Managing your 401k effectively is crucial for securing a comfortable retirement. One of the most powerful tools to help you maximize your 401k is Microsoft Excel. Excel offers a wide range of features that can help you track, analyze, and optimize your 401k investments. In this article, we will explore five ways to use Excel to maximize your 401k.

Understanding Your 401k Data

Before you can start using Excel to maximize your 401k, you need to understand the data involved. Your 401k plan likely provides you with a quarterly or annual statement that shows your account balance, contributions, and investment returns. You can use this data to track your progress and make informed decisions about your investments.

Tracking Your 401k Contributions

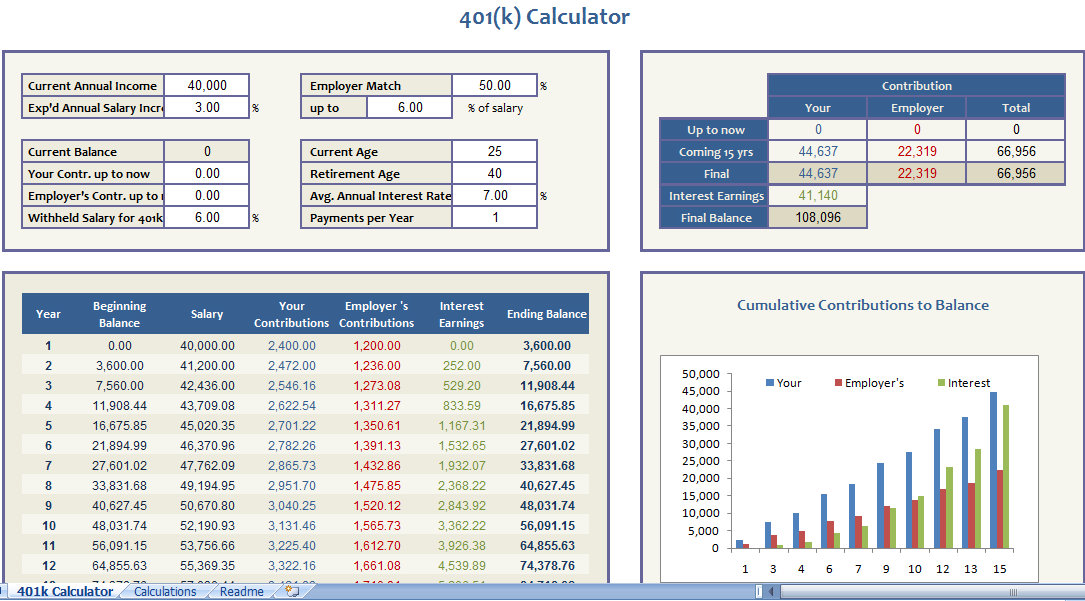

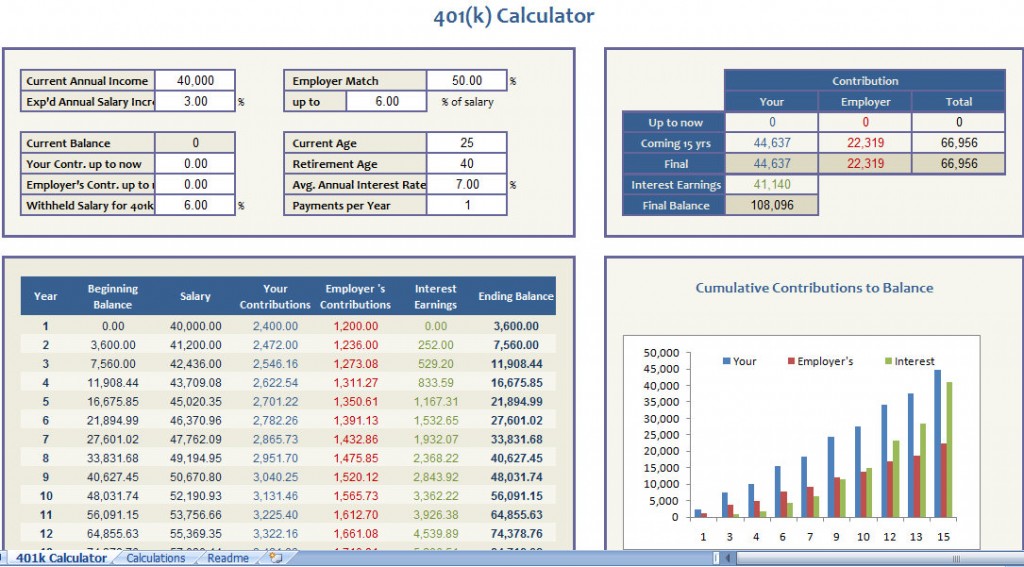

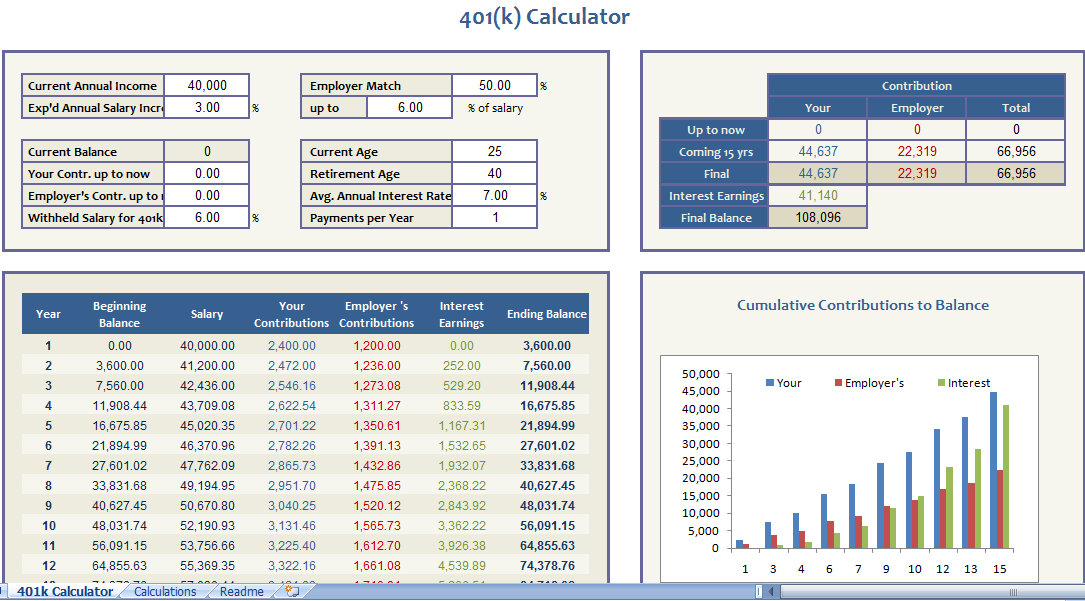

One of the simplest ways to use Excel to maximize your 401k is to track your contributions. You can create a table in Excel to record your monthly or quarterly contributions, including the date, amount, and investment allocation. This will help you see how much you are contributing to your 401k over time and make adjustments as needed.

To create a contributions table in Excel, follow these steps:

- Open a new Excel spreadsheet and create a table with the following columns: Date, Contribution Amount, and Investment Allocation.

- Enter your contribution data into the table, including the date, amount, and investment allocation.

- Use formulas to calculate the total contributions and average monthly contribution.

- Use charts and graphs to visualize your contribution data and track your progress over time.

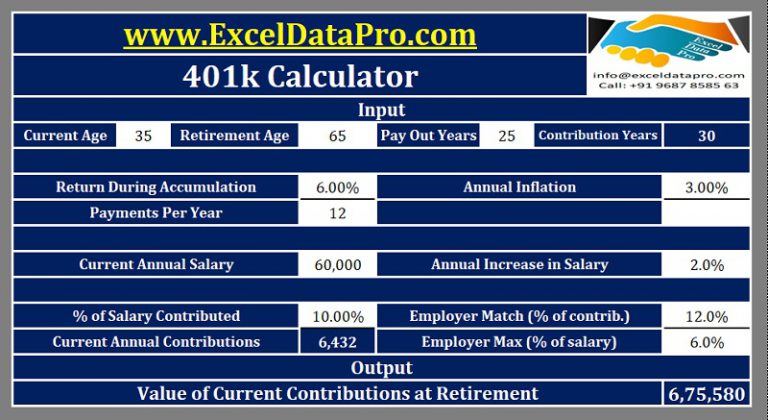

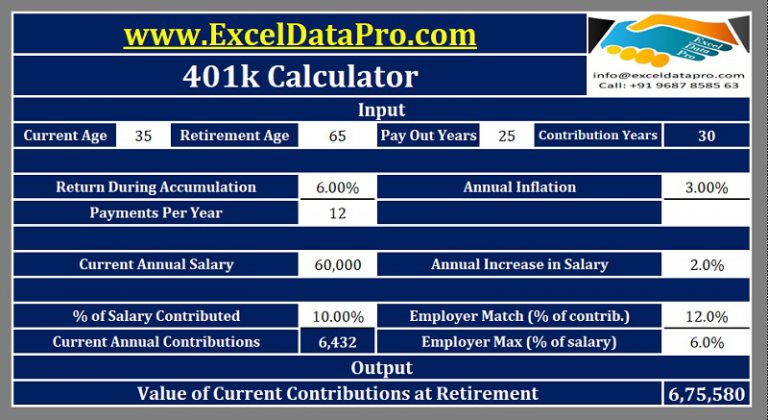

Calculating Your 401k Investment Returns

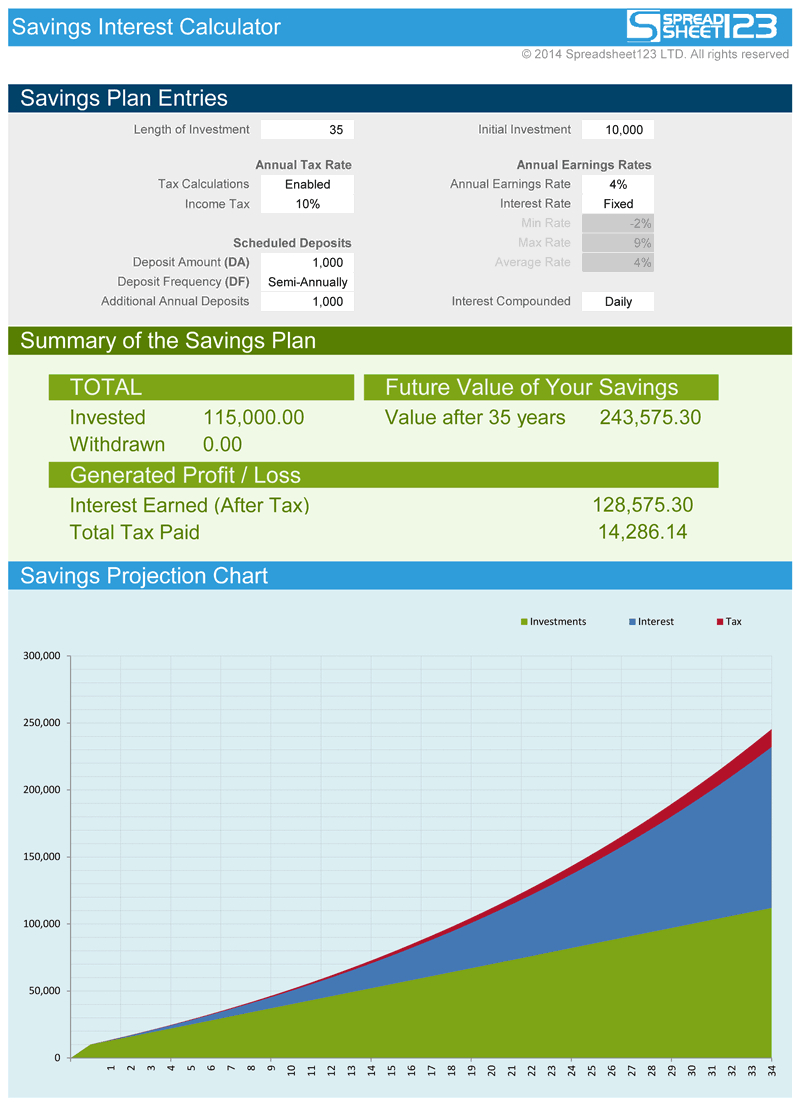

Another way to use Excel to maximize your 401k is to calculate your investment returns. You can use Excel to calculate your returns based on your contributions and investment allocation. This will help you see how well your investments are performing and make adjustments as needed.

To calculate your investment returns in Excel, follow these steps:

- Open a new Excel spreadsheet and create a table with the following columns: Date, Contribution Amount, Investment Allocation, and Investment Return.

- Enter your contribution data into the table, including the date, amount, and investment allocation.

- Use formulas to calculate the investment return based on the contribution amount and investment allocation.

- Use charts and graphs to visualize your investment return data and track your progress over time.

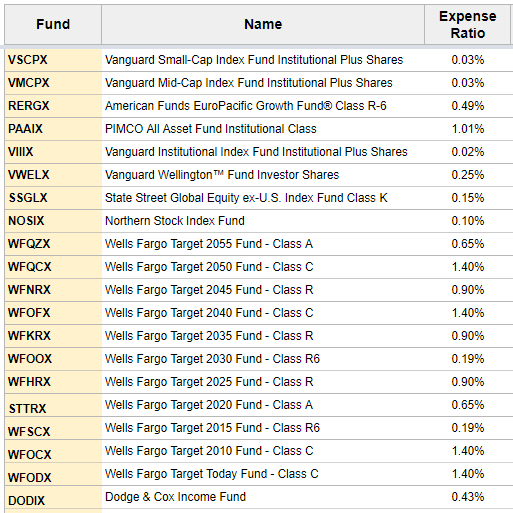

Analyzing Your 401k Fees

Fees can eat into your 401k returns, so it's essential to analyze your fees and minimize them whenever possible. You can use Excel to analyze your 401k fees and identify areas where you can reduce costs.

To analyze your 401k fees in Excel, follow these steps:

- Open a new Excel spreadsheet and create a table with the following columns: Fee Type, Fee Amount, and Total Fees.

- Enter your fee data into the table, including the fee type, amount, and total fees.

- Use formulas to calculate the total fees and average fee amount.

- Use charts and graphs to visualize your fee data and identify areas where you can reduce costs.

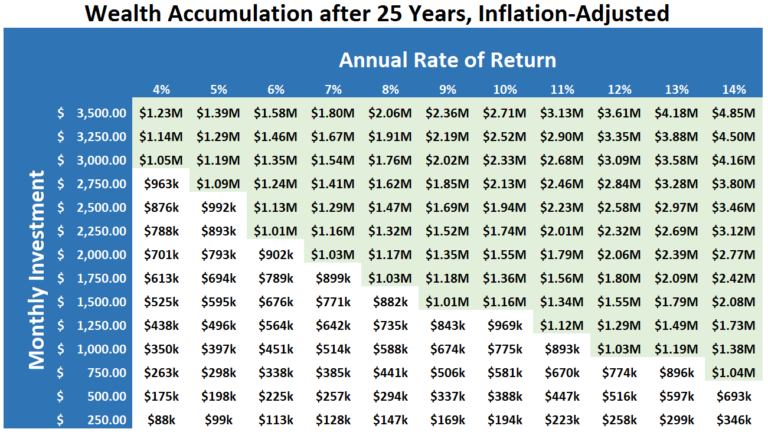

Creating a 401k Investment Strategy

A well-diversified investment portfolio is critical to maximizing your 401k returns. You can use Excel to create a 401k investment strategy that aligns with your risk tolerance and investment goals.

To create a 401k investment strategy in Excel, follow these steps:

- Open a new Excel spreadsheet and create a table with the following columns: Investment Type, Allocation Percentage, and Target Allocation.

- Enter your investment data into the table, including the investment type, allocation percentage, and target allocation.

- Use formulas to calculate the target allocation based on your risk tolerance and investment goals.

- Use charts and graphs to visualize your investment data and track your progress over time.

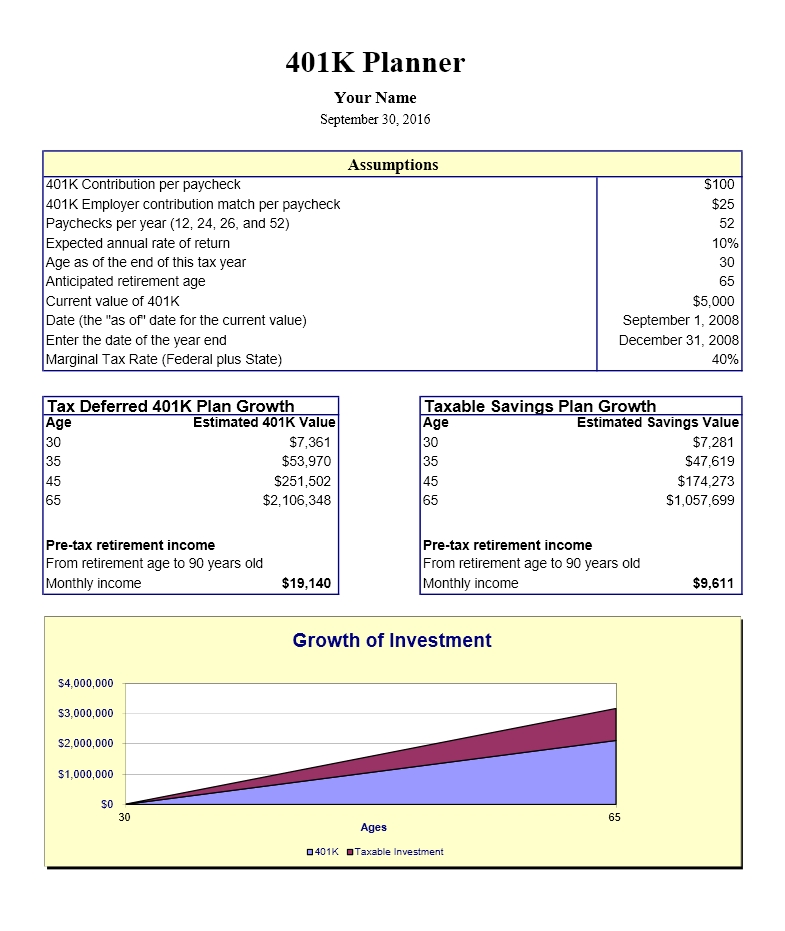

Monitoring Your 401k Progress

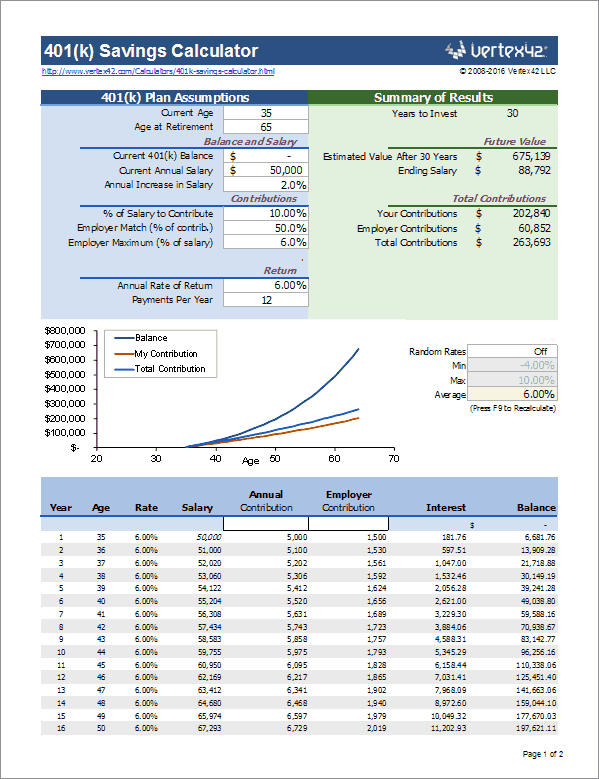

Finally, you can use Excel to monitor your 401k progress and make adjustments as needed. You can create a dashboard in Excel to track your account balance, contributions, investment returns, and fees.

To create a 401k dashboard in Excel, follow these steps:

- Open a new Excel spreadsheet and create a table with the following columns: Date, Account Balance, Contributions, Investment Returns, and Fees.

- Enter your data into the table, including the date, account balance, contributions, investment returns, and fees.

- Use formulas to calculate the total contributions, investment returns, and fees.

- Use charts and graphs to visualize your data and track your progress over time.

By following these five ways to use Excel to maximize your 401k, you can take control of your retirement savings and make informed decisions about your investments.

What is the best way to track my 401k contributions?

+The best way to track your 401k contributions is to use a spreadsheet like Excel. You can create a table to record your contributions, including the date, amount, and investment allocation.

How can I calculate my 401k investment returns?

+You can calculate your 401k investment returns by using formulas in Excel. You can calculate the return based on the contribution amount and investment allocation.

What are some common 401k fees?

+Some common 401k fees include management fees, administrative fees, and investment fees. You can use Excel to analyze your fees and identify areas where you can reduce costs.

-balance.png)