Mastering the FY formula in Excel is a crucial skill for anyone looking to achieve financial success, whether you're a seasoned financial analyst or just starting out in the world of finance. The FY formula, also known as the Financial Year formula, is a powerful tool that allows you to easily manipulate and analyze financial data in Excel. In this article, we'll take a deep dive into the world of FY formulas, exploring what they are, how they work, and how you can use them to achieve financial success.

What is the FY Formula?

The FY formula is a type of formula in Excel that allows you to calculate financial data based on a specific financial year. It's commonly used in financial modeling and analysis to calculate metrics such as revenue, expenses, and profits over a specific period. The FY formula is particularly useful when working with large datasets, as it allows you to easily summarize and analyze financial data without having to manually create formulas for each individual year.

How Does the FY Formula Work?

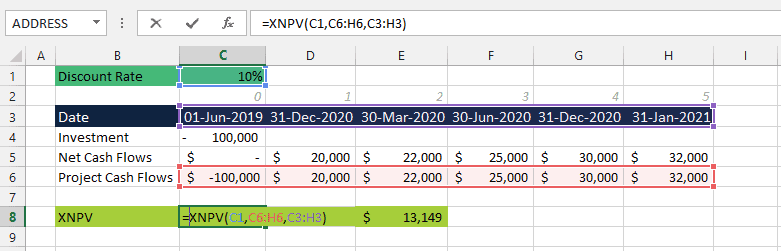

The FY formula works by using a combination of Excel functions, including the YEAR function, the DATE function, and the SUMIFS function. The formula essentially works by identifying the financial year of a specific date, and then using that information to calculate financial data for that year.

For example, let's say you have a dataset that includes sales data for each month of the year. To calculate the total sales for the financial year 2022, you could use the following FY formula:

=SUMIFS(Sales, YEAR(Date), 2022)

This formula uses the YEAR function to identify the financial year of each date in the dataset, and then uses the SUMIFS function to sum up the sales data for the year 2022.

Benefits of Using the FY Formula

So why should you use the FY formula in your financial analysis? Here are just a few benefits:

- Easy data analysis: The FY formula makes it easy to analyze financial data over a specific period, without having to manually create formulas for each individual year.

- Time-saving: The FY formula saves time by automating the process of calculating financial data for each year.

- Improved accuracy: The FY formula reduces the risk of human error, by using Excel functions to accurately calculate financial data.

- Flexibility: The FY formula can be used to calculate a wide range of financial metrics, including revenue, expenses, and profits.

Common Uses of the FY Formula

The FY formula has a wide range of applications in financial analysis, including:

- Financial modeling: The FY formula is commonly used in financial modeling to calculate financial metrics such as revenue, expenses, and profits over a specific period.

- Budgeting: The FY formula can be used to create budgets and forecasts for future financial years.

- Financial reporting: The FY formula is often used in financial reporting to analyze financial data and create reports for stakeholders.

Step-by-Step Guide to Using the FY Formula

Here's a step-by-step guide to using the FY formula in Excel:

- Enter your data: Enter your financial data into a table in Excel, including the date and sales data.

- Create a new column: Create a new column in your table to calculate the financial year of each date.

- Use the YEAR function: Use the

YEARfunction to identify the financial year of each date. For example:=YEAR(A2) - Use the SUMIFS function: Use the

SUMIFSfunction to sum up the sales data for each financial year. For example:=SUMIFS(C:C, A:A, ">="&DATE(2022,1,1), A:A, "<="&DATE(2022,12,31)) - Combine the formulas: Combine the

YEARfunction and theSUMIFSfunction to create the FY formula. For example:=SUMIFS(Sales, YEAR(Date), 2022)

Tips and Tricks for Using the FY Formula

Here are a few tips and tricks for using the FY formula in Excel:

- Use absolute references: Use absolute references (e.g.

$A$2) instead of relative references (e.g.A2) to ensure that the formula references the correct cell. - Use named ranges: Use named ranges (e.g.

Sales) instead of cell references (e.g.C:C) to make the formula easier to read and understand. - Use Excel functions: Use Excel functions (e.g.

YEAR,DATE,SUMIFS) to make the formula more efficient and accurate.

Conclusion

Mastering the FY formula is a crucial skill for anyone looking to achieve financial success in Excel. By following the steps outlined in this article, you can use the FY formula to easily manipulate and analyze financial data, and achieve financial success.

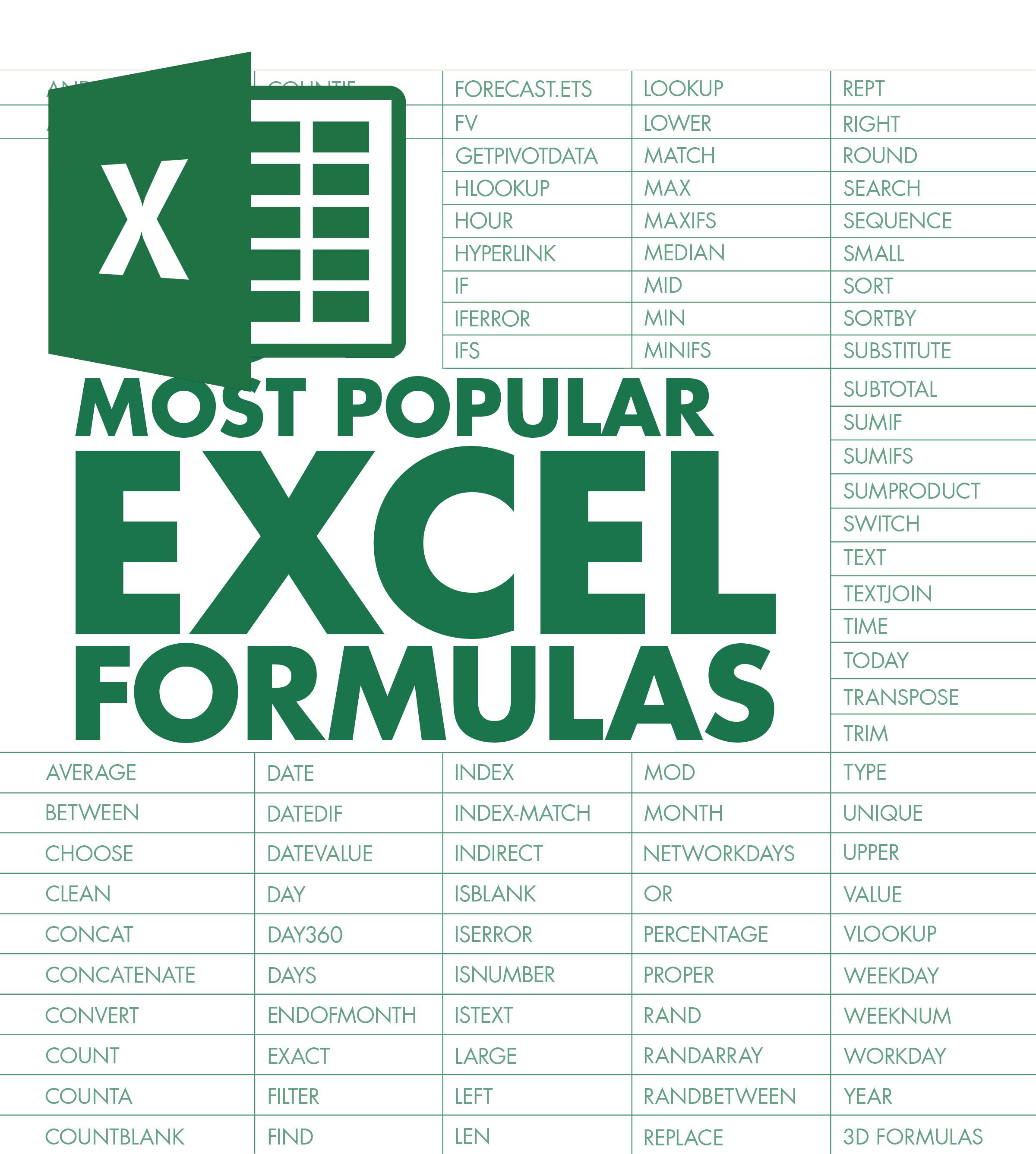

Gallery of Financial Formulas

What is the FY formula in Excel?

+The FY formula is a type of formula in Excel that allows you to calculate financial data based on a specific financial year.

How does the FY formula work?

+The FY formula uses a combination of Excel functions, including the `YEAR` function, the `DATE` function, and the `SUMIFS` function, to calculate financial data for a specific financial year.

What are the benefits of using the FY formula?

+The benefits of using the FY formula include easy data analysis, time-saving, improved accuracy, and flexibility.