Managing daily cash flow is crucial for the financial health of any business. Accurate tracking of cash inflows and outflows helps in making informed decisions, preventing cash shortages, and ensuring compliance with financial regulations. A daily cash count sheet template is a valuable tool for businesses to monitor their cash transactions effectively. In this article, we will explore the importance of daily cash count, the components of a daily cash count sheet template, and provide a comprehensive guide on how to use it for accurate tracking.

The Importance of Daily Cash Count

Daily cash count is the process of tracking and recording all cash transactions, including receipts, payments, and petty cash transactions. This process helps businesses to:

- Maintain accurate financial records

- Prevent cash shortages and overdrafts

- Identify and prevent cash handling errors

- Ensure compliance with financial regulations

- Make informed decisions about cash management

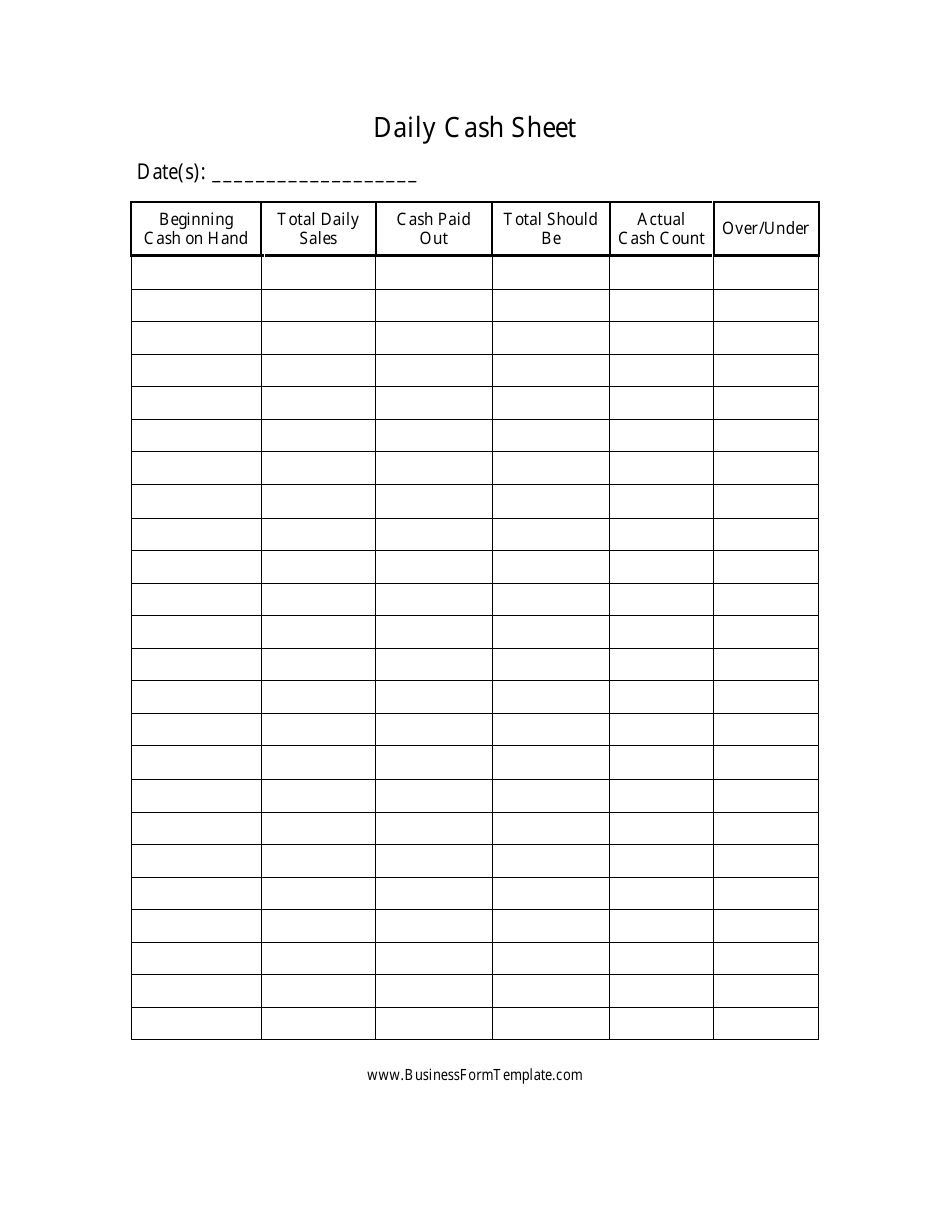

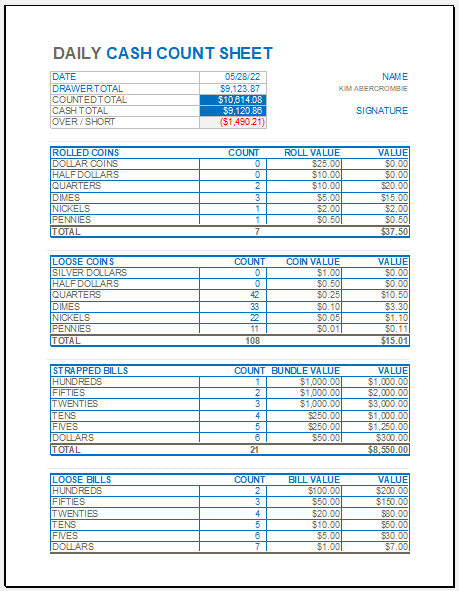

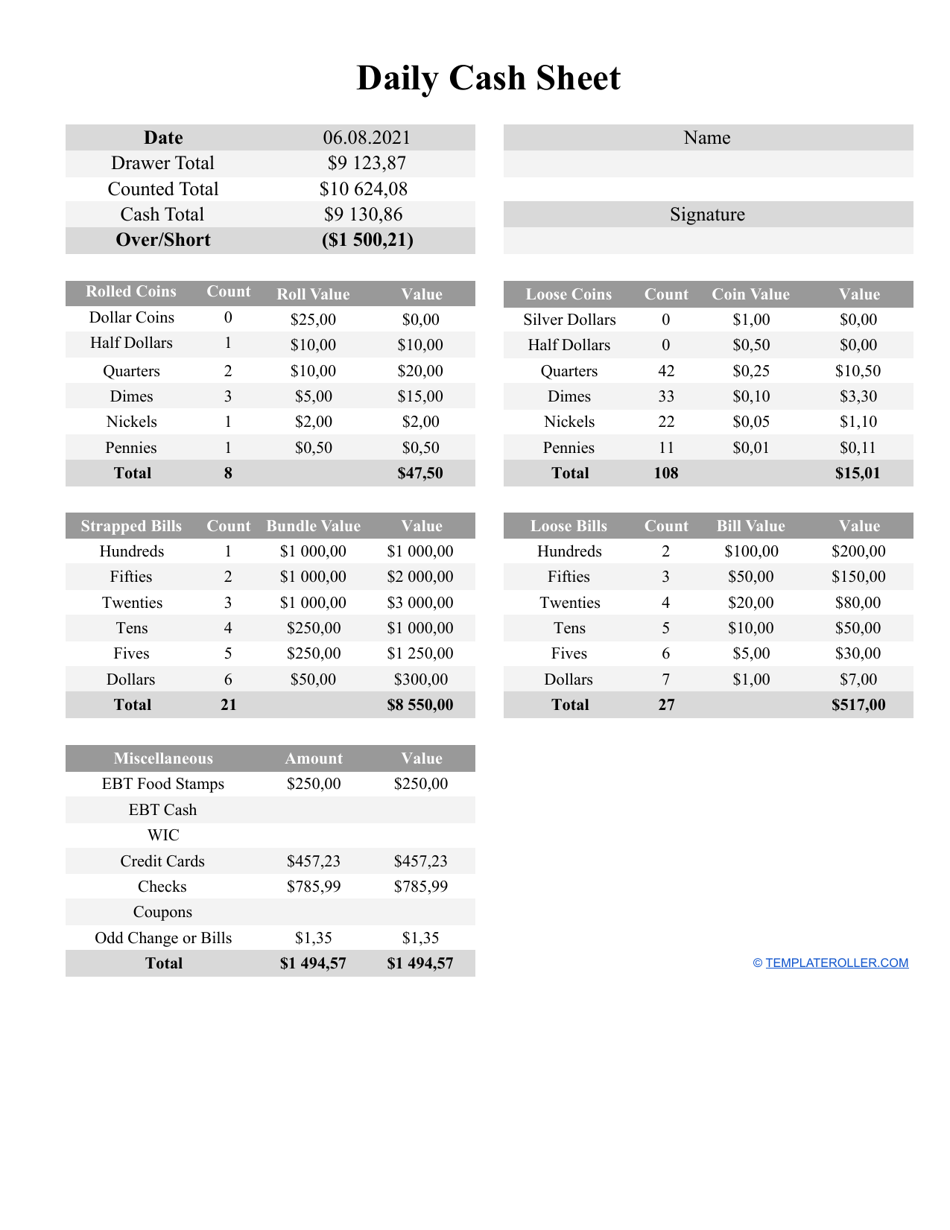

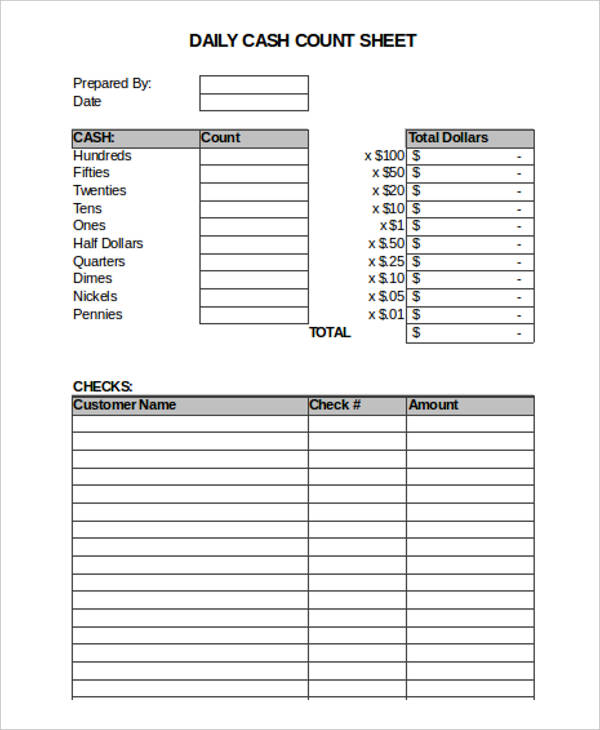

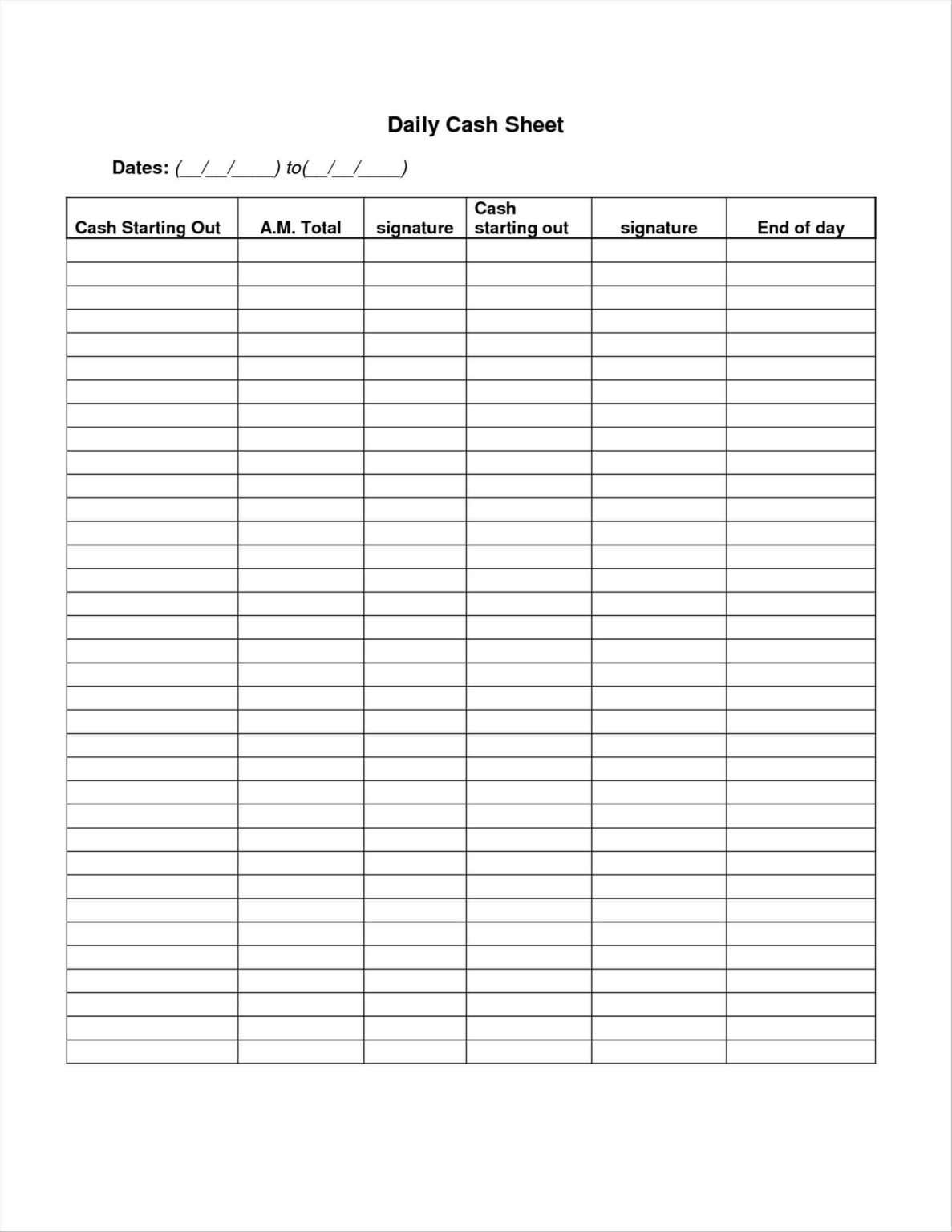

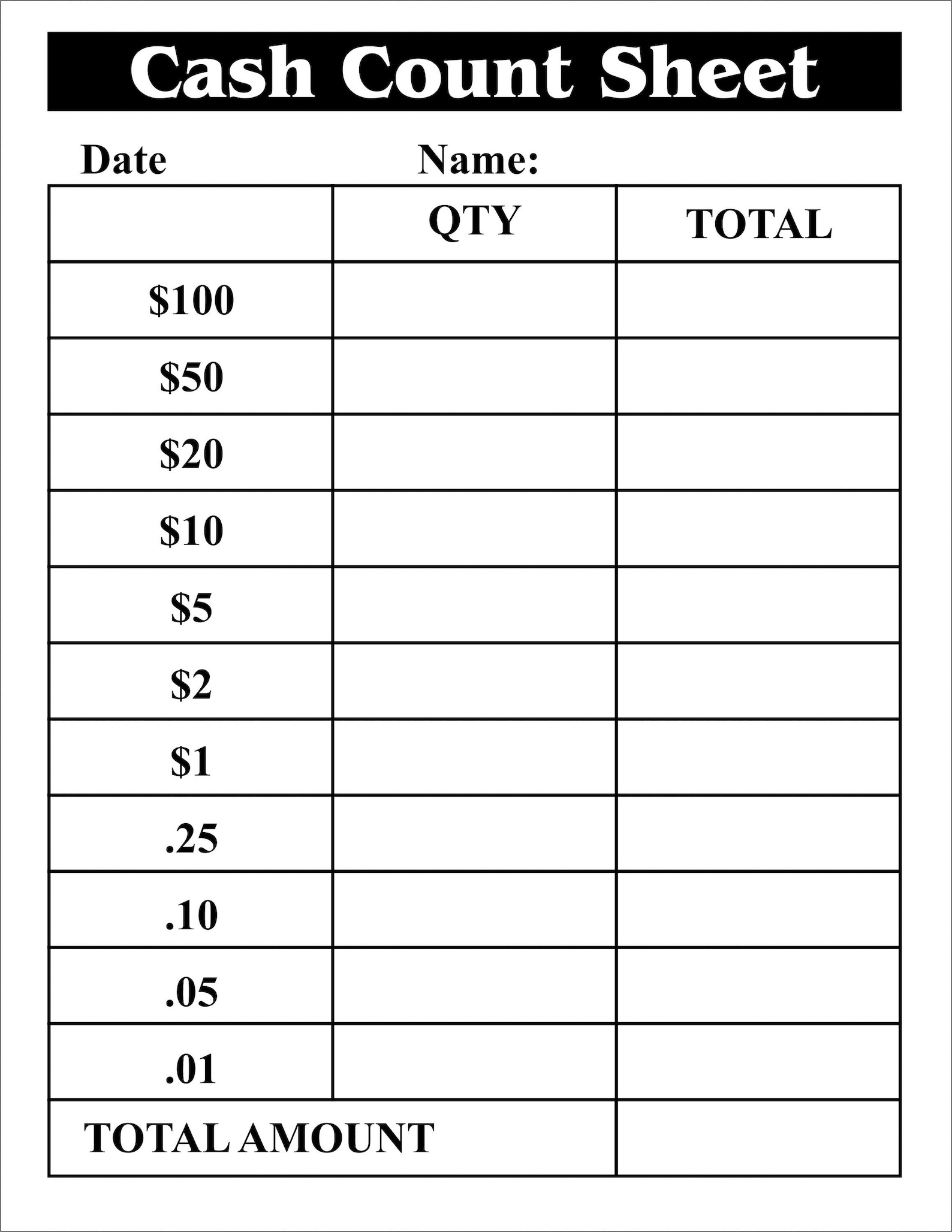

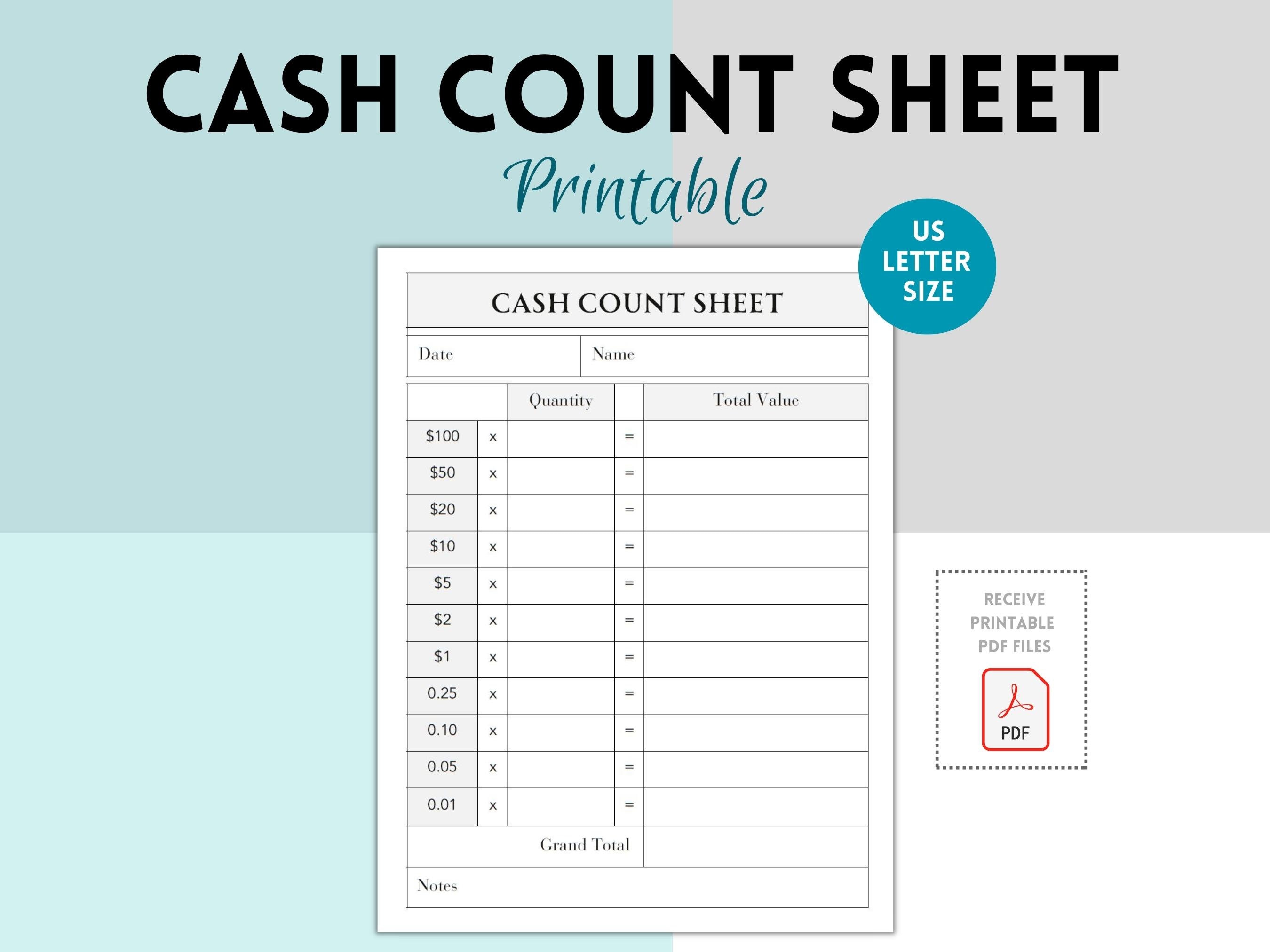

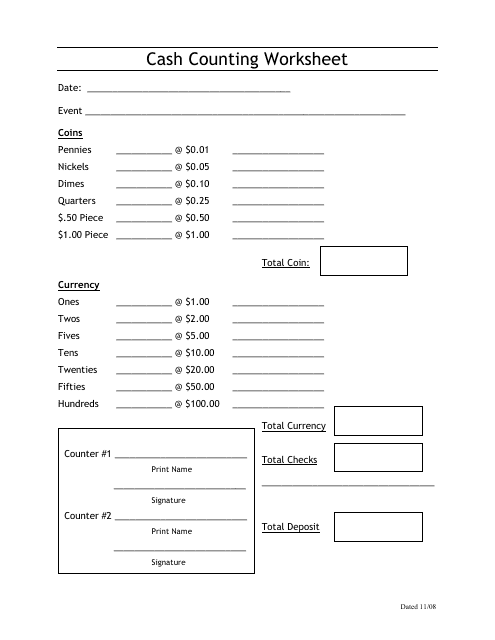

Components of a Daily Cash Count Sheet Template

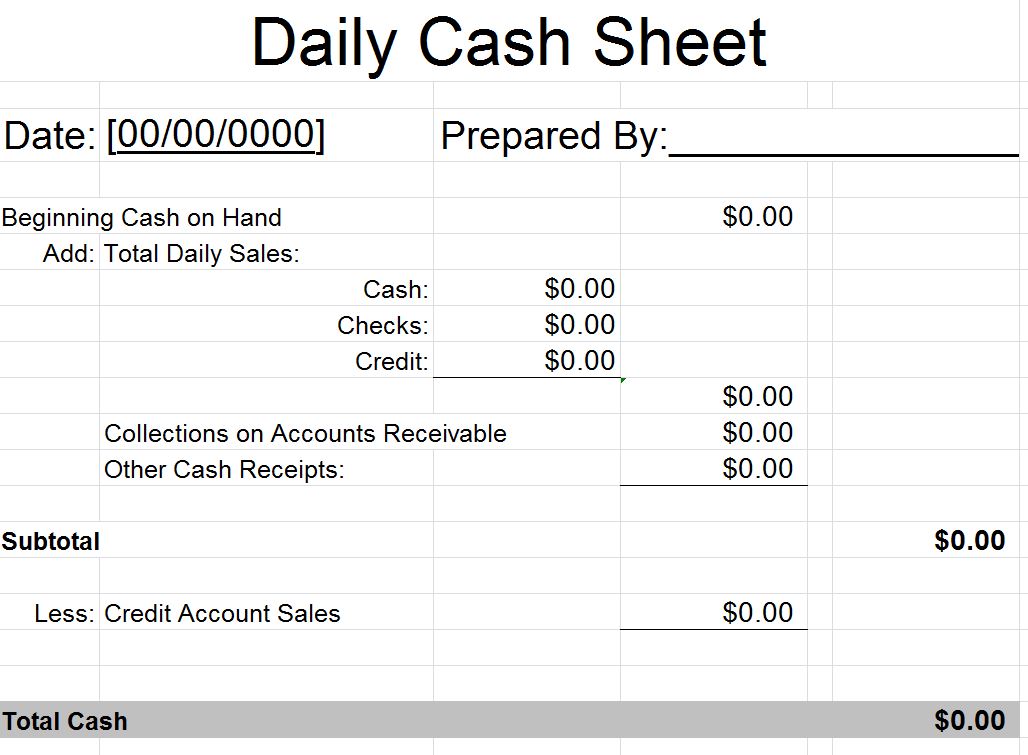

A daily cash count sheet template typically includes the following components:

- Date and Time

- Cash Receipts:

- Cash sales

- Credit card sales

- Cheques and bank transfers

- Other receipts

- Cash Payments:

- Cash purchases

- Credit card payments

- Cheques and bank transfers

- Other payments

- Petty Cash Transactions:

- Petty cash fund balance

- Petty cash receipts

- Petty cash payments

- Cash Balance:

- Beginning cash balance

- Ending cash balance

- Discrepancies:

- Overages or shortages

- Reason for discrepancies

How to Use a Daily Cash Count Sheet Template

Using a daily cash count sheet template is a straightforward process that involves the following steps:

- Set up the template: Create a template with the above components or download a pre-designed template.

- Record cash receipts: Enter all cash receipts, including cash sales, credit card sales, and other receipts.

- Record cash payments: Enter all cash payments, including cash purchases, credit card payments, and other payments.

- Record petty cash transactions: Enter all petty cash transactions, including petty cash receipts and payments.

- Calculate cash balance: Calculate the beginning and ending cash balance by adding or subtracting cash receipts and payments.

- Identify discrepancies: Check for overages or shortages and investigate the reason for discrepancies.

Benefits of Using a Daily Cash Count Sheet Template

Using a daily cash count sheet template offers several benefits, including:

- Improved accuracy: A template helps to ensure accurate recording of cash transactions, reducing errors and discrepancies.

- Increased efficiency: A template streamlines the cash counting process, saving time and effort.

- Enhanced financial management: A template provides a clear picture of cash inflows and outflows, enabling informed decisions about cash management.

- Better compliance: A template helps to ensure compliance with financial regulations, reducing the risk of non-compliance.

Tips for Effective Daily Cash Count

To ensure effective daily cash count, follow these tips:

- Use a standardized template: Use a standardized template to ensure consistency and accuracy.

- Train staff: Train staff on the use of the template and the importance of accurate cash counting.

- Conduct regular audits: Conduct regular audits to ensure accuracy and detect any discrepancies.

- Use technology: Consider using technology, such as cash management software, to streamline the cash counting process.

Common Challenges in Daily Cash Count

Despite the importance of daily cash count, many businesses face challenges, including:

- Human error: Human error is a common challenge in daily cash count, resulting in discrepancies and inaccuracies.

- Lack of training: Lack of training on cash handling procedures can lead to errors and discrepancies.

- Insufficient resources: Insufficient resources, including time and personnel, can hinder the cash counting process.

Best Practices for Daily Cash Count

To overcome challenges and ensure effective daily cash count, follow these best practices:

- Implement a standardized template: Implement a standardized template to ensure consistency and accuracy.

- Provide regular training: Provide regular training on cash handling procedures and the use of the template.

- Conduct regular audits: Conduct regular audits to ensure accuracy and detect any discrepancies.

- Use technology: Consider using technology, such as cash management software, to streamline the cash counting process.

Gallery of Cash Counting Templates

Frequently Asked Questions

What is the purpose of a daily cash count sheet template?

+The purpose of a daily cash count sheet template is to help businesses track and record all cash transactions, including receipts, payments, and petty cash transactions.

What are the benefits of using a daily cash count sheet template?

+The benefits of using a daily cash count sheet template include improved accuracy, increased efficiency, enhanced financial management, and better compliance with financial regulations.

How can I ensure accurate daily cash count?

+To ensure accurate daily cash count, use a standardized template, train staff on cash handling procedures, conduct regular audits, and consider using technology, such as cash management software.

By using a daily cash count sheet template, businesses can ensure accurate tracking of cash transactions, prevent cash shortages, and make informed decisions about cash management. Remember to implement a standardized template, provide regular training, conduct regular audits, and consider using technology to streamline the cash counting process.