Understanding the key formulas in AP Macroeconomics is crucial for success in the course and on the exam. These formulas will help you analyze and solve problems related to economic concepts, models, and policies. Here are 10 essential AP Macroeconomics formulas you need to know:

The significance of mastering these formulas lies in their application to real-world economic scenarios. By understanding how to use these formulas, you'll be able to evaluate the impact of economic decisions, policies, and events on the overall economy. This skill is essential for anyone interested in pursuing a career in economics, finance, or business.

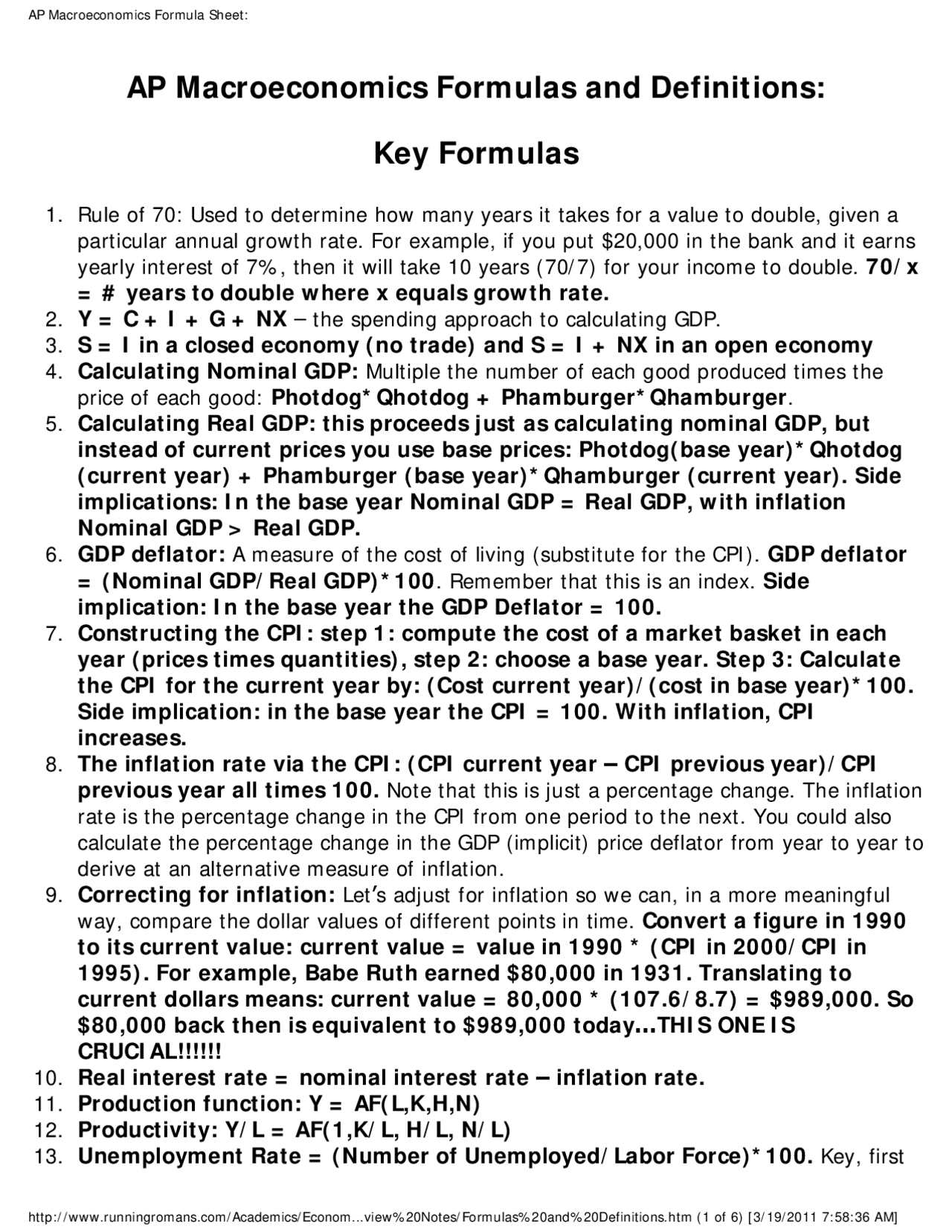

The 10 Essential AP Macroeconomics Formulas

1. The Circular Flow Model

The Circular Flow Model is a fundamental concept in AP Macroeconomics. It illustrates the flow of resources and goods between households, businesses, and the government. The formula for the Circular Flow Model is:

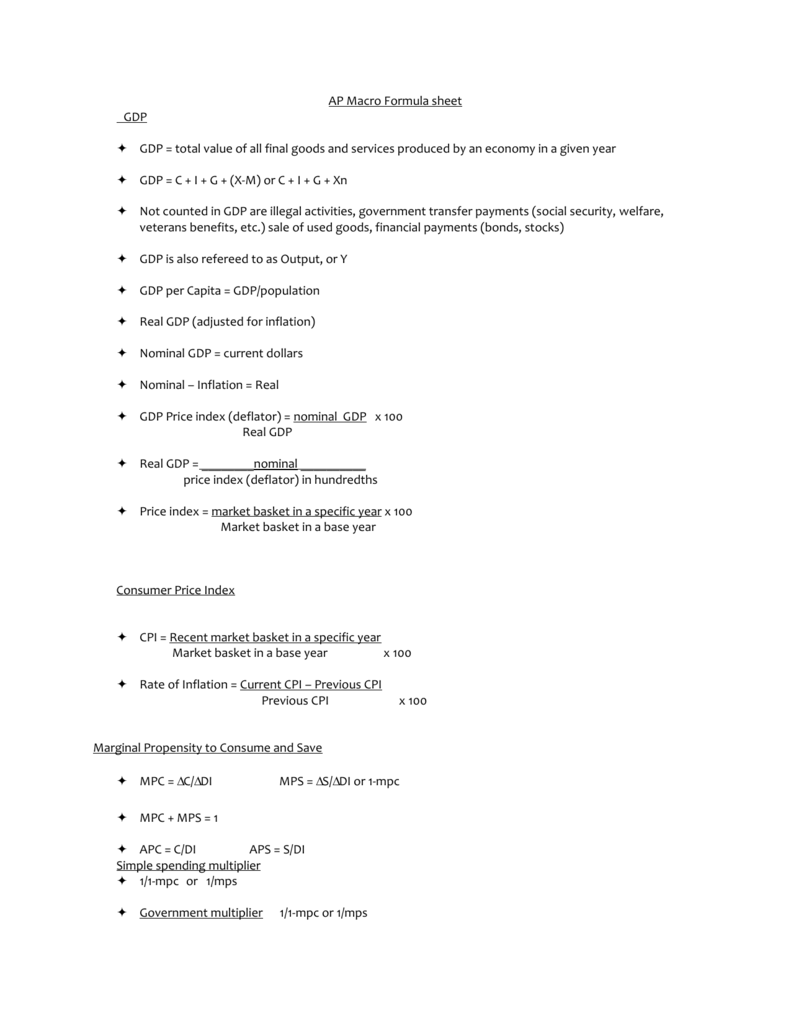

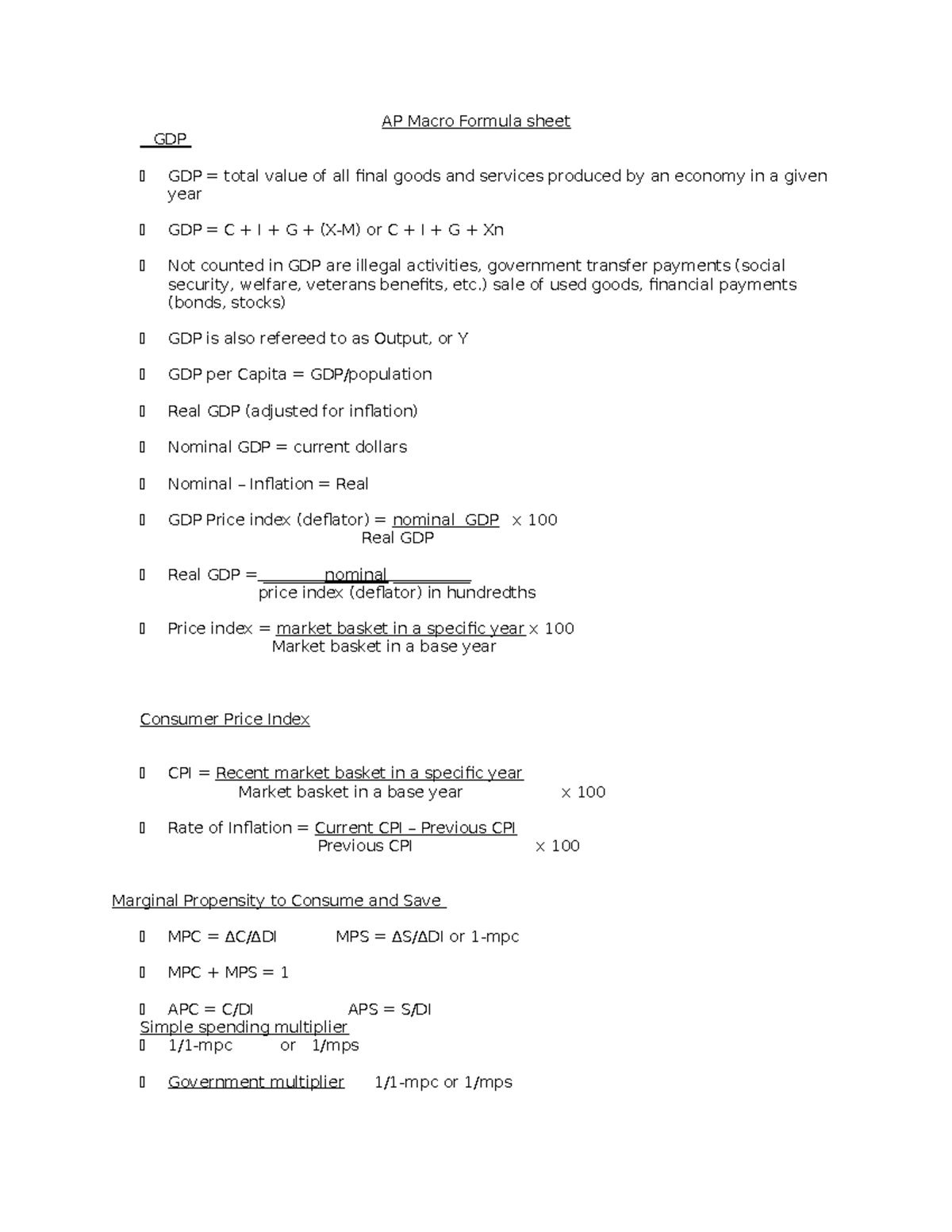

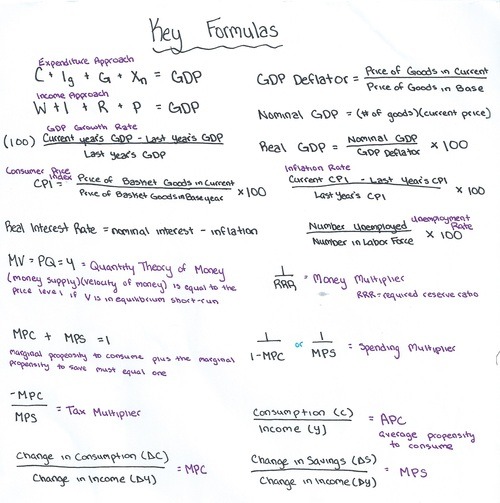

GDP = C + I + G + (X - M)

Where:

- GDP = Gross Domestic Product

- C = Consumer Spending

- I = Investment

- G = Government Spending

- X = Exports

- M = Imports

2. The Multiplier Effect

The Multiplier Effect is a key concept in AP Macroeconomics that describes how an initial change in spending can lead to a larger change in GDP. The formula for the Multiplier Effect is:

Multiplier = 1 / (1 - MPC)

Where:

- Multiplier = the multiplier effect

- MPC = Marginal Propensity to Consume (the percentage of additional income spent on consumption)

3. The Marginal Propensity to Consume (MPC)

The MPC is the percentage of additional income spent on consumption. The formula for MPC is:

MPC = ΔC / ΔY

Where:

- MPC = Marginal Propensity to Consume

- ΔC = Change in Consumption

- ΔY = Change in Income

4. The Marginal Propensity to Save (MPS)

The MPS is the percentage of additional income saved. The formula for MPS is:

MPS = ΔS / ΔY

Where:

- MPS = Marginal Propensity to Save

- ΔS = Change in Savings

- ΔY = Change in Income

5. The Fiscal Policy Multiplier

The Fiscal Policy Multiplier measures the impact of a change in government spending on GDP. The formula for the Fiscal Policy Multiplier is:

Fiscal Policy Multiplier = 1 / (1 - MPC) * (1 - Tax Rate)

Where:

- Fiscal Policy Multiplier = the fiscal policy multiplier

- MPC = Marginal Propensity to Consume

- Tax Rate = the percentage of income paid in taxes

6. The Money Multiplier

The Money Multiplier measures the impact of a change in the money supply on the money supply. The formula for the Money Multiplier is:

Money Multiplier = 1 / Reserve Requirement

Where:

- Money Multiplier = the money multiplier

- Reserve Requirement = the percentage of deposits that banks are required to hold in reserve

7. The Quantity Theory of Money

The Quantity Theory of Money states that the money supply determines the price level. The formula for the Quantity Theory of Money is:

MV = PT

Where:

- M = Money Supply

- V = Velocity of Money (the rate at which money is spent and respent)

- P = Price Level

- T = Transactions (the number of times money is spent and respent)

8. The GDP Deflator

The GDP Deflator is a measure of the price level. The formula for the GDP Deflator is:

GDP Deflator = (Nominal GDP / Real GDP) * 100

Where:

- GDP Deflator = the GDP deflator

- Nominal GDP = GDP measured in current prices

- Real GDP = GDP measured in constant prices

9. The Consumer Price Index (CPI)

The CPI is a measure of the price level. The formula for the CPI is:

CPI = (Current Year's Basket of Goods / Base Year's Basket of Goods) * 100

Where:

- CPI = the Consumer Price Index

- Current Year's Basket of Goods = the basket of goods in the current year

- Base Year's Basket of Goods = the basket of goods in the base year

10. The Unemployment Rate

The Unemployment Rate is a measure of the number of unemployed individuals. The formula for the Unemployment Rate is:

Unemployment Rate = (Number of Unemployed Individuals / Labor Force) * 100

Where:

- Unemployment Rate = the unemployment rate

- Number of Unemployed Individuals = the number of individuals who are unemployed

- Labor Force = the total number of individuals in the workforce

Gallery of Macroeconomics Formulas

What is the difference between nominal and real GDP?

+Nominal GDP is GDP measured in current prices, while real GDP is GDP measured in constant prices. Real GDP is used to measure the actual change in GDP over time, while nominal GDP is used to measure the change in GDP in current prices.

What is the formula for the unemployment rate?

+The formula for the unemployment rate is: Unemployment Rate = (Number of Unemployed Individuals / Labor Force) \* 100

What is the money multiplier?

+The money multiplier is the ratio of the money supply to the reserve requirement. It measures the impact of a change in the money supply on the money supply.

In conclusion, mastering the essential AP Macroeconomics formulas is crucial for success in the course and on the exam. These formulas will help you analyze and solve problems related to economic concepts, models, and policies. By understanding how to use these formulas, you'll be able to evaluate the impact of economic decisions, policies, and events on the overall economy.