Calculating the Annual Percentage Rate (APR) is a crucial step in understanding the true cost of borrowing money. Whether you're dealing with credit cards, loans, or mortgages, knowing how to calculate APR can help you make informed financial decisions. In this article, we'll explore five easy ways to calculate APR in Excel, making it simple for you to determine the APR of any financial product.

Understanding APR and Its Importance

Before we dive into the calculation methods, it's essential to understand what APR represents and why it's crucial in personal finance. APR is the rate of interest charged on a loan or credit product over a year, including fees and compound interest. It provides a clear picture of the total cost of borrowing, allowing you to compare different financial products and make informed decisions.

Why APR Matters

APR matters because it helps you:

- Compare interest rates and fees among different lenders

- Understand the total cost of borrowing, including fees and compound interest

- Make informed decisions about credit cards, loans, and mortgages

- Avoid hidden costs and surprises

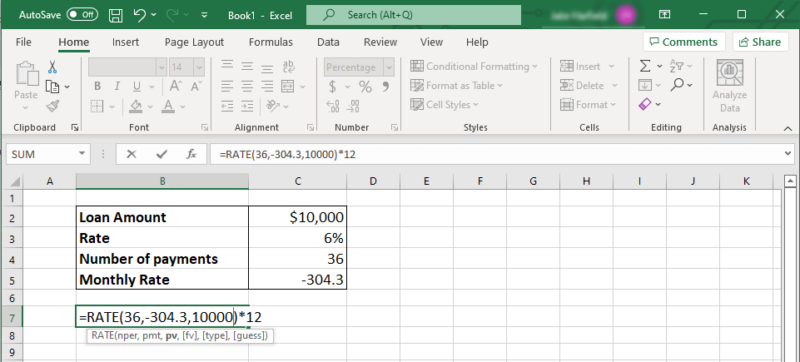

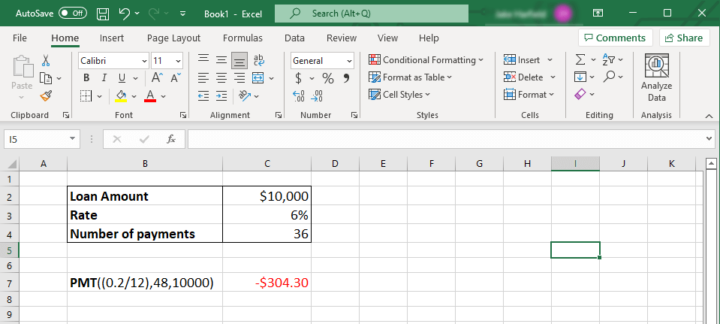

Method 1: Using the APR Formula in Excel

The APR formula in Excel is:

= (1 + (Interest Rate/N))^(N*T) - 1

Where:

- Interest Rate is the monthly interest rate

- N is the number of times interest is compounded per year

- T is the number of years

For example, if the monthly interest rate is 1.5% and interest is compounded monthly for 1 year, the APR would be:

= (1 + (0.015/12))^(12*1) - 1 ≈ 19.56%

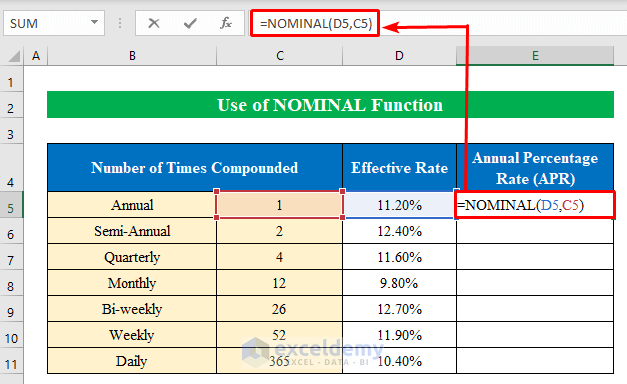

Method 2: Using the EFFECT Function in Excel

The EFFECT function in Excel calculates the effective annual interest rate, which is equivalent to APR. The syntax is:

=EFFECT(rate, npery)

Where:

- rate is the monthly interest rate

- npery is the number of times interest is compounded per year

Using the same example as before:

=EFFECT(0.015, 12) ≈ 19.56%

Method 3: Using the POWER Function in Excel

The POWER function in Excel can be used to calculate APR by raising the monthly interest rate plus 1 to the power of the number of compounding periods per year, then subtracting 1.

=POWER(1 + (Interest Rate/N), N*T) - 1

Using the same example as before:

=POWER(1 + (0.015/12), 12*1) - 1 ≈ 19.56%

Method 4: Using the XIRR Function in Excel

The XIRR function in Excel calculates the internal rate of return for a series of cash flows. It can be used to calculate APR by setting up a series of cash flows that represent the interest payments.

=XIRR(values, dates)

Where:

- values is the range of interest payments

- dates is the range of dates corresponding to the interest payments

Using the same example as before:

=XIRR(A1:A12, B1:B12) ≈ 19.56%

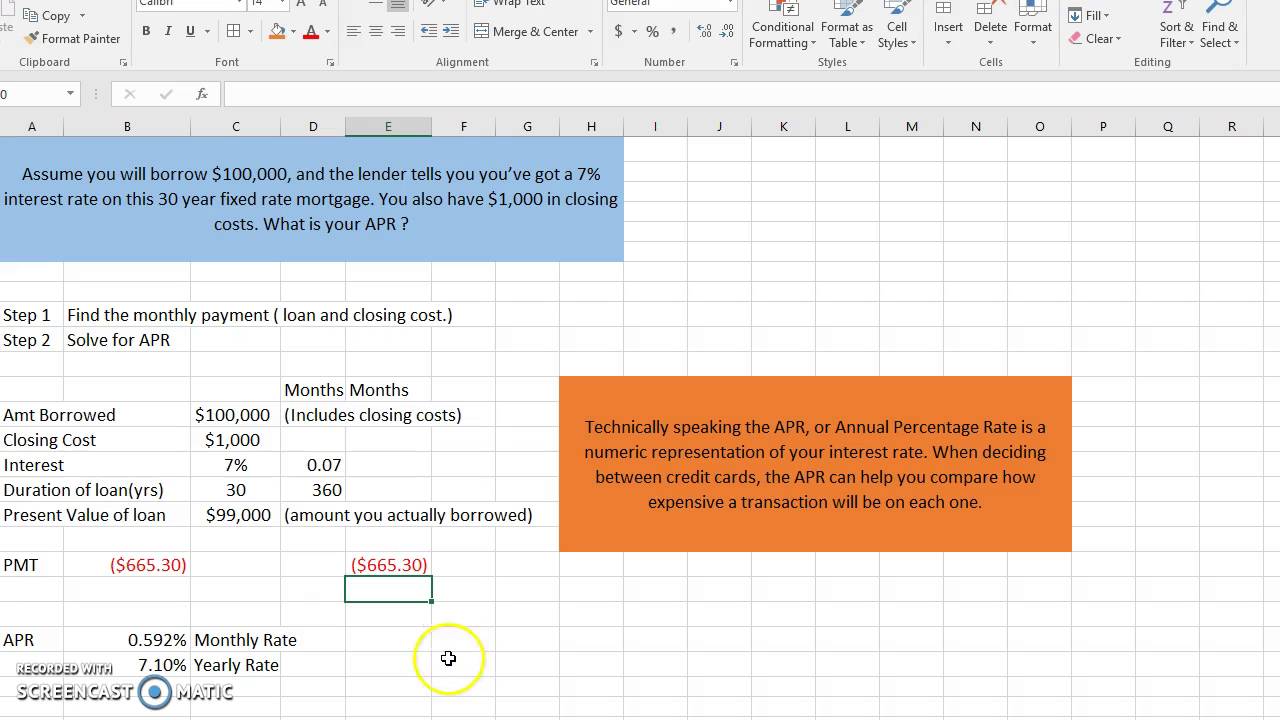

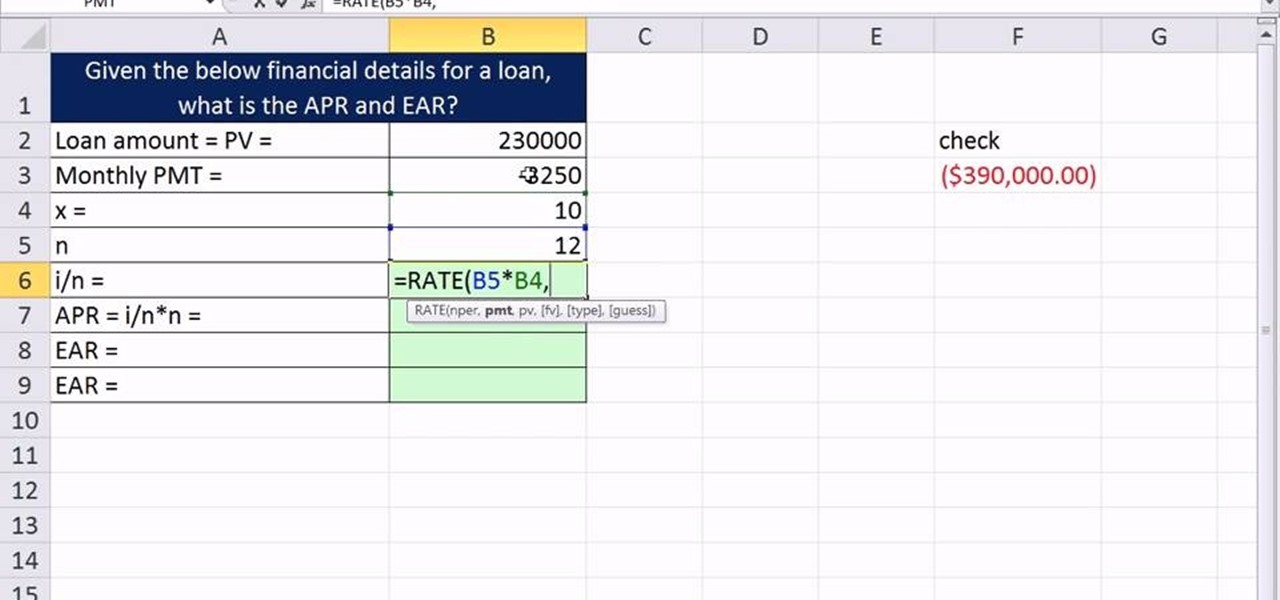

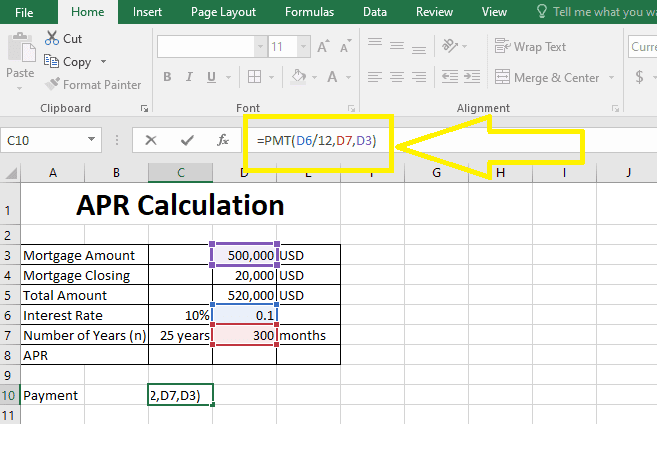

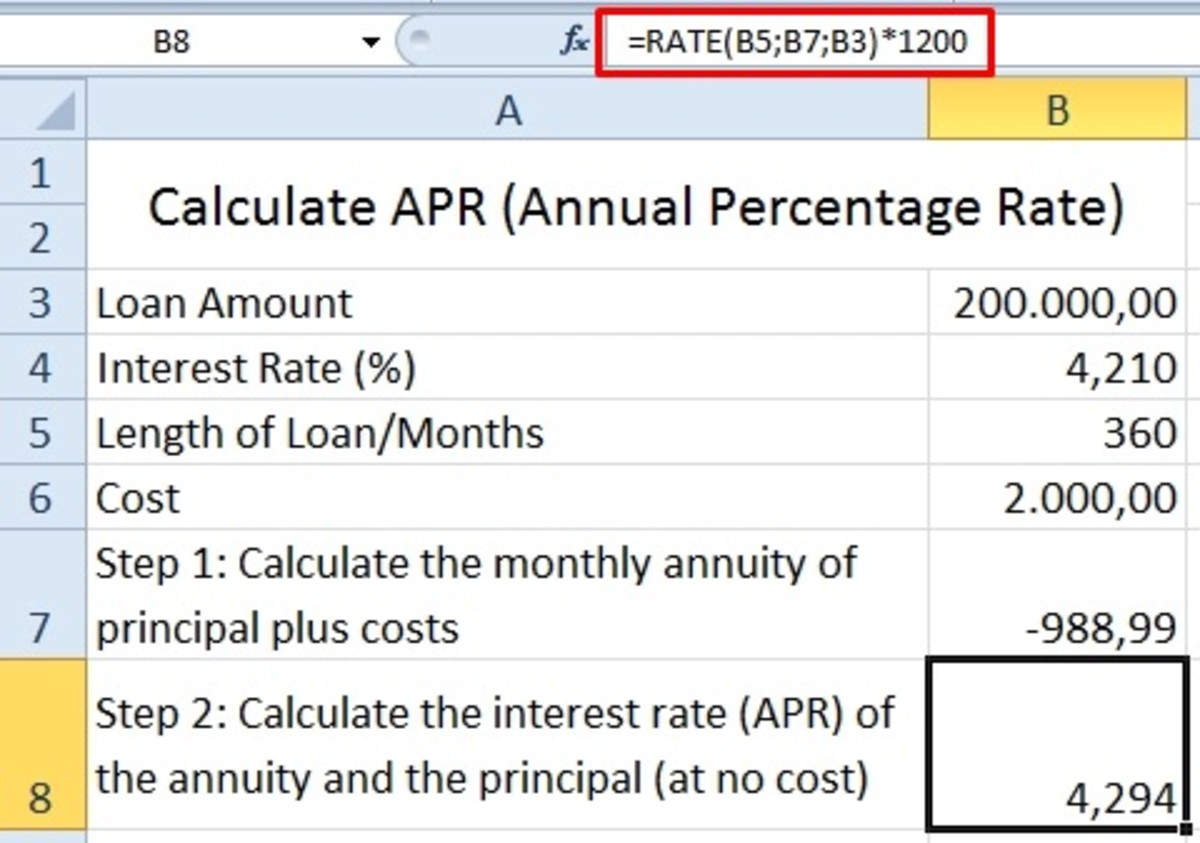

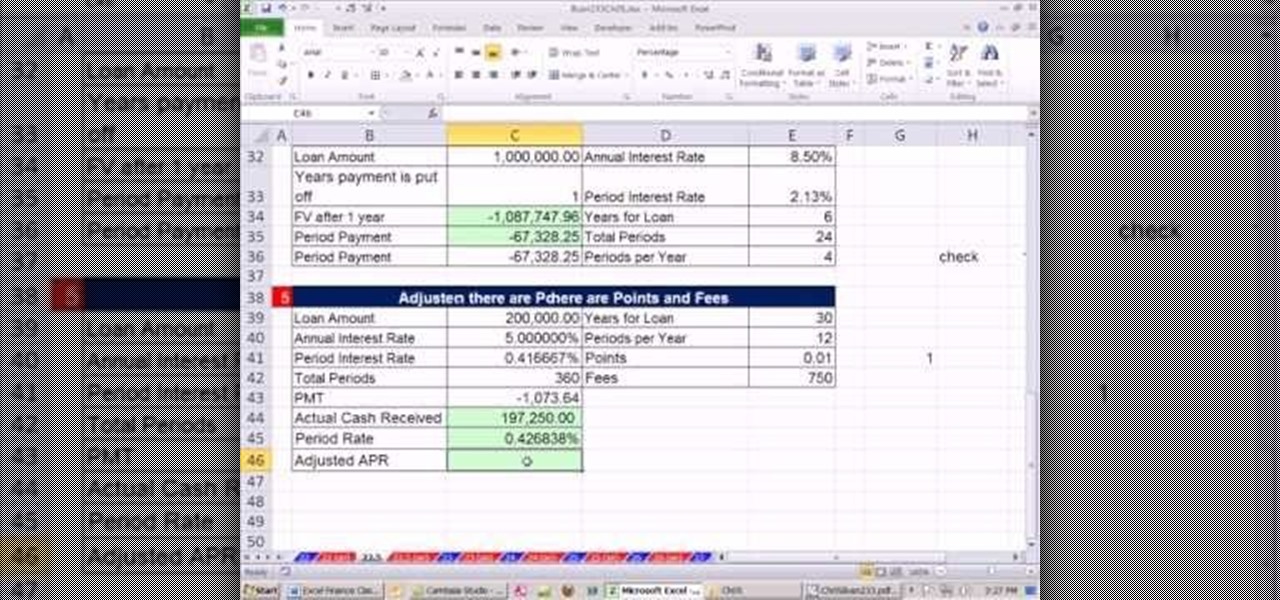

Method 5: Using an APR Calculator Template in Excel

You can also use an APR calculator template in Excel to calculate APR. These templates usually have pre-built formulas and formatting to make it easy to calculate APR.

Gallery of APR Calculators

We hope this article has helped you understand how to calculate APR in Excel using different methods. Whether you're a financial analyst or just starting to learn about personal finance, calculating APR is an essential skill to have. By following these methods, you'll be able to make informed decisions about credit cards, loans, and mortgages.

Frequently Asked Questions

What is APR?

+APR stands for Annual Percentage Rate, which is the rate of interest charged on a loan or credit product over a year, including fees and compound interest.

Why is APR important?

+APR is important because it helps you understand the total cost of borrowing, including fees and compound interest. It allows you to compare different financial products and make informed decisions.

How do I calculate APR in Excel?

+You can calculate APR in Excel using the APR formula, EFFECT function, POWER function, XIRR function, or an APR calculator template.