Understanding basis points is crucial in the world of finance, as it helps individuals and businesses accurately calculate and compare interest rates, investment returns, and other financial metrics. Basis points (BPS) represent one-hundredth of a percentage point, making it a precise unit of measurement for small changes in percentage values. In this article, we will explore how to calculate basis points in Excel with ease and accuracy, simplifying financial calculations for users of all levels.

What are Basis Points?

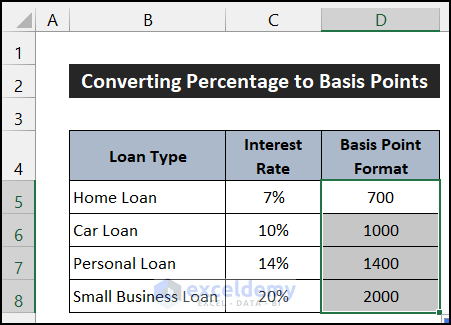

Basis points are used to express the difference between two interest rates or percentages. Since percentages can be cumbersome to work with when dealing with small changes, basis points provide a more precise way to measure and communicate these changes. One basis point equals 0.01% or 0.0001 in decimal form.

Why are Basis Points Important in Finance?

Basis points play a critical role in finance for several reasons:

- Accuracy: They allow for precise measurements of interest rates and returns, which is essential for accurate financial calculations and comparisons.

- Comparability: Basis points enable the comparison of different financial instruments and investment opportunities on a level playing field.

- Risk Management: Understanding the basis points associated with different investments or financial decisions helps in managing risk more effectively.

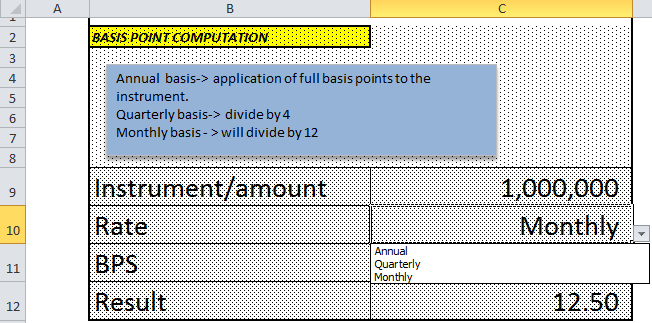

How to Calculate Basis Points in Excel

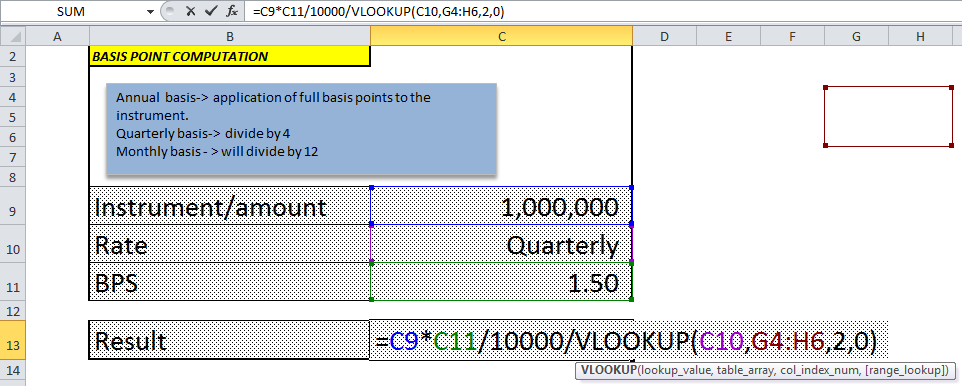

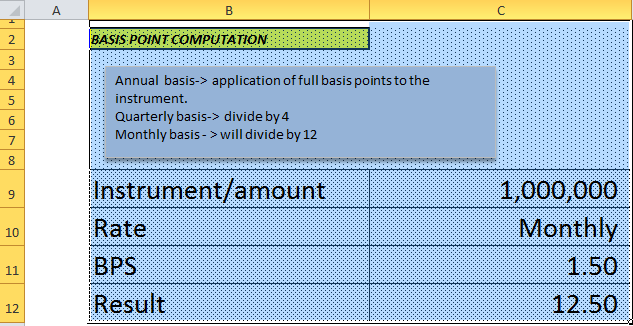

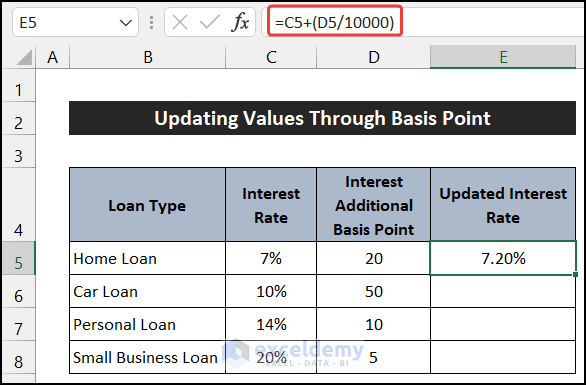

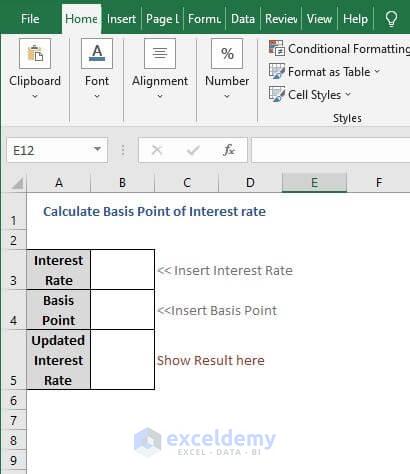

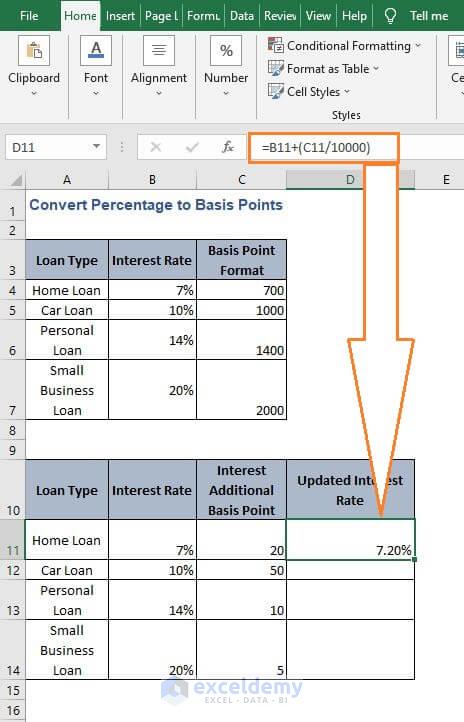

Calculating basis points in Excel is straightforward and can be done in a few steps:

-

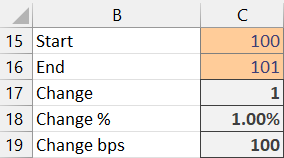

Understanding the Formula: The formula to calculate basis points in Excel involves converting percentages to decimals and then to basis points. If you have two percentages, you subtract one from the other, convert the result to a decimal, and then multiply by 100 to get the basis points.

-

Applying the Formula: Let's say you want to find the difference in basis points between two interest rates, 4.25% and 4.50%. First, you convert these percentages to decimals by dividing by 100: 4.25% becomes 0.0425 and 4.50% becomes 0.0450. Then, you subtract the smaller rate from the larger one: 0.0450 - 0.0425 = 0.0025. Finally, you multiply by 100 to convert the decimal to basis points: 0.0025 * 100 = 2.5 basis points.

-

Using Excel Functions: Excel can automate this process using formulas. For the example above, assuming the percentages are in cells A1 and B1, the formula would look like this:

=(B1-A1)*100. This formula calculates the difference between the two percentages and converts it directly to basis points. -

Handling Negative Results: If the result is negative, it means the first percentage is higher than the second. This could indicate a decrease in interest rates or investment returns. Understanding the direction of the change is crucial for making informed financial decisions.

Best Practices for Working with Basis Points in Excel

- Consistency: Ensure consistency in formatting and calculating basis points across your Excel workbook. This helps in avoiding errors and ensures that all calculations are comparable.

- Documentation: Clearly document your formulas and assumptions. This is especially important for complex financial models or when working in a team environment.

- Validation: Always validate your results by performing manual checks. This can help catch any errors in your formulas or data entry.

Common Mistakes When Calculating Basis Points in Excel

- Incorrect Conversion: Failing to convert percentages to decimals correctly can lead to significant errors in basis point calculations.

- Inconsistent Formatting: Inconsistent formatting of percentages or decimals can cause formulas to produce incorrect results.

- Not Considering the Direction of Change: Neglecting to interpret the direction of the change (positive or negative) can lead to incorrect conclusions about interest rate or return changes.

Advanced Applications of Basis Points in Finance

Basis points are not limited to simple interest rate comparisons. They are widely used in various financial calculations and analyses:

- Yield Spread Analysis: Understanding the yield spread between different securities helps investors and analysts evaluate the relative attractiveness of investments.

- Risk Premium Analysis: Calculating the risk premium in basis points provides insight into the additional return investors demand for taking on extra risk.

- Derivatives Pricing: Basis points are crucial in derivatives pricing, especially in options and futures contracts, where small changes in underlying asset prices can significantly impact the derivative's value.

Conclusion

Calculating basis points in Excel is a fundamental skill for anyone working in finance or managing financial data. By understanding how to accurately calculate basis points and avoiding common mistakes, users can make more informed financial decisions and improve their analytical capabilities. Basis points are a powerful tool for evaluating interest rates, investment returns, and other financial metrics, making them an indispensable part of any financial analyst's toolkit.

What is the difference between basis points and percentage points?

+Basis points and percentage points are both units of measurement, but they differ in their precision. A percentage point is a full percentage (e.g., 1%), while a basis point is one-hundredth of a percentage point (e.g., 0.01%).

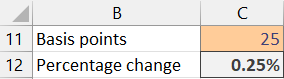

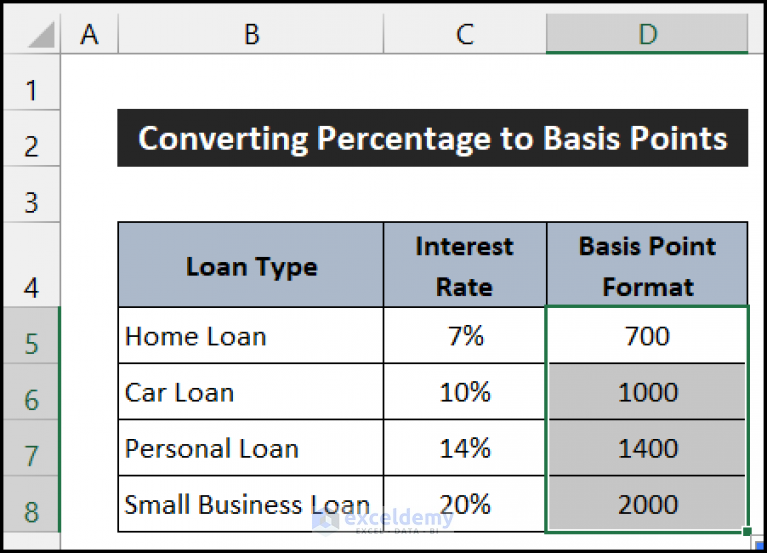

How do I convert percentage to basis points in Excel?

+To convert a percentage to basis points in Excel, you first convert the percentage to a decimal by dividing by 100, and then multiply the result by 100 to get the basis points.

Why are basis points important in financial calculations?

+Basis points are important because they provide a precise way to express small changes in interest rates, investment returns, and other financial metrics, which is crucial for accurate financial analysis and decision-making.