Calculating the Compound Annual Growth Rate (CAGR) is a crucial step in understanding the performance of an investment, business, or project over time. It provides a clear picture of the average annual growth rate, allowing for informed decisions and comparisons. While CAGR can be calculated manually, using Excel makes the process simpler and more efficient. In this article, we will explore how to calculate CAGR using Excel, breaking down the process into a step-by-step guide.

Understanding CAGR

Before diving into the Excel tutorial, it's essential to understand what CAGR represents. The Compound Annual Growth Rate is the rate of return that would have been required to achieve the same level of growth over a specific period, assuming constant annual growth. CAGR is a useful metric for evaluating the performance of investments, companies, or projects, as it smooths out the volatility of year-to-year growth rates.

Why Use CAGR?

Using CAGR offers several benefits:

- Simplifies growth rate analysis: CAGR provides a single, easy-to-understand number that represents the average annual growth rate.

- Facilitates comparisons: By using CAGR, you can compare the performance of different investments, companies, or projects.

- Accounts for compounding: CAGR takes into account the compounding effect of growth, providing a more accurate picture of the overall performance.

Calculating CAGR in Excel

Now that we've covered the basics of CAGR, let's move on to the step-by-step guide on how to calculate it using Excel.

Step 1: Set Up Your Data

To calculate CAGR in Excel, you'll need to set up your data in a table format. Here's a sample dataset:

| Year | Value |

|---|---|

| 2018 | 100 |

| 2019 | 120 |

| 2020 | 150 |

| 2021 | 180 |

| 2022 | 210 |

Create a table with two columns: "Year" and "Value". Enter the corresponding values for each year.

Step 2: Calculate the Growth Rate

To calculate the growth rate, you'll use the formula:

Growth Rate = (Current Value / Previous Value) - 1

In Excel, you can use the formula:

=(B2/B1)-1

Assuming your data starts in cell A1, and the current value is in cell B2, and the previous value is in cell B1.

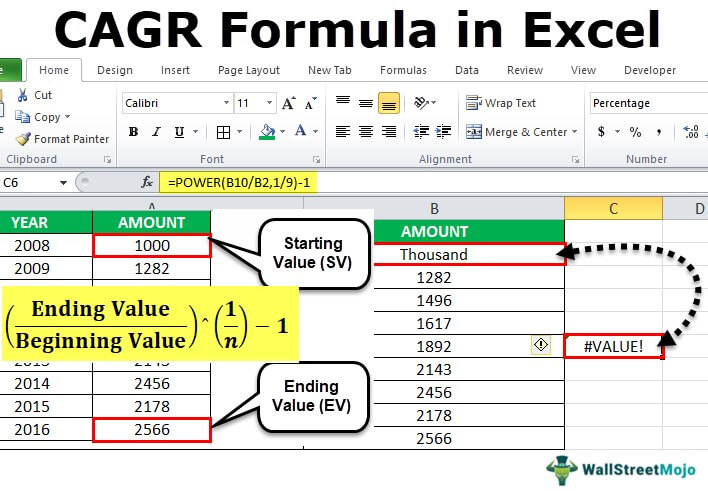

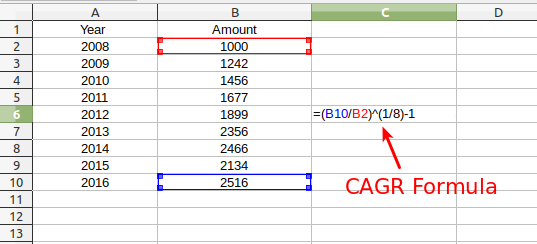

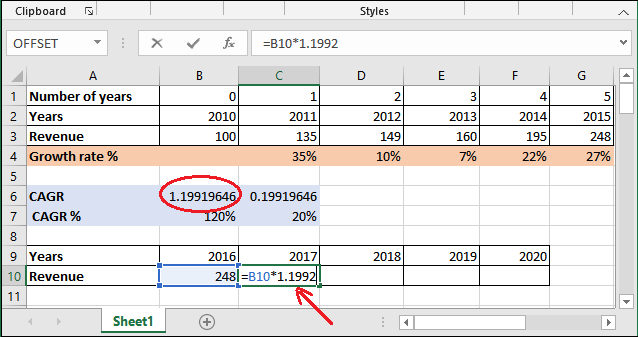

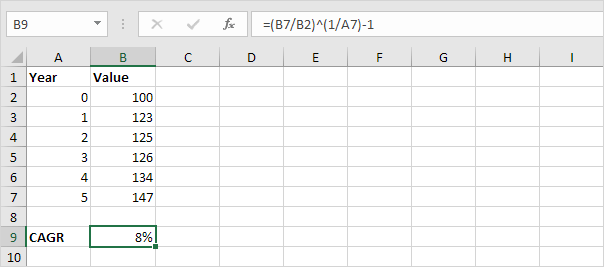

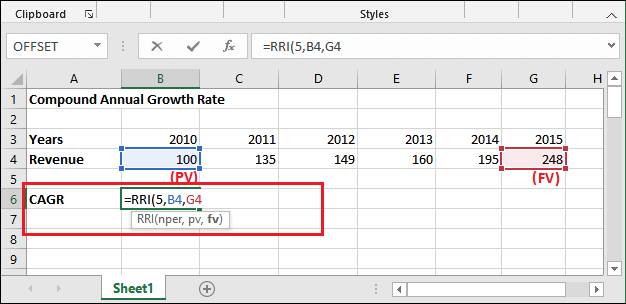

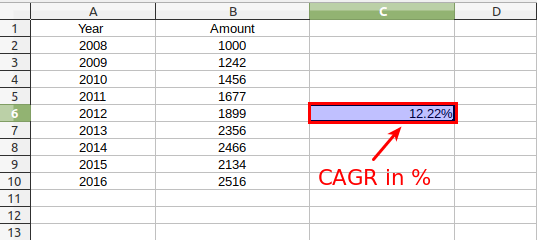

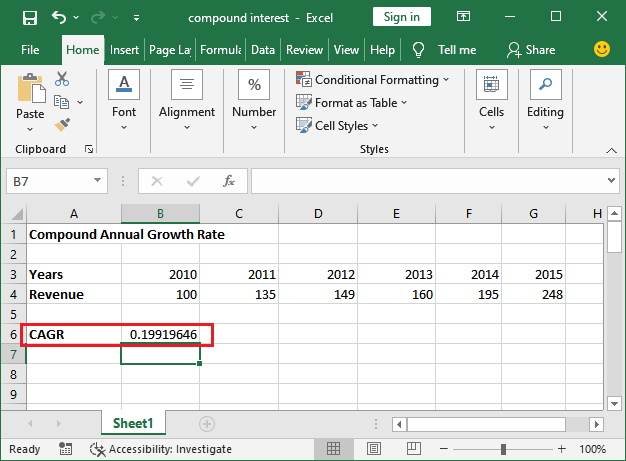

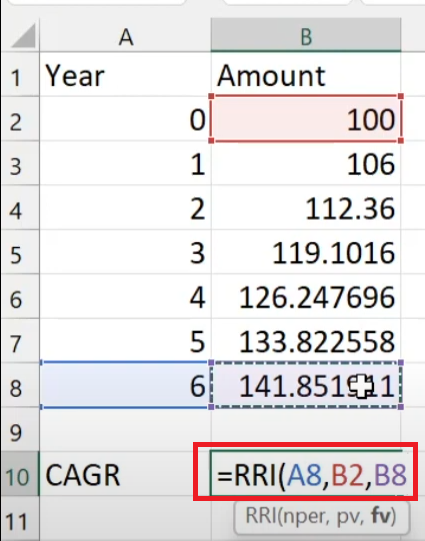

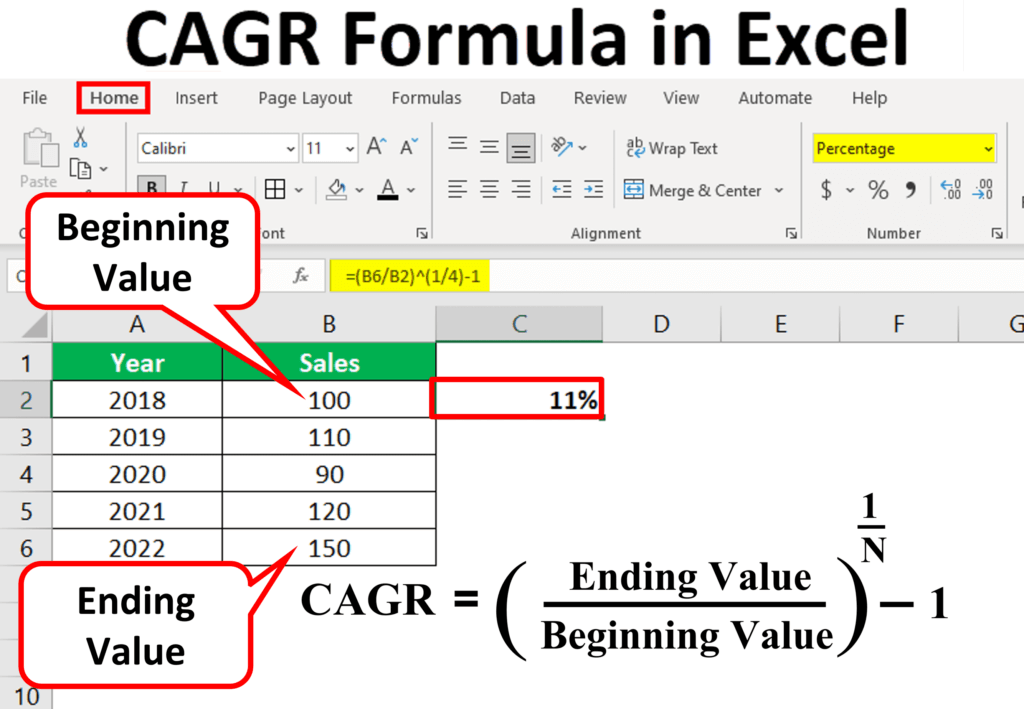

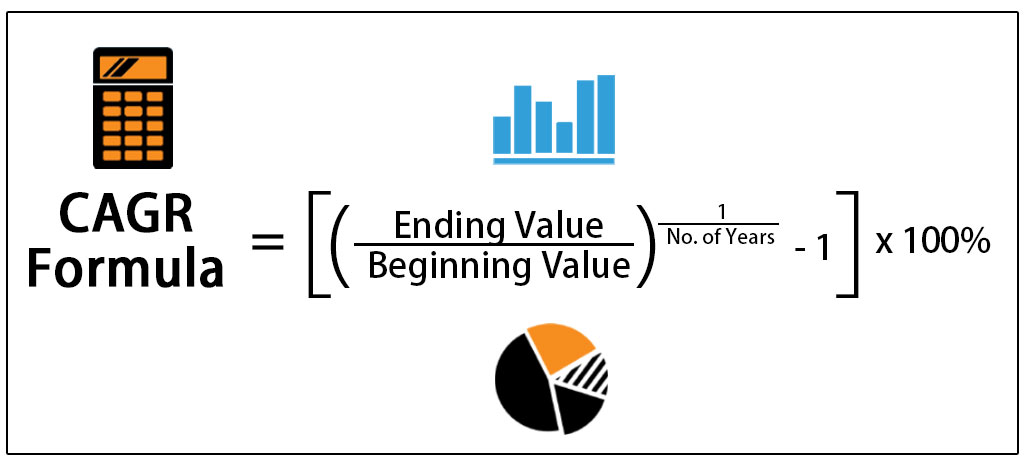

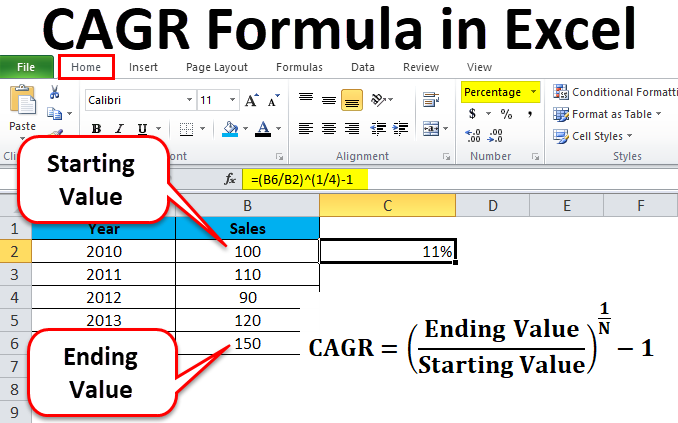

Step 3: Calculate the CAGR

To calculate the CAGR, you can use the formula:

CAGR = (End Value / Beginning Value)^(1/Number of Years) - 1

In Excel, you can use the formula:

=(B5/B1)^(1/4)-1

Assuming your data starts in cell A1, and the end value is in cell B5, and the beginning value is in cell B1. The number of years is 4 (2022-2018).

Step 4: Format the Result

To format the result as a percentage, select the cell containing the CAGR value and go to the "Number" section in the Home tab. Click on the "Percent" button to format the value as a percentage.

Example Use Cases

CAGR can be applied to various scenarios, such as:

- Evaluating investment performance: CAGR helps investors understand the average annual growth rate of their investments, making it easier to compare different investment options.

- Analyzing company growth: CAGR can be used to evaluate a company's growth rate over time, providing insights into its financial performance.

- Comparing project returns: CAGR can be used to compare the returns of different projects, helping to identify the most profitable ones.

Best Practices

When using CAGR, keep the following best practices in mind:

- Use a consistent time period: Ensure that the time period used to calculate CAGR is consistent across different investments, companies, or projects.

- Account for inflation: CAGR does not account for inflation. To get a more accurate picture, consider using a real CAGR, which takes into account inflation.

- Use CAGR in conjunction with other metrics: CAGR should be used in conjunction with other metrics, such as return on investment (ROI) and payback period, to get a comprehensive understanding of the investment or project.

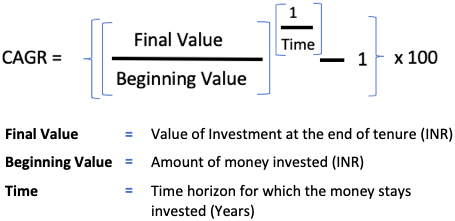

What is CAGR?

+CAGR stands for Compound Annual Growth Rate, which is a measure of the average annual growth rate of an investment, company, or project over a specific period.

How is CAGR calculated?

+CAGR is calculated using the formula: CAGR = (End Value / Beginning Value)^(1/Number of Years) - 1

What are the benefits of using CAGR?

+CAGR provides a clear picture of the average annual growth rate, facilitates comparisons, and accounts for compounding.

We hope this comprehensive guide has helped you understand how to calculate CAGR using Excel. Whether you're an investor, analyst, or business professional, CAGR is a valuable metric that can provide insights into growth rates and performance. By following the steps outlined in this article, you'll be able to calculate CAGR with ease and make more informed decisions.