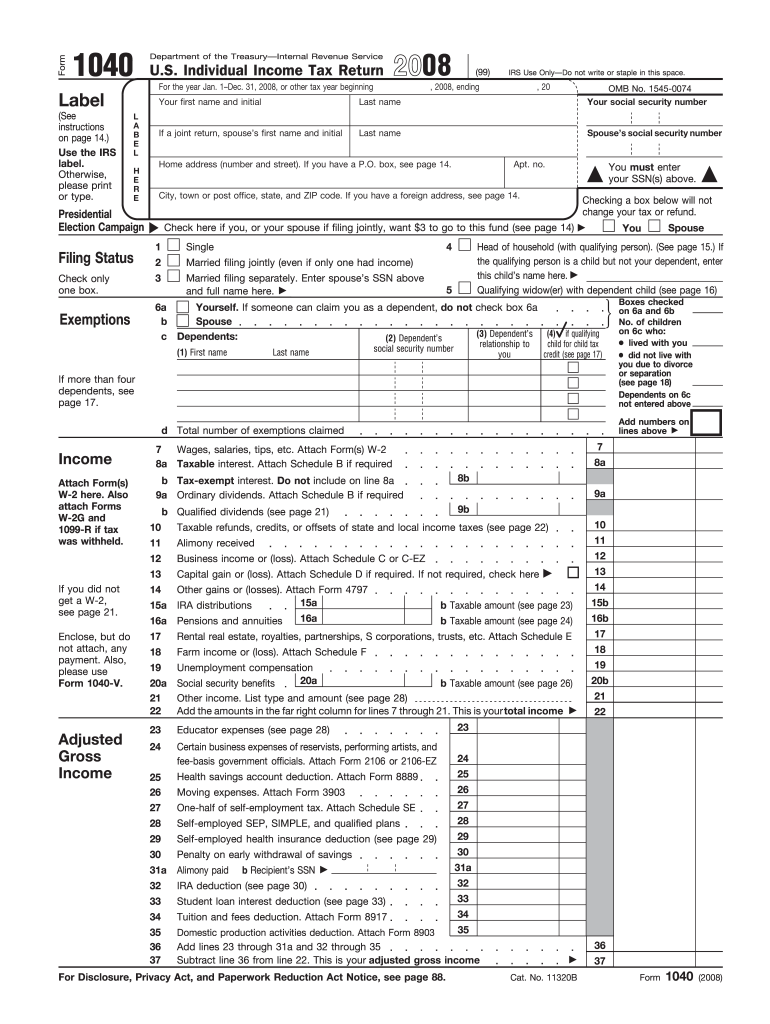

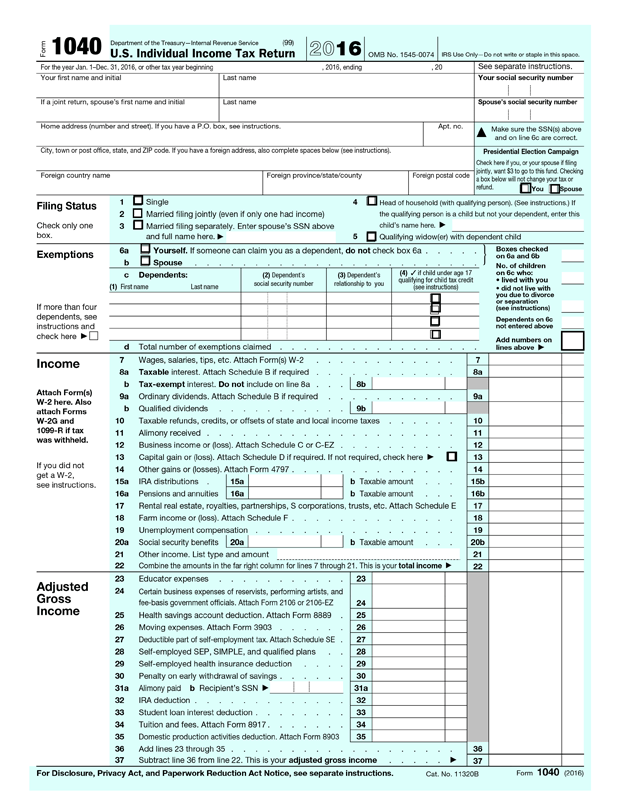

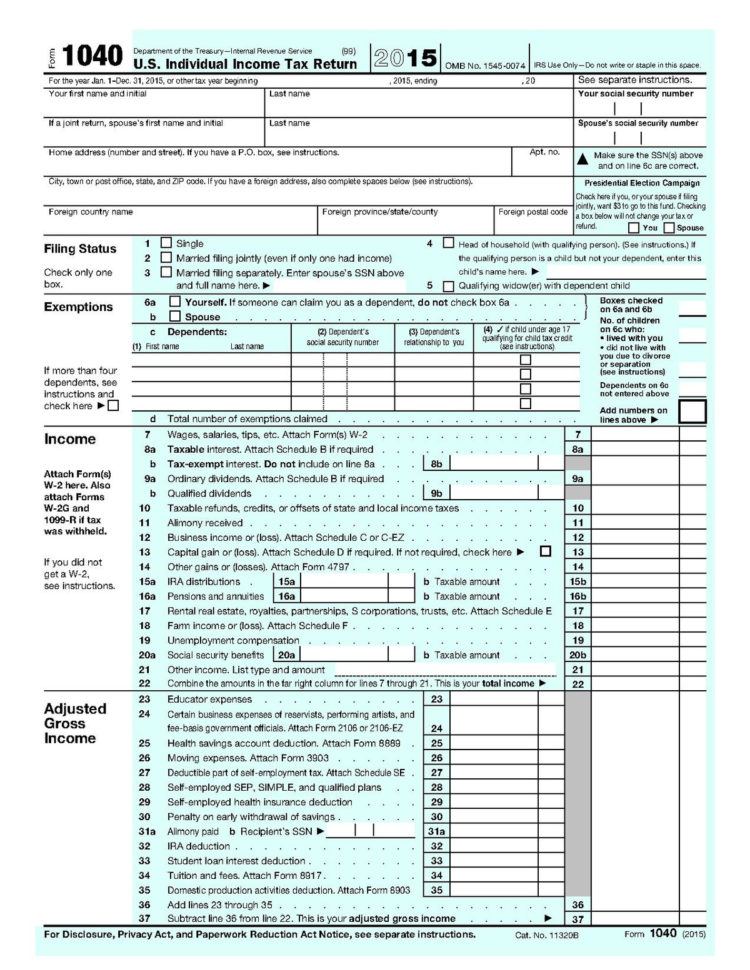

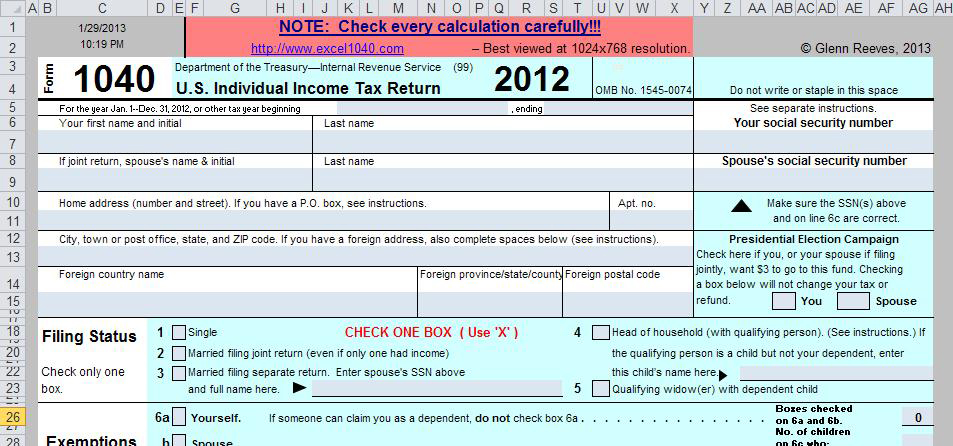

Tax season can be a stressful time for many individuals, with the complexity of tax laws and the need to ensure accuracy in filing. However, with the right tools, the process can be significantly simplified. One such tool is an Excel template for filing Form 1040, which can make it easier to organize your financial information and ensure that you're taking advantage of all the deductions and credits available to you.

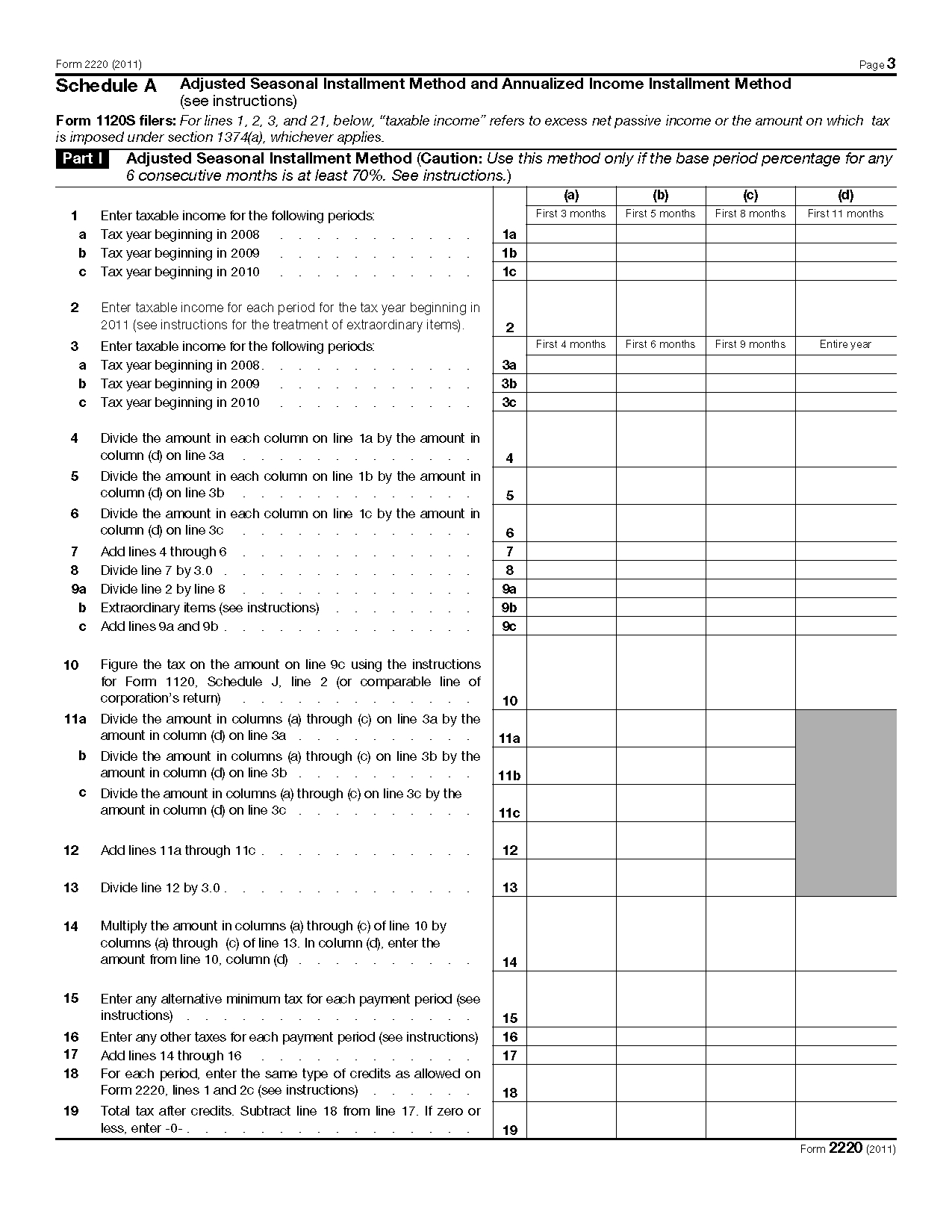

Using an Excel template for Form 1040 can be particularly beneficial for those who are self-employed or have complex financial situations. By utilizing a template, you can streamline the process of tracking your income and expenses, and ensure that you're not missing out on any important deductions.

In this article, we'll explore the benefits of using an Excel template for Form 1040, and provide a step-by-step guide on how to create and use one. We'll also discuss some tips for maximizing your deductions and credits, and highlight some common mistakes to avoid.

Benefits of Using an Excel Template for Form 1040

- Simplifies the filing process: An Excel template can help you organize your financial information in a clear and concise manner, making it easier to file your taxes.

- Reduces errors: By using a template, you can minimize the risk of errors and ensure that you're not missing out on any important deductions or credits.

- Saves time: An Excel template can save you time and effort by automating many of the calculations and formatting tasks.

- Increases accuracy: A template can help you ensure that you're reporting your income and expenses accurately, and that you're taking advantage of all the deductions and credits available to you.

- Improves budgeting: By using an Excel template, you can get a better understanding of your financial situation and make informed decisions about your budget.

Creating an Excel Template for Form 1040

Creating an Excel template for Form 1040 is relatively straightforward. Here's a step-by-step guide to get you started:

Step 1: Download a Template

You can download a free Excel template for Form 1040 from the IRS website or from various online sources. Make sure to choose a template that is compatible with your version of Excel.

Step 2: Customize the Template

Once you've downloaded the template, you'll need to customize it to fit your specific needs. This may include adding or removing columns, rows, or worksheets, depending on your financial situation.

Step 3: Enter Your Information

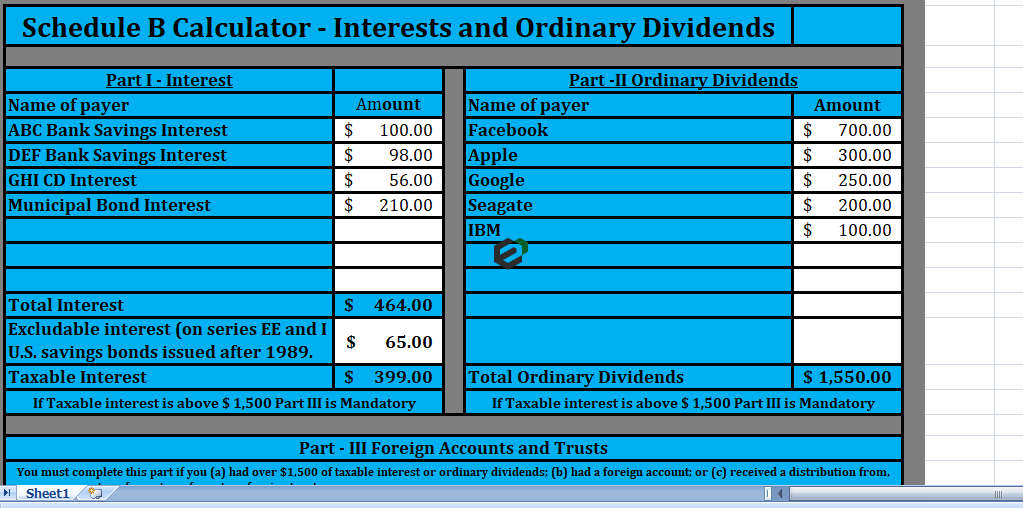

Enter your financial information into the template, including your income, expenses, deductions, and credits. Make sure to follow the instructions provided with the template and to use the correct formulas and formatting.

Step 4: Review and Edit

Review your template carefully to ensure that all the information is accurate and complete. Make any necessary edits or adjustments before printing or e-filing your return.

Tips for Maximizing Your Deductions and Credits

Here are some tips for maximizing your deductions and credits when using an Excel template for Form 1040:

- Keep accurate records: Keep accurate records of your income and expenses throughout the year, and make sure to save receipts and other documentation for deductions and credits.

- Take advantage of deductions: Take advantage of all the deductions and credits available to you, including mortgage interest, charitable donations, and medical expenses.

- Claim the Earned Income Tax Credit (EITC): If you're eligible, claim the EITC, which can provide a significant refund.

- Claim the Child Tax Credit: If you have children under the age of 17, claim the Child Tax Credit, which can provide up to $2,000 per child.

- Consider hiring a tax professional: If you're unsure about any aspect of the tax filing process, consider hiring a tax professional to help you maximize your deductions and credits.

Common Mistakes to Avoid

Here are some common mistakes to avoid when using an Excel template for Form 1040:

- Math errors: Double-check your calculations to ensure that they're accurate.

- Missed deadlines: Make sure to file your return on time to avoid penalties and interest.

- Inaccurate information: Ensure that all the information you enter into the template is accurate and complete.

- Failure to report income: Make sure to report all income, including freelance work or tips.

- Not claiming deductions: Don't miss out on deductions and credits that you're eligible for.

Gallery of Form 1040 Templates

FAQs

What is Form 1040?

+Form 1040 is the standard form used by the IRS for personal income tax returns.

How do I file Form 1040?

+You can file Form 1040 electronically or by mail. If you're using an Excel template, you'll need to print and sign the return before mailing it to the IRS.

Can I use an Excel template for Form 1040 if I'm self-employed?

+By using an Excel template for Form 1040, you can simplify the tax filing process and ensure that you're taking advantage of all the deductions and credits available to you. Remember to keep accurate records, claim all eligible deductions and credits, and avoid common mistakes. If you're unsure about any aspect of the tax filing process, consider hiring a tax professional to help you navigate the process.