As a business owner, investor, or financial analyst, calculating growth rates is a crucial task to assess performance, make informed decisions, and predict future outcomes. One popular metric to measure growth is the Compound Annual Growth Rate (CAGR). In this article, we'll explore the Google Sheets CAGR formula, its benefits, and provide a step-by-step guide on how to calculate growth with ease.

The Importance of CAGR in Business and Finance

CAGR is a widely used metric to evaluate the growth of investments, revenue, profits, or any other financial metric over a specified period. It represents the rate of return that would have been required to achieve the same growth rate if it had been constant over the measurement period. CAGR is essential in business and finance because it helps:

- Evaluate investment performance

- Compare growth rates between different periods or companies

- Make informed decisions about investments or business strategies

- Predict future growth rates

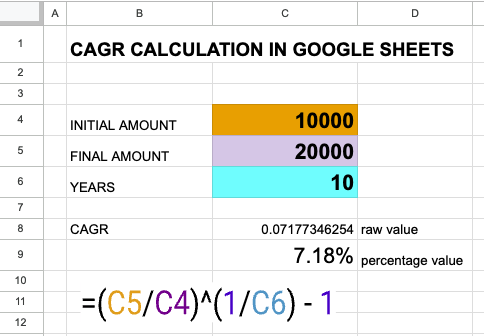

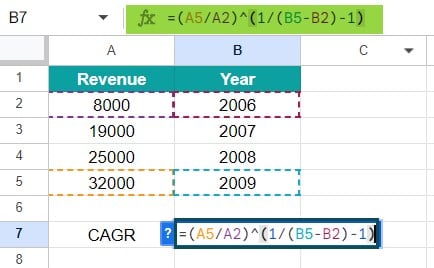

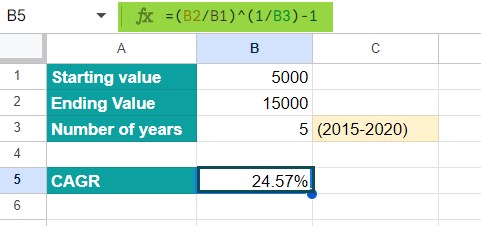

Calculating CAGR in Google Sheets

Google Sheets provides a straightforward way to calculate CAGR using a formula. The CAGR formula in Google Sheets is:

=(END/(BEGIN)^((END-YEAR-BEGIN)/YEAR))^(1/YEAR)-1

Where:

ENDis the ending valueBEGINis the beginning valueYEARis the number of years

Assuming you have the following data in a Google Sheets spreadsheet:

| Year | Value |

|---|---|

| 2018 | 100 |

| 2019 | 120 |

| 2020 | 150 |

| 2021 | 180 |

To calculate the CAGR, follow these steps:

- Select the cell where you want to display the CAGR result.

- Type the formula:

=((180/100)^((2021-2018)/1))-1 - Press Enter to calculate the CAGR.

The result will be the CAGR value, which in this case is approximately 14.47%.

Tips and Variations

- To calculate the CAGR for a specific period, adjust the

BEGINandENDvalues accordingly. - To calculate the CAGR for multiple periods, use an array formula or multiple instances of the CAGR formula.

- To calculate the CAGR with a different compounding frequency (e.g., monthly or quarterly), adjust the

YEARvalue accordingly.

Example Use Cases

- Investment Analysis: Calculate the CAGR of an investment portfolio to evaluate its performance over time.

- Business Growth: Calculate the CAGR of revenue or profits to assess a company's growth rate and make informed decisions.

- Financial Planning: Calculate the CAGR of a savings account or retirement fund to determine the expected growth rate and plan accordingly.

Best Practices

- Use clear and concise labels for your data and formulas.

- Use absolute references (e.g.,

$A$1) instead of relative references (e.g.,A1) to ensure accurate calculations. - Use named ranges or references to make your formulas more readable and maintainable.

Common Errors and Troubleshooting

- Error: #VALUE!: Check that the input values are numbers and not text.

- Error: #NUM!: Check that the input values are valid and not causing division by zero or other numerical errors.

- Incorrect result: Double-check the formula and input values to ensure accuracy.

Conclusion

Calculating growth rates with ease is crucial in business and finance. The Google Sheets CAGR formula provides a straightforward way to evaluate growth rates and make informed decisions. By following the steps and tips outlined in this article, you'll be able to calculate CAGR with confidence and accuracy. Whether you're an investor, business owner, or financial analyst, mastering the CAGR formula in Google Sheets will help you make data-driven decisions and achieve your goals.

Gallery of Google Sheets CAGR Formula

FAQs

What is CAGR?

+CAGR stands for Compound Annual Growth Rate. It's a metric used to evaluate the growth of an investment or a business over a specified period.

How do I calculate CAGR in Google Sheets?

+Use the formula: `=((END/(BEGIN))^((END-YEAR-BEGIN)/YEAR))-1` and adjust the input values accordingly.

What are some common errors when calculating CAGR?

+Common errors include incorrect input values, division by zero, and formatting issues. Double-check your formula and input values to ensure accuracy.