Investing and saving money is an essential part of personal finance. When it comes to growing your wealth, compound interest can be a powerful tool. Compound interest is the interest earned on both the principal amount and any accrued interest over time. Calculating daily compound interest can be a bit tricky, but Excel can make it easier. In this article, we'll explore five ways to calculate daily compound interest in Excel.

Daily compound interest can make a significant difference in your savings over time. For instance, if you deposit $1,000 into a savings account with a 2% annual interest rate compounded daily, you'll earn approximately $20.16 in interest over a year. This may not seem like a lot, but it can add up over time. Understanding how to calculate daily compound interest in Excel can help you make informed decisions about your investments.

What is Compound Interest?

Before we dive into calculating daily compound interest, let's quickly review what compound interest is. Compound interest is the interest earned on both the principal amount and any accrued interest over time. It's the result of reinvesting interest, rather than paying it out, so that the interest earns interest on itself.

For example, if you deposit $1,000 into a savings account with a 2% annual interest rate, you'll earn $20 in interest over a year. If the interest is compounded annually, you'll have a total of $1,020 at the end of the year. However, if the interest is compounded daily, you'll earn interest on the accrued interest, resulting in a higher total amount.

Method 1: Using the DAILY RATE Function

One way to calculate daily compound interest in Excel is by using the DAILY RATE function. This function calculates the daily interest rate based on the annual interest rate and the compounding frequency.

Formula:

=DAILY_RATE(A2, A3, A4)

Where:

- A2 is the annual interest rate

- A3 is the compounding frequency (e.g., daily, monthly, quarterly)

- A4 is the principal amount

Example:

| Interest Rate | Compounding Frequency | Principal Amount |

|---|---|---|

| 2% | Daily | $1,000 |

=DAILY_RATE(0.02, 365, 1000)

This formula returns the daily interest rate, which can be used to calculate the daily compound interest.

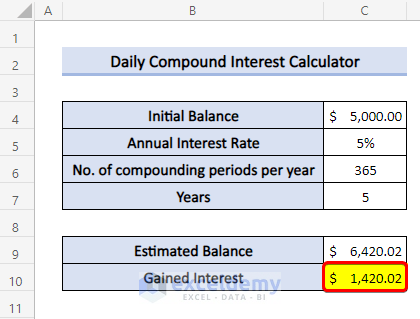

Method 2: Using the POWER Function

Another way to calculate daily compound interest in Excel is by using the POWER function. This function calculates the future value of an investment based on the principal amount, interest rate, and compounding frequency.

Formula:

=POWER(1 + A2/A3, A3\*A4) \* A1

Where:

- A1 is the principal amount

- A2 is the annual interest rate

- A3 is the compounding frequency (e.g., daily, monthly, quarterly)

- A4 is the number of years

Example:

| Principal Amount | Interest Rate | Compounding Frequency | Number of Years |

|---|---|---|---|

| $1,000 | 2% | Daily | 1 |

=POWER(1 + 0.02/365, 365\*1) \* 1000

This formula returns the future value of the investment, which can be used to calculate the daily compound interest.

Method 3: Using the IPMT Function

The IPMT function calculates the interest portion of a loan payment based on the principal amount, interest rate, and payment period.

Formula:

=IPMT(A2, A3, A4, A5)

Where:

- A2 is the interest rate

- A3 is the payment period (e.g., daily, monthly, quarterly)

- A4 is the principal amount

- A5 is the number of payments

Example:

| Interest Rate | Payment Period | Principal Amount | Number of Payments |

|---|---|---|---|

| 2% | Daily | $1,000 | 365 |

=IPMT(0.02, 365, 1000, 365)

This formula returns the interest portion of the loan payment, which can be used to calculate the daily compound interest.

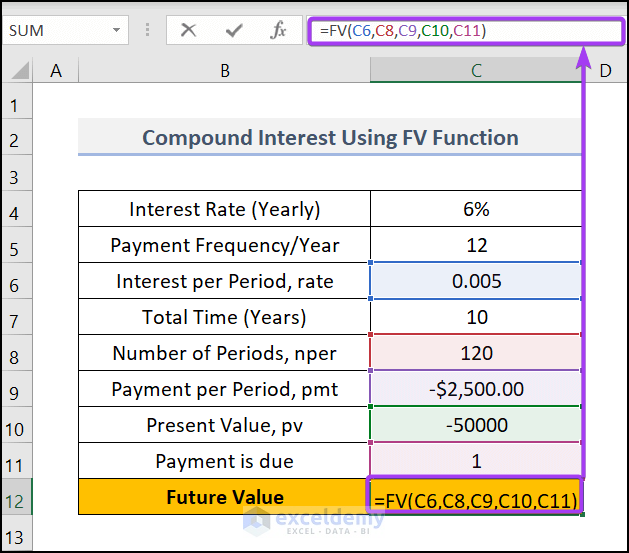

Method 4: Using the FV Function

The FV function calculates the future value of an investment based on the principal amount, interest rate, and compounding frequency.

Formula:

=FV(A2, A3, A4, A5)

Where:

- A2 is the interest rate

- A3 is the number of payments

- A4 is the payment amount

- A5 is the principal amount

Example:

| Interest Rate | Number of Payments | Payment Amount | Principal Amount |

|---|---|---|---|

| 2% | 365 | $0 | $1,000 |

=FV(0.02, 365, 0, 1000)

This formula returns the future value of the investment, which can be used to calculate the daily compound interest.

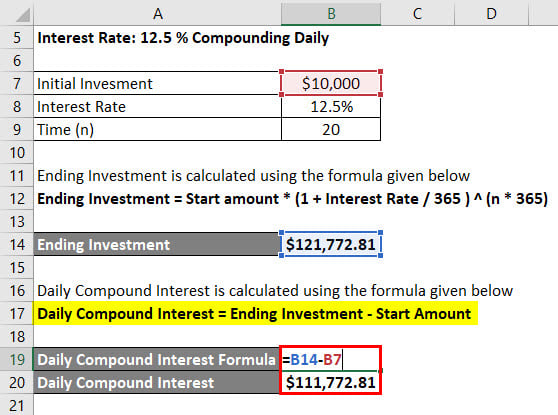

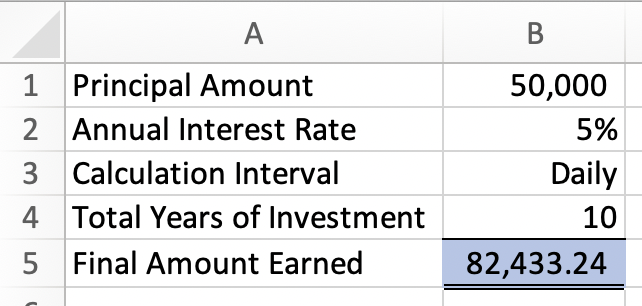

Method 5: Using a Custom Formula

If you prefer not to use built-in functions, you can create a custom formula to calculate daily compound interest.

Formula:

=A1 \* (1 + A2/A3) ^ (A3\*A4)

Where:

- A1 is the principal amount

- A2 is the annual interest rate

- A3 is the compounding frequency (e.g., daily, monthly, quarterly)

- A4 is the number of years

Example:

| Principal Amount | Interest Rate | Compounding Frequency | Number of Years |

|---|---|---|---|

| $1,000 | 2% | Daily | 1 |

=1000 \* (1 + 0.02/365) ^ (365\*1)

This formula returns the future value of the investment, which can be used to calculate the daily compound interest.

Gallery of Compound Interest Formulas:

FAQs:

What is compound interest?

+Compound interest is the interest earned on both the principal amount and any accrued interest over time.

How do I calculate daily compound interest in Excel?

+You can calculate daily compound interest in Excel using the DAILY RATE function, POWER function, IPMT function, FV function, or a custom formula.

What is the difference between annual and daily compounding?

+Annual compounding earns interest on the principal amount once a year, while daily compounding earns interest on the principal amount and accrued interest daily.

By understanding how to calculate daily compound interest in Excel, you can make informed decisions about your investments and grow your wealth over time. Whether you use the DAILY RATE function, POWER function, IPMT function, FV function, or a custom formula, you can easily calculate daily compound interest in Excel.