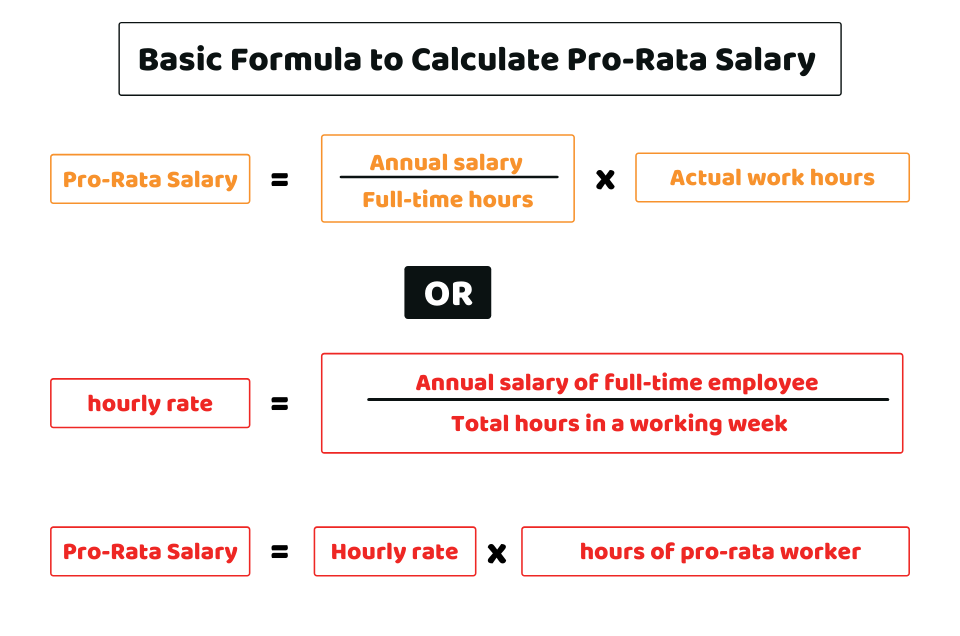

- Determine the calculation formula: The pro rata calculation formula is: (Number of days policy was in effect / Total number of days in the policy term) * Total premium paid.

- Set up the Excel spreadsheet: Create a new Excel spreadsheet and set up the following columns:

- Policy start date

- Policy end date

- Policy term (in days or months)

- Total premium paid

- Number of days policy was in effect

- Pro rata refund amount

- Enter the calculation formula: Enter the pro rata calculation formula in the pro rata refund amount column.

- Format the calculator: Format the calculator to display the results in a clear and transparent manner.

Example of an Insurance Pro Rata Calculator in Excel

Here's an example of an insurance pro rata calculator in Excel:

| Policy Start Date | Policy End Date | Policy Term (days) | Total Premium Paid | Number of Days Policy Was in Effect | Pro Rata Refund Amount |

|---|---|---|---|---|---|

| 01/01/2022 | 12/31/2022 | 365 | $1,000.00 | 180 | $492.46 |

In this example, the policyholder paid a total premium of $1,000.00 for a 365-day policy term. If they cancel their policy after 180 days, the pro rata refund amount would be $492.46.

Common Applications of Insurance Pro Rata Calculators in Excel

Insurance pro rata calculators in Excel have several common applications, including:

- Policy cancellations: Calculators are used to determine the pro rata refund amount when a policyholder cancels their policy mid-term.

- Premium adjustments: Calculators are used to adjust premiums when a policyholder makes changes to their policy, such as adding or removing coverage.

- Claims processing: Calculators are used to determine the proportionate amount of a claim that needs to be paid out when a policyholder makes a claim.

Best Practices for Using Insurance Pro Rata Calculators in Excel

When using insurance pro rata calculators in Excel, it's essential to follow best practices, including:

- Regularly update the calculator: Regularly update the calculator to ensure it remains accurate and compliant with regulatory requirements.

- Use clear and transparent formatting: Use clear and transparent formatting to display the results in a way that's easy to understand.

- Test the calculator: Test the calculator to ensure it's working correctly and producing accurate results.

Gallery of Insurance Pro Rata Calculator Excel

Frequently Asked Questions

Q: What is an insurance pro rata calculator? A: An insurance pro rata calculator is a tool used to calculate the proportionate amount of insurance premium that needs to be refunded to a policyholder if they cancel their policy mid-term.

Q: How do I create an insurance pro rata calculator in Excel? A: To create an insurance pro rata calculator in Excel, determine the calculation formula, set up the Excel spreadsheet, enter the calculation formula, and format the calculator.

Q: What are the benefits of using an insurance pro rata calculator in Excel? A: The benefits of using an insurance pro rata calculator in Excel include accuracy, time-saving, flexibility, and transparency.

Q: What are some common applications of insurance pro rata calculators in Excel? A: Common applications of insurance pro rata calculators in Excel include policy cancellations, premium adjustments, and claims processing.

Q: What are some best practices for using insurance pro rata calculators in Excel? A: Best practices for using insurance pro rata calculators in Excel include regularly updating the calculator, using clear and transparent formatting, and testing the calculator.

By following these best practices and using an insurance pro rata calculator in Excel, insurance companies can ensure accurate and efficient calculations, improve transparency, and enhance the overall policyholder experience.