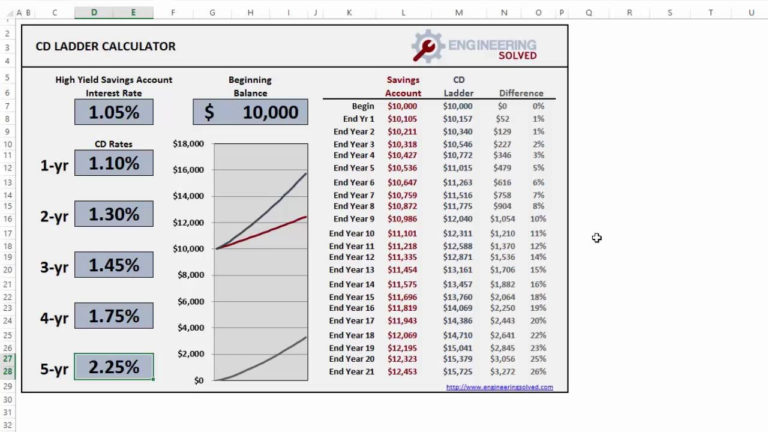

Building a CD ladder can be a smart investment strategy for those looking to manage their cash flow and maximize their returns. A CD ladder is a type of investment portfolio that involves investing in multiple certificates of deposit (CDs) with different maturity dates. This approach allows you to take advantage of higher interest rates for longer-term CDs while still maintaining access to your money. In this article, we'll explore five ways to build a CD ladder using Excel.

CD ladders are particularly useful for those who want to avoid market volatility and ensure a steady stream of income. By staggering the maturity dates of your CDs, you can create a predictable income stream and reduce the risk of losing principal. In this article, we'll show you how to use Excel to create a CD ladder that meets your investment goals.

What is a CD Ladder?

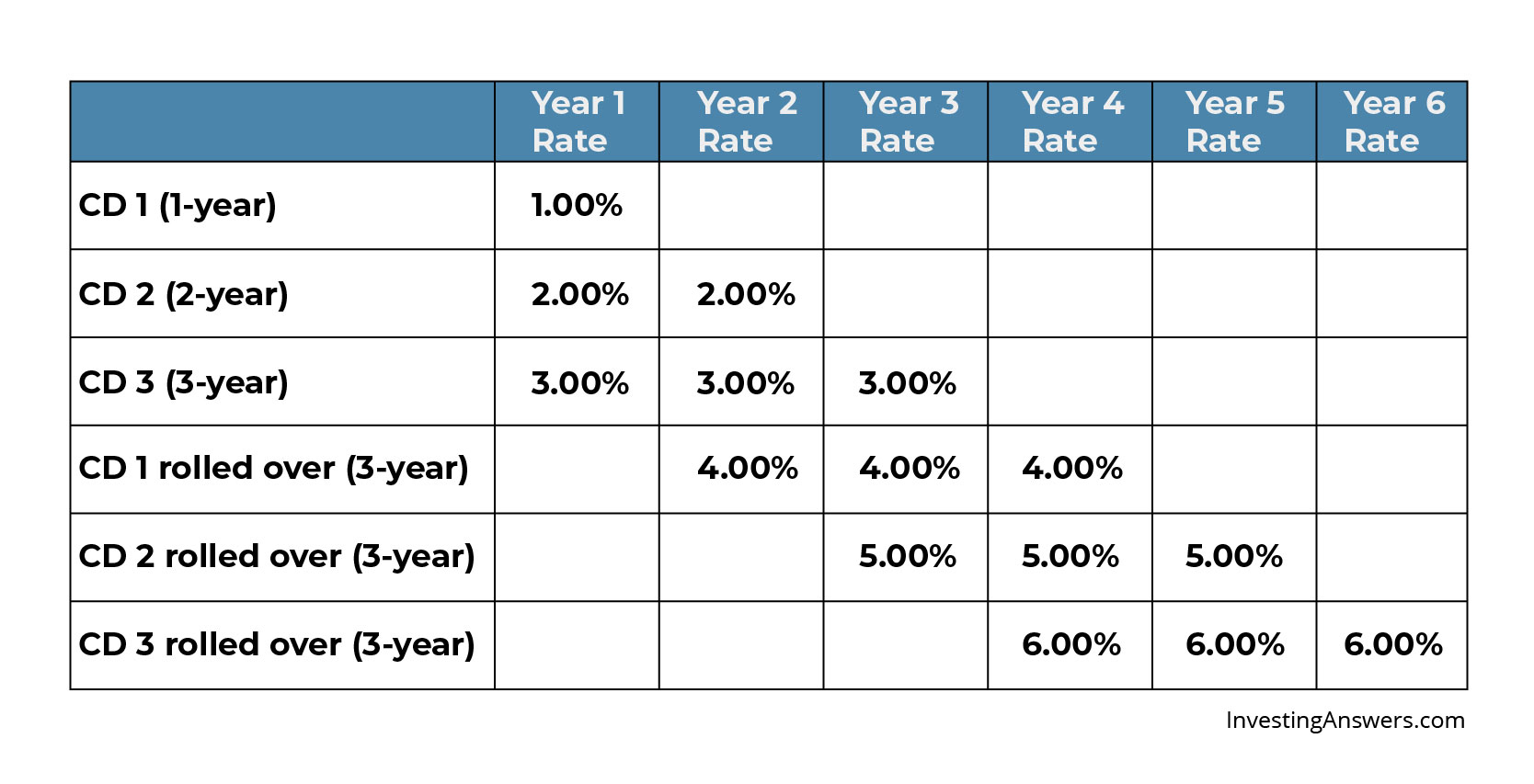

A CD ladder is a type of investment portfolio that involves investing in multiple CDs with different maturity dates. The idea is to create a staggered portfolio of CDs with varying maturity dates, typically ranging from a few months to several years. By doing so, you can take advantage of higher interest rates for longer-term CDs while still maintaining access to your money.

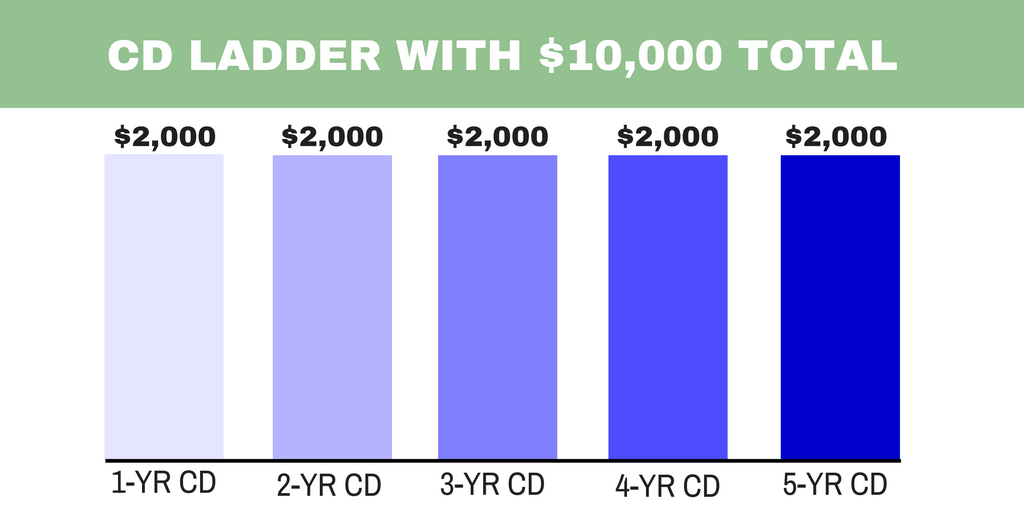

For example, let's say you have $10,000 to invest and you want to create a CD ladder with five rungs. You could invest $2,000 in a 6-month CD, $2,000 in a 1-year CD, $2,000 in an 18-month CD, $2,000 in a 2-year CD, and $2,000 in a 3-year CD. This would create a staggered portfolio of CDs with varying maturity dates, allowing you to take advantage of higher interest rates for longer-term CDs while still maintaining access to your money.

Why Use Excel to Build a CD Ladder?

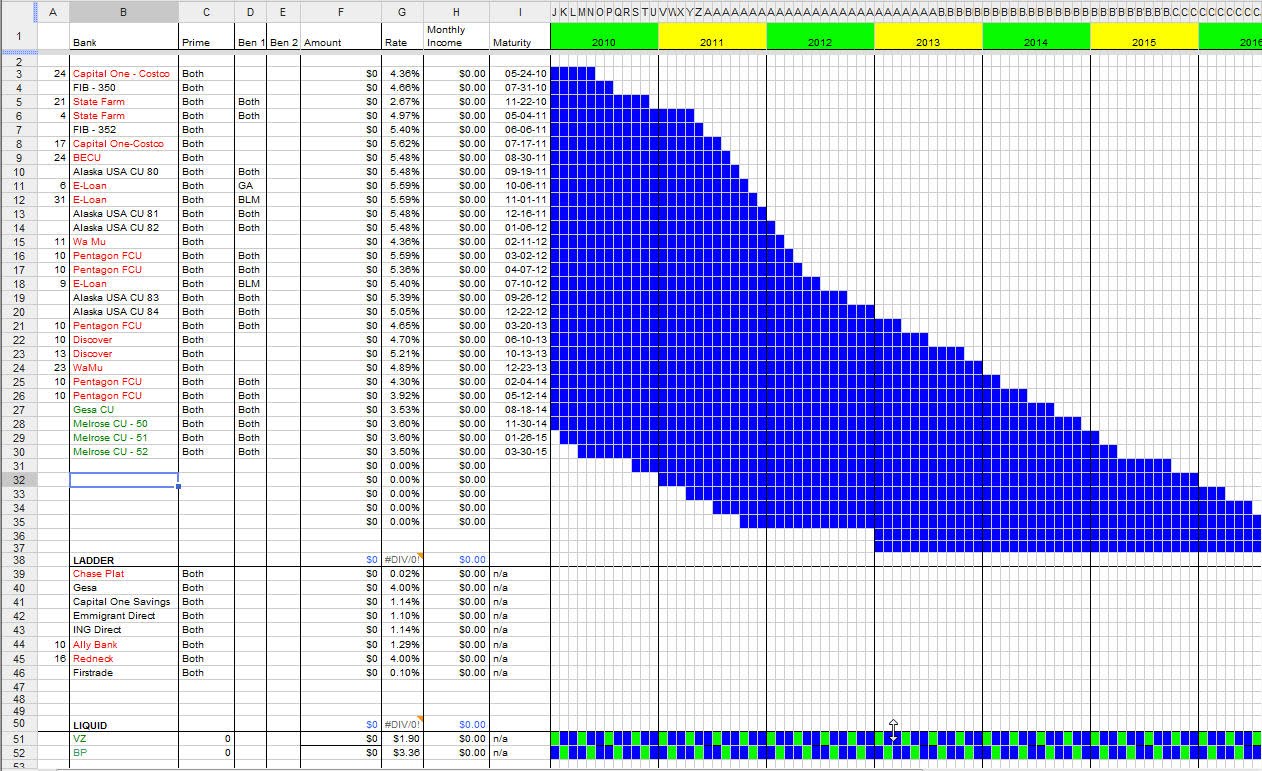

Excel is a powerful tool that can help you build and manage a CD ladder. With Excel, you can easily track your investments, calculate your returns, and make adjustments to your portfolio as needed. Here are five ways to build a CD ladder using Excel:

1. Create a CD Ladder Template

To build a CD ladder using Excel, you'll need to create a template that outlines your investment goals and strategy. This template should include the following columns:

- Investment amount

- CD term (e.g. 6 months, 1 year, 2 years, etc.)

- Interest rate

- Maturity date

- Return on investment (ROI)

You can use the following formula to calculate the ROI:

ROI = (Interest Rate x Investment Amount) / 100

For example, if you invest $2,000 in a 1-year CD with an interest rate of 2.0%, the ROI would be:

ROI = (2.0 x $2,000) / 100 = $40

2. Determine Your Investment Amount

Before you start building your CD ladder, you'll need to determine how much you want to invest. This will depend on your investment goals and risk tolerance. As a general rule, it's a good idea to invest a portion of your portfolio in CDs to reduce risk and increase returns.

For example, let's say you have $10,000 to invest and you want to allocate 50% of your portfolio to CDs. You could invest $5,000 in CDs and $5,000 in other investments, such as stocks or bonds.

3. Choose Your CD Terms

Once you've determined your investment amount, you'll need to choose the terms of your CDs. This will depend on your investment goals and risk tolerance. As a general rule, it's a good idea to choose CDs with varying maturity dates to create a staggered portfolio.

For example, let's say you want to create a CD ladder with five rungs. You could choose the following CD terms:

- 6 months

- 1 year

- 18 months

- 2 years

- 3 years

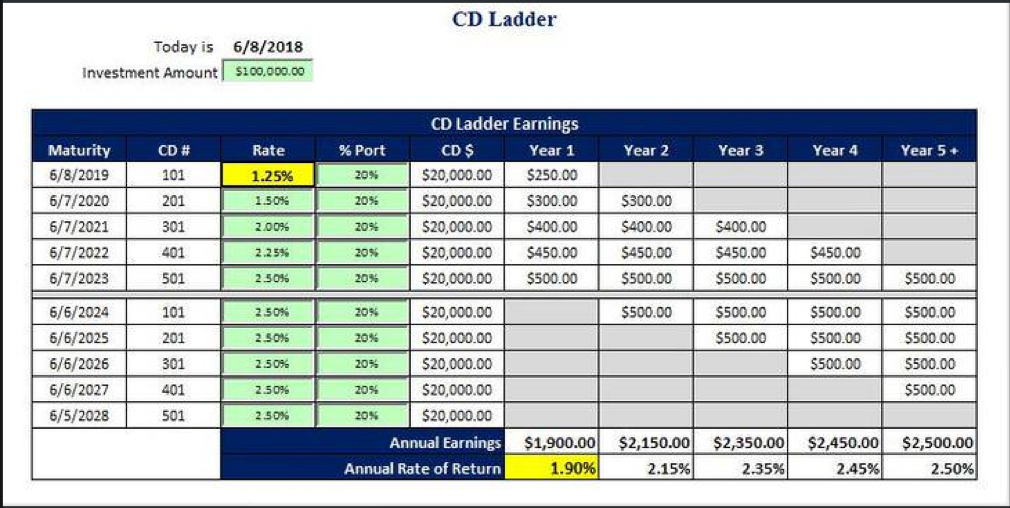

4. Calculate Your Returns

Once you've chosen your CD terms, you can calculate your returns using the ROI formula. This will give you an idea of how much you can expect to earn from your investments.

For example, let's say you invest $2,000 in a 1-year CD with an interest rate of 2.0%. The ROI would be:

ROI = (2.0 x $2,000) / 100 = $40

5. Monitor and Adjust Your Portfolio

Finally, you'll need to monitor and adjust your portfolio regularly to ensure that it remains aligned with your investment goals. This may involve reinvesting your returns, adjusting your CD terms, or reallocating your portfolio.

For example, let's say you've invested $2,000 in a 1-year CD with an interest rate of 2.0%. After one year, the CD matures and you receive $2,040 ($2,000 principal + $40 interest). You could reinvest the $2,040 in a new CD with a higher interest rate or adjust your portfolio to reflect changes in your investment goals.

Gallery of CD Ladder Investment Strategies

Frequently Asked Questions

What is a CD ladder?

+A CD ladder is a type of investment portfolio that involves investing in multiple CDs with different maturity dates.

How do I build a CD ladder using Excel?

+To build a CD ladder using Excel, you'll need to create a template that outlines your investment goals and strategy. This template should include columns for investment amount, CD term, interest rate, maturity date, and return on investment.

What are the benefits of a CD ladder?

+The benefits of a CD ladder include reduced risk, increased returns, and a predictable income stream.

We hope this article has provided you with a comprehensive guide to building a CD ladder using Excel. By following these steps, you can create a customized investment portfolio that meets your financial goals and reduces your risk. Remember to regularly monitor and adjust your portfolio to ensure that it remains aligned with your investment objectives.